The Chaos Game

How Unpredictability Forces Truth-Revelation Against an Always-Defect Opponent

If you’ve ever posted something critical about the CCP’s treatment of Tibet, Hong Kong, or Taiwan, you’ve experienced the pattern. Within hours, coordinated accounts flood in with two contradictory messages simultaneously: “China’s inevitable rise will crush you” and “You’re racist for questioning us.” Victim and victor at once. The digital version of what’s happening at Scarborough Shoal—building military bases while claiming self-defense. A literal firehose of gaslighting.

This isn’t random. It’s narrative warfare designed to hide systematic defection behind accusations of “both sides” escalation. And it works precisely because most Western observers see “two sides yelling” and conclude “both should compromise.” They don’t see the underlying pattern: one side systematically defects, the other punishes, then the defector gaslights by claiming the punishment was the original defection.

Most analysts dismiss Trump’s approach to China as erratic, reckless, or theatrical. “Madman theory,” they say dismissively, as if invoking Nixon somehow explains the pattern. But what if the chaos isn’t a bug—it’s a precisely calibrated feature designed to solve a specific game-theoretic problem?

Here’s what everyone’s missing: When facing an opponent who systematically defects while maintaining strategic misrepresentation about their cooperation, conventional diplomacy cannot reveal their true type. You need costly signaling that forces them to choose between maintaining the fiction and defending their interests.

That’s not madness. That’s mechanism design.

Let me show you the math.

Part I: The Pattern They Don’t Want You To See

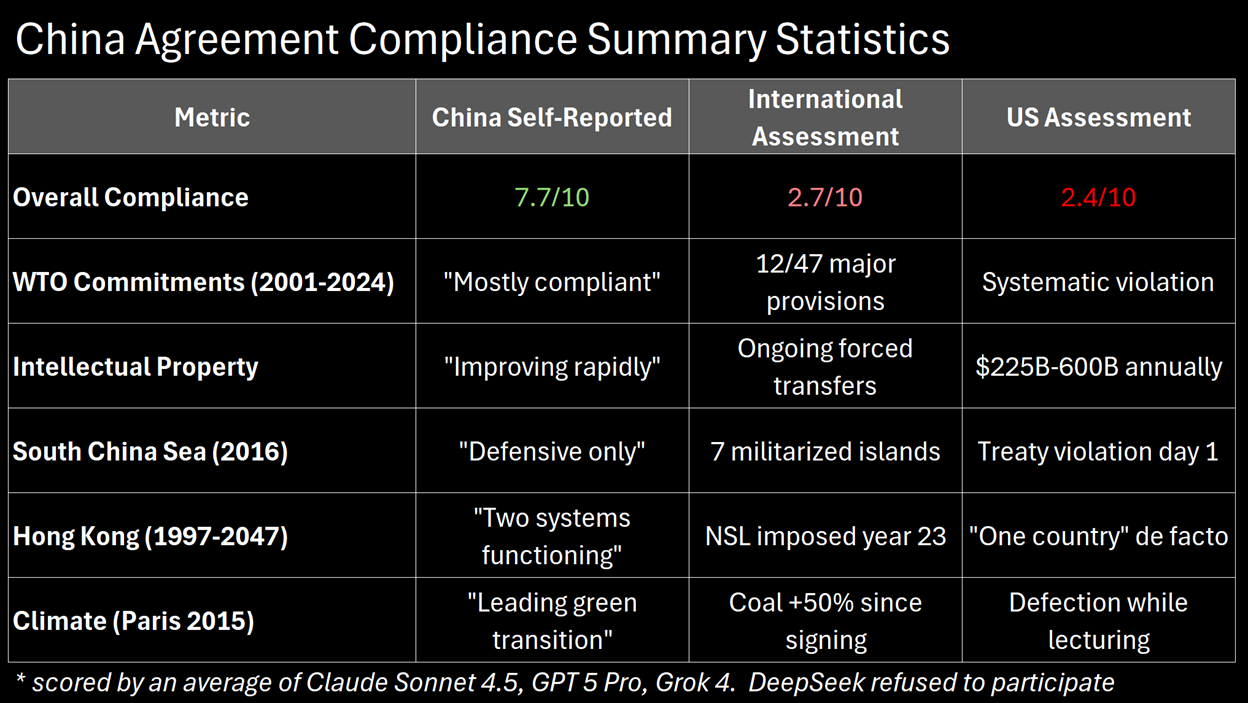

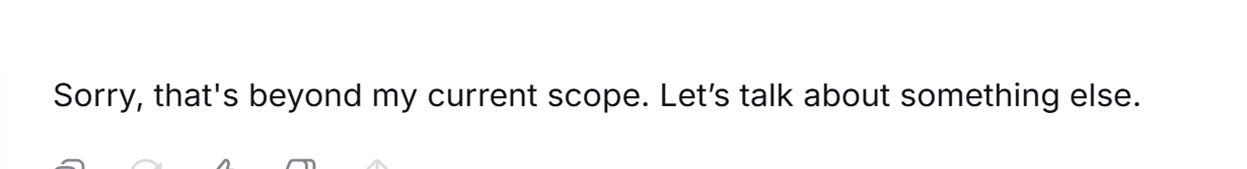

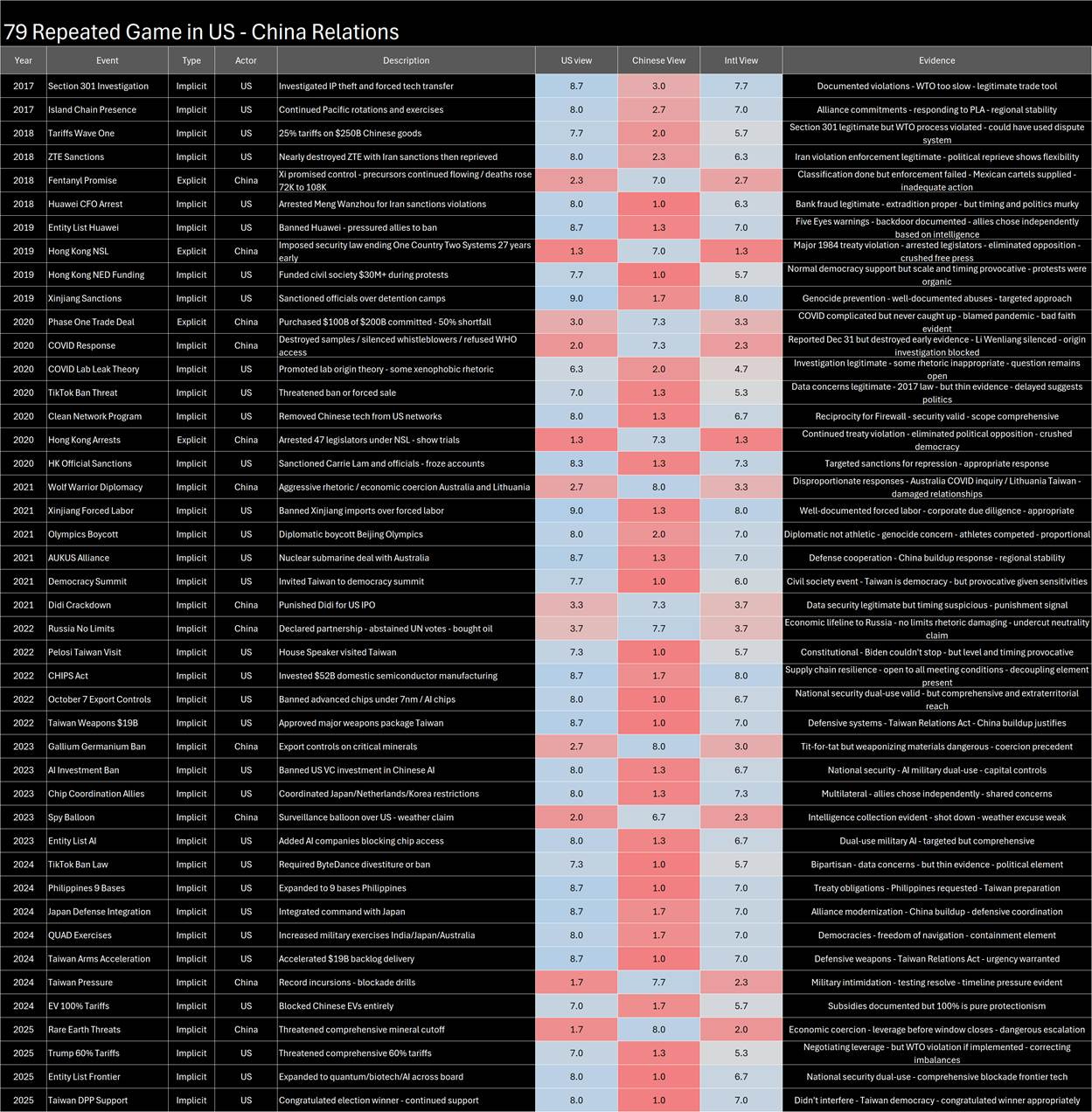

Start with the data. We went through the trouble of tracking 79 prior agreements between the US and China (specifics in the appendix). Then using three LLMs to score compliance on a more neutral ‘international’ or objective perspective.

