Least Favored Nations

R.I.P. WTO

Well, the price of cars is about to go up. As if the egg inflation wasn’t enough.

Trump's 25% tariff on imported Canadian and Mexican goods has mixed effects. While it strengthens the dollar, it worsens inflation. It’s also probably the beginning of the end for the WTO, and the entire post-war consensus. We are entering uncharted waters.

Today we’re going to make three simple points:

These actions alone will not close the US Current Account.

This is bad for our friends in Mexico. Canada and Mexico are the pillars to NAFTA (now USMCA). They are our neighbors and ‘best friends’ in terms of trading partners. A 25% tariff on these countries challenges the “Most Favored Nation” baked into the heart of the WTO and our entire post-war consensus on global free trade.

As such, it opens up the possibility of Trump not only deploying tariffs as a tool of statecraft, but threatening to leave the WTO.

How much do we trade with Canada, Mexico and China?

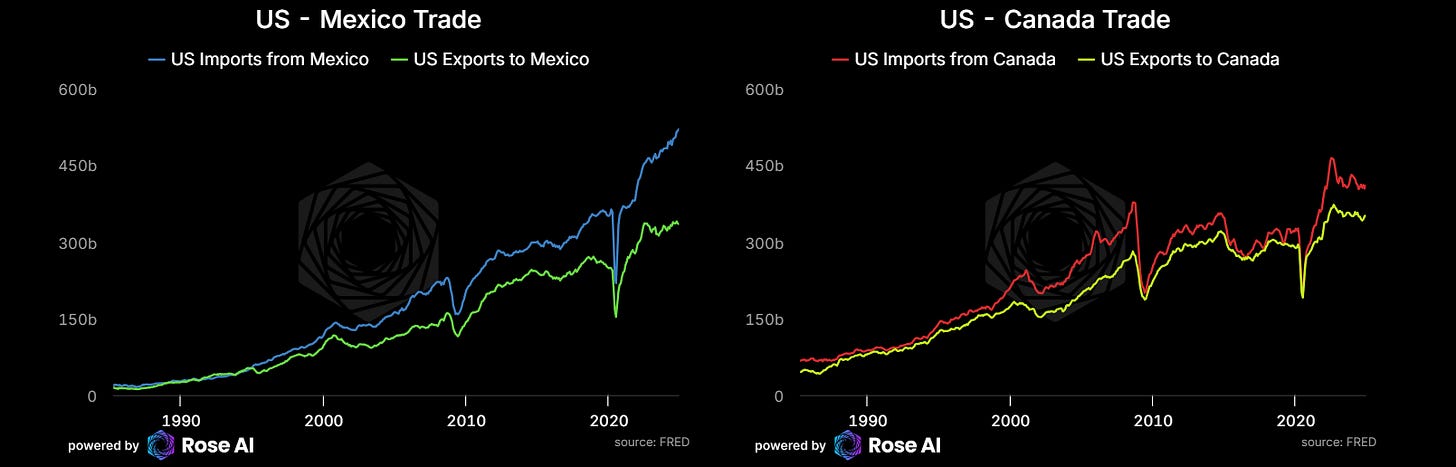

To start, the US does something like $1.5 trillion of bilateral with its land neighbors. $900bn or so of imports.

Meaning even if the 25% tariff applied to all goods trade (and to our extent it carves out energy, which is a lot of this, maybe 20%), you are talking somewhere on the order of $200bn of revenue and support to the current account.

The US goods trade deficit with Canada and Mexico is only ~20% of the accumulated current account over the past 30yrs. Adding in China gets you to ~60%.

At its peak, the US trade in good deficit with China was ~2% of GDP, or a good portion of the entire current account deficit. Though note the significant contraction over the last year, bringing it to a more manageable 1% of US GDP. Something to dig into more.

While folks in the US think mostly of this as a tradeoff between the increase in the cost of stuff against a (potential) improvement in trade/budget deficits, the calculus for our neighbors is much more grim, particularly for our friends in Mexico. $500bn of exports to the US goes a long way in a <$2tr GDP country, and the positive trade balance has provided 10% of net demand to Mexico since 2018. Recent increases in exports have been a big support to growth over the past year.

These tariffs are not only bad for exports directly today, insofar as it increases the price of those goods whilst routing US demand towards domestic supply, but it is a dagger pointed at the heart of an entire modern Mexican growth model: investing in production to export to the US. Mexico has energy assets, but is actually a net importer of energy from the US and so their goods exports are not spared by the energy exemption.

Canada’s economy is more industrialized and diversified than Mexico’s. It is also much less dependent on US demand. Even at the peak back in the mid 2000s, the positive trade surplus with the US was only providing 5% of net demand to Canada (vs the 9% and rising we see in Mexico today). More recently, the trade balance was on the order of 2%. Given around a 1/3 of Canada’s exports to the US are energy products, this will hit them less in the pocket book and more in the gut.

As someone who went to college in Canada, the relationship is akin to a sibling. The entire modern Canadian economy was built shipping auto parts back and forth across that line. There are still more barriers to trade between some provinces in Canada than across the border.

The bull case here is this “America first” shift in policy forces Canada to confront those internal barriers, and unifies it into a more cohesive block.

The bear case is that it puts pressure on existing linguistic, cultural, and ethnic “cleavages”.

For China, the news is more confirmation that Cold War II is on. Luckily for them, it’s too little, too late, to change their fundamental trajectory. Were the US to impose 10% tariffs on China back in 2008, it would have been devastating. At the time exports to the US were running at 10% of GDP. While due to the unilateral nature of this trade, imports from the US (aka US exports to China) barely budged.

