Freedom of Navigation

What is it good for?

Freedom of Navigation is a sneaky concept.

On it’s face, it seems like a pretty straightforward liberal, cosmopolitan view. Almost banal. Yes yes yes, we know, free trade is good and you need free navigation to get it.

When you look a bit deeper, and examine it from a historical perspective, it’s really kind of a broad thing. International law defines Freedom of Navigation as “freedom to enter ports and to make use of plant and docks, to load and unload goods and to transport goods and passengers.“ Meaning I am free, to use your docks, to transport my stuff to your shores, whether you like it or not.

Kind of an affront to sovereignty, depending on which century you derive your notions of nationhood from. Not to mention your opinion on how far international borders can be extended into the water.

Further complicated by the relatively modern notion of the sea as a productive but exhaustible asset (of oil, fish whatever) versus just a medium for transportation.

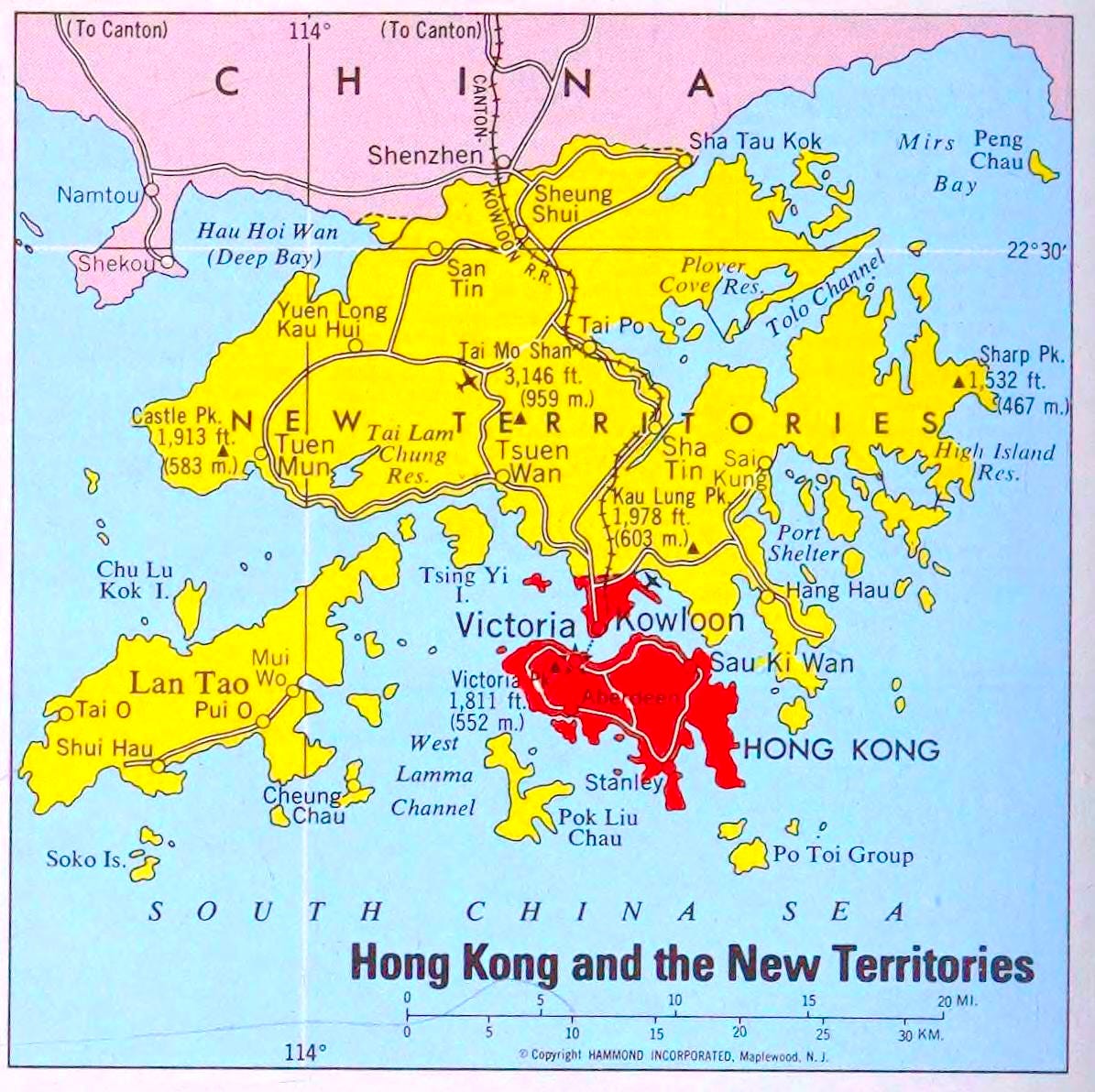

The Chinese certainly thought so back in 1839, when they kicked off a war with the British to prevent the import of…the 19th century version of fentanyl.

