Yes, there will be a recession in America

Though we're "not quite dead yet"...

Look folks, it’s not that hard.

The Fed has tightened a ton.

Turned out it was, rates, not crypto, to the moon, after all.

QE is over. The Fed balance sheet is now contracting

While the resulting carnage in the bond market is absolutely historical.

And remember folks, there’s bonds in the stocks.

Maybe we were onto something with that unicorn economy blarg back in 2016.

What what happens when you…

Buy long duration assets during ZRIP.

Come to think of it, what’s the duration of a satellite?

So here we are, 15 years after the global financial crisis. A huge proponent of American household wealth is in real estate.

This time however, the houses and the economy are much less levered.

Keep in mind those mortgages have to go somewhere. Tradtionally they flow through the “GSEs” (Fannie, Freddie, Ginnie) and end up somewhere on balance sheet as a MBS (Mortgage Backed Security).

During QE (Quantitative Easing) the Fed bought a lot of these. But now they are tightening.

And if you thought there were bonds in the stocks, let me tell you about MBS…

Meanwhile the tightening has pushed up mortgage rates

Meaning, demand for real estate has collapsed.

Given the relatively low indebtedness in housing, we should expect to see a surge in home equity lending, especially if and when employment conditions weaken.

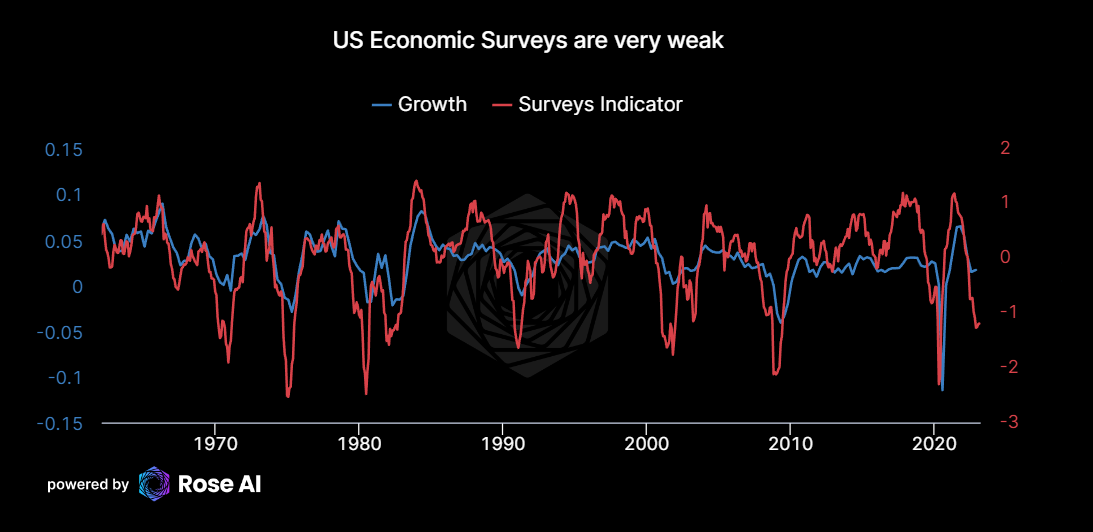

Looking forward, surveys are very very weak.

While the hard data (production, capacity, employment) remains pretty strong

So it looks like the very end of the cycle. When the markets know some pain is coming.

Which should good for inflation hawks. The question is, how fast can these lines fall?

Speaking of, looks like food and energy have peaked, and with it, we should expect a convergence from headline to core. Aka more deflation.

Leaving us wondering, if the soft data is weak, and the scope for more tightening remains, how long can the hard data hold up?

And second, if the Fed continues to tighten until inflation is actually well below rates, how long until something breaks in the credit pipes…

Disclaimers