"Fill it up again!"

What if China never takes the pain?

A couple of months ago, we published a piece outlining where China looked to be in its ugly deleveraging. The basic idea was to apply the credit boom-deleveraging framework laid out by the team at BW, and layer in some salt from a couple hundred years of studying boom-busts in the US and UK. We came to a couple of preliminary conclusions, wrapped up in our 5B framework.

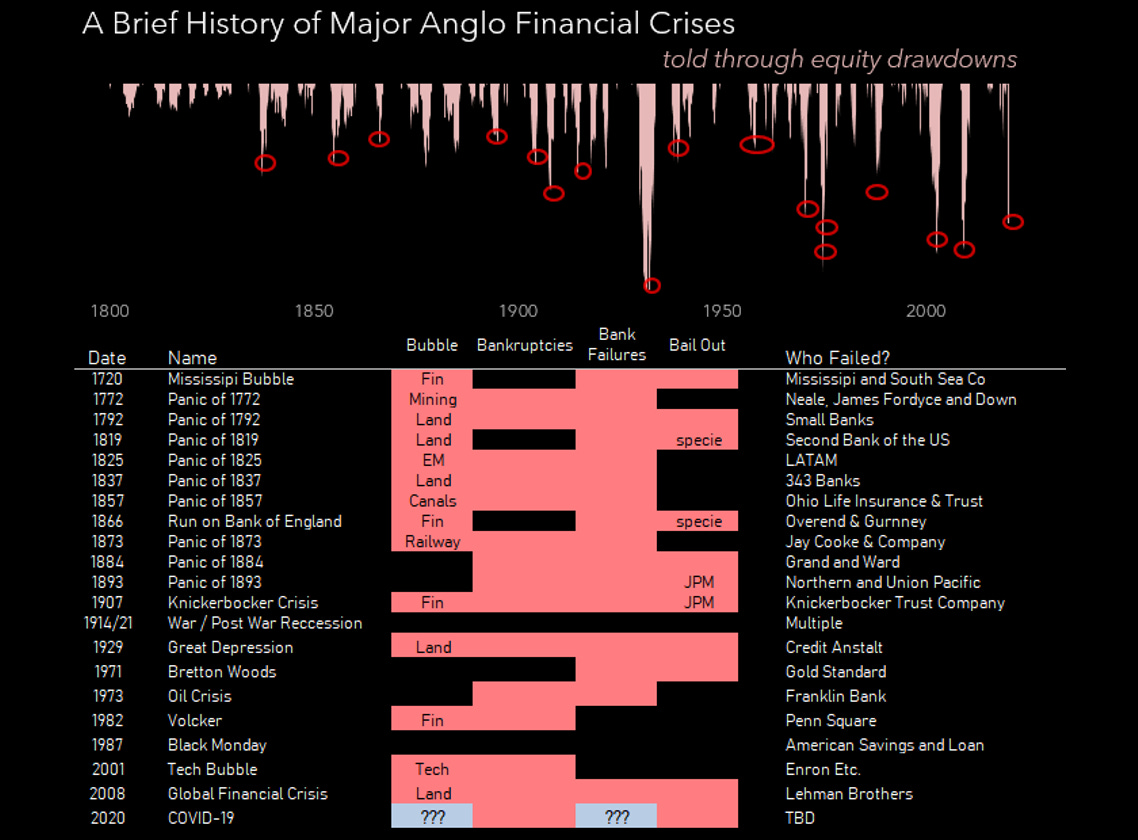

First you get a boom, usually based on some infrastructure or technology that was fundamentally a good idea (canals, highways, railroads, telephones, the internet). When coupled with easy monetary policy and investor faddishness, this often turned into a bubble, where the last investor in is more concerned with price appreciation from new buyers than earning a yield or return derived from the underlying investment or business. This process, being unsustainable, leads to bankruptcies right around the time when money gets tight and the rocket ship peters out. Owing to the role of banks as agents of leverage in the financial system, many of these bubbles once popped led to bank failures.