They lost those wars, and the power to dictate what Britain could sell them. Along with the port of Hong Kong.

Their silver reserves would never recover.

History is funny sometimes.

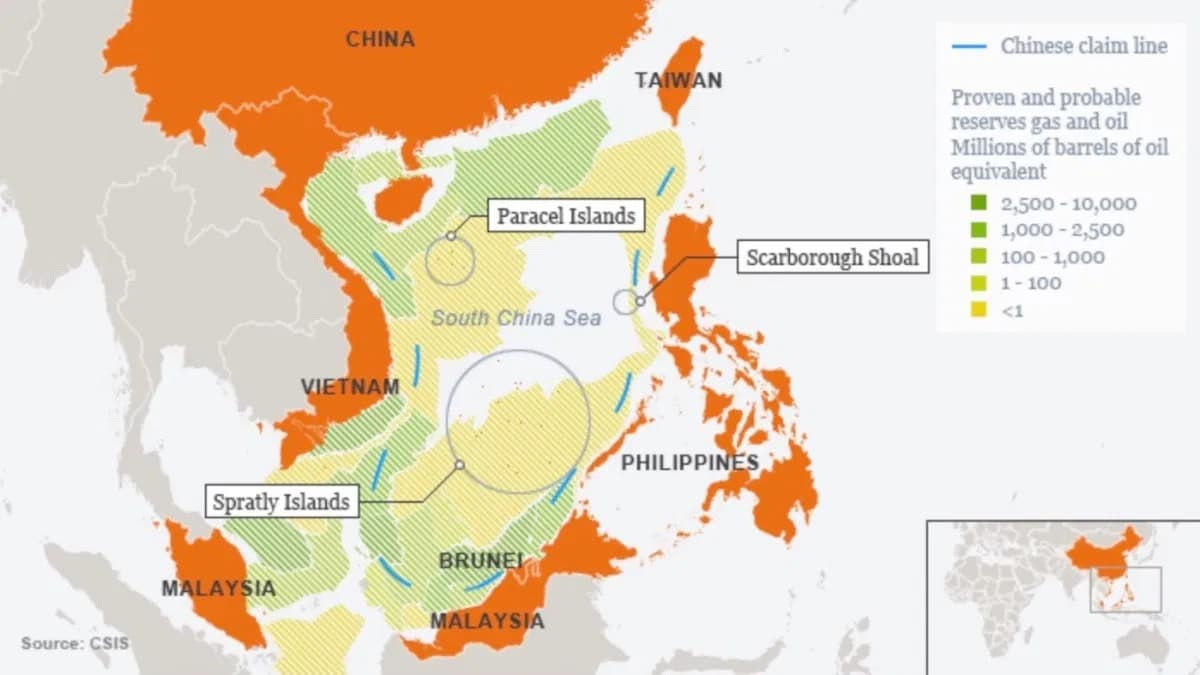

So, it’s perhaps not surprising that much of the grey-zone conflict that China currently faces on it’s borders echoes this historical uncertainty. Where does your country end, and mine begin? Especially when the mainland is far away for everyone and the island is difficult to inhabit (or even underwater).

Turns out freedom of navigation was mostly a European idea. The British extending it from the initial observation that piracy damaging to global trade, to an actual responsibility of the global hegemon to protect the freedom to trade via force of naval arms.

The Roman’s believed in a mare clausum (closed sea). Spain and Portugal attempted to own the sea as part of their quest to world domination, but were thwarted by it’s volume and the rise of an idea published by Dutch jurist Hugo Grotius in 1609 in a book called Mare Liberum (The Free Sea).

The British took up this idea and expand it along with the empire (though in classic fashion also subverted it by giving their pirates “letters of marque” which converted them magically into privateers when faced with a French or Spanish ships in a time of war - think Francis Drake).

