The Return of the S Curve

Cognitive dissonance made manifest

This is the moment.

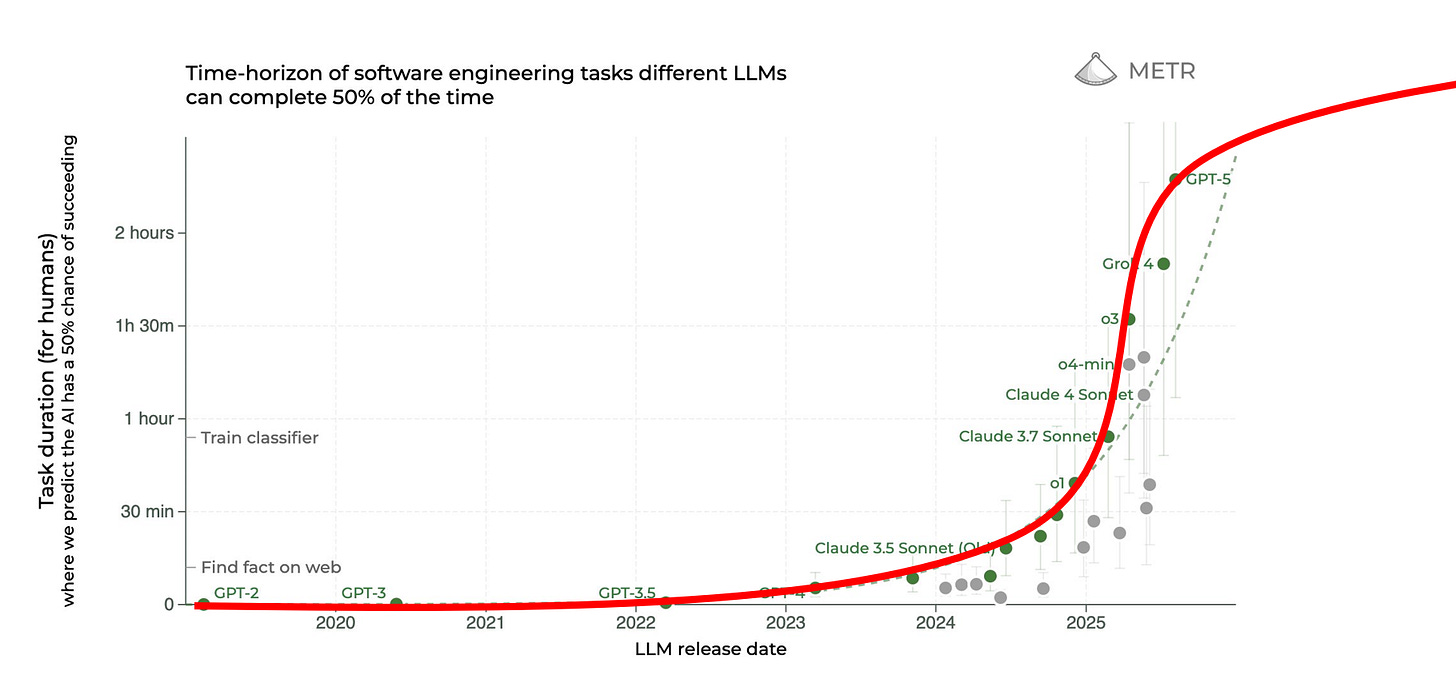

The second derivative is clear.

