Why is everyone talking about Credit Suisse's CDS?

From - a guy who used to trade CDS and volatility at Lehman.

Why is everyone talking about Credit Suisse's CDS and how we can use that to understand the overall credit stress in the economy?

From - a guy who used to trade CDS and volatility at Lehman.

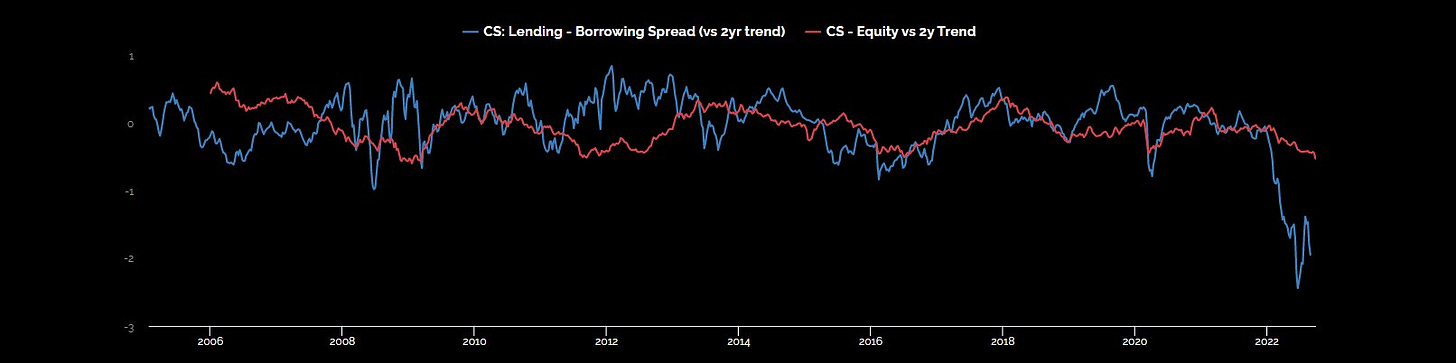

Let's start with global credit conditions, which look pretty bad, but not yet 08 levels.

The 2008 global financial crisis emanated from the US housing market. As you may be able to tell from the news, it's the European credit system that's under pressure today, leading the US down in our indicator.

As opposed to prior credit events, conditions in US money markets remain relatively stable. There is elevated corporate spreads, and equity volatility is ticking higher, but we aren't yet at crisis levels anywhere.

Market credit conditions in the EU are moderately more painful, lead by the stress signals coming from the broker dealer CDS market (aka Credit Suisse and Deutsche Bank).

Bank spreads in the US are up, though not yet at covid, or thankfully, the 2008 US and 2012 EU financial crisis highs.

EU Bank spreads are approaching 2012 levels though, which, if you recall, required 'whatever it takes' from ECB Prez Draghi.

Why do bank spreads matter?

Well, banks borrow at Risk Free + CDS

Meaning, Credit Suisse cost of funding went up 4% in the last year. This is pretty scary for a bank.

There doesn't seem to be any acute reason for the weakness in EU brokers, outside of global tightening, a 10y+ of unprofitability, and proximity to global conflict... Thus, barring further escalation, we would expect policymakers to step in soon to ensure history doesn't repeat.

Another way to view this is to compare Credit Suisse to the other major global banks.

In particular, we compare the equity Market Cap to the banks’s “Risk Weighted Assets” (aka “RWA”), where on a comparison basis CS stands out as particularly leveraged.

Lot of ways to measure leverage, and the bankers don't like this metric, but describes the energy imho. Note Minsheng and some of the other Chinese banks also don’t look great by this measure.

These indicators were built using to compare spreads sourced from Bloomberg to historic trends. If you would like more information on methodology, or have a Bloomberg license and would access to these indicators, please email me or DM me on Twitter.

We are also experimenting with short Youtube streams to walk through the analytics and visualizations in this dashboard. Please excuse the amateurish production quality while we get this up and running.

:)

Note this piece was originally posted earlier this week as a thread on twitter. Follow us there for this kind of work when it comes out.

Disclaimers