The Case for Greenland

Or: How Evergrande Will Melt Greenland (2021)

One of the things Ray taught me at the old shop was the value of forcing yourself to publish. Even when it’s half-baked. Even when you’re waiting for a thrice-delayed flight. Various drafts of this piece have been sitting in my drafts since 2021.

Today, it seems relevant.

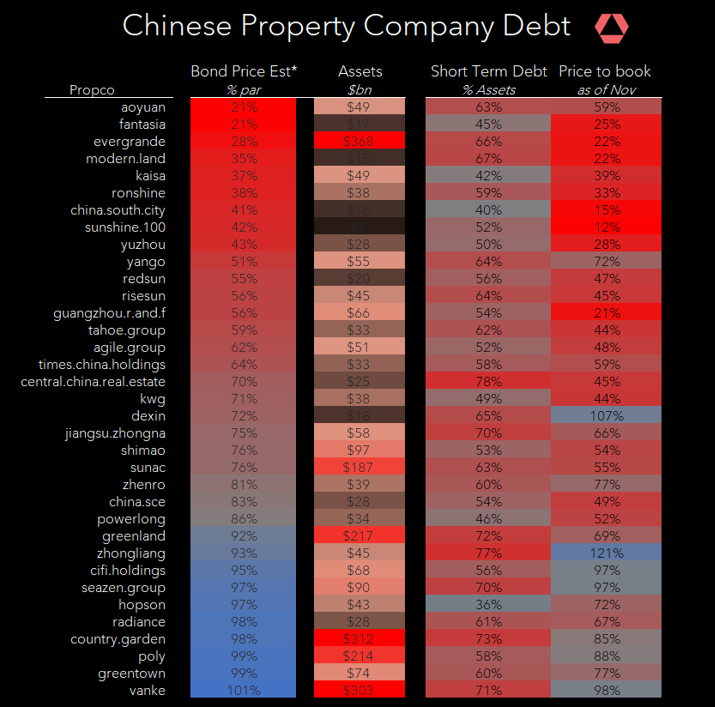

The original title (now subtitle) was a double entendre. Evergrande was clearly cooked (controversial at the time), and half of the piece was predicting the financial stress would cascade to developers previously considered “safe”—like Greenland Holdings. Work that made it into the piece below, where we went line by line across hundreds of these firms, to show just how deep the problem was (and still is, but that’s the topic of another ramble).

But the deeper point was about carbon math, and how our notion of the status of Greenland was supported by our notions of how long it would remain utterly inhospitable.

Now the venn diagram overlap of people who a) believe that climate change is real, and b) think annexing Greenland is a good idea might be pretty much…me, but hey that’s the kind of horseshoe thinking you come to the ramble for. Plus, you know me, never saw a cheap option I didn’t want to buy.

1. The Carbon Math

The whole double entendre of the old title was based on the notion that the pathology that killed Evergrande was playing out with coal. The Chinese growth model that they seemed irrevocably committed to: light rocks on fire to make more valuable rocks to make skyscrapers.