The lesson from history was that some form of bailout was inevitable, as policymakers were forced to draw the line under what part of the system was 'too big to fail.'

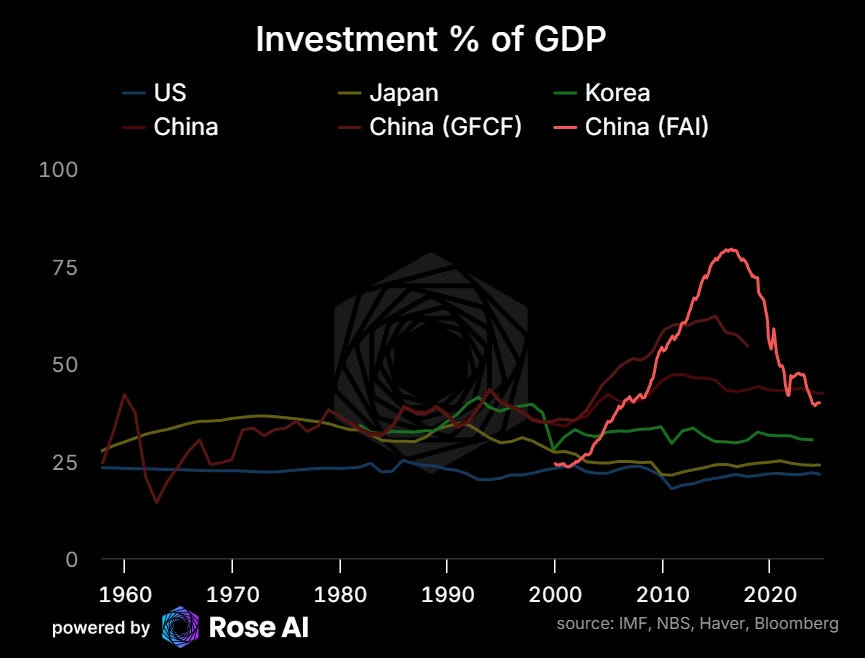

The implications for China, after two decades of excessive credit creation and an obsession with investing in fixed assets, were clear.

Decide which borrowers (be they property companies, SOEs, or local government projects called LGFVs) would be bailed out and which would not. Then use that understanding to identify the financial institutions (bank and non-bank) that were no longer solvent given that decision, and recap those banks in a proactive way, while directly stimulating household consumption by way of something akin to 'helicopter money.'

Three months later, and what have we got?

No real clarity on where the line is outside of grumbling that many LGFVs would be brought on provincial or national balance sheets (keep in mind this is actually a biggish deal since the local governments now have more debt outstanding than the central government, and hence this move materially eats up its capacity for leverage).

No real clarity on what the debt resolution system is. In an effort to be too cute by half, policymakers have tried to stiff western, dollar-based investors with the loss from failures such as Evergrande, without really considering that there isn't enough of these liabilities to restructure the firm without domestic currency lenders also taking a hit. Oops. Which explains why we are four years on from the first problems in Evergrande and yet there is no real resolution. This in turn keeps a host of zombie property companies technically alive, as long as the government is willing to sustain the house of cards.

No concrete moves to proactively resolve the banking issues. Again, grumbling at the low levels about resolving the local banks (which are obvious targets), but no concrete or actionable moves to get ready for the inevitable failure from the trillions of mid-tier banks that would be technically insolvent were they forced to mark their books to market.

Well padawan, this is what year 5 of investing in China looks like. For those of us with more than a decade in this trade, the policy pivot in the cards looks a lot more like 'fill it up again' than any real grappling with the very real problems under the surface.

What does that mean in this context?

