Long APIs, Short Slides

A pair trade for the AI transition

The market is selling “software” as a monolith. Within that monolith there are tollbooth operators and road workers. AI replaces road workers. It pays tolls.

The Air Pocket

I am by no means what you would call a “technical” trader. At the same time, I think if you are investing in an asset without looking at the price history, you should have your ISDA taken away.

A lot of people draw lines on charts as a way to try to predict the future. This is dumb. Over long periods of time, the price of assets is driven by buyers and sellers. Why did the price go down? More sellers than buyers. Why did it gap up? More buyers than sellers.

The reason you look at the historical price of an asset is to develop a useful mental model for the psychology of those buyers and sellers. We are, after all, animals.

The best markets to trade are the ones with lots of different kinds of buyers and sellers. Commodity markets have “natural” participants — people who make the stuff and people who eat it — and then financial players like me and you attempting some form of informed speculation. The alpha is in understanding how these different groups behave over long periods of time.

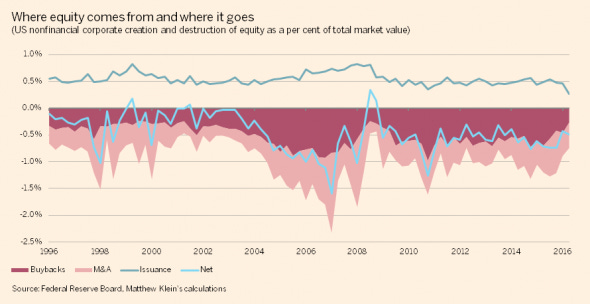

Stocks are kind of weird in this framework. The only natural sellers of stocks are the companies themselves (issuance), and the only natural buyers — besides speculators — are companies trying to acquire each other and the issuers themselves when they do reverse issuance, aka buybacks.