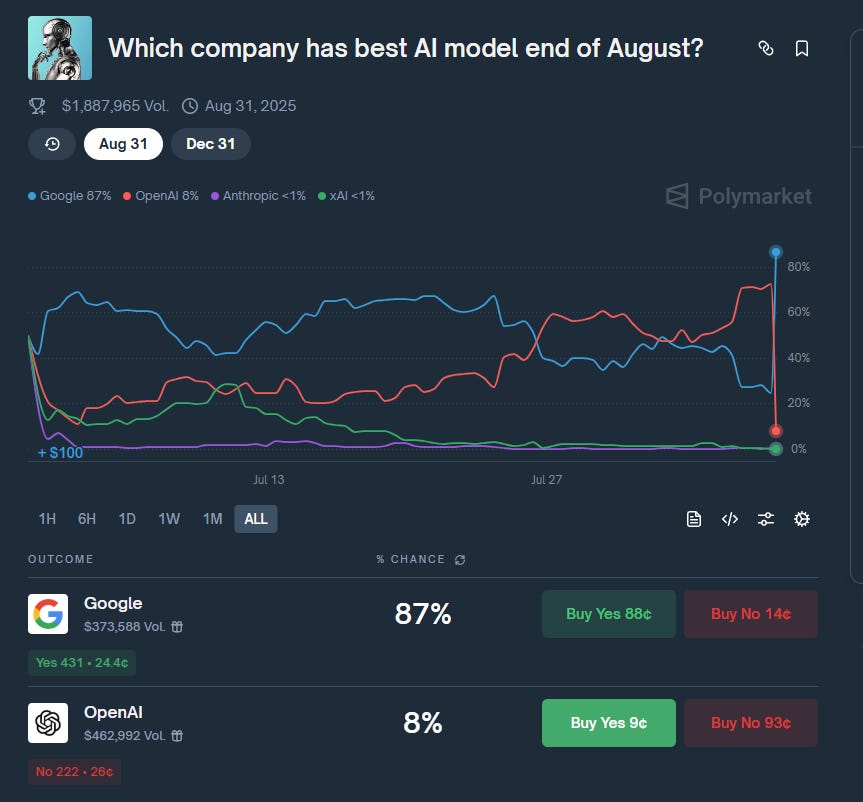

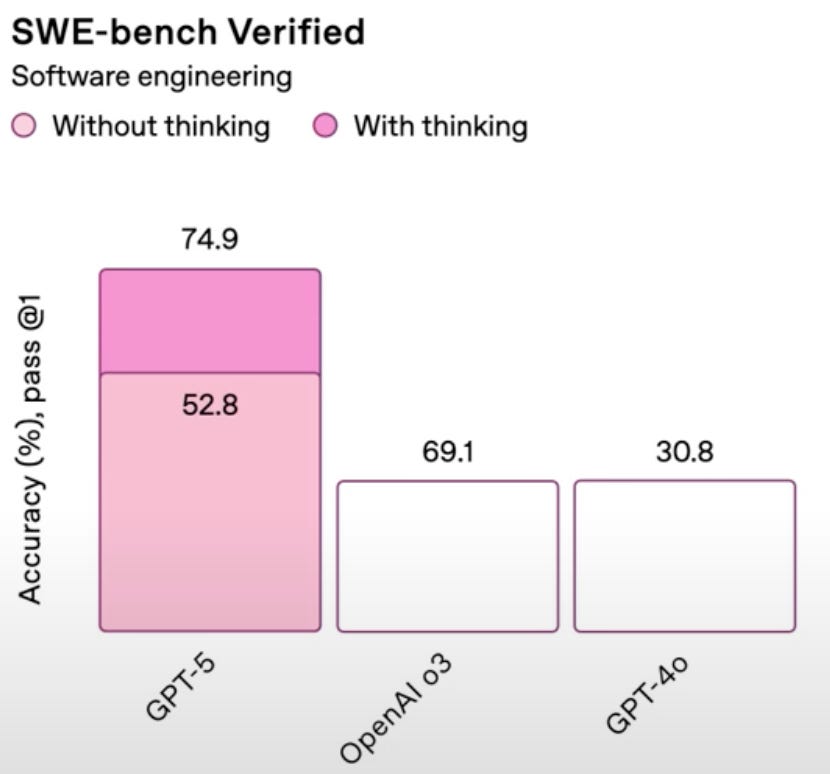

GPT5 is here and the rate of change is clearly slowing.

The market wasn’t sure what was more disappointing, the confirmation of what we’ve been saying on this topic for a year…or this chart crime.