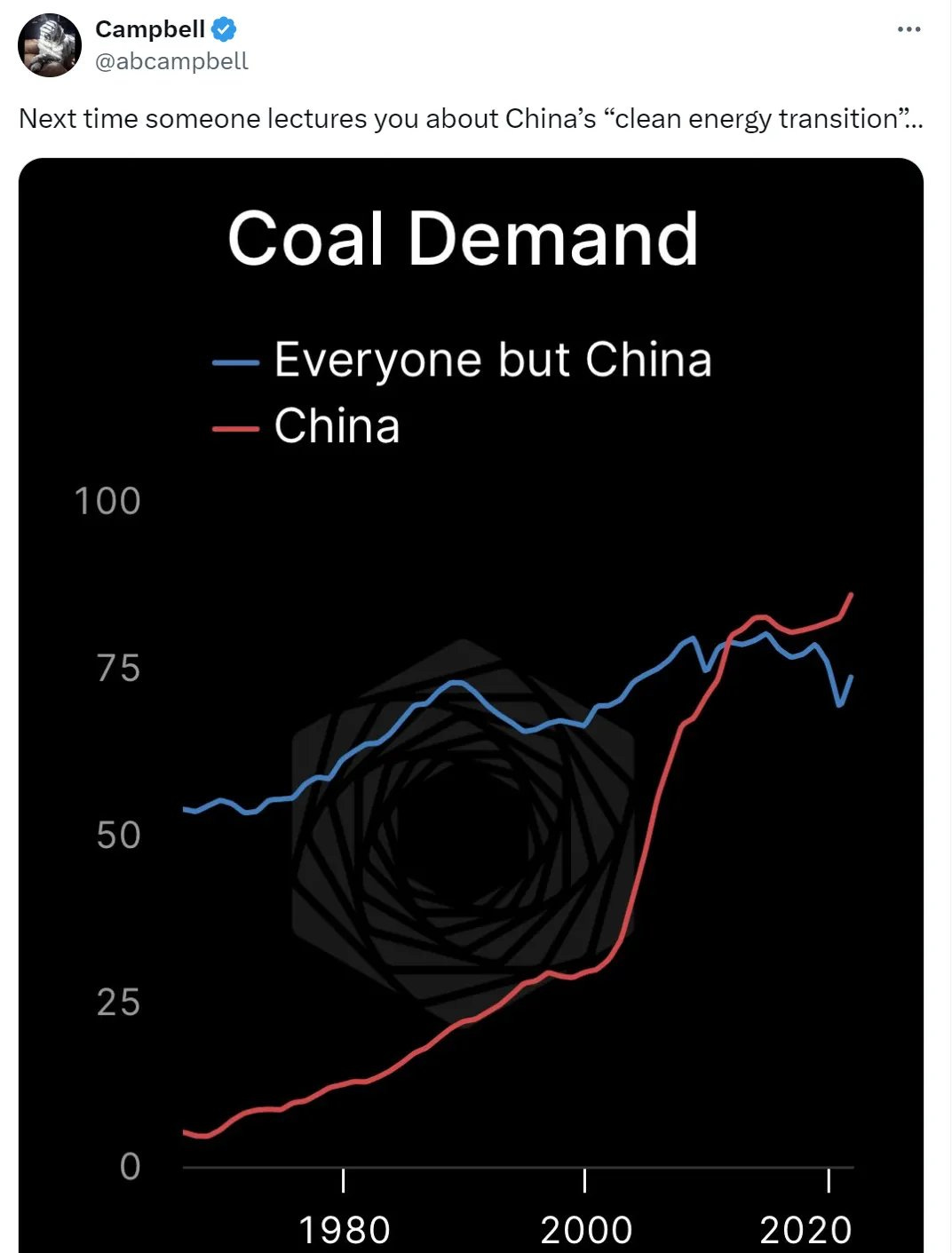

Today? They're still lighting the rocks on fire.

They just stopped making the skyscrapers.