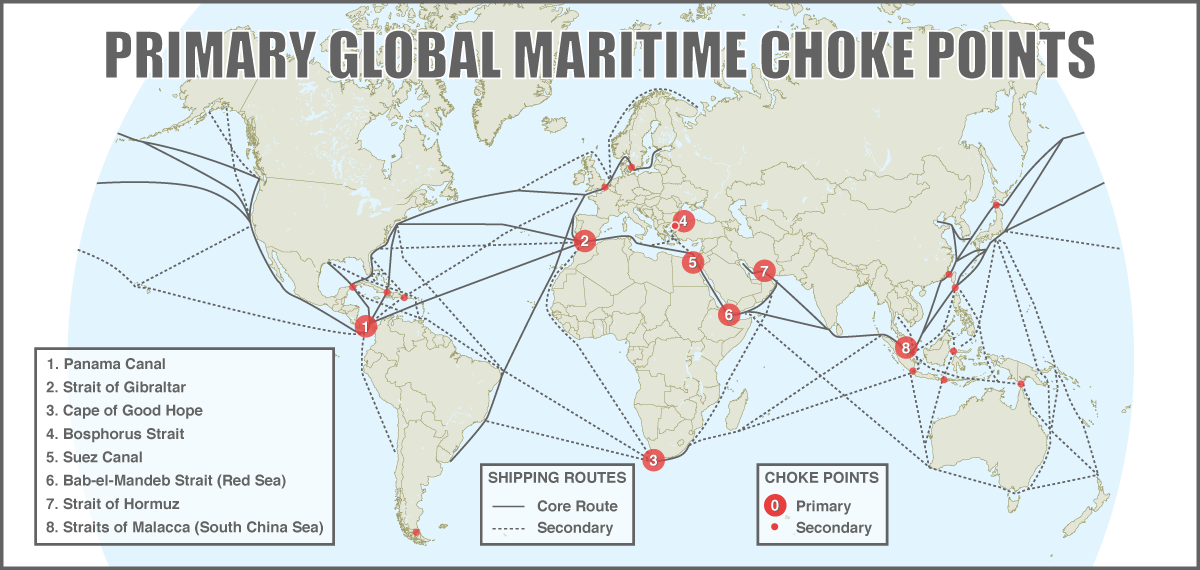

An empire that runs on trade depends on stable, reliable and cheap transportation links. Turns out that while the oceans are relatively disperse as channels for potential navigation, getting from A to B often requires going through one of a few handful of ‘chokepoints.’

Many of which, coincidentally, fall in regions recently brought under British control.

Yet another reflection of how the US didn’t forge the international order from whole cloth post WW2, we inherited it from the Brits.

Which is how we also got to the point of US aircraft carriers playing tag with the Houthis off the coast of Yemen.

Or the Scarborough Shoals and Kinmen Island being America’s problem, not the UN.

Because if we start letting people just chop up parts of the oceans based on their furthest island holdings, there’s no saying where it ends.

