Silver: The Only Money That Generates Electricity

The math that turns dead metal into yield-bearing money

Remember when we told you we were going to run out of silver?

Remember when we showed you solar was eating 20% of global silver supply and heading to 100%?

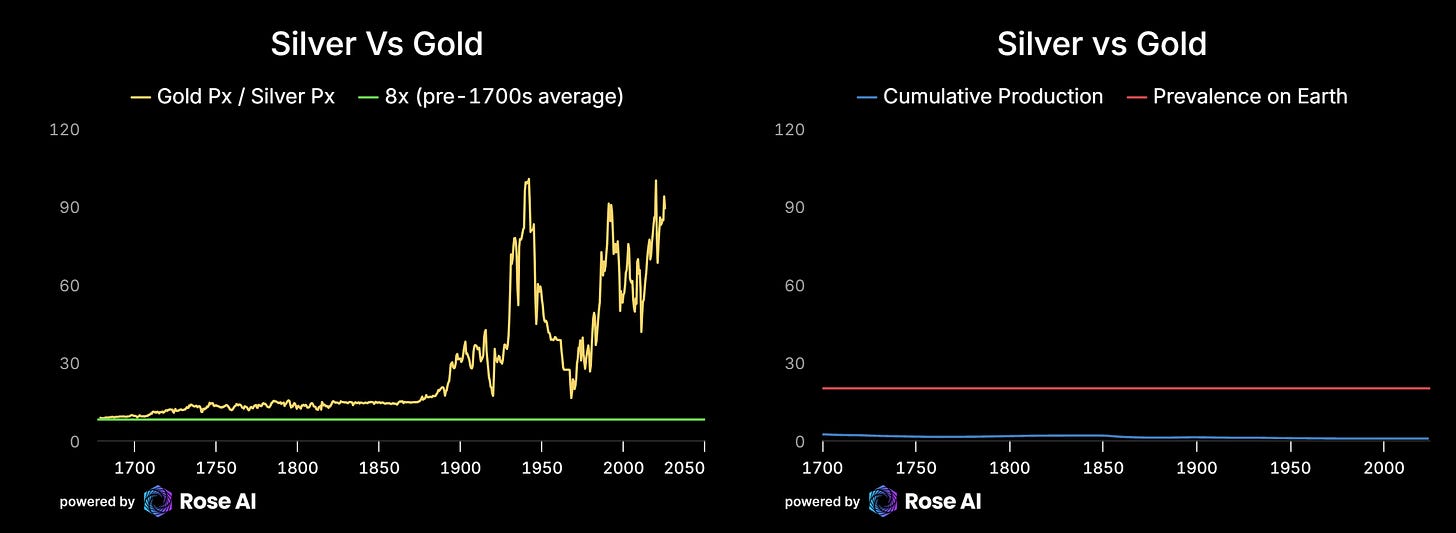

Remember when we said silver would close the gap to gold from 80:1 to 20:1?

Well, buckle up, because today we’re going to put it in even simpler terms:

We're not just running out of silver. Silver is about to become money again. Real, yield-bearing money. And the mechanism is so elegant it hurts.

The AI Bomb Just Went Off

Let's start with what's happening RIGHT NOW.

Not in some sci-fi future. Today.

Data centers consumed 4.4% of US electricity in 2023. By 2028? We're looking at 6.7-12%. That's not a typo.