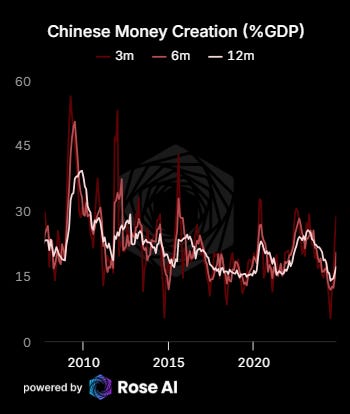

Well, if you follow the actual policy decisions, the direction of movement is clear. Lower rates. Lower reserve requirements. Talk up and target stock market outcomes. Move on the margins to ease in a macroprudential fashion further on the property market, in an effort to force a bottom via monetary easing alone. Though more recently, there are some signals that the money printing machine is back up and running.

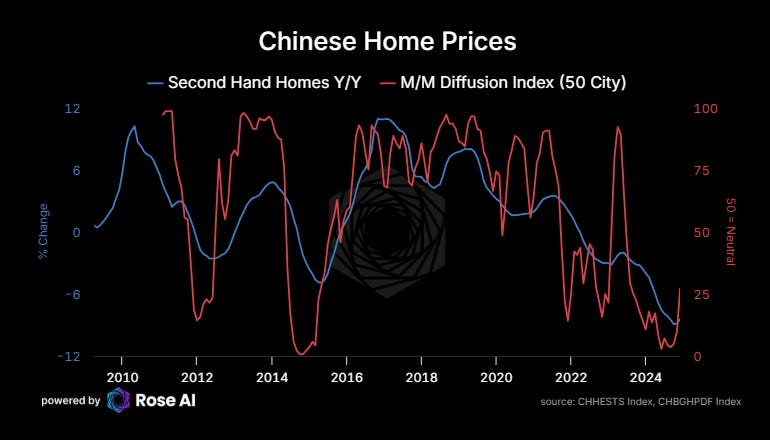

In short, a tripling down on the very same engine myself and others have said will only lead to long-term ruin. Note how weak home prices have been over the past two years, and how muted the recent ‘bottom’ is thusfar.

No tangible movement on helicopter money, outside of more grumblings about stimulation via fiscal policy?

Well Campbell, you might be right to ask, if nothing has been done, why do I keep reading about all the stimulation they are doing? To which I would reply? “What’s up with the drip drip drip? Where’s the bazooka?”

This time however, China bulls are armed with more than just a two decade track record of lifting a billion out of poverty and maps of High Speed Rail (HSR) build out (both of which are fair). No, this time they have new toys. In particular, the new economy segments of electric vehicles, chips, robots and other new ways to lever their extremely productive manufacturing base.

Folks familiar with the way China's production of autos has steadily eaten share from the US, Japan and Europe may be familiar with this play.

Thus far, the government has pretty successfully built a firewall between the problems in the real estate sector and the broader financial system. Outside of some small failures, and a general appreciation that many of the small rural banks need to be 'rolled up' (aka resolved and brought on balance sheet by a larger firm, likely one of the big five).

This policy of 'extend and pretend' has thus far been successful, owing to the fact that most of the debt is domestic. While the most vulnerable and risky banks have indeed suffered, the broader banking system has performed reasonably well. Though it's hard to tell how much of the recent strength in these stocks is as a result of buying by the 'national team' in response to the weakness in the A share market a couple of months ago.

Finally, as policymakers turn back to the pre-real estate bubble model of a closed capital account and an export-led economy, the commitment to a strong yuan works directly against the objective to stimulate. The desire to have a steady, strong and controlled CNY comes directly in conflict with the idea of growing your way out via exports. Particularly in periods of Fed tightening.

Time wasted while the losses accrue and the uneconomic behavior continues. Meanwhile western powers threaten higher tariffs and less openness to trade, threatened by the rise of a more belligerent China. Implicitly turning their back on the liberal, post-war WTO-era, "Washington Consensus" in the process.

China's pivot then to the global south as a source of demand for exports is not only wise but timely. But is it too little to late?