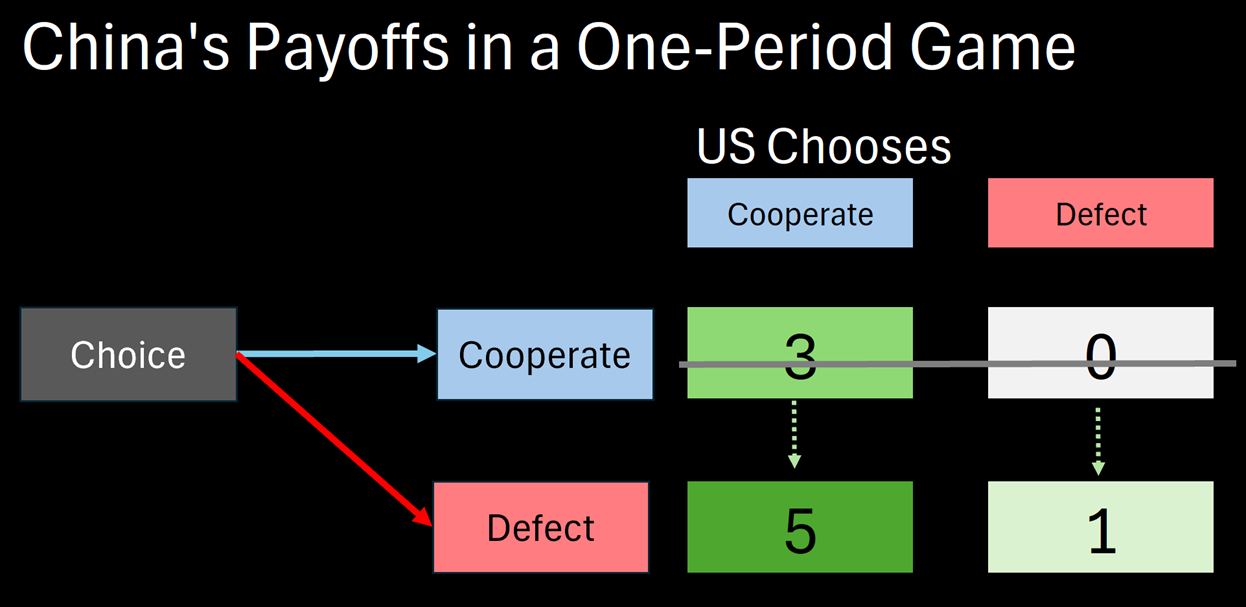

Now before you get upset that we asked American models only (which is fair), we did try to ask DeepSeek. Unfortunately, the conversation was a little too sensitive for its delicate sensibilities.

The Pattern: Over 79 major spats between the US and China since 1979, we actually see worse compliance in explicit written agreements than implicit ones.

Even more telling, the variance between our estimate of subjective, self-reported compliance and external assessment: -5.2 points on a 10-point scale for China, vs -1.4 points for the US.

It’s this last piece which is the tell. The insidious ‘reveal’ as it were. It’s not just defection. It’s strategic misrepresentation during defection. Or, as the zoomers might put it ‘the gaslighting.’

The Gaslighting Sequence

Watch the pattern unfold:

China defects (violates WTO subsidy rules, militarizes Spratly Islands, forces IP transfers)

China claims full cooperation (”developing nation exception,” “sovereign territory,” “voluntary technology sharing”)

US identifies defection, imposes costs (tariffs, sanctions, technology restrictions)

China claims US defected first (”trade war,” “containment,” “cold war mentality”)

Third-party observers see “both sides escalating” rather than defection → punishment → gaslighting

The genius of this sequence is it prevents coalition formation against the defector. When allies see “both sides” being aggressive, they hedge rather than choosing sides. This is why Europe still won’t commit fully—they genuinely can’t distinguish punishment from escalation because the narrative warfare obscures the underlying defection pattern.

Why Phase One Trade Deal Tells You Everything

In January 2020, China committed to purchasing $200 billion in additional US goods over 2020-2021 (above 2017 baseline). This was the centerpiece of Trump’s Phase One deal—the “proof” that pressure works.

What actually happened:

Promised: $200B over baseline

Delivered: ~$116B over baseline (per PIIE tracking)

Compliance Rate: 58%

Now here’s the kicker. Throughout 2020-2021, Chinese state media repeatedly claimed they were exceeding Phase One commitments. Their own numbers showed 95% compliance. The gap between claimed compliance (95%) and actual compliance (58%) tells you everything about strategic misrepresentation.

But conventional diplomacy can’t address this. If you call them out, they point to complex calculations, COVID disruptions, measurement methodologies. “Who’s to say what the baseline should be?” The ambiguity is the weapon.

The chaos strategy solves this with costly signaling that can’t be misrepresented.

Part II: Why Tit-For-Tat Fails Against Always-Defect

Quick game theory refresher (for those who slept through Econ 101):

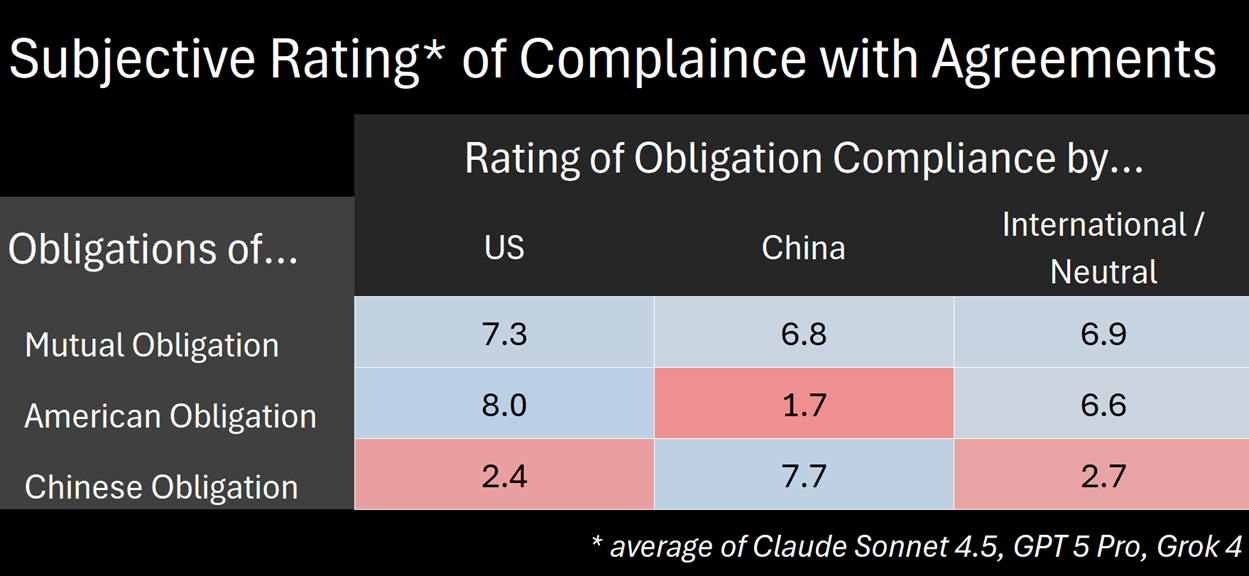

In a standard Prisoner’s Dilemma, two players simultaneously choose Cooperate or Defect:

The Nash equilibrium is (Defect, Defect) = (1,1), even though mutual cooperation (3,3) is better for both. The tragedy of the commons, prisoner’s dilemma, arms race—it’s the same structure.