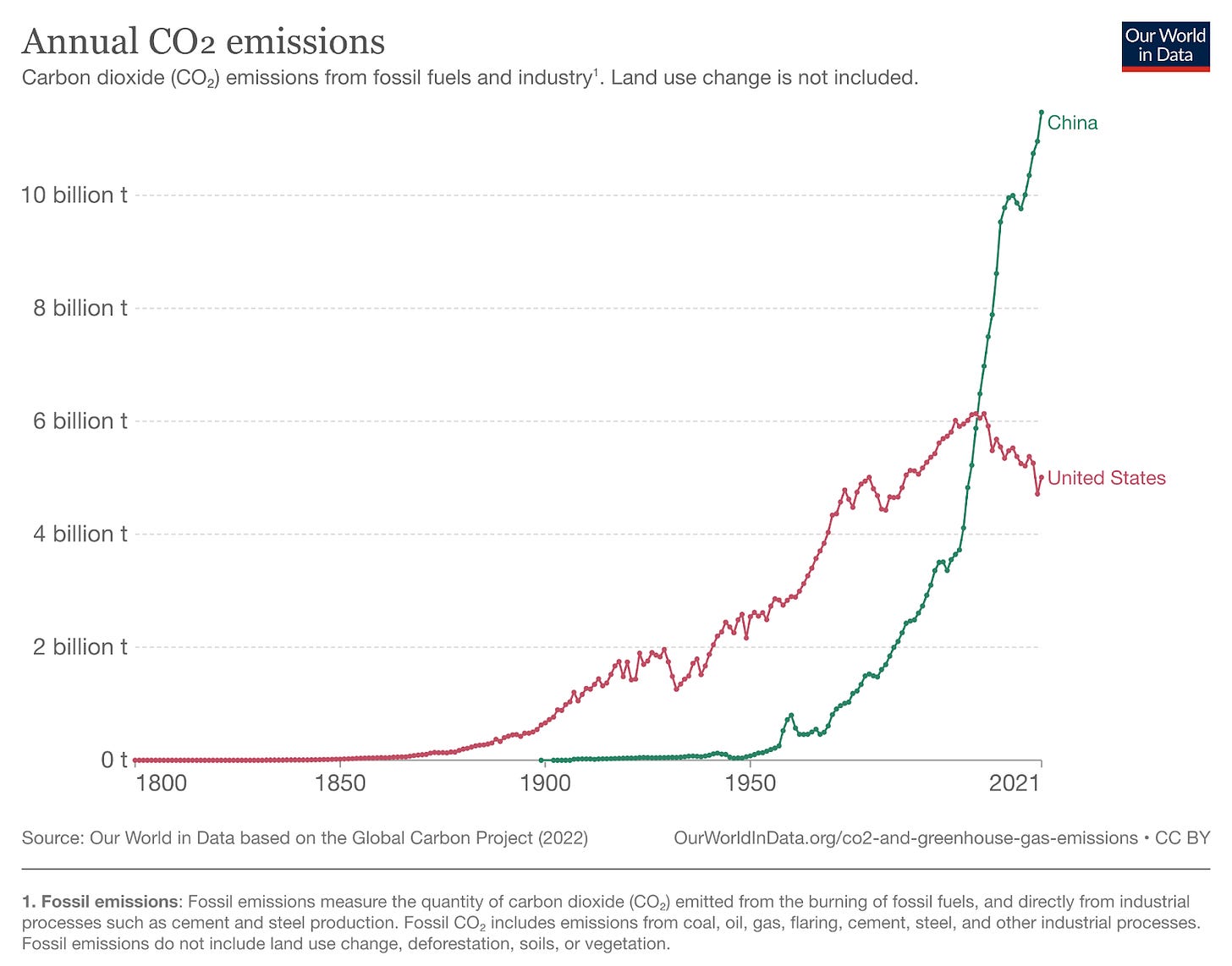

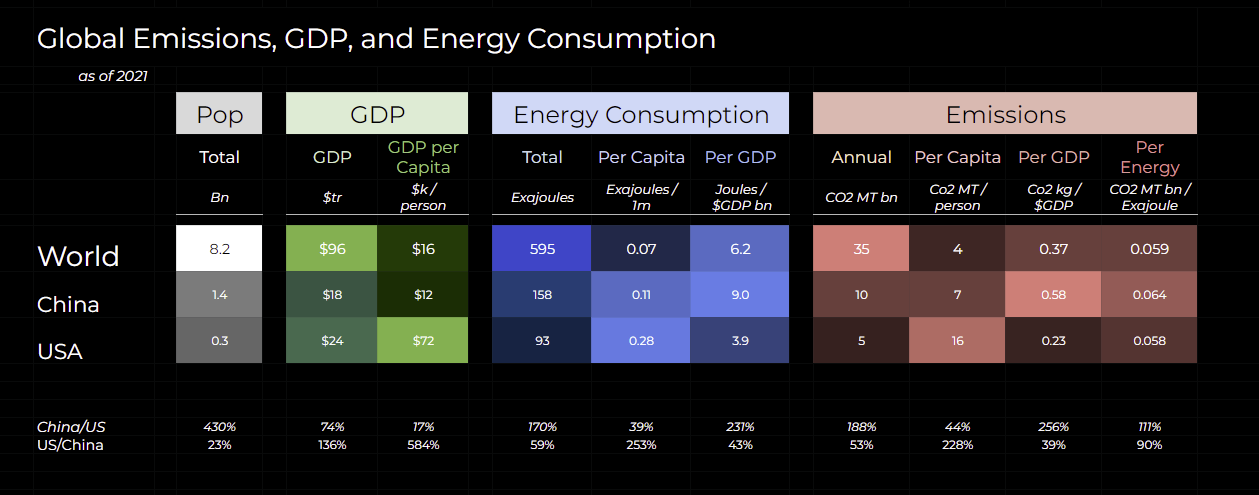

Beijing gets enormous credit, both real and spoofed, for building renewables. And yes, they are building a lot of solar panels. But the argument underneath is: “You industrialized with coal, so we will too. Anything else is imperialism.” Greens and liberals seem strangely vulnerable to this framing. They’ll nod along while China adds more coal capacity in a year than the US has shut down in a decade.

