China is Selling Treasuries

Have you heard?

It’s official.

China is selling Treasuries.

Here we go.

We told you this would happen as soon as the US froze Russia’s holdings.

Why any China / Russia aligned Emerging Market central bank would buy US bonds right now is a total mystery to us.

Personally, I would wait until China is done selling before trying to “catch a falling knife” here.

To review: EMs like Russian & China have observed that the US can / will freeze these assets during conflict. Meaning China can’t count on that $800bn of liquidity when they move on Taiwan. Might as well sell ‘em while ya got ‘em.

From the perspective of nations intent on building a “New World Order…”

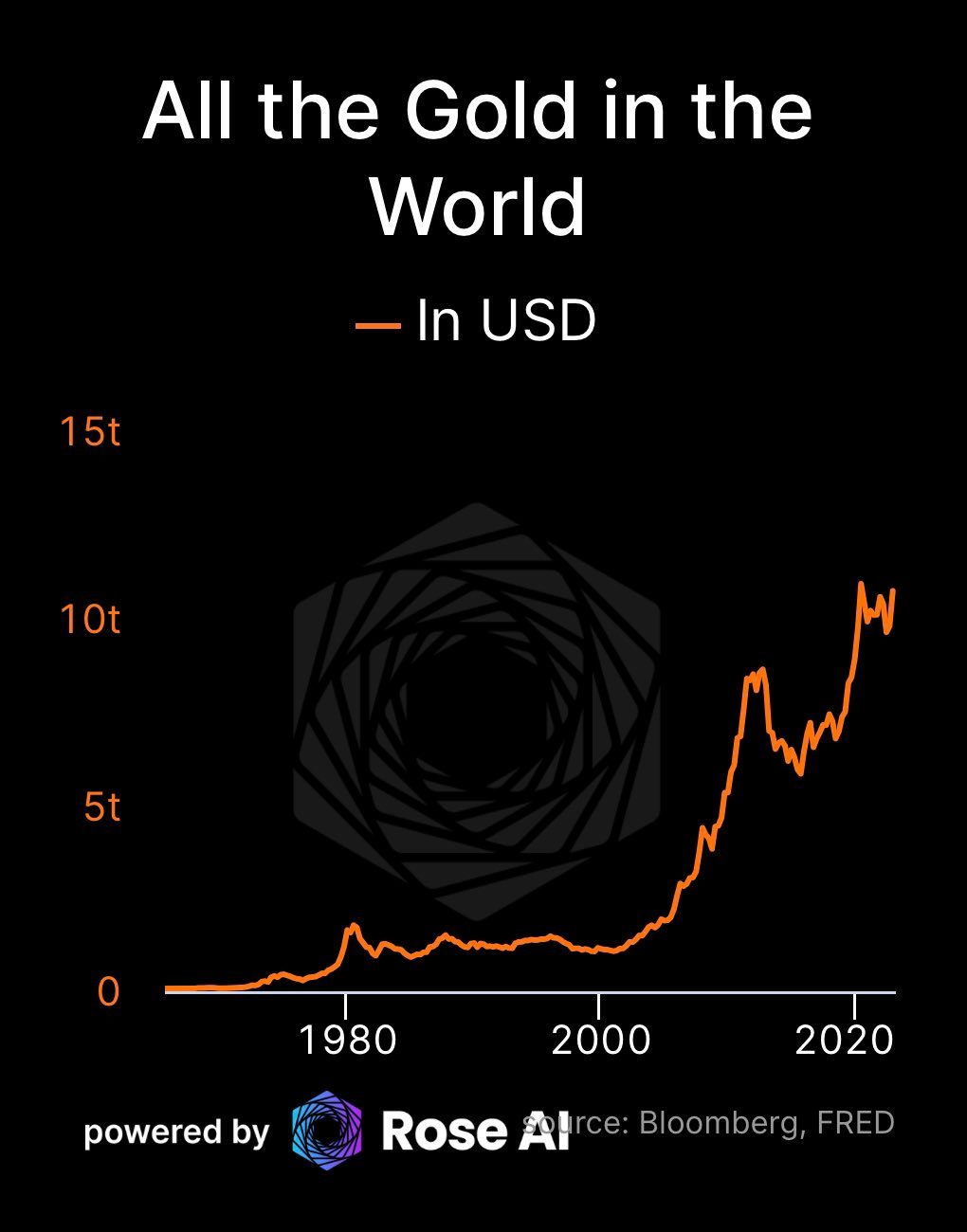

physical gold is a much more attractive reserve asset than US bonds as it is impossible to sanction.