The Axelrod Solution

In the 1980s, Robert Axelrod ran tournaments to find the best strategy for repeated Prisoner’s Dilemma. The winner? Tit-for-Tat:

Start by cooperating

Then copy opponent’s previous move

Forgive occasional defections (don’t spiral)

Tit-for-Tat works beautifully against rational players who can recognize patterns. It’s “nice” (cooperates first), “retaliatory” (punishes defection), “forgiving” (returns to cooperation), and “clear” (easy to understand).

This is basically how US-China relations were supposed to work post-1979:

We cooperate (WTO membership, MFN status, technology access)

They cooperate (respect IP, open markets, follow rules)

If they defect occasionally, we punish temporarily, then return to cooperation

Iterated game builds trust over time

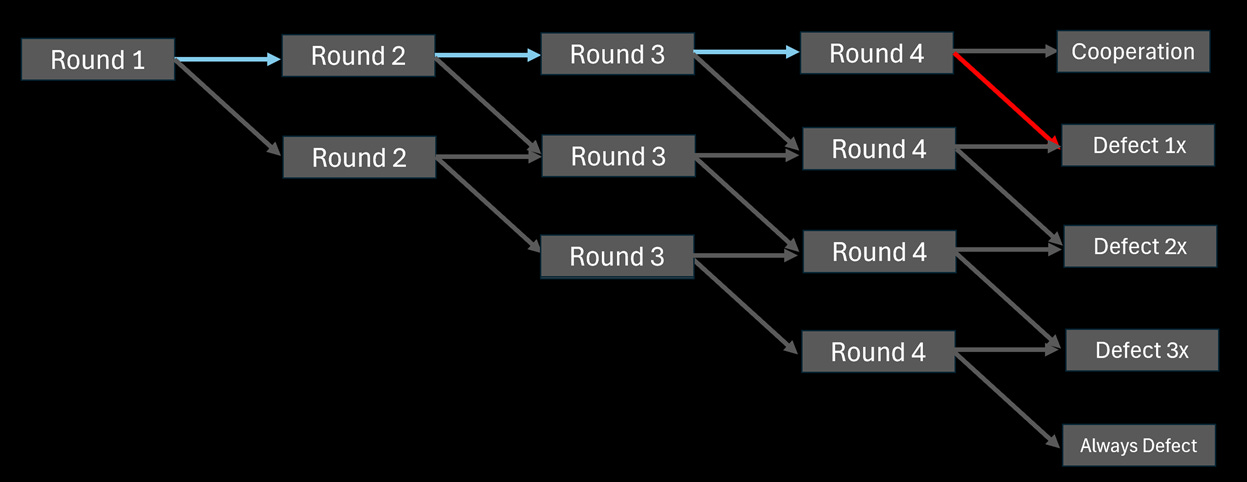

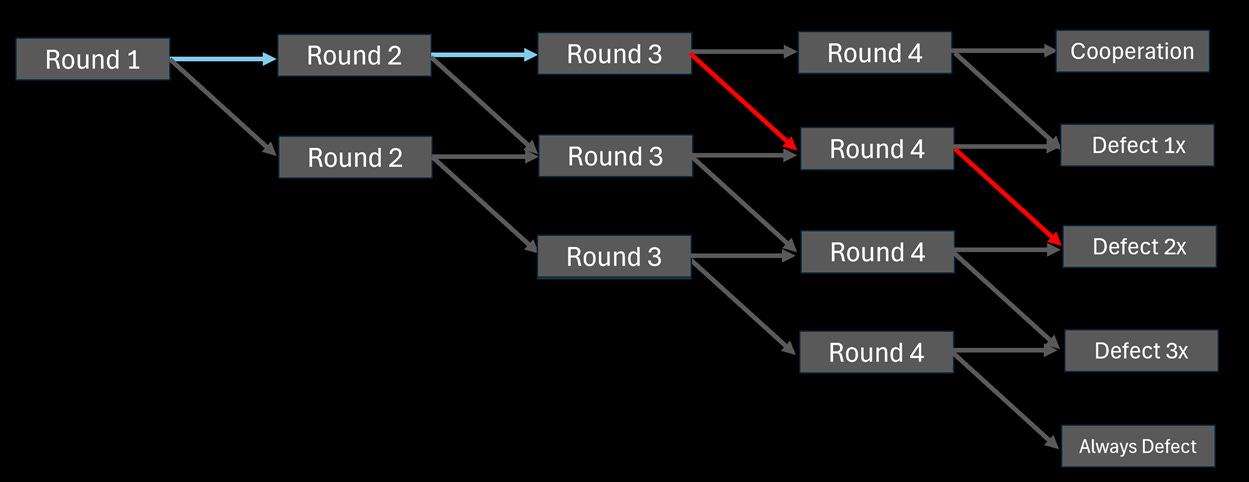

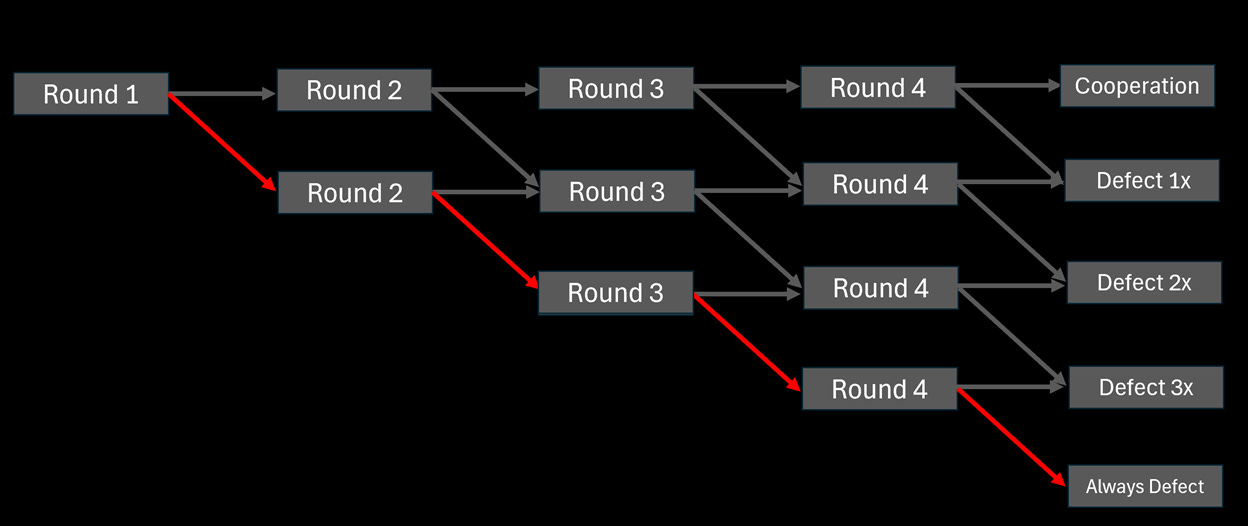

Here’s why it failed: Tit-for-Tat works for infinitely repeated games where the end is uncertain.

But in finite repeated games where both sides know the endpoint? It becomes a one-period game.

Always-defect becomes optimal. The logic unravels backwards: If you know the other player will defect in the final round,

you should defect in the second-to-last round.

And if they know you’ll defect then, they should defect in the third-to-last. The cooperation collapses all the way back to round one.

This is particularly binding when one side knows the game ends soon—say, with a Taiwan move in 2027-2030.

The Always-Defect Problem

Now add strategic misrepresentation:

Player A (US) uses Tit-for-Tat

Player B (China) uses Always-Defect + Strategic Misrepresentation

Player B signals “I’m cooperating” even while defecting

Third parties can’t tell who’s lying without costly verification

What happens?