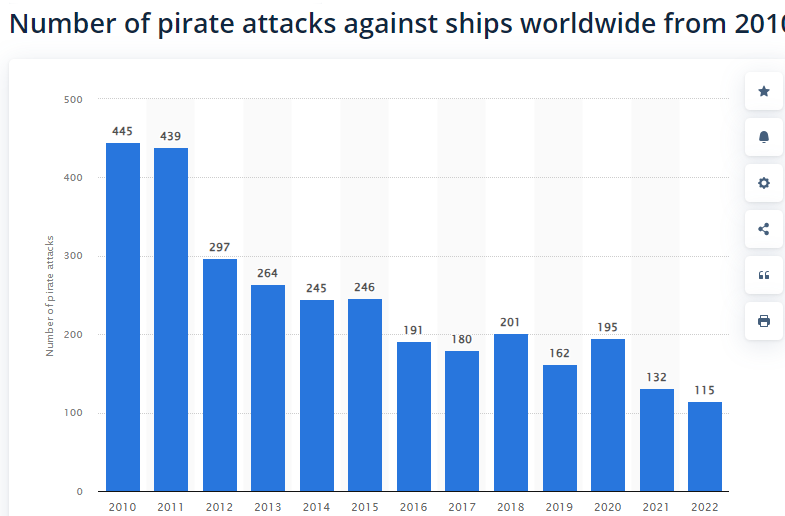

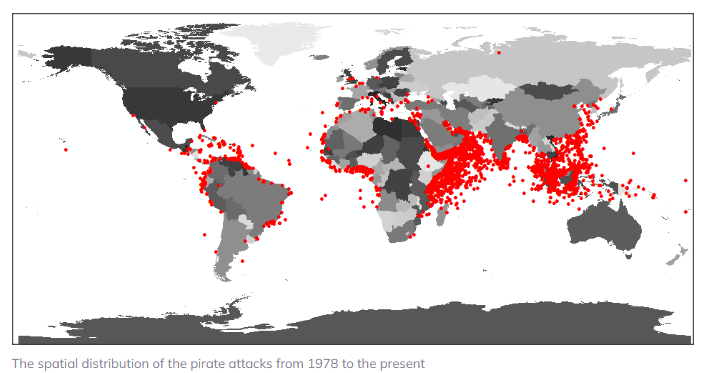

A weird way to think in a world where we had almost eliminated piracy.

Or confined it to a couple of hotspots.

So why are we talking about this now? Well this weekend we saw an escalation in the conflict, where Iranian reprisals for Israel missile attacks came in form of ~300-odd drones and ballistic missiles sent to Israel, with love.

Against this attack, we saw a coalition of coordinated American, European and even Saudi and Jordanian (!) anti-air defense to bring down 90%+ of these missiles, limiting civilian casualties (and hopefully diminishing Israel’s right to a disproportionate response). Even reports that the King of Jordan’s daughter was up in the air shooting down Iranian drones.

Now we wait for Israel’s reply, and whether they will take Biden’s advice to ‘take the win’ or ‘call it over’ as the Iranians have apparently indicated (for now).

There’s a spectrum of potential replies, but most dramatic would be direct attacks on Iranian military infrastructure or uranium enrichment facilities at Natanz.

This kind of tit-for-tat escalation like two poker players re-raising, testing the interest of the other side to really go ‘all in.’

At the moment, it doesn’t appear that pretty much anyone is interested in a broader conflict, though I guess that’s what prediction markets are for:

Iran hoping to cast Israel as most aggressive player in terms of escalation, and likely winning that propaganda war if Israel starts targeting Iran directly.

Israel’s bellicosity reflecting a belief that they exist in a precarious and existential situation where if conflict is inevitable, perhaps it’s better to get it over with sooner rather than later.

Iran on the other hand, appears to continue to benefit from going back to fighting the Israeli’s indirectly via proxy.

Thus far, Iran has been successful in it’s intermediate goal of preventing normalization of relations between Israel and her neighbors. The proposed competitor to China’s Belt and Road that would have traveled through both Saudi and Israel (and hence required a reproachment in order to proceed) is already dead.

If you were Iran, you’d prefer to continue to develop asymmetric capabilities, continue to push as fast towards a nuclear deterrent as practical and continue to hope that senior partners China and Russia continue to undermine US global security guarantees while Israel turns the world against her. In short, continue to play for time.

When does it all go hot?

As the most senior partner in the coalition, it’s my opinion that China still ultimately decides the timing and location for the start of any WW3.

That being said, be it Kinmen or Scarborough, it’s probably in China’s interests for the conflict to remain relatively cool overall for the time being.

They likely prefer to build upon their successful “A2/AD” area denial strategy while developing leading edge capabilities, deepening trade and import channels for food /energy, while kicking off regional problems that drain US time, attention, blood and treasure (add Venezuela, Serbia, space to the list for 2024/25).

In the meantime, the Balkanization of global capital markets continues. This week the LME announced they would comply with sanctions by no longer accepting Russian metals like Aluminum, Nickel and Copper. Aluminum the most interesting as 90%+ of current warehouse stockpiles come from Russia

Interestingly, platinum and palladium were carved out of the latest decision for ‘supply chain reasons.’

Which, in one examples, represents a potential way that the “New Axis” can hope to win Cold War II. Think of it from their perspective. Assuming things don’t grow hot, assuming all conflicts remain regional, how can a coalition of China, Russia and Iran hope to overturn the modern, liberal, western world order?

Well, it starts with securing control over basic commodities like energy (Russia and Iran), and food (Ukraine and domestic moves to produce grains in China in lieu of more profitable foods), as well as more esoteric commodities like the rare earth metals needed for the digital and green revolutions.