Plus there’s only ~$10Tr of gold in the world, so a shift in reserves from bonds to gold will definitely leave a mark.

Some of this decline in official holdings was simply due to the drawdown in value from the bonds.

Remember this is the worst drawdown in US bonds…since the Revolution.

It’s also fair to say there’s a decent amount of Treasuries still held through Chinese intermediaries like Belgium and Luxembourg, as well as in “Agencies” (Fannie Mae, Freddie Mac)

But regardless, a LOT of US government debt is held by foreigners.

At peak about 1/3rd.

In addition it looks like Chinese policymakers were/are intent on defending the ~7 line on the RMB.

To do that, US bonds must be sold to raise dollars.

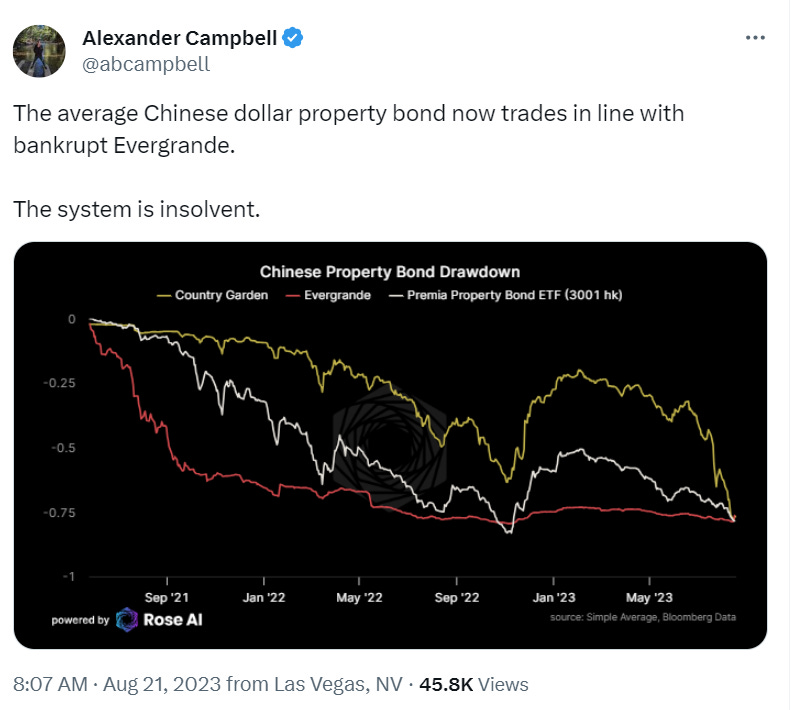

Furthermore the debt situation amongst Chinese property developers has recently gotten worse and not better. Chinese dollar property bonds at back the lows.

China will likely need dollars when they (eventually) bail out the developers - or the banks behind them.

Recall that some of these property companies have sold deposit-like financial products (WMPs) directly to households. So it’s not just a matter of houses that won’t get finished. Individuals are seeing 66% write-downs in products considered as safe as deposits.

For anyone paying attention, this should not be new information.

Raising questions like: how can ~all the property companies be in default, but the banks that financed them not seeing an increase in Non-Performing Loans?

Presumably there are SOME Evergrande and Country Garden loans that are “not performing” at the moment. Where are they?

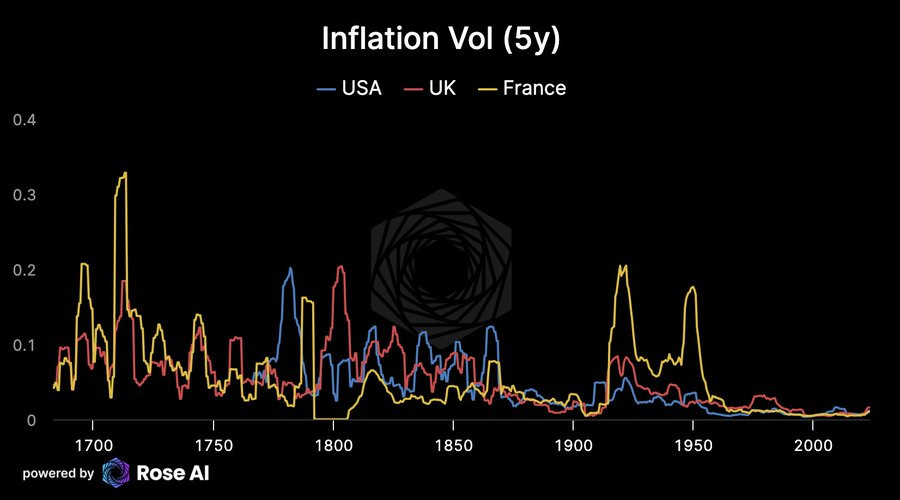

Back to bonds, reminder that conflict leads to a LOT of inflation volatility.

