What if Treasury Defaults?

Did you ever think to ask?

Jamie is going to war room.

Biden says no 14th amendment.

Yet.

How would you feel about being the first President to default?

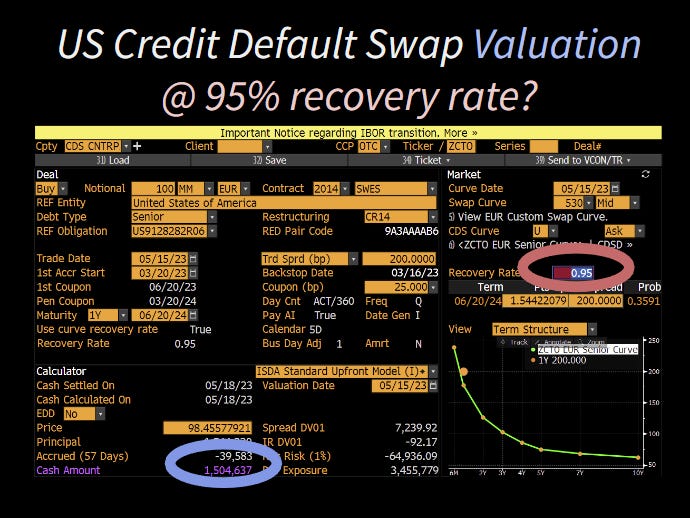

Meanwhile, traders everywhere are trying to back out, what's the recovery rate for treasuries…

Note: ($100 - loss given default) / $100 = recovery rate

Most models take 40% as a base assumption.

Turns out, it’s a pretty important assumption, for those trading at home. I would bet recovery would be something like 95%+.

Remember, usually during a credit crisis, we see a squeeze in treasuries.

A “Scramble for Liquidity:”

Treasuries, the one unanimously agreed upon collateral, for the entire dollar based system.

Currently trading with the credit spread of an emerging market sovereign or stressed bank.

Maybe China won’t have to displace the dollar reserve system, maybe it commits suicide.

Note, as your assumptions for recovery rate go higher with treasuries, these CDS marks look even more ominous. A CDS is an attempt to fill the loss given a default. As your assumptions for the the loss upon default go down, your assumption for the probability of default go UP.

Meaning that 250bps of CDS represents a much higher estimate of default for treasuries than it would some emerging market oil company.

Hard to see how short term bills would sell off more than a point or two, even in the chaos.

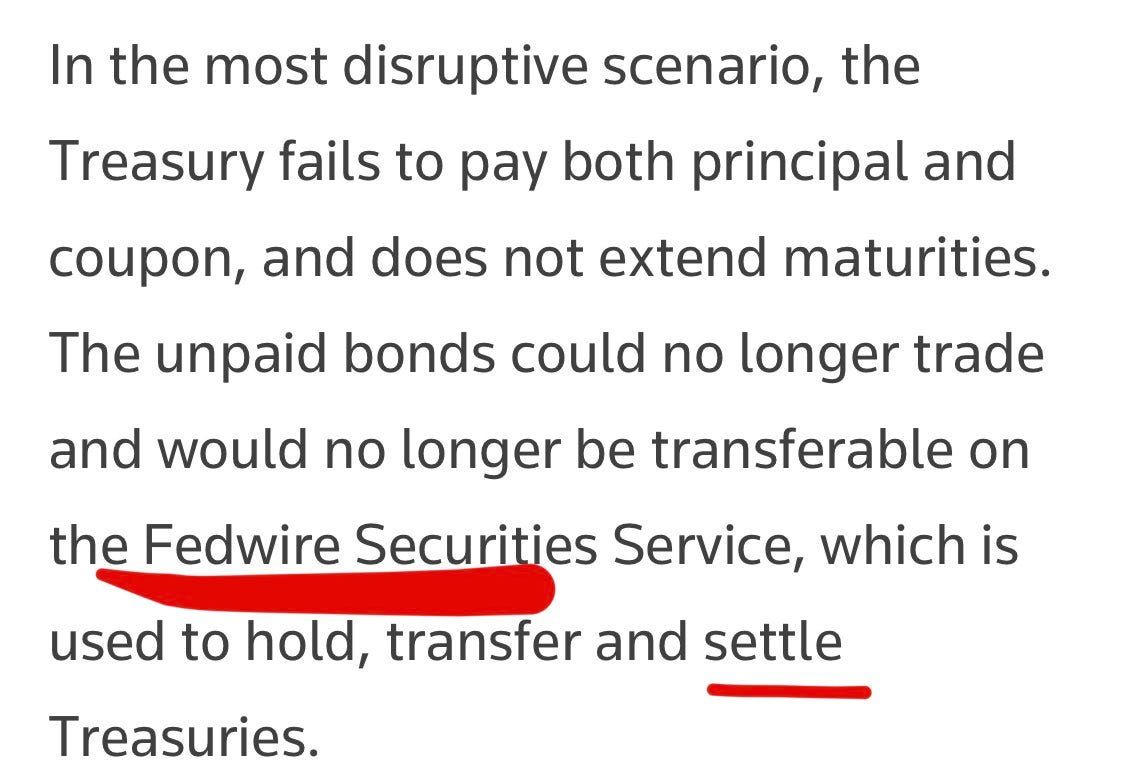

Note, it seems pretty obvious that if Treasury does default, they should roll the principle AND the interest.

We don’t need ANY ambiguity in the financial pipes on whether treasuries are ‘money good’ collateral. That would be a real ‘machine is down’ moment.

Leaving us with a simple view.

Sell protection on a US default, buy protection elsewhere. Because if the US defaults, it’s going to be chaos, even if it shows up in stocks rather than short term government paper.

https://twitter.com/abcampbell/status/1657377105653510144

And don’t forget gold.

Good luck out there.

Disclaimers