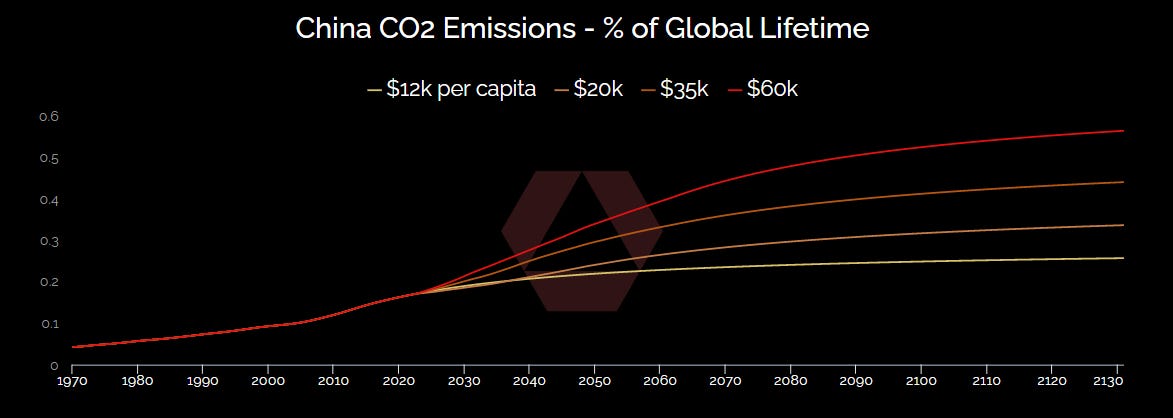

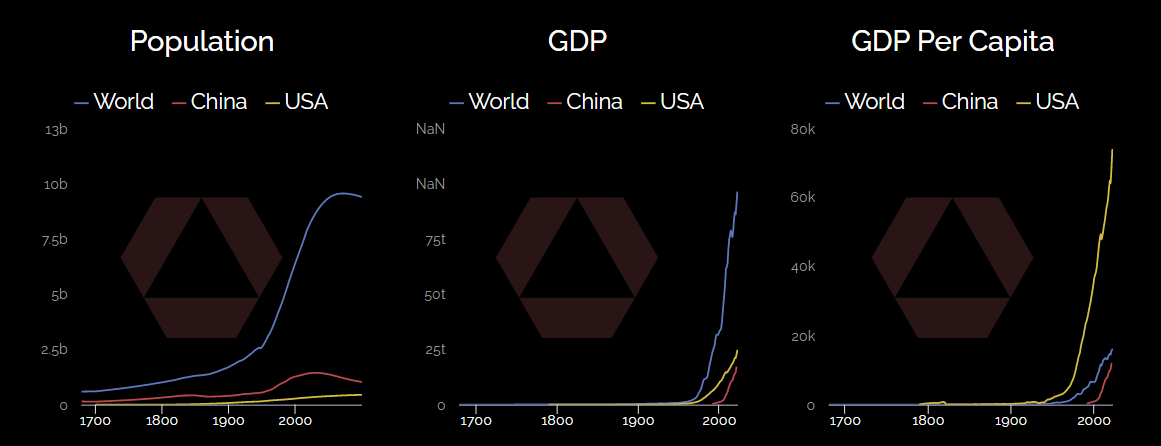

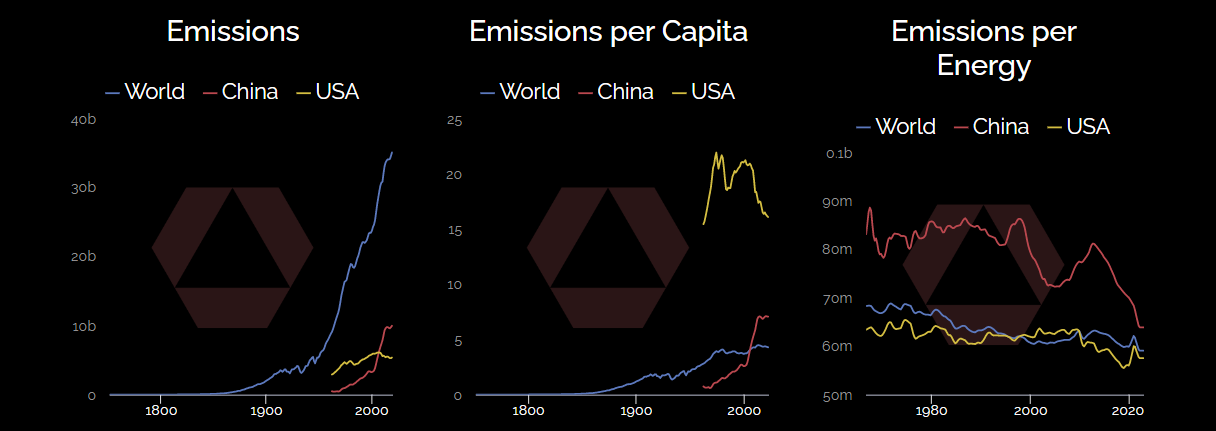

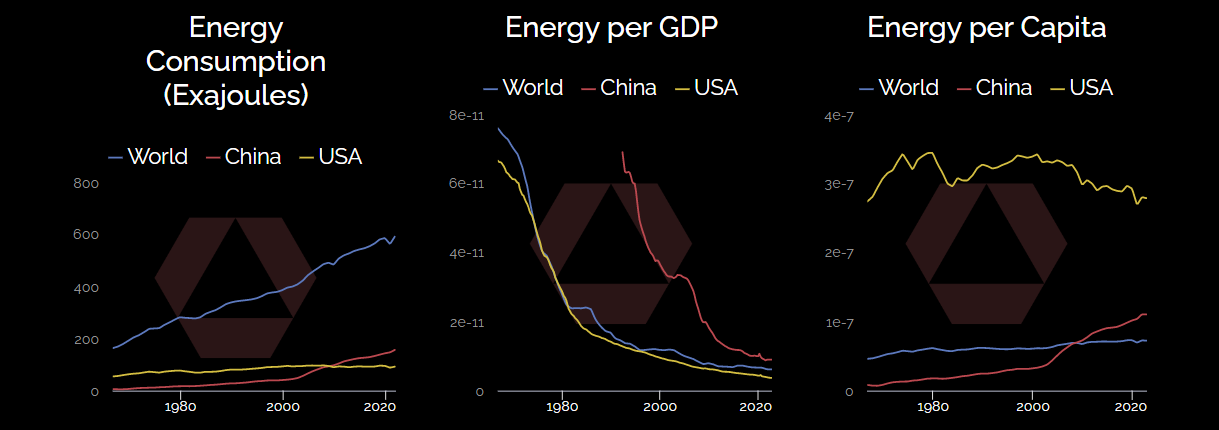

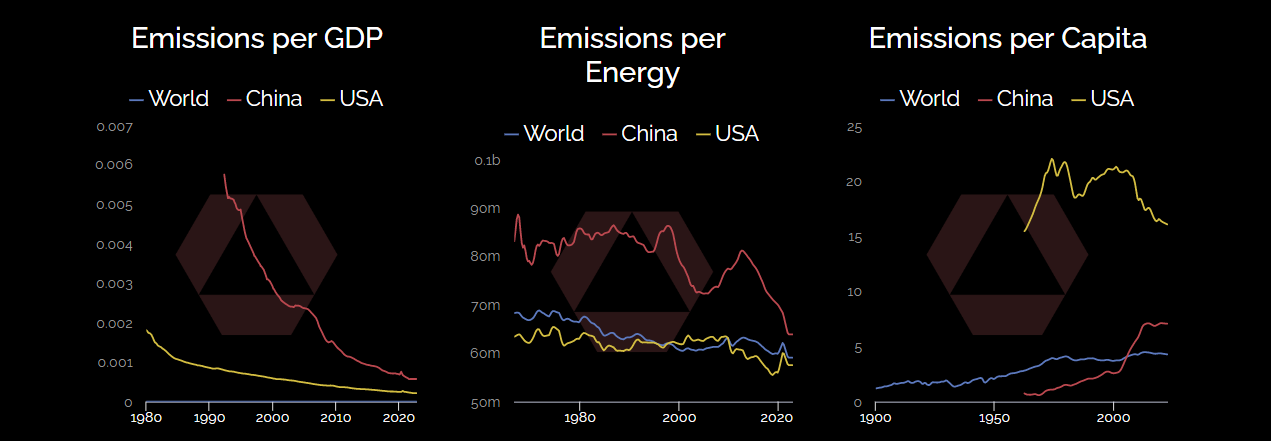

My model here is simple (details in the appendix):