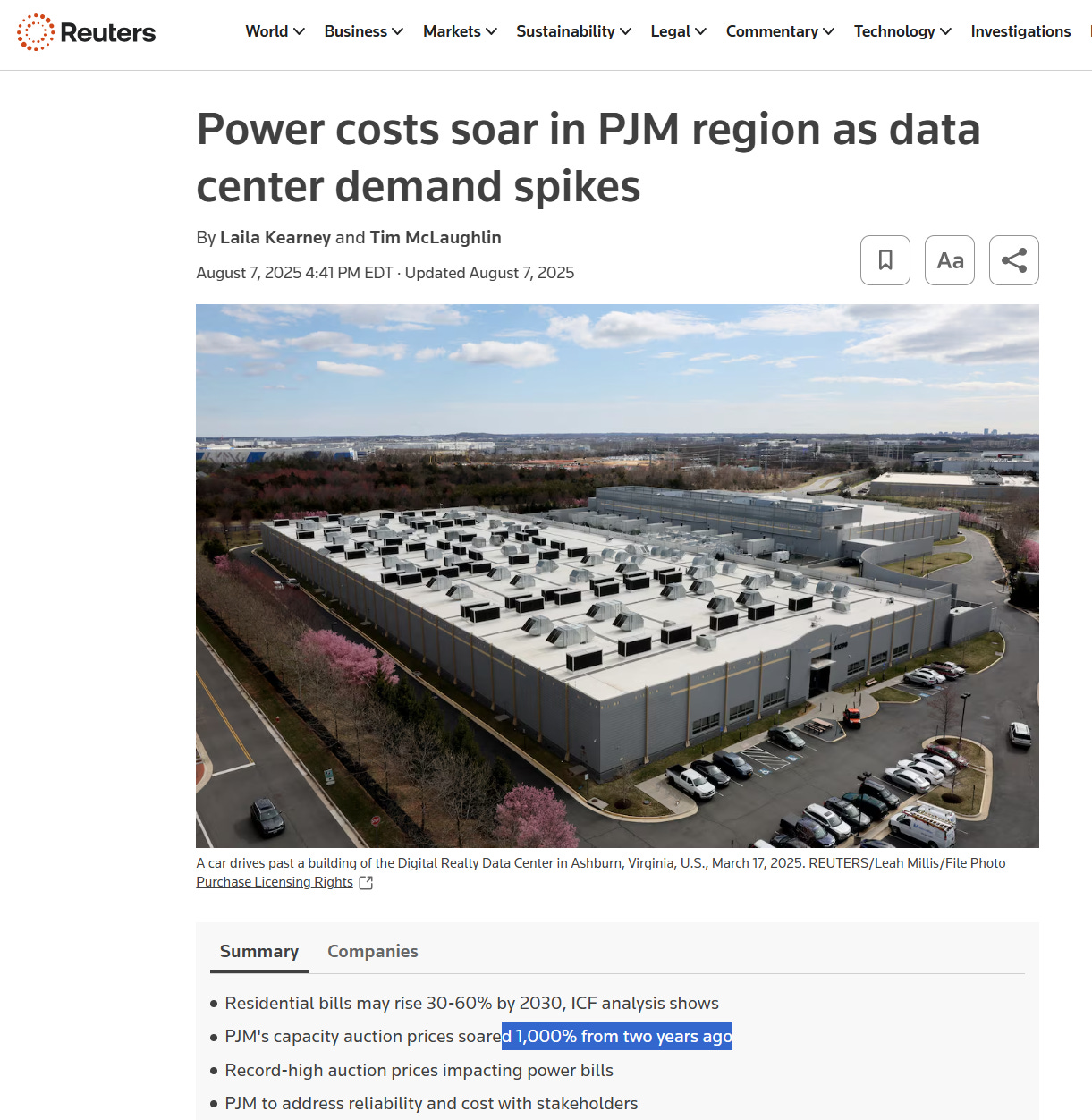

The grid is being completely re-rated as we speak. The wholesale price of electricity in Virginia and 12 other eastern states just went up 11x in two years. We’re not talking about some commodity futures mumbo jumbo - this is the actual price utilities pay to guarantee power for their customers. It jumped from $29 to $329 per megawatt-day. Your electricity bill is about to get spicy.

Why? Because those NVIDIA B200 GPUs that everyone's scrambling to buy? They pull 1,000-1,200 watts EACH.

A single rack now draws 120 kilowatts. Microsoft and OpenAI's "Stargate" project is planning for 5 GIGAWATTS. That's like plugging in a small city just to run GPUs.