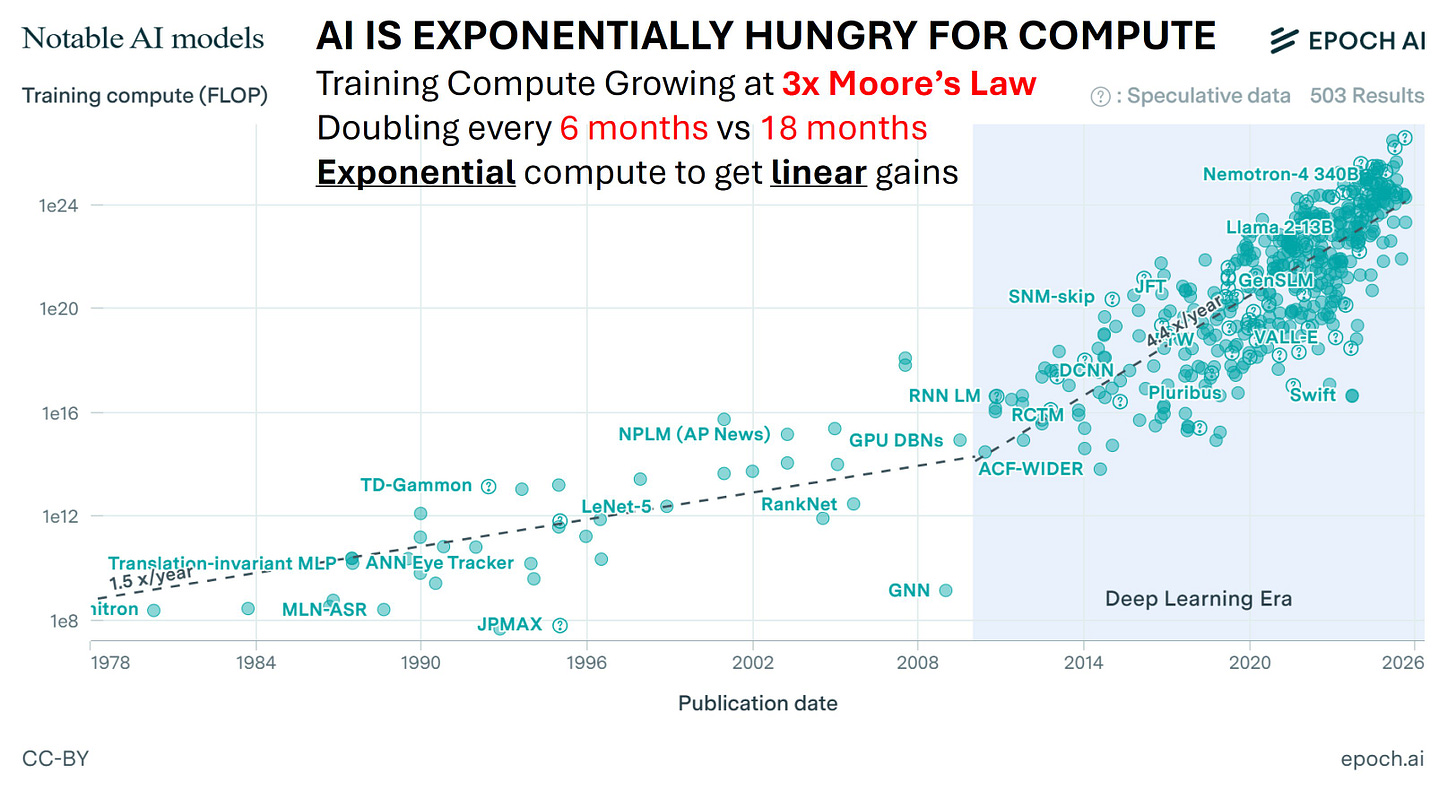

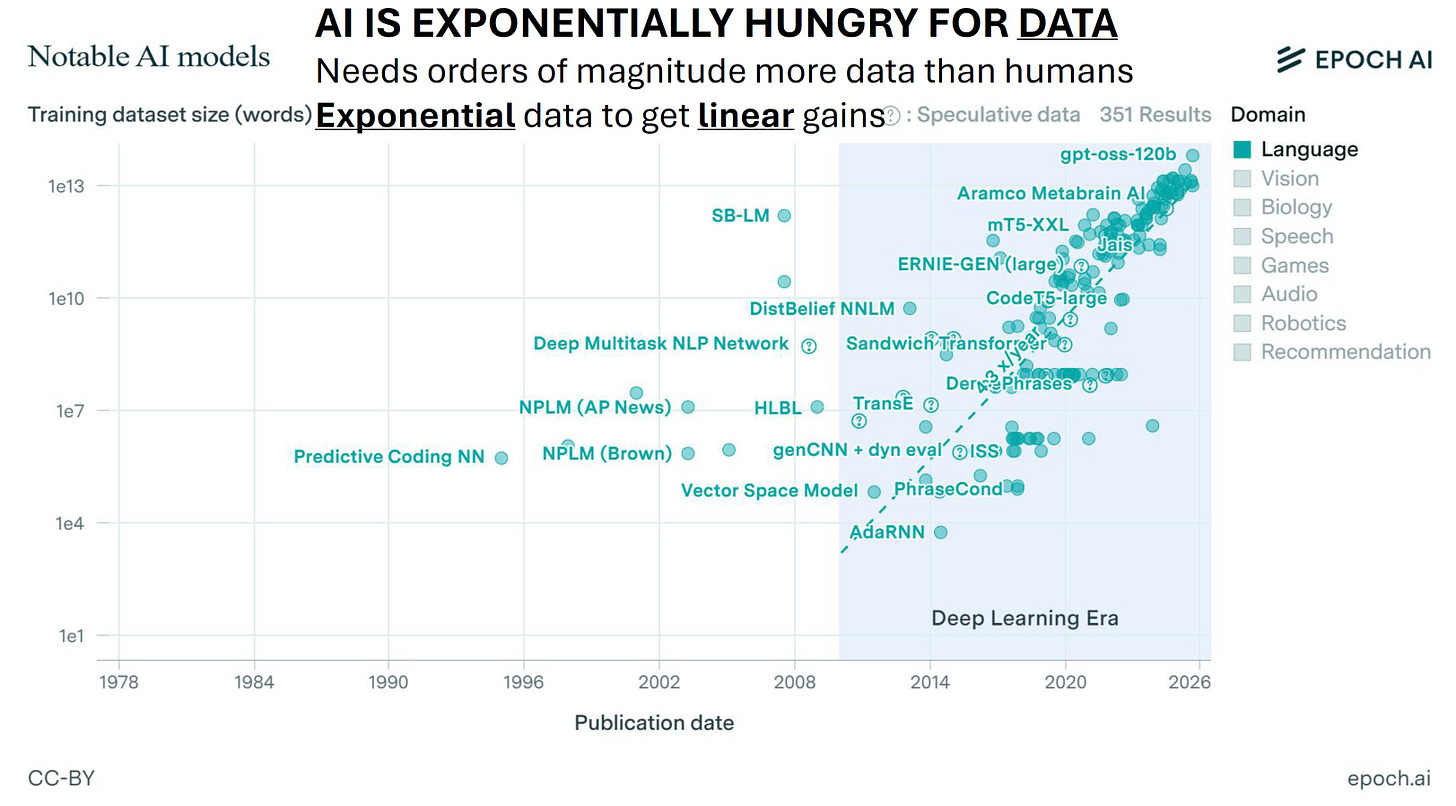

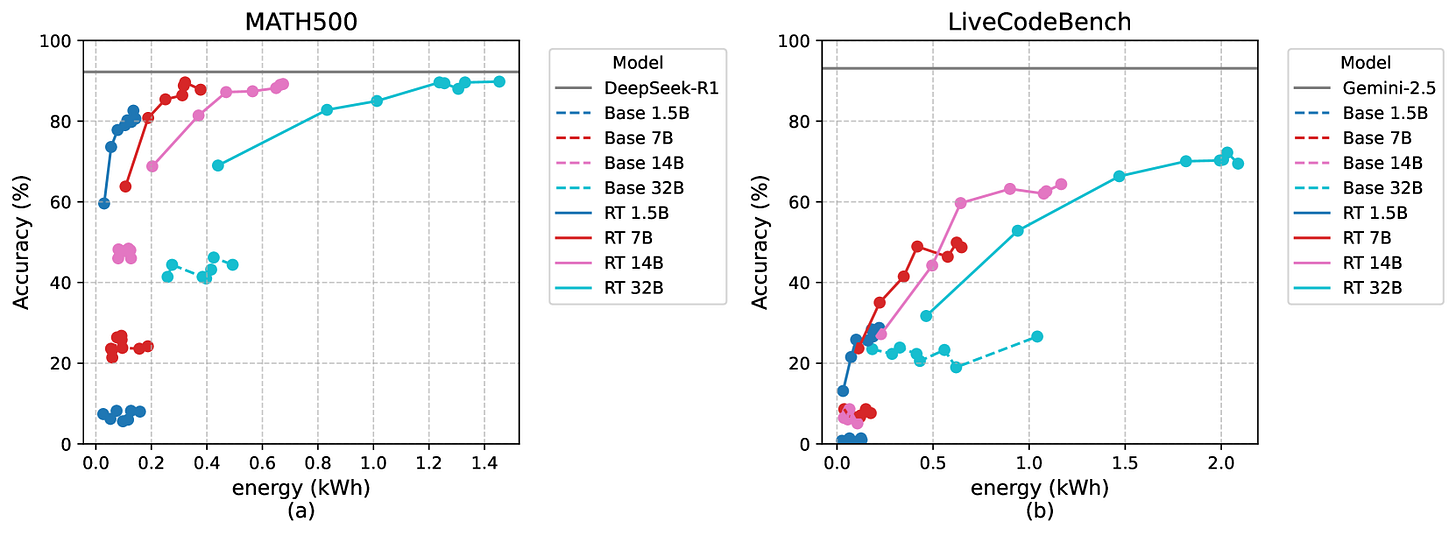

Models are getting better, of course, but just as the scaling law promised