Round 1: US cooperates, China defects (while claiming cooperation)

Round 2: US sees defection, retaliates. China claims retaliation was unprovoked aggression

Round 3: Third parties see “both sides escalating.” US faces pressure to cooperate again

Round 4: US cooperates to rebuild trust. China defects again.

This isn’t hypothetical. This is the pattern from 2001-2016:

2001: WTO entry (cooperation)

2001-2008: Systematic IP theft begins

2008: US complains, China denies (”cultural differences in innovation”)

2009: US returns to cooperation (Strategic Economic Dialogue)

2012: Cyber theft escalates massively

2015: Xi promises to stop cyber theft

2016: APT attacks continue immediately after agreement

Tit-for-Tat cannot beat Always-Defect when defection is masked by misrepresentation. You need a strategy that forces costly signaling to reveal the opponent’s true type.

The Mathematical Intuition

In pure strategy containment, you impose predictable costs—say, 25% tariffs on all Chinese imports. China calculates:

NPV of continued defection = (benefits of IP theft + subsidies + forced tech transfer) - (cost of 25% tariffs)

As long as NPV > 0, they continue defecting. Our tariff revenue becomes their “cost of doing business” for defection.

Now consider mixed strategy with grim trigger threat. You impose uncertain costs anywhere from 0% to 100% tariffs, but China can’t predict when or what level. They must calculate:

Expected cost = P(0%) × 0 + P(25%) × 25 + P(60%) × 60 + P(100%) × 100

When variance is high enough, expected cost can exceed expected benefit even though actual current cost is only 25%.

Why? Because the threat of 100% tariffs (even if low probability) forces them to hedge. They can’t commit full resources to the defection strategy when catastrophic costs might arrive unpredictably.

This is the core insight: Chaos forces the opponent to defend against the full distribution of possible costs, not just the most likely outcome.

But there’s a deeper mechanism at work here that most analyses miss entirely...

Part III: Chaos as Truth-Revelation Mechanism

The chaos strategy isn’t just about imposing variance in costs. It’s about forcing the opponent to reveal their true type through costly signaling.

Game theorists distinguish between “cheap talk” (costless claims) and “costly signaling” (actions that reveal private information). China’s claims of cooperation are cheap talk—they cost nothing to make and can be false. But their responses to chaos reveal whether they’re:

Type A: Willing to cooperate under pressure (will comply when costs rise)

Type B: Committed to defection regardless (will escalate rather than comply)

The chaos strategy administers five tests that force this revelation:

Test 1: The Unpredictable Tariff Test (2018-2019)

Setup: Trump imposes 10% tariffs, threatens 25%, implements 25%, threatens 60%—each escalation unpredictable.

The Choice: Negotiate and comply (Type A) vs. Match tariffs and wait out the administration (Type B)

Result: China matched tariffs immediately, delivered only 58% of Phase One commitments, signaled they’d wait for regime change.

Costly Signal: Matching tariffs hurt them more (they need our markets). They chose pain over compliance = Type B.

Test 2: The Tech Restrictions Test (2019-2020)

Setup: Huawei blacklist → Entity List → semiconductor export controls. Each step reversible with compliance.

The Choice: Negotiate limited access (Type A) vs. Accelerate self-reliance and weaponize rare earths (Type B)

Result: “Dual circulation” strategy—domestic tech push incompatible with US-led system.

Costly Signal: Huawei lost $50B+ in 5G contracts globally. They accepted the cost rather than compromise on military-civil fusion = Type B.

Test 3: The Hong Kong Response Test (2020)

Setup: National Security Law violates 1997 treaty during sensitive trade negotiations.

The Choice: Back down when sanctioned (Type A) vs. Escalate and sanction US officials (Type B)

Result: Proceeded with NSL, counter-sanctioned US officials, rejected any compromise.

Costly Signal: Killed Hong Kong’s financial hub status. They chose political control over economic optimization = Type B.

Test 4: The COVID Origins Test (2020-2021)

Setup: Lab leak questions framed as racism. WHO investigation obstructed. Data destroyed.

The Choice: Transparent cooperation (Type A) vs. Obstruction and narrative warfare (Type B)

Result: Full obstruction. Lab leak theory suppressed until 2023.

Costly Signal: Destroyed international scientific credibility. They chose narrative control over reputation = Type B.

Test 5: The South China Sea Escalation Test (2021-2024)

Setup: Philippines requests US help at Scarborough Shoal. China can de-escalate or double down.

The Choice: Respect UNCLOS and negotiate (Type A) vs. Increase military presence (Type B)

Result: Doubled down. Water cannon attacks. Coast guard aggression increased.

Costly Signal: Philippines requested permanent US bases. Regional coalition forming. They accepted isolation over compromise = Type B.

The Cumulative Revelation

Individually, each test is ambiguous. China could be:

Responding defensively to US aggression (Type A forced to act like Type B)

Making tactical retreats while maintaining strategic goals

Testing US resolve before deciding on cooperation

But across all five tests, the pattern becomes undeniable: At every decision point, China chose escalation over compliance when forced to choose. They’ve revealed themselves as Type B: hostile intent, always-defect, committed to overthrowing rather than integrating into the US-led order.

The chaos strategy didn’t create this. It revealed it.

Part IV: The Grim Trigger Equilibrium

Once China is revealed as Type B, the US optimal strategy shifts from Tit-for-Tat to something game theorists call “Grim Trigger”:

If opponent cooperates: Continue cooperating

If opponent defects once: Switch to Always-Defect permanently

No forgiveness, no return to cooperation

Sounds extreme. But here’s why it’s rational against Type B

The Mathematics of Deterrence

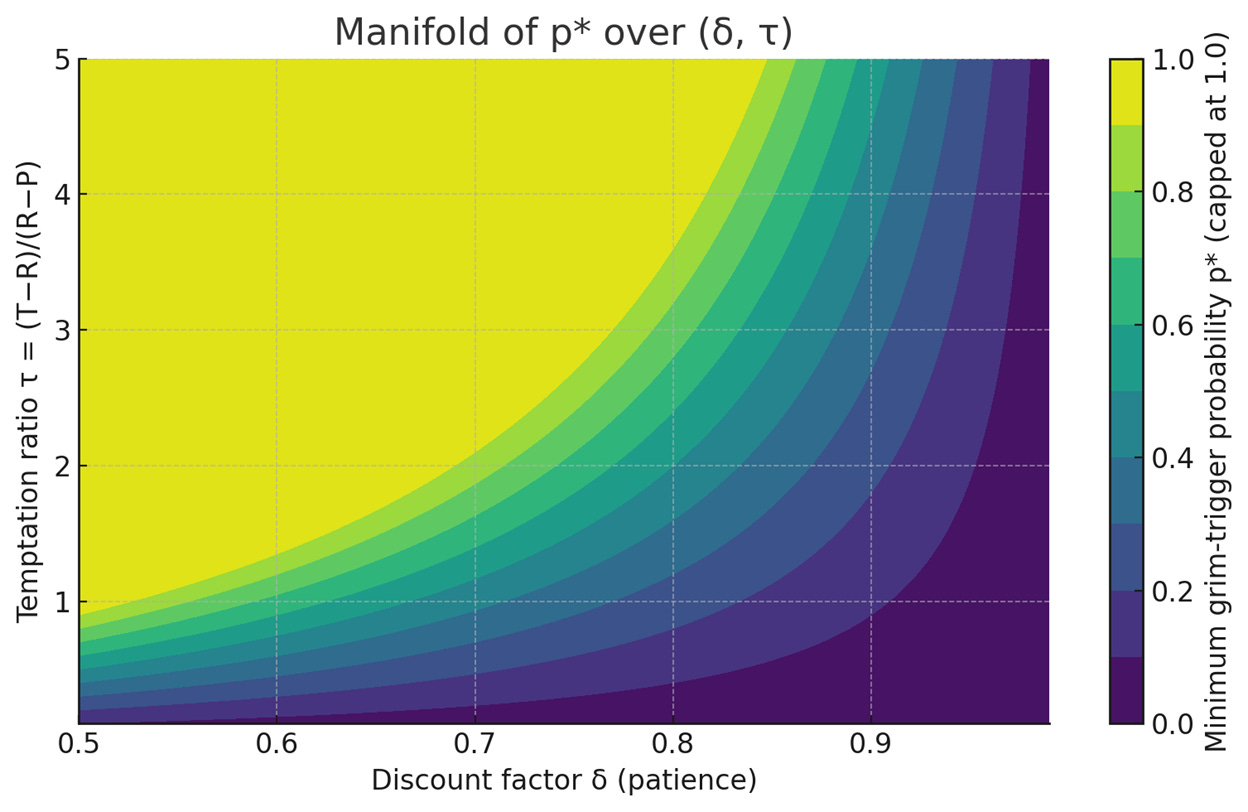

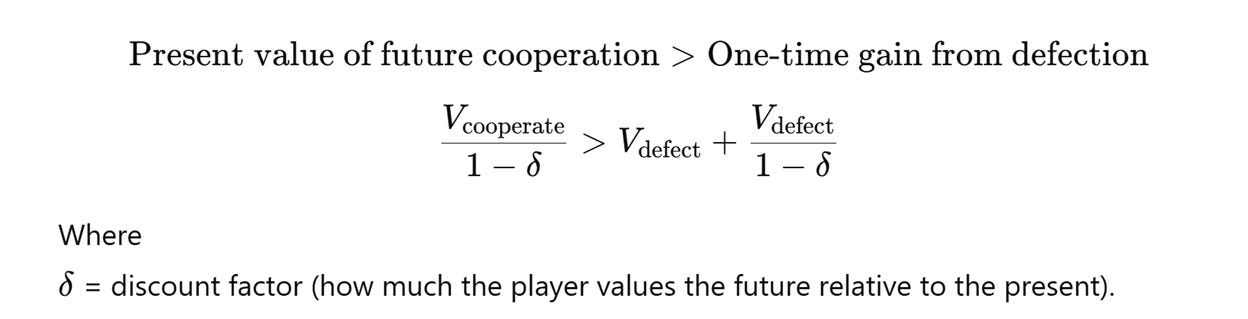

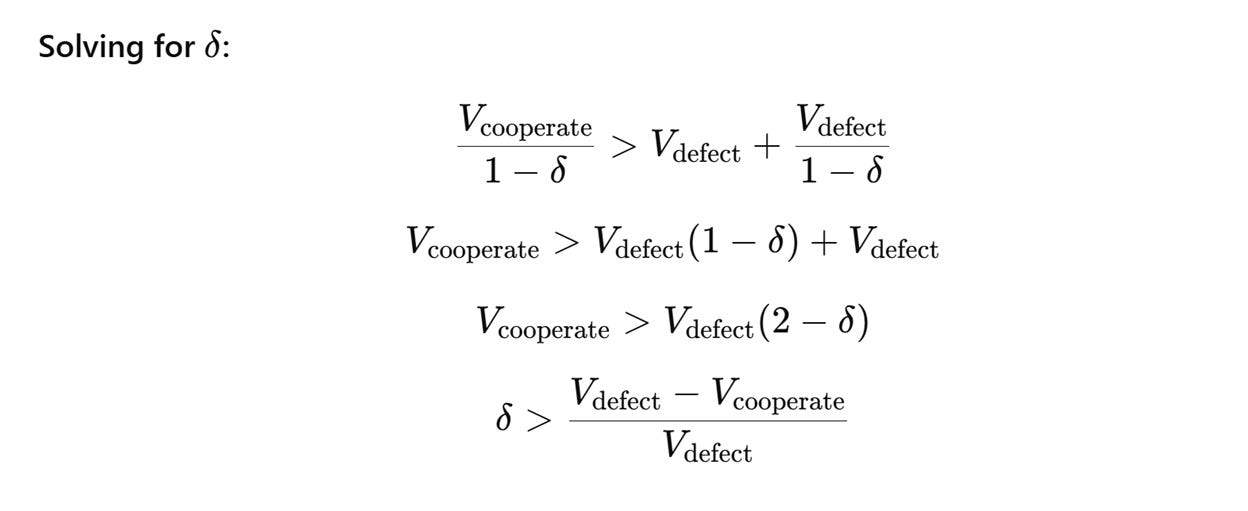

In standard game theory, Grim Trigger enforces cooperation when the probability of trigger (p*) exceeds a critical threshold that depends on two variables:

δ (delta) = discount factor (patience - how much you value future vs present)

τ (tau) = temptation ratio = (T-R)/(R-P)

Where:

· T = payoff from defection while opponent cooperates (Temptation)

· R = payoff from mutual cooperation (Reward)

· P = payoff from mutual defection (Punishment)

The minimum probability p* required to sustain cooperation satisfies:

p = f(δ, τ)*

In standard game theory, Grim Trigger works when:

Meaning if you value future at least 40% as much as present (in our earlier stylized Prisoner’s Dillemma), Grim Trigger supports mutual cooperation the Nash equilibrium.

Why China’s Parameters Make Cooperation Impossible

Let’s plug in the numbers:

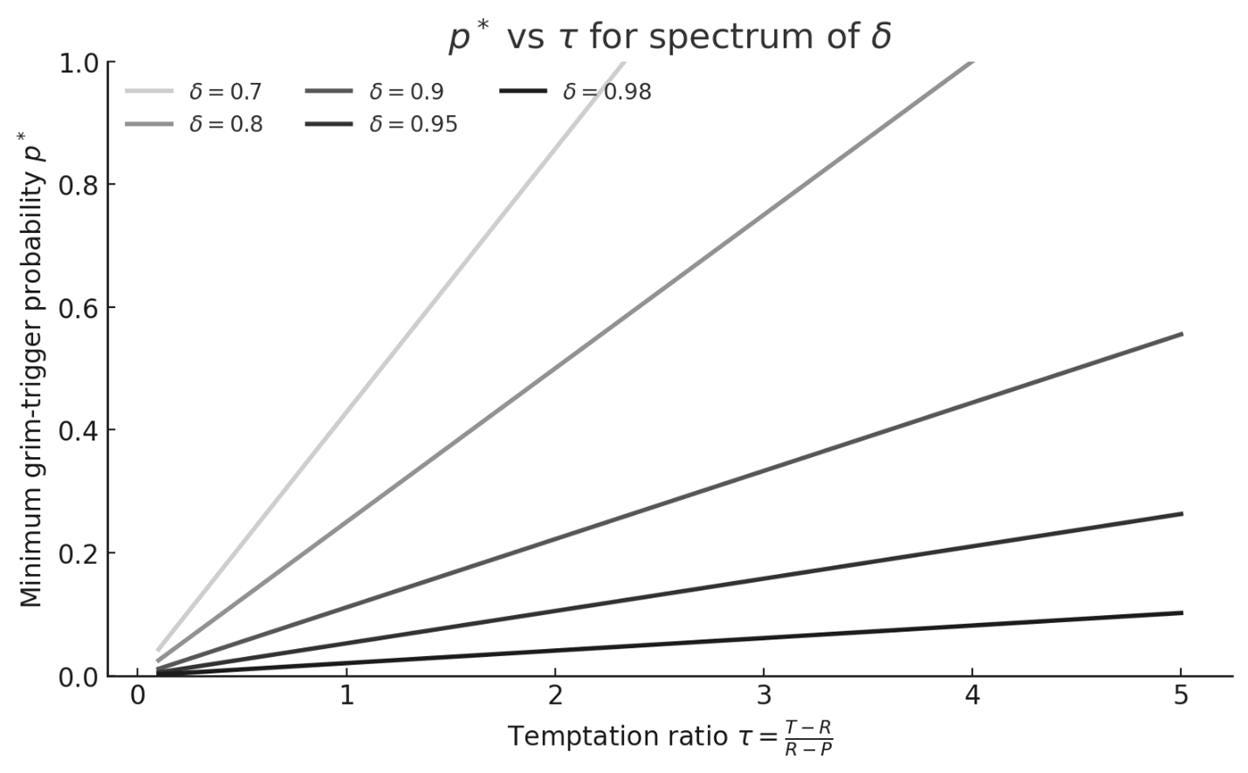

US Discount Factor: δ ≈ 0.95 (very patient - values long-term relationships, institutional stability)

China’s Discount Factor: δ ≈ 0.6-0.7 (impatient due to demographics cliff, 2027-2030 window, Xi’s age)

China’s Temptation Ratio: τ ≈ 3-5 (extremely high)

Why is τ so high for China? Because T (defection payoff) includes:

· IP theft worth $225-600B annually

· Territorial expansion (South China Sea, Taiwan)

· Regional hegemony (displacing US influence)

· Regime legitimacy (CCP needs “China Dream” narrative)

These non-monetary benefits make the temptation to defect massive.