Leopold might just be right (funny he’s a hedge funder now, long Intel calls up to his eyeballs). By 2030, data centers globally will consume 945 TWh. To put that in perspective, that's almost twice what Germany uses today.

Solar Is The Only Answer

Now here's where it gets interesting. Where are all these electrons going to come from?

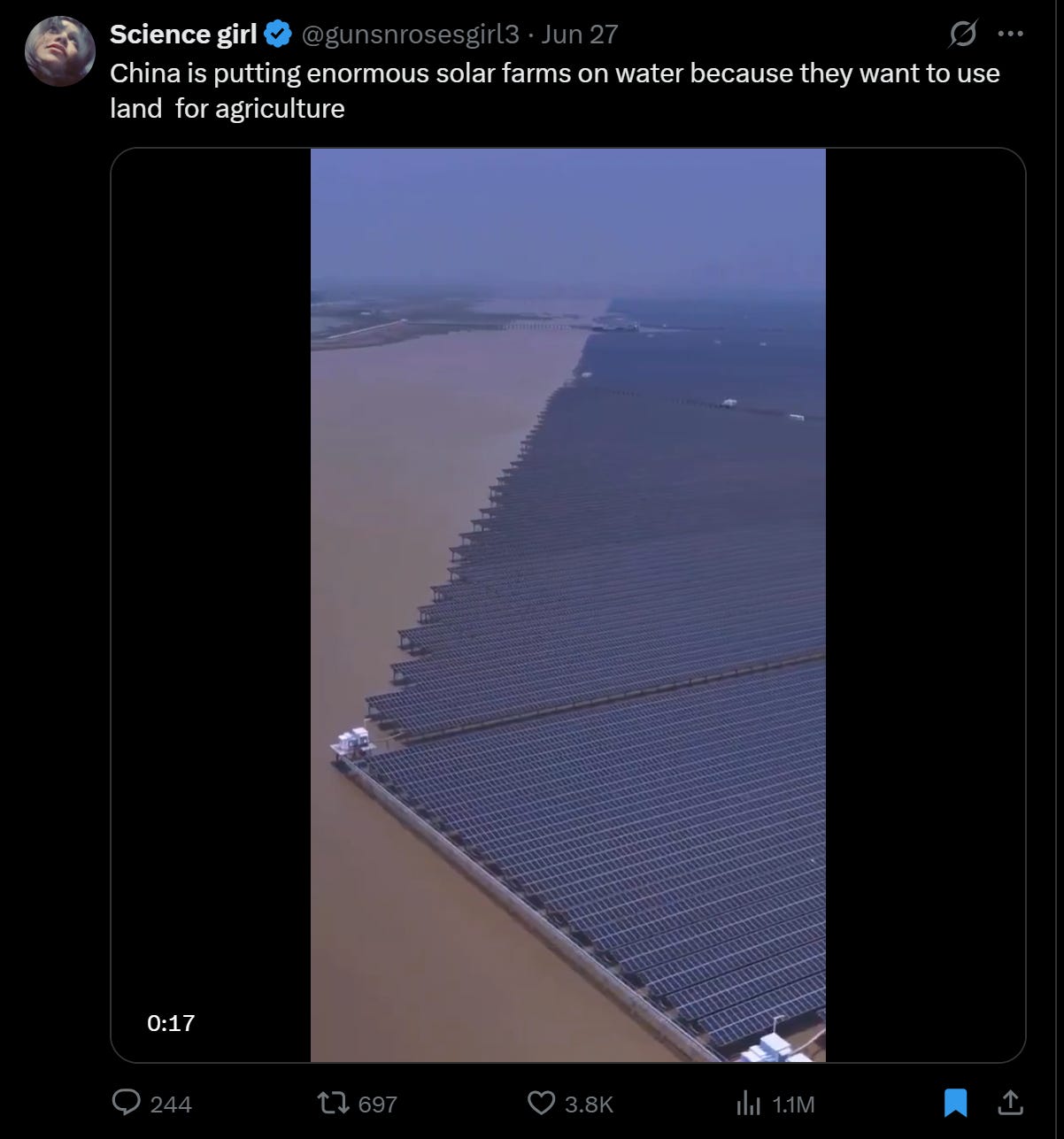

Coal? Dead. Nuclear? Takes a decade to build. Natural gas? Sure, for bridge power, but states are already freaking out about emissions.