and foretold, we've reached the point where the the marginal extra OOM investment in compute, data and energy required to hill climb the intelligence curve is uneconomical.

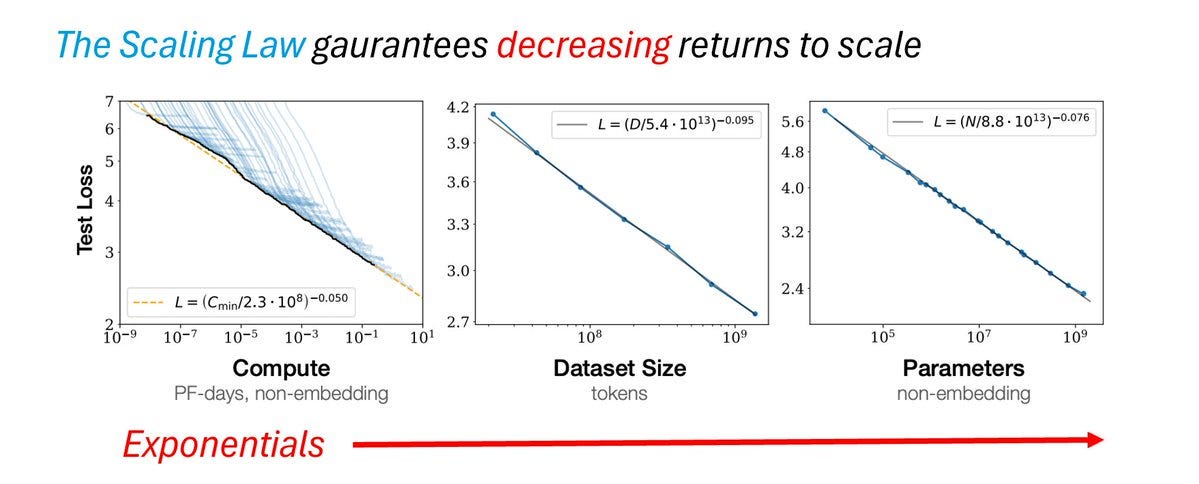

As a reminder, this is a natural consequence of the math we’ve been highlighting for years.

Exponentially bigger models need exponentially more compute to hold and run them.