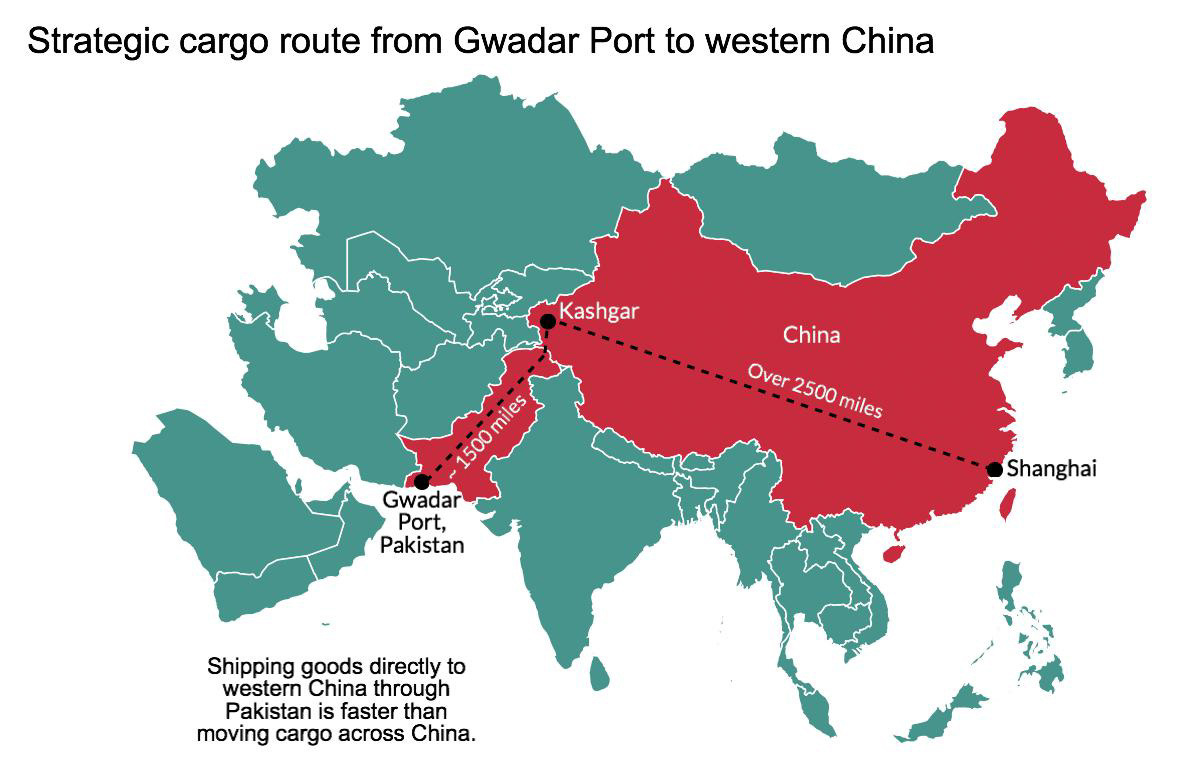

Second step is guaranteeing these supply chains. Funny thing about “Freedom of Navigation” it’s contingent on playing nice with the global world order. If China were to blockage Taiwan, the west would blockade the strait of Malacca.

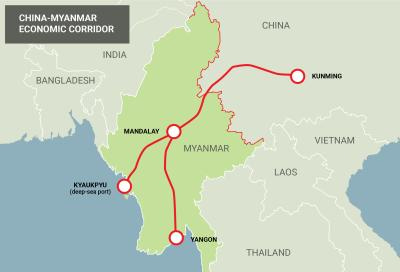

Which then puts into context China’s efforts to build pipelines to Russia,

ports in Pakistan,

and railways through Burma.

As well as that HK-style lease on a port in Sri Lanka, right off India’s doorstep.

The third step is building a manufacturing base that can churn our dramatically more manned systems like ships and airplanes, as well as automated systems like drones and missiles. Steel production being kind of like the ultimate dual use technology the former. Useful for building the buildings and railways before conflict, useful for building boats and tanks during.

This extends to the supply chains not only for manufacturing, but the chips, wires, and databases needed to deliver munitions to where they need to go.

Proxy wars represent helpful feedback and testing grounds here for both sides.

The west gets to see the use of anti-air systems like Iron Dome and Slings and Arrows, but at a scale where the number of missiles is in the tens and hundreds, not thousands like would be expected in opening days of a great power conflict.