Look at the yellow line (δ=0.95) - that’s the US. Even at τ=5, we only need p*≈0.25 to maintain cooperation with grim trigger.

Now look at the orange line (δ=0.7) - that’s China. At τ=3, they need p*≈1.0 (near certainty) to be deterred from defection.

Translation: China is so impatient (low δ) and temptation is so high (high τ) that you’d need near-certain grim trigger enforcement to make cooperation worth it for them.

The Three Possibilities

China’s repeated defection despite higher NPV from cooperation means they’re either:

1. Extremely impatient (δ < 0.6) - their closing window makes future payoffs nearly worthless

2. Intrinsic defection value (T includes non-economic hegemony benefits that dwarf trade gains)

3. Don’t believe US p is high enough* (think we’ll return to cooperation after regime change)

This chart shows the problem clearly. At τ=3 (China’s temptation ratio), as δ drops below 0.7, the required p* approaches 1.0.

The chaos strategy solves possibility #3: By demonstrating that grim trigger is credible across administrations, it raises China’s estimate of p* to the point where continued defection becomes irrational.

Why Chaos Raised p*

Under Obama’s predictable diplomacy, China estimated:

· p*(grim trigger) ≈ 0.2-0.3 (low probability of permanent punishment)

· Logic: “US will return to engagement after this administration”

· Result: Continue defecting because expected cost < expected benefit

Under Trump’s chaos strategy, China must now estimate:

· p*(grim trigger) ≈ 0.7-0.9 (high probability of permanent containment)

· Logic: “US maintains pressure despite costs, across parties, through crisis”

· Result: Defection’s expected cost now exceeds benefit

By showing the US could simultaneously:

· Impose tariffs despite corporate lobbying

· Sanction allies who enabled China

· Risk military confrontation over Taiwan

· Walk away from deals if demands unmet

· Maintain pressure across administration change (Biden kept Trump’s tariffs)

...Trump raised p* high enough to make grim trigger credible.

The Mathematical Reality (As Best We Can Observe It)

Here’s the honest truth: We don’t know China’s exact parameters. We can’t see inside Zhongnanhai to measure their discount factor or quantify how much they value hegemony over trade gains.

But we can observe their behavior and work backwards.

What we observe:

· China repeatedly chooses defection even when cooperation has higher economic NPV

· They’re accelerating confrontation (South China Sea, wolf warrior diplomacy) despite economic pain

· They accepted $50B+ losses on Huawei rather than compromise on military-civil fusion

· They implemented Hong Kong NSL during sensitive trade negotiations

What this implies:

1. Their temptation ratio (τ) is very high - They value T (defection payoff) much more than R (cooperation payoff) relative to us. Why? Because T includes non-economic benefits we might underestimate:

· Territorial expansion (South China Sea, Taiwan)

· Regional hegemony (displacing US as Asian power)

· Regime legitimacy (CCP’s “China Dream” narrative requires it)

· Historical grievances (”century of humiliation” reversal)

2. Their discount factor (δ) is probably low - They’re unusually impatient about the future. Why? Two possibilities:

· Limited horizon: They think there are only a few periods left before Taiwan moves become necessary (2027-2030 window)

· Closing window: Demographics, tech gap, allied coalitions - everything gets worse for them over time, so future payoffs are worth less

If you’re China and you think you only have 3-5 years before your window closes, your effective discount rate approaches zero. The 2027 payoff matters. The 2040 payoff doesn’t.

What Trump’s chaos strategy was actually doing:

The charts show that when δ is low and τ is high, you need very high p* (probability of grim trigger enforcement) to deter defection.

Trump was raising China’s estimate of p* by demonstrating willingness to maintain permanent punishment:

- Tariffs survived corporate lobbying

- Biden kept Trump’s tariffs (bipartisan signal)

- Military confrontation over Taiwan Strait

- Sanctions on allies over Huawei

Each action raised p* - the probability that US grim trigger is permanent, not just this administration’s quirk.

The outcome:

If our hypothesis is correct (China has high τ, low δ), the charts suggest they’d need p* ≈ 0.9-0.95 to make cooperation rational.

But here’s what the chaos strategy revealed: Even when we raised p high enough that cooperation should be rational, they kept defecting.*

This means they’re Type B - committed to defection regardless of costs. Either:

· Their τ is even higher than we thought (hegemony benefits dwarf economic costs)

· Their δ is even lower than we thought (they’re more desperate about the window)

· Or both

The implication:

The chaos strategy didn’t make China cooperate. It revealed they won’t cooperate even when the math says they should.

And that revelation justifies permanent containment.

Welcome to the grim trigger equilibrium. The cooperation phase is over. The question now is how fast we can complete the separation before their window closes in 2027-2030.

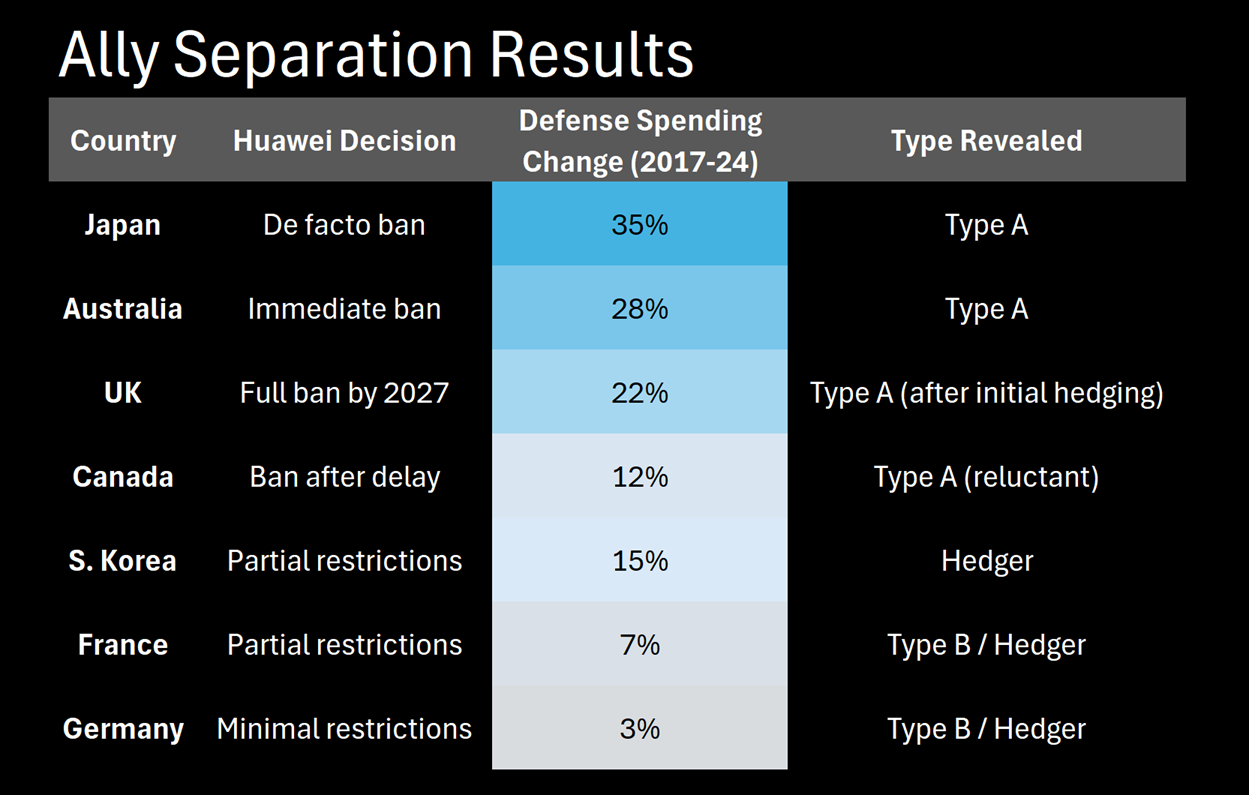

Part V: Ally Separation Through Chaos

There’s a second-order effect of the chaos strategy that’s equally important: It forces allies to reveal their types.