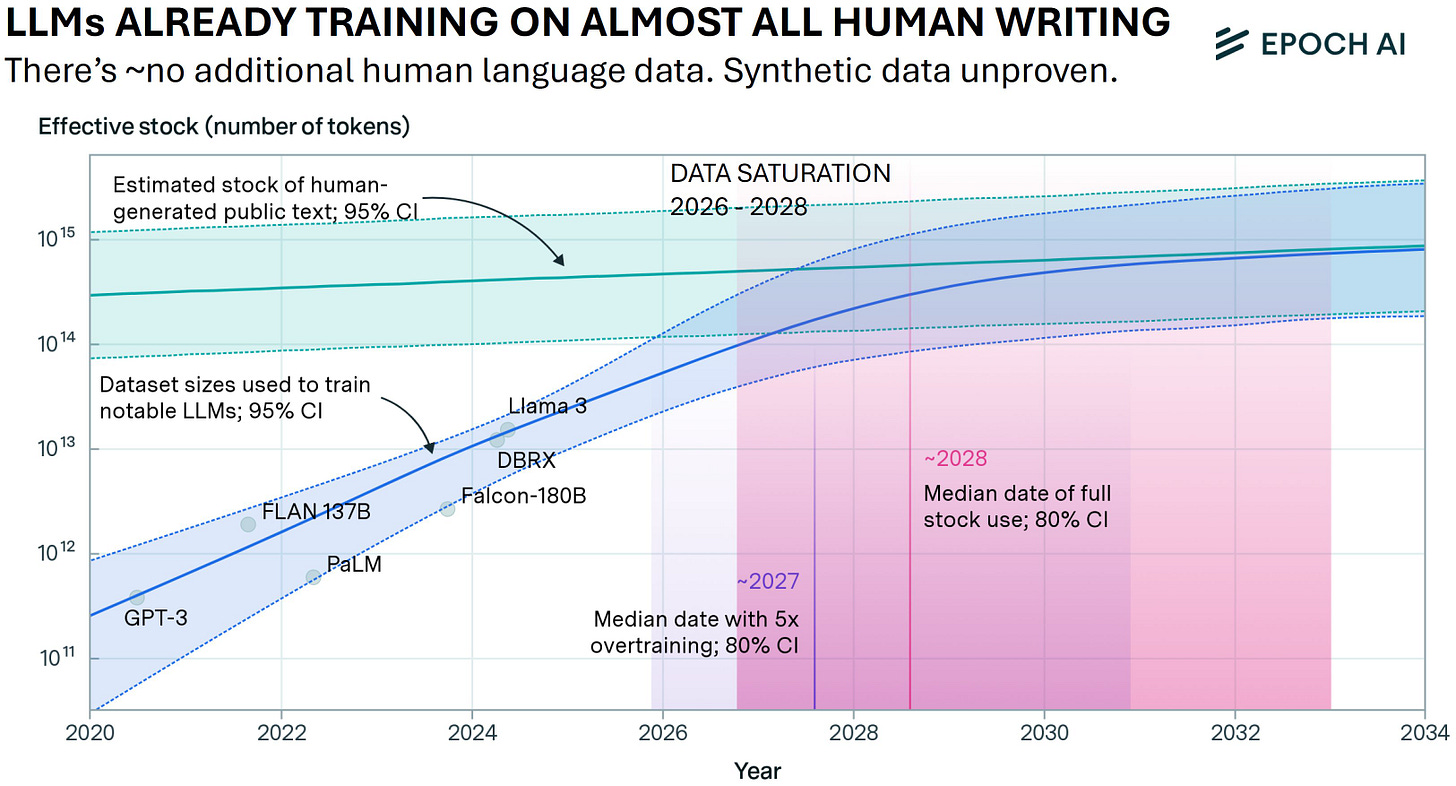

They need exponentially more data to train them.

Which means exponentially more energy to train and run.