Which is bad for bonds. In particular for the those that find themselves on the losing side of the conflict.

Especially when you are measuring these returns in dollars.

Which makes sense. Governments increase their borrowing needs when they feel things are existential. Right on schedule, here’s Yellen saying we can “afford two wars.” To which we would ask: how about three?

Lastly, what happens to oil in the meantime? If the conflict expands to Iran, that’s going to push up oil, and eventually inflation.

Meaning Powell would have to go to 7%, right as China is starting to divest.

No wonder we’re making friends with Venezuela again.

If JPow has to go to 7%, mortgage rates, which just hit 8%, could be pushing >10%!

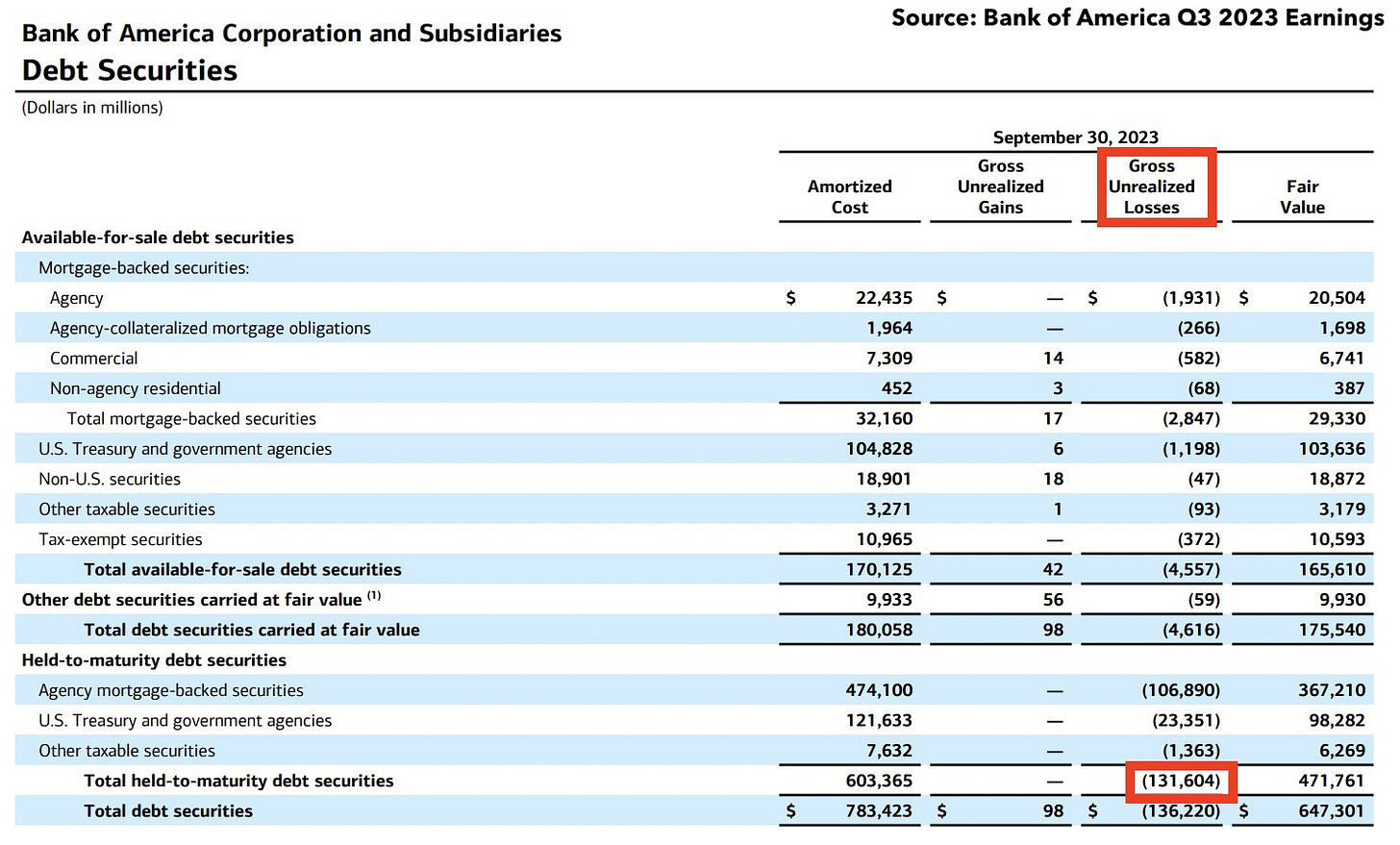

Bad news bears for the smaller banks and those with material (unhedged) duration in “Held To Maturity” portfolios. Also anyone involved in real estate (read: everyone).

For example, Bank of America just reported their HTM losses at $130bn. For a $200bn market cap bank, that’s nothing to sneeze at. What happens to these numbers if Powell has to go to 7%?

There are bonds in the stocks, bonds in the homes, and bonds in the banks.