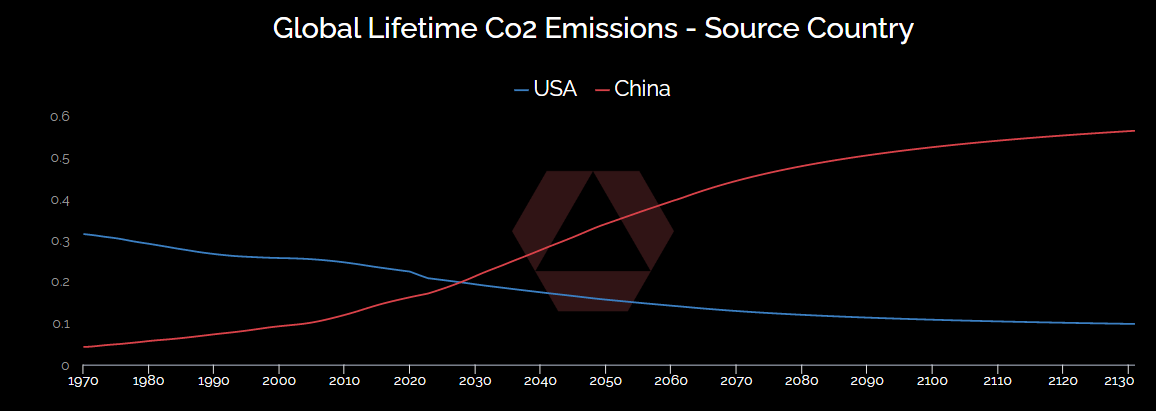

Take trends for GDP, energy consumption per GDP, and emissions per unit of energy. Extrapolate based on different income levels. If you hold China’s energy and pollution intensity constant and map to $20k, $35k, $60k per capita income, you find scenarios where China grows from ~20% of cumulative global CO2 emissions to 40-60%.

My base case: cumulative Chinese emissions surpass the United States around 2030. Paris indeed.

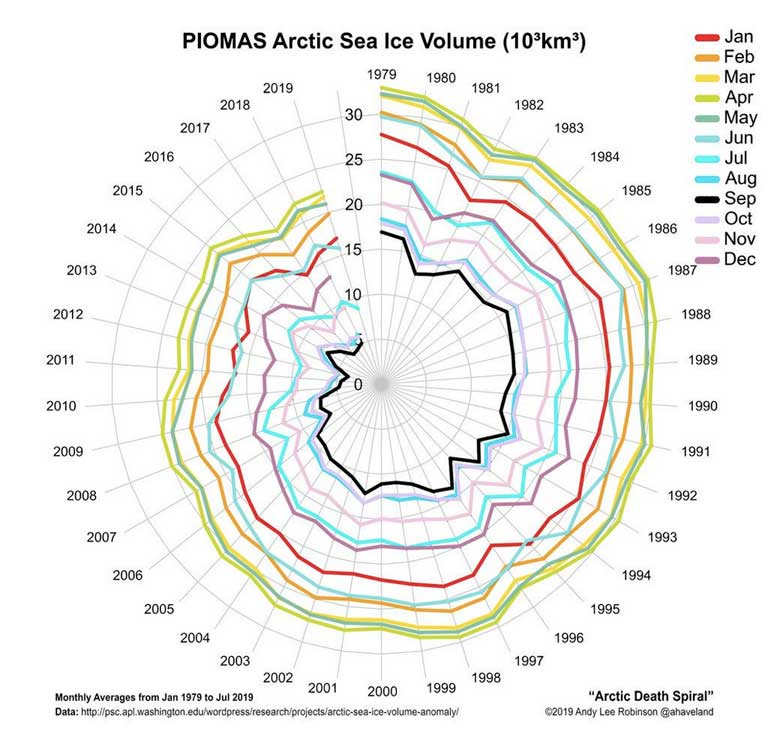

Include India—where 75% of electricity still comes from coal with no phase-out plan—and the numbers get worse. The carbon budget for keeping Greenland’s ice sheet stable (around 1,000 GtC cumulative) gets blown through by 2070-2080 at current rates. We’re already halfway there.

The punchline: Arctic sea ice is already conceptually melted. Just a matter of what you wanna do about it. In this lens, Greenland starts to make a lot more sense.

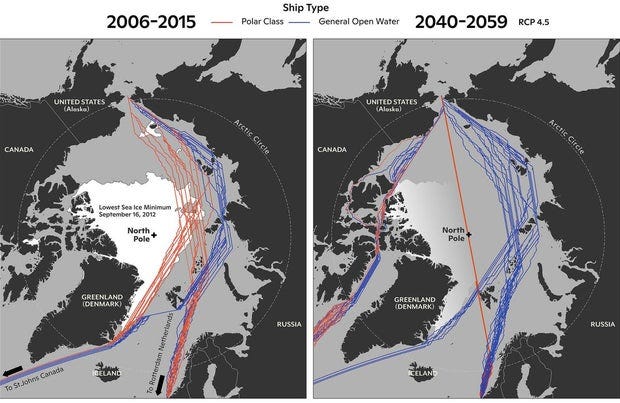

Like a really big ice cream cone, it’s going to take 30-50 years to finish dripping. The sea ice—what blocks the Northwest Passage and offshore drilling—could be gone in summer by 2040-2050. The ice sheet on land will take a lot longer (scientists say 1,000 years but I worry they worry about their own convictions). But for resource access, sea ice is what matters, which is coming much, much sooner.