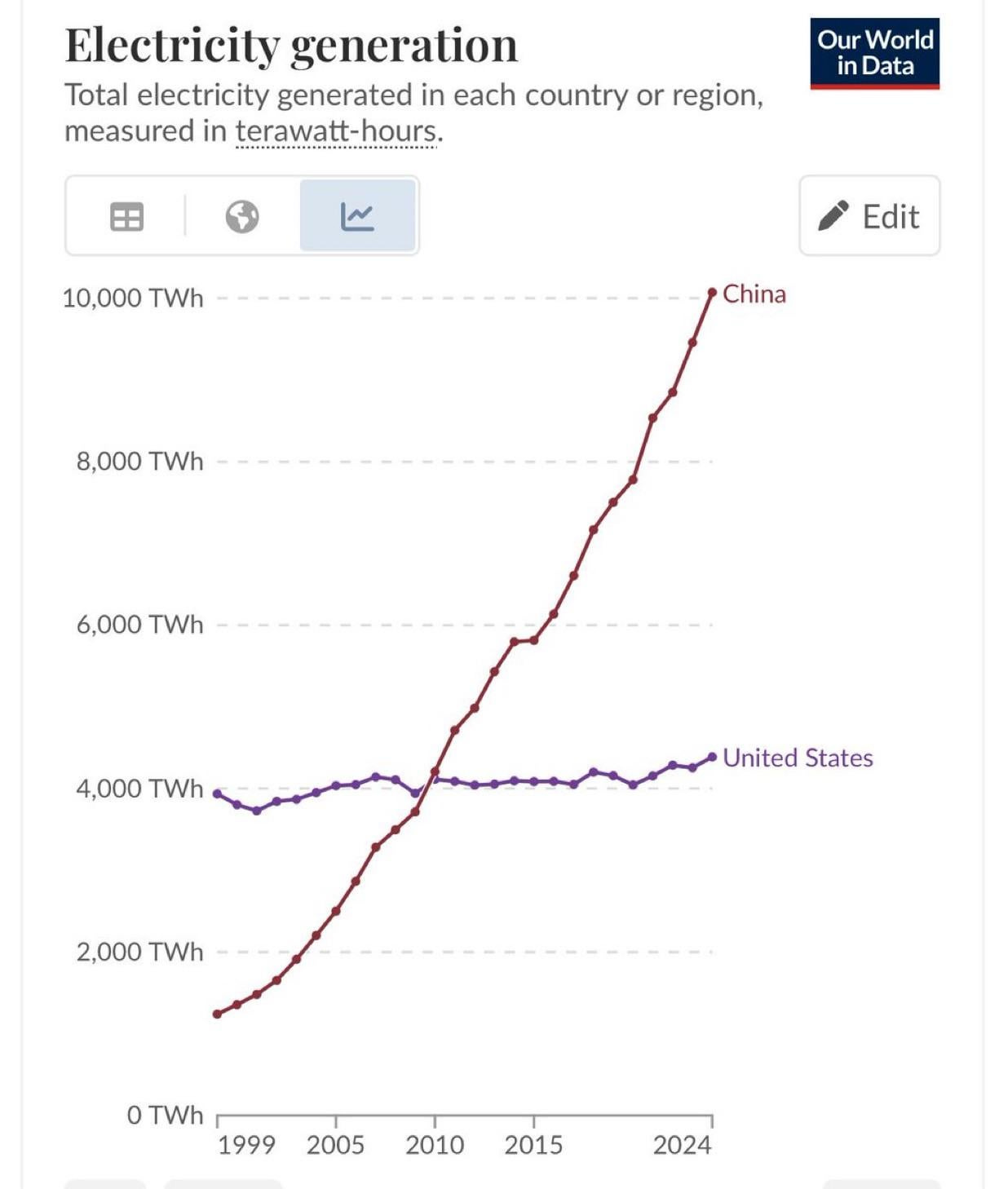

Last time I checked, electricity wasn’t free and the US wasn’t making exponentially more of it.

Remind me, what happens to the price of something when the demand goes up exponentially and the supply stays constant?

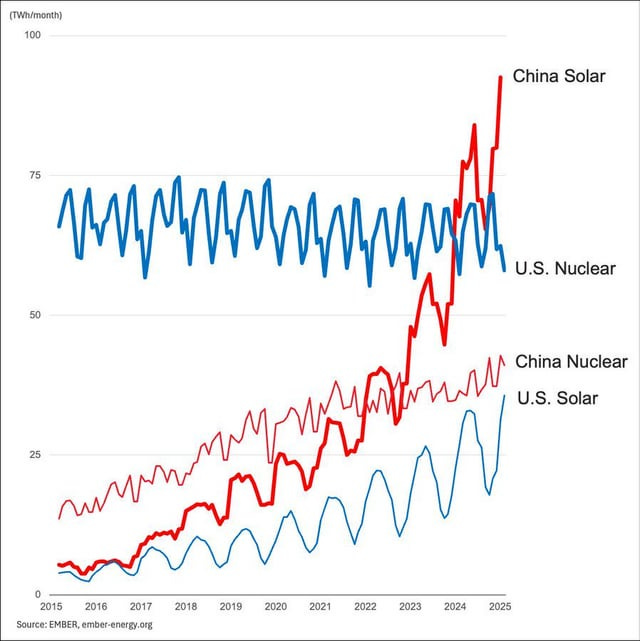

(Seems like a good moment to remind you that every solar panel has silver in it…)

Seethe, Cope and Opportunity

What you will see over the next 12m will be a combination of “seethe”, “cope” and, yes opportunity.

Seethe from the hype machine linkedin posters, who now have to make breathless threads of "You will never believe what the new LLM can do!" even though their audience *knows* that the returns aren't infinitely positive and increasing.

Cope from the dooomers, who now have to move the goalposts to preserve the eschatological narratives that finance their NGOs and group homes.

Opportunities to the wise merchants. Who understand there are still insanely positive and convex economic returns in the gap opened up by the concave returns to scaling models.

Invest (and live) accordingly.

Till next time.

Disclaimers

S 😁