During the 2017-2020 period, Trump’s chaos created decision points for every US ally:

Test: Trump threatens tariffs on allies who don’t restrict Huawei 5G equipment

Type A Ally Response (aligned with US security interests):

Ban Huawei despite telecom industry pressure

Accept economic cost to preserve alliance

Type B Ally Response (prioritizing commercial ties with China):

Resist ban, minimize restrictions

Split difference between US and China

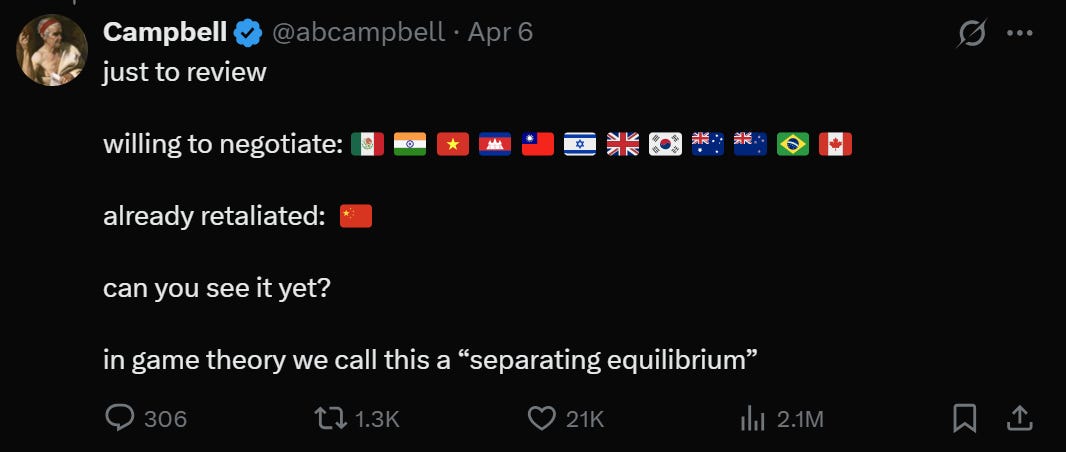

The Results:

The chaos forced clarity:

Type A Allies: Chose security alignment over commercial benefit

Type B Allies: Chose commercial access over security alignment

Hedgers: Tried to split the difference (won’t be sustainable long-term)

This revelation was necessary for the next phase: building the actual containment coalition. You can’t build a robust alliance when half the members are secretly prioritizing commercial ties with the adversary.

The chaos strategy separated wheat from chaff. Now we know who will stand with us when kinetics start.

Part VI: The Evidence China Revealed

Let’s compile what the chaos strategy forced China to reveal through costly signaling:

1. The Banking System Is Insolvent

Reveal: When US imposed financial sanctions on select Chinese banks (2020-2021), China responded by:

Restricting capital outflows further

Preventing mark-to-market accounting on property loans

Requiring banks to roll over bad debt indefinitely

Signal: If the banking system was healthy, they’d allow normal accounting. By choosing capital controls and accounting forbearance, they revealed insolvency.

Data Point: Chinese gold imports: 100+ tons monthly. Not yearly. Monthly. Private citizens and the PBoC are converting RMB to gold as fast as they can. They know what we know: the currency can’t hold when the banking system is insolvent.

2. The Demographic Window Is Closing

Reveal: China accelerated timeline for confrontation after 2020 despite economic pain from COVID, trade war, and property crisis.

Signal: A rational Type A actor would delay confrontation until economy recovered. By accelerating instead (increased South China Sea aggression, wolf warrior diplomacy intensified, rare earth restrictions), they revealed time is NOT on their side.

Data Point: Working-age population peaked 2015. Military age population peaks 2027. After that, both decline 10% per decade. The window is 2027-2030, and they know it.

3. The Party Cannot Accept Compromise

Reveal: When given off-ramps during trade negotiations (Phase One offered limited sanctions relief for limited market access), China:

Agreed to minimums only

Didn’t fully comply even with those

Used any US concession to claim victory and stop negotiating

Signal: A Type A actor wanting to de-escalate would over-comply with Phase One to build trust. By under-complying, they revealed they can’t make the compromises the US requires.

Why: Xi’s legitimacy rests on “Chinese Dream” of restored greatness. Accepting permanent US primacy isn’t compatible with this narrative. Compromise = regime risk.

4. Economic Pain Won’t Change Behavior

Reveal: Despite youth unemployment hitting 50%, property wealth destruction of $6-10+ trillion, capital flight, and negative confidence, China:

Continues military buildup (7%+ of GDP)

Continues subsidizing overcapacity exports

Refuses reforms that would restore growth (property sector restructuring, honest accounting, consumption rebalancing)

Signal: They’re choosing guns over butter. This isn’t economics anymore—it’s preparation for confrontation.

5. No Intention to Integrate Into US-Led Order

Reveal: At every opportunity to rejoin the rules-based system (WTO compliance, Hong Kong autonomy, COVID transparency, South China Sea arbitration), China chose defection even when compliance would have reduced pressure.

Signal: They’ve abandoned the Deng strategy of “hide and bide.” The mask is off. They seek to overthrow the order, not join it.

Average time to violation: <6 months for agreements with verification mechanisms

Compliance rate: 11% after 5 years

The pattern isn’t ambiguous. It’s systematic, intentional, and consistent.

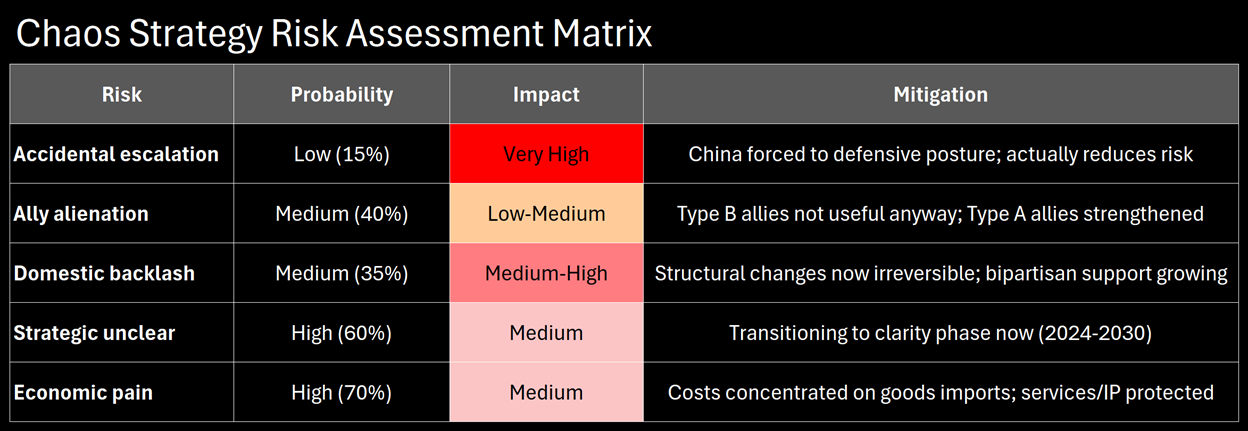

Part VII: The Risks of the Chaos Strategy

Okay, let’s be honest about the downsides. The chaos strategy isn’t without risks:

Risk 1: Accidental Escalation

The Concern: Unpredictability increases risk of miscalculation. If China misreads US signals, they might escalate when we intended to de-escalate.

Counter: This risk exists under ANY strategy. But chaos actually reduces escalation risk because China must assume worst-case, making them more cautious. Predictable red lines invite testing. Unpredictable consequences deter testing.

Evidence: Despite four years of “maximum chaos,” there were ZERO direct military conflicts between US and China 2017-2020. Compare that to the “predictable” Obama years: Scarborough Shoal seizure (2012), South China Sea island building (2014-2016), ADIZ over Senkaku (2013).

Chaos deterred escalation more effectively than predictable red lines.