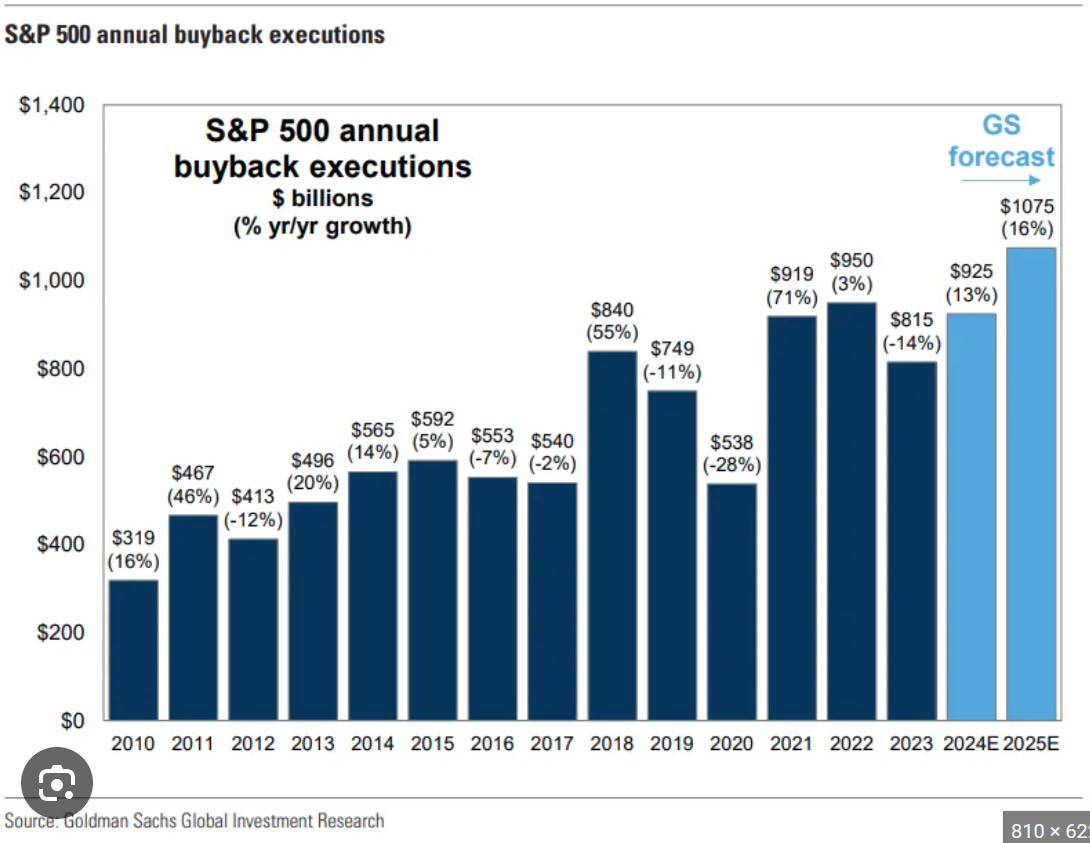

When I speak about an air pocket, part of what I refer to isn't just the idea that financial buyers will get tired of seeing capex well in advance of revenues. It's that the most direct mechanism for financing this investment behavior is fewer buybacks and more debt issuance.

The Air Pocket

There’s a pattern with these rambles, where sometimes I do a ton of research on a topic, research that informs my thinking on this or that trend, and then due to some combination of time, perfectionism, and just the general chaos of trying to do three jobs at once, I kind of just don’t… publish.

So that’s what we are seeing in the market today. Folks are ingesting the idea of fewer buybacks, more debt issuance, and the creative destruction of AI businesses where the victims (expensive software companies) are more easily identifiable than the beneficiaries (newcos) — or at least the beneficiaries you can invest in.

This is what it looks like for a market to internalize the fact that the singularity is here, it’s real, but it is anything but uniformly distributed.

Over the next weeks and months, we expect this trend to continue as investors do the pencil-to-paper work of figuring out how much capex these guys can really deploy, how much that will cost in terms of fewer buybacks and more debt issuance, and who the medium-term winners and losers will be through this process.

Our take is that, when combined with the likely reduction in weight from European investors still stinging from Trump tweaking their noses, we’ll see broader lower stock multiples across the board, with outperformance by the players that actually are positioned for the next decade and not caught flat-footed.

Which brings me to what’s happening in software.

The Setup

Software stocks just got obliterated. IGV — the iShares Expanded Tech-Software ETF, the closest thing to a one-click bet on the software sector — is down 30% from its September highs. $118 to $82.

The narrative writes itself. DeepSeek ships a frontier model for $6 million. Anthropic launches Cowork, a suite of AI agents that do legal review, sales ops, and compliance workflows autonomously. Cursor and GitHub Copilot are writing production code. The conclusion the market is drawing: AI writes software now, therefore software companies die.

That conclusion is wrong. Or more precisely, it’s aimed at the wrong target.