Meanwhile, the Axis coalition essentially becomes the party of pirates. Note the 17th century kind, running through blockages in the name of free trade, but the kind supported implicitly via bigger regimes, who’s primary goal is the undermining of the western liberal order and with it…freedom of navigation. Using new technology to launch asymmetric warfare against empires. Building alternative trade and financial systems, recruiting a coalition of emerging and frontier nations unhappy with the current western order.

To tie this all together, we can start to game through ‘what if’ situation depending on the various responses by Israel.

Without any real expertise or training in this space (so buyer beware) we see Iran’s most dramatic route to further escalation would be to play the role of the Houthis with the Bab al-Mandab Strait (aka the suez), but on a much more critical pipe in the global energy system.

Approximately 30% of the world’s seaborne oil goes through the straight of Hormuz.

Everything from the Persian Gulf, and all the natural gas shipped from Qatar.

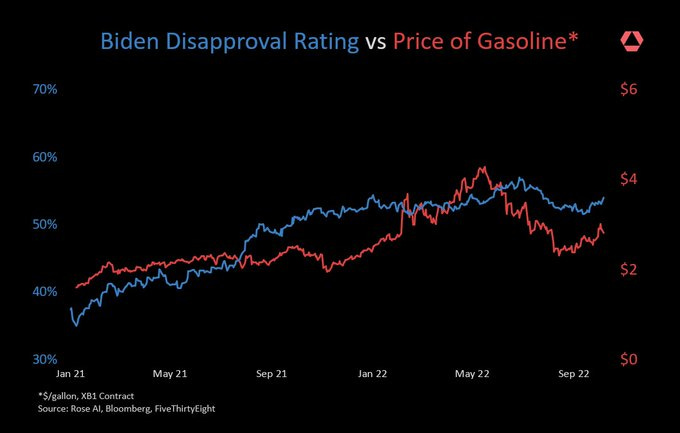

Presumably the removal of these energy supplies from European markets would lead to a repeat of the market action we saw in 2022, when energy became scarce and we all worried if Europe would have enough gas for winter.

(BTW as an aside it turned out Europe did have enough gas for winter and Citadel made $10bn over two years by calling it. Alpha is not dead, it’s just getting more and more concentrated.)

A surge in energy prices would be consistent with our principle of “conflict is inflationary.” The idea that conflict leads to fundamental drivers on both demand and supply which inevitably put upward pressure on prices.

It would also be consistent with our principle of ‘you don’t own enough gold.’ Which we saw rather dramatically Saturday. News broke of the Iranian drone attack on Saturday, while most major markets were closed. What happened? Bitcoin down 7%, alt coins down 15-20%+. Meanwhile the lone crypto asset linked to gold traded up 20%+

Turns out there’s no gold in your bitcoin when you need it! Not to mention when the lights go out.

Anyway, as an investment management professional, I am not supposed to speculate on global politics. That’s the line from the old shop: “We’re just punting rates and credit here, no politics!”

Me, I got my start trading bank volatility and then gold at Lehman, before being asked by that austere investment firm to help them speculate on global oil and metal markets.

This is where I learned that, yes, if your day job is punting Meta vs Alphabet shares, you probably shouldn’t be trading Israel vs Iran.

On the other hand, if you are trading in the front month of the oil market, you really have no choice. If Hormuz goes down, that front month is going UP, and fast. You own the risk whether you have an opinion on it or not. “The only way to win is not to play” etc.

Which - if we can take a quick dive into the market for oil - you can see in the degree of backwardation (aka downward sloping) futures curve, as well as the 20 points of additional volatility for OOM calls relative to spot, as well as another 20points of ‘inverted term structure.’

Markets all saying the same thing, oil is already priced for some disruption. If you think we de-escalate from here, it’s a good sell. “Nothing ever happens” usually is the mantra of those that short volatility (or commodities).

However, if you think escalation of the conflict is more likely, well you would expect the ‘belly’ of this oil curve to start to trend towards spot, as tightness in the medium term oil market is increasingly priced in.

That would likely flow through directly to energy sensitive goods and services and make the Fed’s path to 2% while cutting a lot more challenging. “Inflation is about oil” etc.

However, early Sunday returns here are that front month oil is down, and with it, expectations for further escalation.

Good thing we refilled the Strategic Petroleum Reserve when we had the chance…oh wait. Shut up Campbell, no one wants you to get political!

Disclaimers

Excellent work. Thanks for posting these free reports for us little guys. Really appreciate it.