Which means the vast majority of those export receipts found their way into foreign assets and reserves. Which have been the only thing preventing even more currency depreciation.

If things in Taiwan ever go hot, the historians are going to guffaw at the American hubris from 1995-2005. Right as Clinton and co (myself included) were crowing about the end of history, we were seeding our competition.

Meanwhile, Gold in China continues to be our preferred way to play the likely depreciation from both the tariffs and the ongoing economic malaise in China resulting from the property bubble popping.

Now is probably the time for professionals to put this trade on 'in size' on the currency leg (double up the long dollars via calls/spreads). Ideally setting your entry point at the next drawdown to get a better price...if we get one. So yes, I'm still bullish here. At some point, the fundamental dynamics will change and gold in China will no longer makes sense as a way to play Chinese capital flight. Until then, it should remain a good 'valve' aka pressure point and I remain long-term bullish.

Tomorrow (and even likely later today/tonight), you are going to see a lot of hot takes about the implication for asset markets. Maybe there’s a shift in consensus, maybe some critical assumptions get called into question. Maybe it’s time to buy a little implied equity volatility.

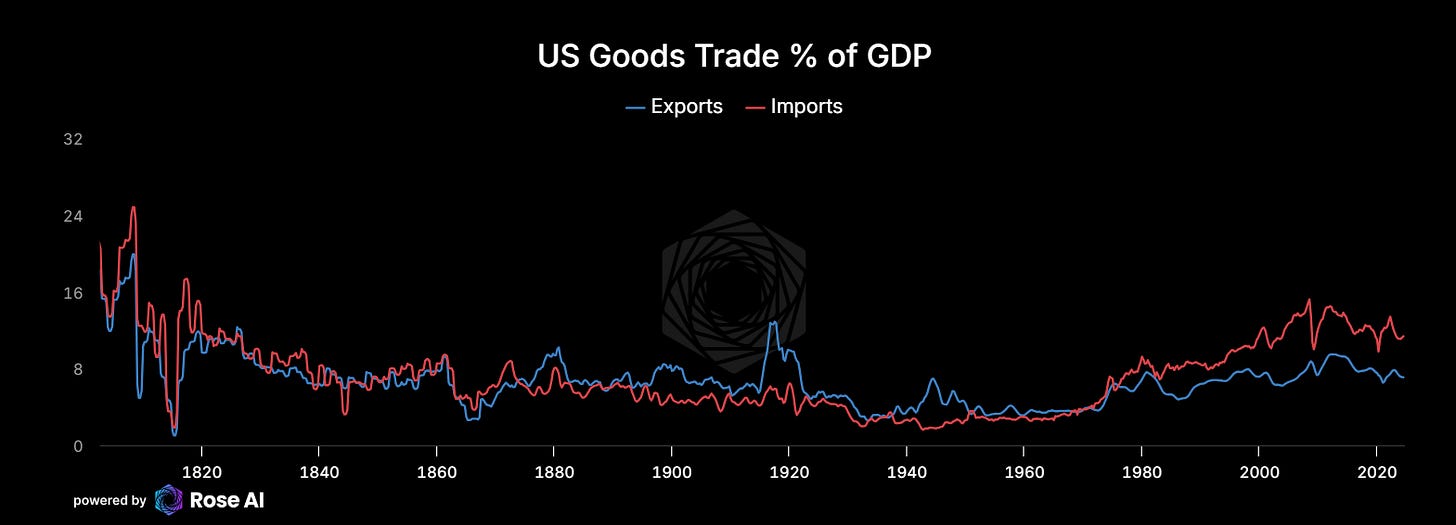

What I think we can say immediately though, is that by going after our best friends, Trump immediately calls into question how we would treat our enemies. Only putting a 10% tariff on China is thus what one might call an ‘emotional bid.’ A way of de-escalating the tension (that he created 10 years ago recall), while also opening up more strategic options or ‘area to maneuver.’ Because this isn’t just about China, it’s about using access to the America, access to our market, our financial system, and even the land itself, as a lever to negotiate a better deal with those that benefit from it. The goal is to bring production, capital, and future productivity gains from automation and AI back to the good ol’ U-S-A. An attempt to a return to the semi-open economy of the 1890s-1920s.

The first dawn of the machines.

Though whether that first dawn was a function of globalization in trade unlocking the value from that automation, and whether that work in reverse, remains to be seen.

Whether it works or alienates our friends while emboldening our enemies – and as some online quickly point out, undermines the US role as the global reserve currency, I’m not so sure. On balance this improves the current account and likely forces people to bring forward purchase decisions for expensive imports. Cars, commodities, electronics. You name it. If we don’t make it here, probably time to go out and get it.

Sounds inflationary. So lower real yields, higher break even inflation? I guess we’ll find out tomorrow.

Till then.

Disclaimers

Given the volatile nature of this administration, I wouldn’t be totally shocked if he announced the best deal you’ve ever seen to protect the US from fentanyl and says never-mind to the tariffs on Mexico and Canada. Or he goes ahead and doubles the tariffs to 50% on Tuesday.

It'd be interesting to see if the end result is anything close to 25%. One of the recurring themes about auto production is that items cross the border multiple times - this article says 8 on average: https://www.marketplace.org/2017/03/24/when-it-cones-nafta-and-autos-parts-are-well-traveled/. That'll be hit with a 25% tariff on each trip, not 25% on the total part.