That leaves solar. And the IEA just told us solar will provide 80% of new renewable capacity through 2030. We're already at 600 GW of annual installations. By 2030? 940 GW. Per year.

Module prices have crashed to $0.08-0.15/W. At these prices, solar is THE marginal electron. Period.

The Silver Math That Will Melt Your Brain

Okay, here's the killer equation. Tattoo this on your forearm:

1 mg/W = 1 tonne of silver per GW

Let that sink in.

Current solar panels use:

PERC: 9-10 mg/W (the old stuff)

TOPCon: 13-16 mg/W (the new standard)

HJT: 16-20 mg/W (the cutting edge)

At 600 GW/year and 13 mg/W average, that's 7,800 tonnes of silver. Or 251 million ounces. That's 31% of global mine production (820 Moz/year).

At 940 GW/year by 2030 with 15 mg/W average (as the industry shifts to TOPCon/HJT)? We're talking 14,100 tonnes or 453 million ounces. That's 55% of mine production.

Oh, and remember - 72% of silver comes as a byproduct of mining other metals. You can't just "mine more silver." It doesn't work that way.

Okay, here's the killer equation. Tattoo this on your forearm:

The Yield Revolution

Here's what nobody has really said out loud yet.

A bar of silver in a solar panel is a bar of silver with a yield.

Let me break this down so simply fintwit can understand it:

The Old World:

You deposit gold/silver at a bank

Bank pays YOU 3-5% interest

Your money has positive carry

The World We Live In:

You pay 0.5-1% annually to store gold/silver

It produces nothing

Pure negative carry

The New World (Starting... Now):

Here's where it gets beautiful. Take one ounce of silver ($35-40 over the past month). That ounce can be embedded in solar panels. What happens?

The Real Math:

1 oz = 31.1 grams

At 15 mg/W, that ounce enables 2,070 watts of solar capacity

Those panels cost ~$350 total ($0.17/W × 2,070W)

The silver is only $35 of that - just ~10% of the total

But here's the kicker (using US utility-scale 24% capacity factor):

Annual generation: 2,070W × 24% × 8,760 hours = 4,360 kWh/year

Over 25 years (with degradation): ~95,000 kWh lifetime

At $0.10/kWh: $9,500 of electricity revenue

At $0.15/kWh (coming soon thanks to AI): $14,250

So yes, you need to invest $350 total to "bank" your $35 oz of silver. But that investment generates $9,500-14,250 over its life. That's a 12-18% annual return.

(Even in cloudy Germany at 10% capacity factor, you still get 6-9% returns.)

Compare that to gold:

Gold storage: -1% per year

Gold yield: 0%

Silver in panels: +12-18% per year

That's a 13-19% spread. In finance, spreads like that create ‘generational wealth’.

What This Changes

Think about what this means:

For Industrial Users: At current 15 mg/W intensity:

$35/oz silver adds $0.017/W to panel costs (1.7 cents)

$100/oz silver adds $0.048/W to panel costs (4.8 cents)

Compare to $1.00-2.00/W total installed cost

Even at $100/oz, silver is less than 5% of system cost. Industrial demand is COMPLETELY price inelastic.

For Monetary Demand: At $100/oz silver, your "banked" solar silver is now worth $100 but still generating the same $9,500+ in electricity. The return is still north of 10% annually. This beats the hell out of gold's negative carry.

The Arbitrage:

Option A: Store silver in a vault, pay 1% annually, get nothing

Option B: "Store" silver in solar panels, earn 12-18% annually, can recover 90% of the silver later if needed

This isn't even a choice. It's an IQ test.