2. What’s Under the Ground

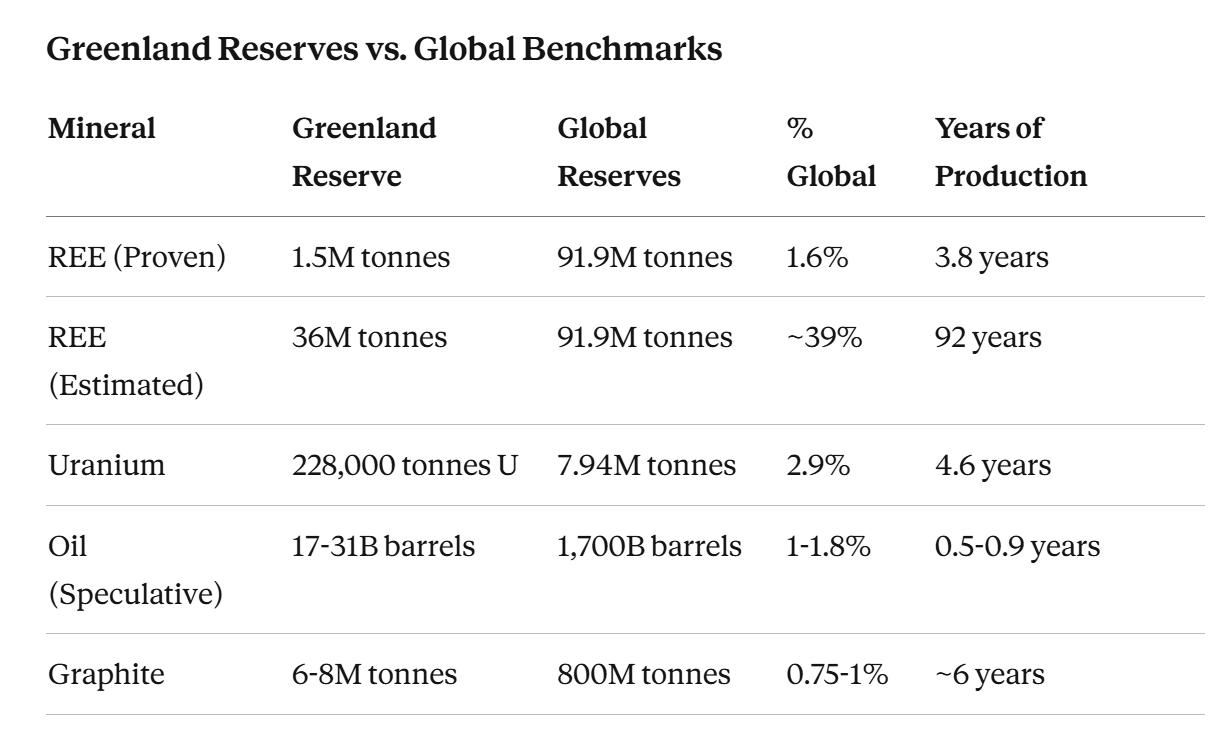

The US (and the rest of the west) just woke up to the fact that a lot of the cool minerals essential to our modern toys depends on supply from our strategic rival. Greenland offers a place that contains this stuff already in the ground, with no massive population centers or valuable ecologies to complain when you start running pollutive refining processes.

The enviros will squeal. But we’re already doing this. It’s the price China paid to corner this market. I’d prefer we do it to a part of the world currently covered in ice than anywhere near existing (human or animal) population centers.

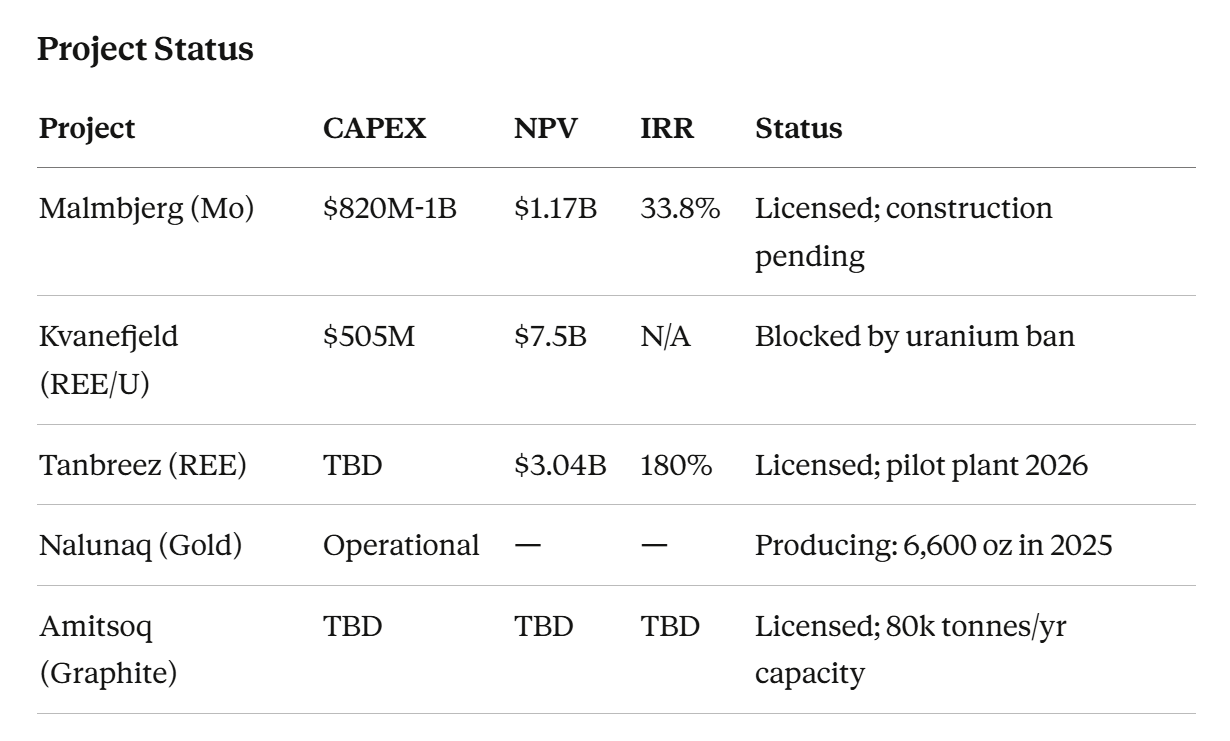

Greenland’s estimated REE reserves—36 million tonnes—represent nearly 40% of current global reserves. Tanbreez alone could be the world’s largest rare earth deposit.