The Category Error

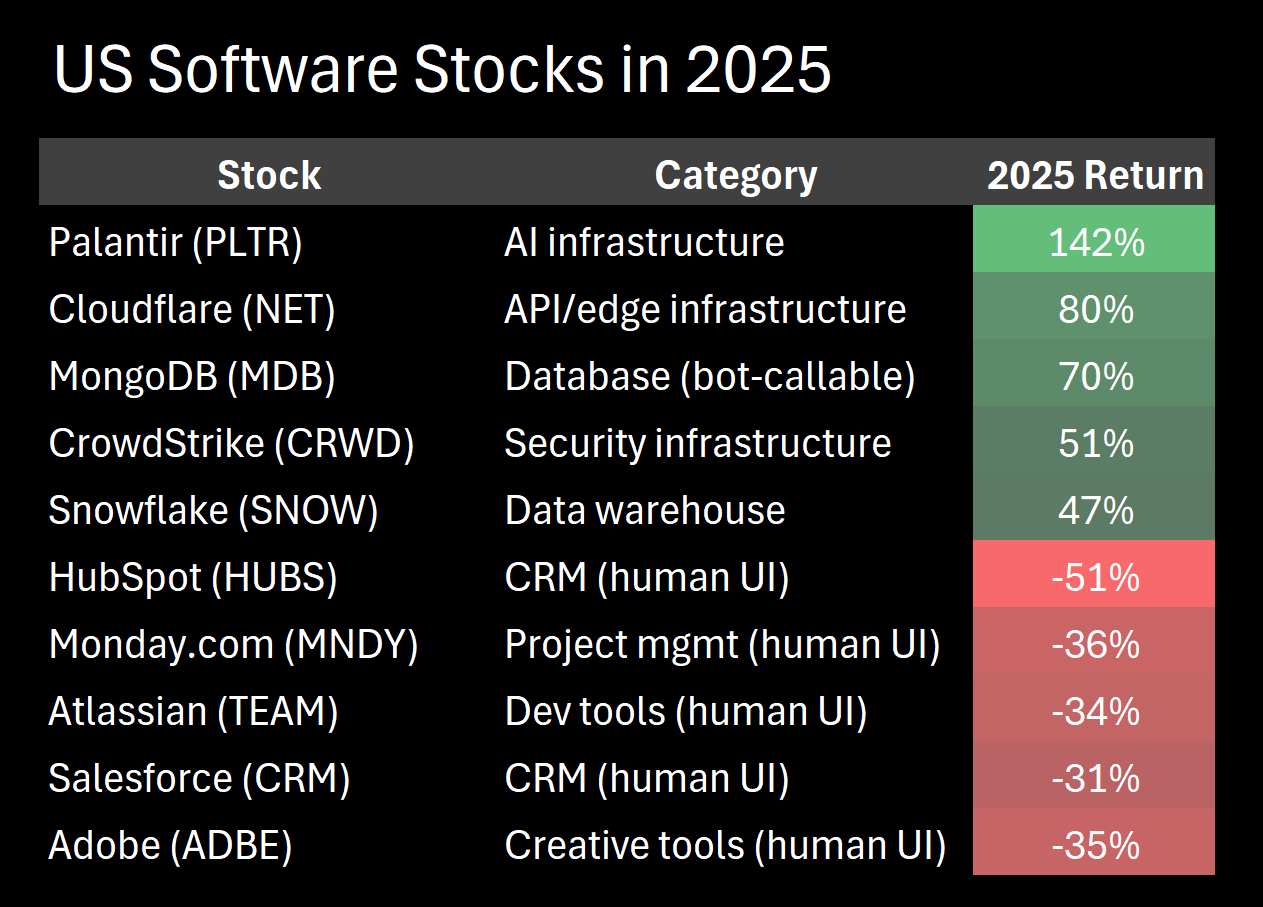

There are two types of software companies in the world, and the market is treating them as one.

Type 1: Software humans click on. Dashboards. CRMs. Project management tools. Anything with a user interface that a person stares at for eight hours a day. Salesforce, HubSpot, ServiceNow, Monday.com. These products exist because a human needs a visual interface to do a task.

Type 2: Software bots call. APIs. Databases. Event streams. Monitoring. Authentication. Infrastructure layer. No human UI required. Consumed per call, per query, per event. Cloudflare, MongoDB, Datadog, Twilio, Snowflake.

The first category is threatened. If an AI agent does the work, you don’t need a seat license for the human who used to do it. One less customer service rep means one less Zendesk seat. One less project manager means one less Monday.com seat. Seat-based SaaS compresses as headcount compresses. The market is right to sell these.

The second category gets more usage when AI proliferates. Every AI agent that replaces a human still needs to authenticate (Okta), query a database (MongoDB, Snowflake), send a notification (Twilio), log its actions (Datadog), stream events (Confluent), search documents (Elastic), and get protected from cyberattacks (CrowdStrike).

Here’s the key difference: one human doing a task generates one session, a few clicks, maybe a dozen API calls per hour. One AI agent doing the same task generates hundreds of API calls per minute. It’s hitting the database constantly. It’s logging every action. It’s streaming events in real time. It’s authenticating on every request.

The infrastructure layer doesn’t care whether it’s serving a human or a bot. It charges per unit of consumption either way. And bots consume orders of magnitude more than humans.

2025 returns tell the story. The market already knows this, even if it hasn’t articulated it cleanly:

The bifurcation is already happening. Human-UI SaaS is getting destroyed. Bot-infrastructure SaaS is ripping. IGV owns both — which is why it's a bad proxy for either side of the trade.

Not Software. Services.

The thing that’s really dead isn’t software at all. It’s the services economy built on top of software.

What does Infosys actually do? It sells competent Indian engineering hours to Western corporations at competitive rates. What does Capgemini do? It sells bodies — 350,000 of them — to run, maintain, customize, and implement enterprise software. What does Cognizant do? Same thing, different logo.

The entire IT outsourcing model is labor arbitrage. Hire in Bangalore at $15/hour, bill in New York at $80/hour, pocket the spread. This model has generated hundreds of billions of dollars in revenue and created some of the largest companies in India.