The Sovereign Wealth Fund Play: Imagine you're Saudi Arabia or Norway (or..Russia). You can:

Buy silver at $40/oz

Deploy it in solar farms (adding ~$315/oz in panel costs)

Generate 12-18% annual returns forever

Keep the optionality to recover the silver if needed

It's not hoarding. It's not speculation. It's turning a commodity into permanent, yield-bearing infrastructure. It's the best carry trade in history.

The Feedback Loop From Hell (or Heaven)

Here's what we see playing out, why we won’t shut up about silver, and why you should expect more and more progressively histrionic rambles on this topic:

AI drives electricity demand through the roof

Solar is the only scalable, rapidly available, green solution

Solar needs silver (no, copper substitution isn't ready, stop asking)

Silver becomes scarce

Silver price rises as high returns lead to even more demand as a financial asset.

Solar panels become "silver banks" with higher yields than fiat bank accounts

Countries/investors start hoarding silver as yielding money

Silver/gold ratio collapses from 80:1 toward 20:1

Silver becomes money again

We're already seeing this start. The market is in its 4th consecutive year of deficit. Above-ground stocks are being drained. China's paying 5-10% premiums over Western prices.

The Escape Valves (That Aren't)

"But Campbell, what about..."

Copper substitution? Years away. Reliability issues. Patent fights. And even if it works, retooling the entire industry takes time we don't have.

Mining more silver? It's 72% byproduct! Amazing. You'd need to mine 3x more copper/lead/zinc. Good luck with that.

Recycling? From a tiny base, and takes years to scale. Though if you know any good recycler stocks it’s an interesting trade for sure.

Demand destruction? Even at $100/oz, silver adds just 5 cents per watt - that's 4% of total installed cost for utility-scale ($1.20/W) and less than 2% for residential ($3/W). When you're generating $2-3 worth of electricity per watt over the panel's lifetime, nobody cares about 5 cents. Demand for silver in solar is INELASTIC.

The Punchline

We're witnessing the return of silver as money, but not how anyone expected. Not through some libertarian fever dream or a return to political bimetallism.

Through solar panels. Through AI's insatiable hunger for electricity. Through the simple fact that silver embedded in energy infrastructure yields 10% returns while gold yields negative 1%.

That 11% spread will not persist. The arb is too obvious. Too massive. Too structural.

My prediction: By 2030, silver trades at a 30:1 or even 20:1 ratio to gold (from 80:1 today). That's $100-150/oz at current gold prices. (Though gold could fall relative to silver when people realize silver has become yield-bearing money again).

We're not just going to run out of silver. Silver is about to become the most important monetary asset on Earth. Because it's the only money that pays you back in electrons.

Position accordingly.

P.S. - That "Stargate" project needs 12 million ounces of silver if powered by solar. We only mine 820 million ounces per year globally. One datacenter = 1.5% of annual mine production. There are dozens planned. That’s the math, don’t blame the messenger.

That's a really interesting post and to me it seems like it could be partially true.

However

First of all, the big problem is extrapolating AI demand. We have seen those extrapolations not only with fiber optics in 2000s but also with say oil and gas demand. I'm from Russia and I saw those investment banks reports about how bullish they are about Gazprom at 250/share because China would need more oil that's nowhere to find. Even before war it just got back to 200+ in 2021 with ruble being 70% cheaper.

Another important thing I got from Alex Stahel who discussed energy grid in EU in detail after the outage this year. Solar panels generate direct current. This is important because our grid runs on alternating current. It can be transformed, but the problem is that CAN NOT have more than 25% of you grid to be on Solar electricity. Otherwise there is an exponentially increasing risk of outage vecause solar panels can not damp spikes in the grid.

(Fwiw the spike in the EU was a big one and it was damped by French nuclear stations, because they are massive and have very big capacity for dampening. If not for the French grid that is 60% nuclear - the outage was so strong that it would have reached all the way to Netherlands and Poland blacking out all EU)

I don't get this description of silver as "yield bearing." Same could be said for just about any raw material? the lumber that goes into apartment buildings. Steel in factories. etc.