3. The Binding Constraints Are Bans

The major deposits are already ice-free. The 81% of Greenland covered by ice is mostly Precambrian basement rock. The coastal margins, fjords, and southern regions where the good geology sits are accessible today.

So why isn’t this stuff being mined?

The 2021 uranium ban. Greenland’s parliament banned uranium mining, which killed Kvanefjeld—the world’s second-largest rare earth deposit and eighth-largest uranium deposit. $7.5 billion valuation, blocked.

The 2021 offshore drilling ban. The government banned new offshore exploration, stranding 17-18 billion barrels of speculative oil reserves. All 23+ offshore licenses were relinquished after the 2014-2016 oil price collapse and haven’t been renewed.

The infrastructure. Greenland has 93 miles of paved roads in a territory 25% the size of the continental US. Sixteen ports with limited capacity. 54 MW of electrical capacity 290 miles from the mining regions. Arctic cost multipliers run 3-5x temperate mining. For now. Call it undeveloped, call it a capex bonanza waiting to happen. Just don’t call it folly.

This reframes the Trump / Campbell interest. Political change could do more for resource access in five years than another century of warming.

4. The Skies and Seas

The airspace. Most of our maps look east to west. But we live on a sphere. If things go really kinetic with Russia, Greenland’s airspace sits directly between Russian ICBM bases and Washington. The best way to prevent that from happening is to make it a bad idea. Enter Golden Dome. Reasonable people will point out there already exist treaties in place to enable the US to build bases. But remember, as Canadian PM is to happy to expain, we’re entering a New World Order. One where both friends and foes are challenging old notions of the status quo.

The sea lanes. The Northwest Passage used to strand boats in ice. Summer Arctic sea ice could be gone by 2040-2050. When it opens, the route from East Asia to Europe shortens by 7,000+ miles versus Suez. Greenland sits astride that route.

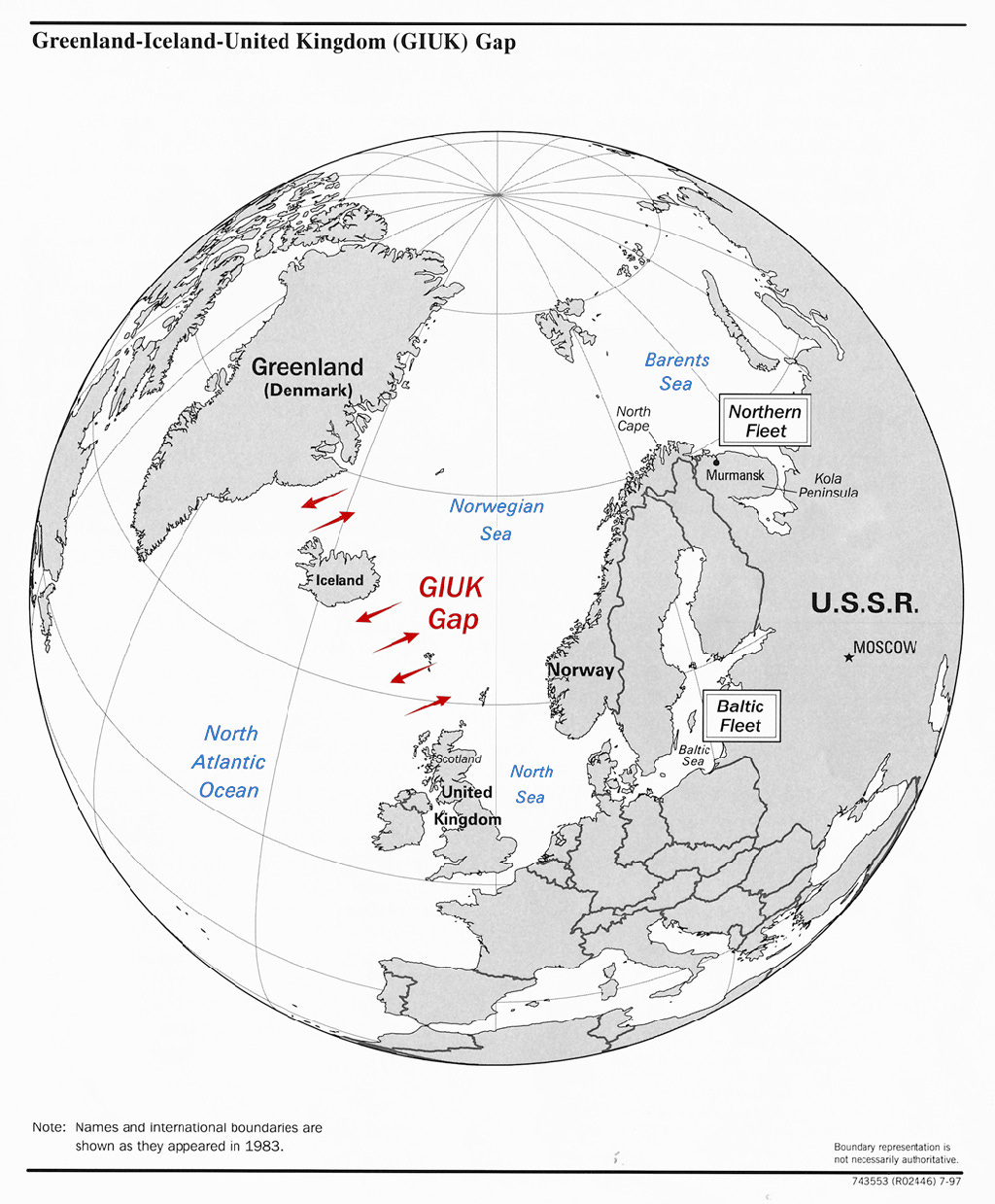

The naval calculus. Control of the GIUK gap (Greenland-Iceland-UK) was the centerpiece of Cold War Atlantic strategy. What’s changed is that the gap now extends into waters that used to be frozen year-round.