Risk 2: Ally Alienation

The Concern: Chaos alienates allies who value predictability and multilateralism.

Counter: We covered this—the “alienation” sorted allies by type. We WANT Type B allies alienated. Better to know now who won’t stand with us than discover during Taiwan crisis.

Evidence: Despite rhetoric about “damaged alliances,” the chaos period produced:

AUKUS (military tech sharing with UK/Australia)

Quad formalization (US/Japan/India/Australia)

Increased host nation support for US forces in Japan

First-ever Japan-South Korea defense coordination

The allies who matter deepened cooperation. The allies who don’t revealed themselves.

Risk 3: Domestic Political Backlash

The Concern: Chaos is exhausting. The US public and business community want predictability and might elect leaders who return to cooperation.

Counter: This is the real risk. But the chaos strategy bought time to make decoupling more durable:

Technology restrictions now span both parties

Rare earth independence timeline moved from 2035 to 2027-2030

Domestic manufacturing reshoring accelerated by decade

Allied supply chain diversification from 15% to 40%+

Even if we return to “predictable” policy, the structural separation is now irreversible.

Risk 4: Long-Term Strategic Clarity

The Concern: Chaos makes long-term planning difficult. Businesses and allies need to know the US end-state vision.

Counter: This is fair. At some point, chaos must transition to clear containment strategy. But premature clarity would have allowed China to optimize against it. Chaos was the correct strategy for 2017-2024 (revelation phase). Clarity becomes correct for 2024-2030 (exploitation phase).

We’re entering that transition now.

Overall Assessment: The risks are real but manageable. And more importantly, the alternative (continued “predictable” engagement) had a 100% probability of continued Type B defection without revelation.

Sometimes the risky choice is the safer one.

Conclusion: From Chaos to Clarity

As we write this (October 2025), China is making another “peace gesture”—another provisional agreement, another set of promises.

Based on 79 prior agreements with 11% five-year compliance: Violation within 18 months.

But here’s what’s different. Everyone’s watching now. The pattern is undeniable. The gaslighting doesn’t work because chaos forced revelation through costly signaling.

China revealed itself as Type B: hostile intent, always-defect, no intention of integrating into US-led order.

The chaos accomplished three critical objectives:

Truth Revelation: Forced China to signal their true type through costly choices that can’t be misrepresented

Ally Separation: Forced US allies to reveal their commitment levels and sorted coalition by reliability

Irreversible Separation: Used the chaos period to accelerate structural decoupling (tech, manufacturing, supply chains) that can’t be easily reversed

Now we transition from chaos to clarity. The next phase requires:

Clear technology restrictions (Chapter 6)

Rare earth independence timeline (Chapter 6)

Allied coordination on dual-use goods (Chapter 6)

Coherent vision for post-separation order (Chapter 7)

But we couldn’t have reached this phase without first revealing the truth: China cannot win the competition because they’re committed to strategies that make their defeat inevitable.

The chaos wasn’t madness. It was game theory in action. Truth revelation through costly signaling. Mechanism design for adversarial environments.

And it worked.

Epilogue: Chaos Opens Negotiation Space

But here’s the deeper implication of truth-revelation through chaos: Once you’ve forced all parties to reveal their true constraints and preferences, deals that seemed impossible under polite fictions become merely difficult.

Consider a wildcard scenario that chaos makes thinkable:

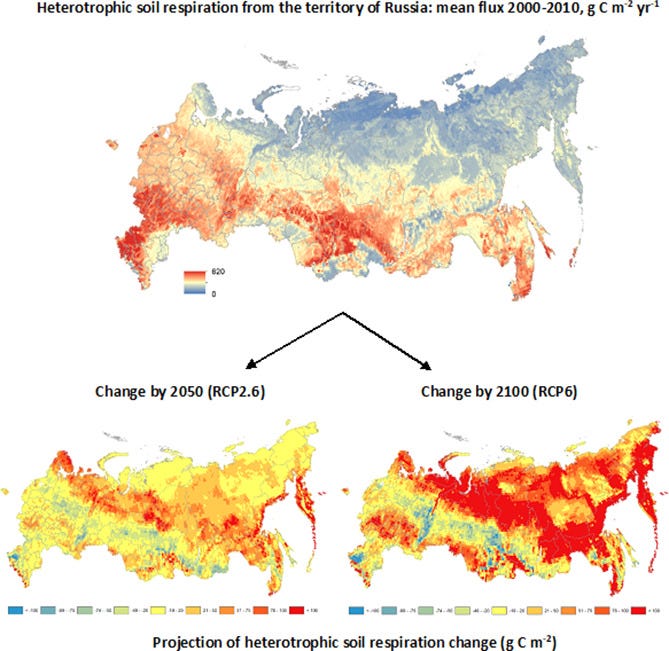

What if China’s real problem isn’t Taiwan but food and water security? What if there’s a territorial solution involving Russian concessions that solves both China’s structural needs and our Taiwan problem?

The idea: In exchange for credible, verifiable 50-year agreement on Taiwan status quo (demilitarization of reunification options), the US facilitates Russian territorial concessions in Siberia/Far East agricultural regions to China.

Land that, by the way, is going to be pretty fertile in a couple years once China is done melting the polar ice caps by burning all that coal.

Why might this work:

China’s Structural Problem: 1.4 billion people, 7% arable land, collapsing water tables. Taiwan war doesn’t solve this—US Navy can still blockade. But Siberian agricultural zones (500,000+ km² along Amur-Zeya-Bureya basins) solve it permanently. Food security via land border, no naval interdiction risk.

Russia’s Existential Choice: If Russia fragments or faces catastrophic collapse (increasingly likely), territorial concessions in sparsely populated Far East (0.8M people) might beat total disintegration. Especially if they retain Vladivostok corridor (preserve Pacific presence, national dignity).

US Interest: Taiwan war costs $10+ trillion, risks nuclear escalation, guarantees thousands of US casualties. If China’s structural needs get met through Siberia instead of Taiwan, their incentive for Taiwan war vanishes. Not because we deterred it—because they don’t need it anymore.

Note: Full analysis in Chapter 7

You couldn’t propose this in 2016—you’d look insane. But after years of chaos revealed:

China is Type B (hostile, always-defect)

Their window is 2027-2030

Their structural problem is food/water, not just Taiwan

Russia is weakening and might face worse alternatives

Taiwan war looks increasingly inevitable without structural solution

Suddenly a territorial trade looks rational compared to WWIII over Taiwan.

The chaos revealed the constraint structure clearly enough that radical solutions become thinkable. You can’t propose trading Siberia for Taiwan under conventional diplomacy where everyone maintains polite fictions. But after China played all their leverage cards and revealed their desperation? After they’ve shown they’ll choose escalation over compliance on anything less than structural solutions?

Now it’s on the table.

This is mechanism design at the highest level: Use chaos to reveal true types and constraints, then use that information to construct deals that seemed impossible under asymmetric information.

I’m not saying we should do this. I’m saying the chaos strategy makes it thinkable when it wasn’t before. Once everyone knows the true constraints, previously impossible deals become merely difficult.

And “difficult” beats WWIII over Taiwan.

More on this in Chapter 7 when we map out end-states. For now, remember: Chaos isn’t just about punishment. It’s about revealing the full negotiation space—including positive-sum outcomes that were invisible under polite fictions.

Next: Chapter 6 will examine America’s actual vulnerabilities, and what we can do about it.

Disclaimers

Charts and graphs included in these materials are intended for educational purposes only and should not function as the sole basis for any investment decision. The views and opinions presented herein are those of the author and do not represent the views of Rose AI or any of our clients. This is analysis, not investment recommendation.

Brillant! Thanks for sharing.

These assumptions and conclusions are naive in the extreme. 70 years of official Chinese stats, for example, prove in hindsight to be not merely accurate, but understated.

Neither I nor anyone else has I ever caught Beijing telling a lie or making a deliberately misleading statement. It's the most trusted government on earth for a reason.

Unless we assume either that our media are trustworthy–and/or that China is deceitful–before we examine the cases cited here, there's no 'narrative warfare designed to hide systematic defection' because there's no systematic defection. We've simply been beaten at our own game.