The question remains there whether those emerging and frontier countries can grow domestic demand fast enough to continue to soak up Chinese exports, without seeing commensurate demand growth from China for imports of their own products.

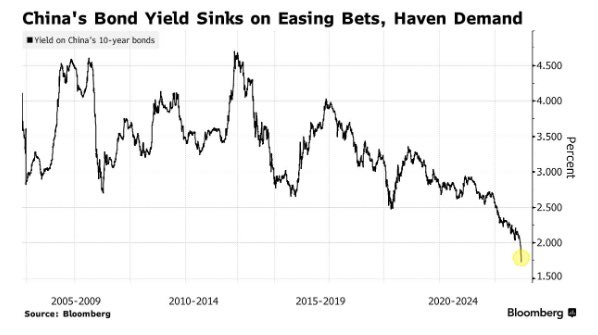

Meanwhile domestic capital continues to flee risky assets like stocks and bonds for the safety of government bonds to such a degree that last month the government had to name and shame the local bank buyers. Meanwhile, the Chinese 30 year bond now trades ‘inside’ that of Japan. Speaking of deflation…

Well, if at this point, we take the government at their word, then the movements we see in the bond market start to make sense. Maybe it will take ZIRP to really stop the deflation.

It also means that the way to express this view is clearer than ever: the currency.

Recall the reasoning behind our "Gold in China" thematic investment. If China deals with its banking and credit problems proactively, we think a lot of the big wall of money will find its way out of those banks and into gold. So you want to be long gold for that outcome.

On the other hand, if they determine the best way to get out of the real estate bubble is to inflate bubbles elsewhere in the economy (particularly in stocks), then we should expect the currency to be the valve. As PBoC easing drags down the return of money in China compared to elsewhere and we start to see material downward pressure on the currency.

For an economy committed to growing its way out of problems with exports, and in the process, pushing their credit bomb under the rug, you have to think about how much stimulation will be required to get that never-ending cycle of upward price expectations moving again. Will it take ZIRP? Maybe if you believe what the bond market is saying.

This downward pressure on CNY yields makes foreign assets more attractive, particularly western fixed income which also makes for a good place to park capital flight.

Meaning yes, it may be possible to stimulate the economy through monetary easing alone. We remain skeptical given the hole in the bank balance sheets is likely trillions of dollars, and not billions, but regardless. If you take the Ministry of Finance and PBoC at their word, then the commitment to easing is legitimate and the currency should be sold in size.

At least until the downward pressure on the currency starts a self-fulfilling prophecy regarding the gains to be had from shorting the CNY. Which is around when we expect the folks behind the curtain to change their tune. They tend not to like when foreigners and capital flight can make more money shorting the CNH than investing in domestic Chinese assets, which will likely kick in well before any type of self-sustaining positive credit cycle can gain hold. Recall, there is now more debt in China than the US.

Leading us to believe that the capital flight problem is worse than reported, meaning that when they inevitably do let the currency go in response to intolerable domestic credit pain, the move likely will be faster and more dramatic than many appreciate.

Bringing us back to our original framework for how this all plays out:

- If they protect domestic asset prices, they have to let the currency go, and the CNY will depreciate.

- If they keep policy tight in order to protect the currency, the banks end up going under, pushing households (and officials) to shift their marginal savings into gold (and silver).

It may be nice to post a thought piece on the internet about rotation of the economy and how it's just a matter of pushing some buttons, but these banks have real losses on real assets, and real holders of liabilities. Expecting to be paid back. Meanwhile, the biggest sector of growth for a decade continues to contract, wracking up ever more losses.

The clock is ticking.

Till Next Time.

Disclaimers

“A man who procrastinates in his choosing will inevitably have his choice made for him by circumstance.” - H.S. Thompson

I am in china and many frind of mine agree that the cny gold trade is a good trade. And Short Cny is also a good trade because of the carry. As you may know, many banks provide the trade about using dollar and the ccs to buy onshore ncd which the investor could get 15-20 bps pickup.