5. The Death of Globalism

Not sure if you’re tracking Davos, but it’s almost like they are reading the ramble.

Or listening to my latest podcast (pardon the ‘catfish’ thumbnail, as both my fiance, and youtube commenters, call it)

If you ask Europeans, the US is overturning the rules-based order for the whims of a capricious leader. If you ask a China hawk like me, the rules-based order came under threat the moment Russia invaded Ukraine, and becomes untenable the moment China has local overmatch around Taiwan—which, between their A2/AD missile networks and penchant for pumping out a carrier every two years, may be now.

Trump is aware of this strategic pickle. He’s also aware that many treaty allies harbor deep resentment for the arrogant role America plays maintaining that global order. “We buy bullets, they buy butter” works when the butter buyers appreciate the blood and treasure that went into the security blanket. Eighty years after that power was kinetic, most Westerners have never known anything else, so they don’t appreciate what the world would look like without it.

Which naturally leads to resentment. And when you joke about other nations’ sovereignty, as Trump is wont to do, it triggers people.

But if you think the risk of actual global conflict has never been higher, and you look at an alliance where Germany a) bragged about shutting down nuclear power while b) complaining about a bellicose Russia while also c) financing Russia’s military through energy purchases—you start to wonder: are these allies even serious? If we had to go to the mattresses over Taiwan, would they show up?

When Ukraine was invaded by Russia Germany’s first response was to send…helmets. If China invades Taiwan, what’s the plan, send sauerkraut?

This is the context for Greenland. Trump’s signature move is to speak with chaos, to force separating equilibria of revealed preferences. What we’re seeing is the latest round in negotiations about what the deal really looks like.

Do I think we see US boots on the ground in Greenland anytime soon? Of course not. When I put it in my New New Deal Policy Pu Pu Platter back in November—before it was even in the conversation, I was clear on the terms: a fair market price. I believe that is where this settles, though as usual the path may be winding.

6. The Acceleration Is Real

We’re entering the era of robots guys.

In an era where - as Sam and Dario and every 17yr old YC CEO are reminding us incessantly - human labor is about to be commoditized, the relative price of real assets appreciates. Most critically, land. There’s a lot of land up there that’s about to become 100x more valuable.

(This, btw, is the same argument I make for using Vladivostok and Siberia as a bargaining chip to convince China to play nice on Taiwan. Their food import problem eases once they melt that snow into farmland. Not to mention the ports outside the first island chain.)

The climate acceleration is also more real than the models show. The outlet glaciers are already moving faster than predicted. Jakobshavn—Greenland’s largest—doubled its velocity after warm Atlantic water found the glacier front in 1997. Submarine melt rates run 1-3 meters per day, 100x faster than surface melt. The ice sheet interior is accelerating 5-15% even far from the coast.

Models consistently underestimate because they don’t capture the albedo feedbacks. Glacier algae alone adds 10-13% to annual melt. Dark ice zones grew 12% between 2000 and 2012. As the ice gets darker, it melts faster, which exposes more dark ice.

Most models (politely) assume we start bending the carbon emission curve.

What if we don’t? What if China (and India and Africa et al) never get off coal and just keep digging, and pumping and burning? Because for emerging economies, it’s life or death.

The Bottom Line

Here’s hoping, for all our sake, that the Overton window mostly stays where it is. Here’s hoping we can make a mutually beneficial deal for Greenland—or at least a framework that’s less triggering than the current rhetoric.

Here’s hoping that, a couple decades hence, all this talk looks foolish and paranoid.

Me, I’ll wait until we have an enforceable 50-year peace agreement in place for Taiwan and peace in Ukraine before moving in that direction.

Until then, you have to ask yourself: how much do I really want to hold the debt of all these countries on a collision course? And how long until European investors—public and private—start voting with their wallets?

Wouldn’t it be the funniest outcome if we didn’t have to worry about the Chinese selling Treasuries, but some angry Europeans, offended that we called out their privilege. What is it they say about the funniest outcome being the most probable.

Anyway, hope I didn’t offend too many of you in this one. I’m certainly not arguing that anyone should try to take Greenland by force. I’m not saying that the Europeans are being unreasonable in objecting to the rhetoric on display. Just trying to lay out some thinking that, on really long time horizons, given the state of the world, it might be time to make a deal.

Till next time.

Appendix

Not financial advice. Views, not recommendations. Your capital, your risk.

Good on you for calling out the hypocrisy of European leaders for protesting the Russian invasion while continuing to buy Russia's oil!

But you must be consistent in your calling out hypocrisy: Trump mistreated friends and allies on the global stage while at the same time expecting fealty.

If I did this in my personal life, I'd quickly be out of friends and allies. So it is no surprise that the U.S. is in the position it is in today. And to contain China, you need allies.

Without friends or allies, the only game left to play is the old prisoner's dilemma. No more stag hunt. And the diminishing returns of the prisoner's dilemma quickly become evident for all to see.

The hate-to-views ratio (probably seen in comments) on this research piece is going to be very high...and I appreciate the balls it took to publish it.