Are there bonds in gold?

Well, kinda.

People like to say there are real yields in the gold, but inflation linked bonds (TIPS) have only been around post-Volcker, aka in disinflationary regimes where the correlation of bonds and stocks was by and large negative.

Aka maybe the future won’t look like the past, because we didn’t have enough backhistory in our sample. A classic tale.

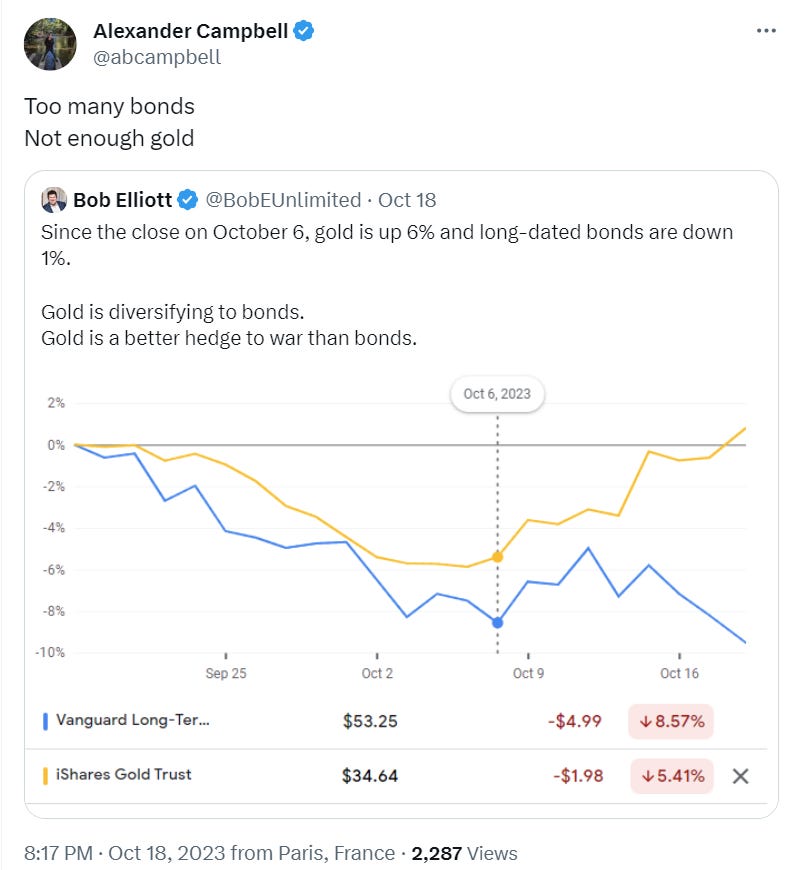

Zooming out, it’s clear, the 60/40 portfolio is vulnerable to conflict via the destruction of wealth in the bond market. It’s also clear that, in those times, gold ends up being a pretty good diversifier.

Long story short: too many bonds, not enough gold.

Which has by and large been true since we wrote about this back in 2020.

We’ll let you know when it’s the other way around. Till then, stay safe out there.

Disclaimers

Worth noting that the Treasury changed the methodology of how it reports TIC data in February 2023 https://x.com/SantiagoAuFund/status/1715405048451051693?s=20

Has China really been selling treasuries or do they just have a huge market to market loss on the treasury portfolio?