AI is the thing that makes labor arbitrage worthless. Not by making the labor cheaper — you can’t get much cheaper than $15/hour — but by eliminating the need for the labor entirely. Yes, a lot of this work will get augmented by AI, making it more productive, but given the increase in supply, this should also compress margins in a field where the quantity is fundamentally denominated in human hours. You can make an outsourced engineer more productive, but if your model is charging per hour you have a problem.

When Anthropic launched Cowork on February 3rd, the market gave you a real-time demonstration. Nifty IT — the index of Indian IT services companies — dropped 6% in a single session. Infosys ADRs fell 8.4%, the worst day since October 2023. Wipro dropped 4.5%. Cognizant sold off ~10%.

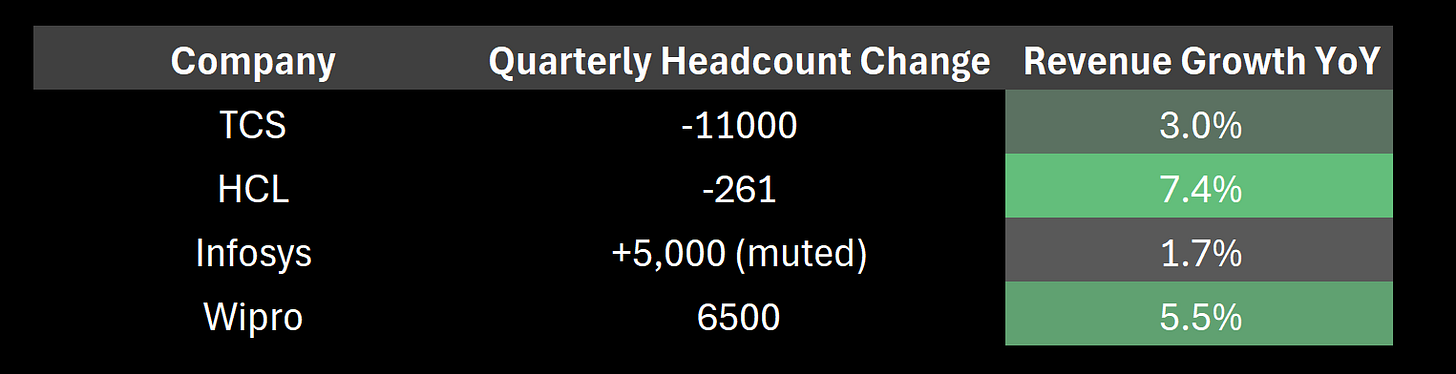

The hiring numbers tell the structural story even more clearly. India's Big 4 IT firms — TCS, Infosys, Wipro, HCL — normally hire 10,000+ people per quarter. It's the engine of the Indian middle class. Here's what the most recent quarter looked like:

TCS cut eleven thousand people in a single quarter. HCL is flat. The hiring machine has stopped. Revenue is growing at low single digits for an industry that did 15-20% annually for two decades.

And this is before AI agents are widely deployed in enterprise. We’re in the “enterprise confusion” phase — the CGI CEO said on their earnings call that clients “don’t know what to do with these AI tools.” We haven’t even reached the “mass cancellation” phase yet.

The Body Shops Can’t Pivot

The obvious counterargument: won’t Infosys and Capgemini just pivot to selling AI implementation services?

Accenture is trying. They’ve announced $3 billion in AI bookings. Good for them. But the margin structure doesn’t work for the Indian outsourcers. Selling 10,000 junior developers at $30/hour is a volume business. You need the bodies. Selling AI strategy consulting is a completely different capability — and there are maybe a few thousand people on earth qualified to do it, not 350,000.

The Indian IT firms are built around labor arbitrage. Their campuses, their training programs, their entire corporate infrastructure exists to process tens of thousands of fresh engineering graduates into billable resources. That’s not a capability you repurpose into an AI consultancy. It’s the capability that AI makes redundant.

The saving grace for the short thesis is that these are multi-year contracts with significant switching costs. Revenue doesn’t fall off a cliff — it decays slowly as contracts come up for renewal and clients either don’t renew or renew at lower headcount. This is a 12-to-24-month trade, not a 3-month trade. Expect eight quarters of consensus estimates getting trimmed by 2-3% each time, not one quarter where someone misses by 30%.