Wait and See

The market responds to the Bank Term Funding Program (BTFP)

Today will be a light one. We’re in reaction mode vs prognostication mode.

With one proviso, left over from our time at Lehman shorting banks:

Wait until banks stop dying to buy risk.

Tomorrow will be important.

In the meantime, here’s some market moves we recommend tracking to get a sense of the potential (and realized) contagion.

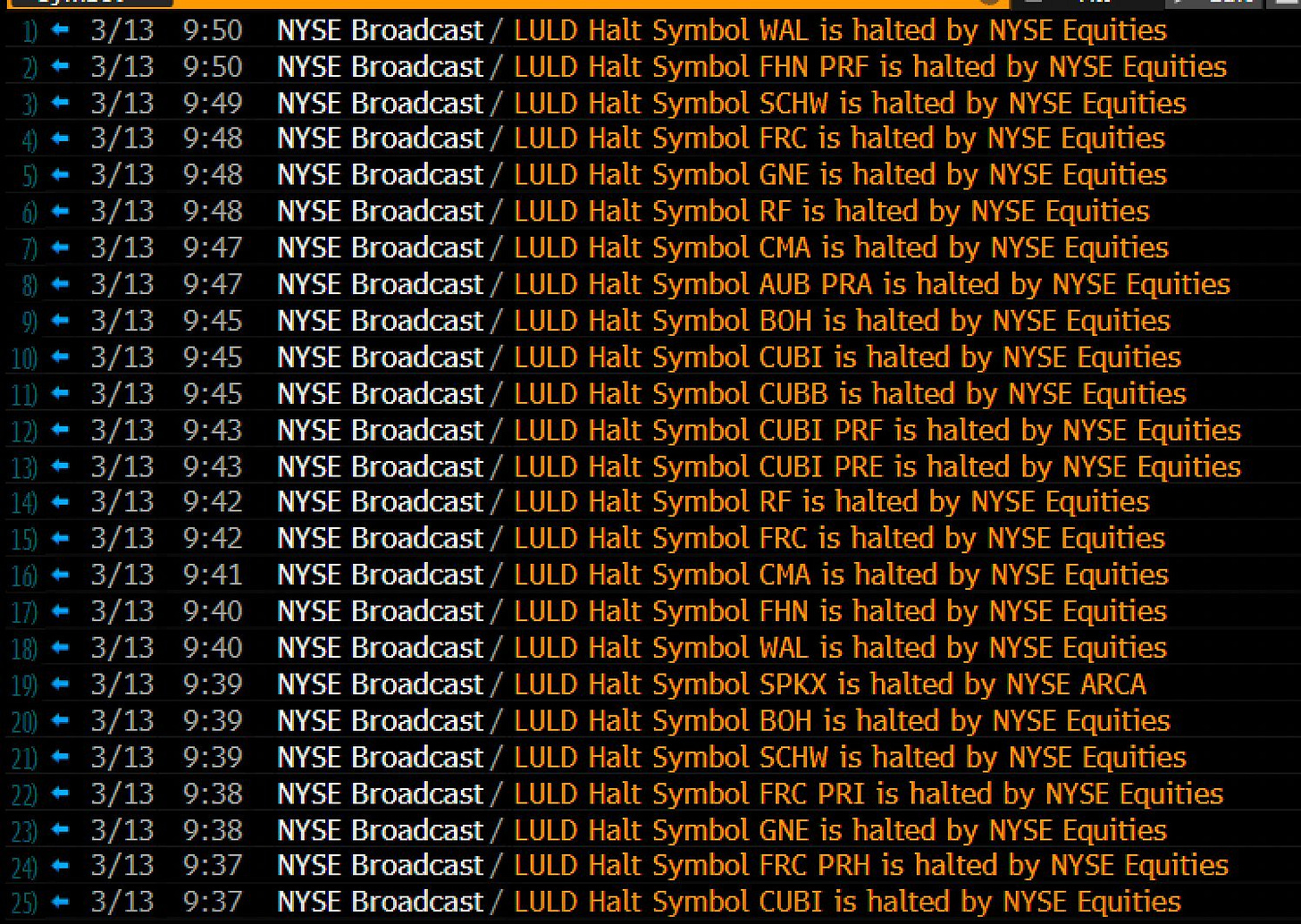

US regional bank equity collapsing. Many names down 30%+ and trading (temporarily) halted earlier in the day.

Credit Suisse CDS at the highs. Contagion from California to Switzerland. Though UBS (and many of the most systemically important banks) still look fine.

Nomura calling for 25bps of cuts!

Massive moves in rates markets, basically one more hike and then pricing in easing. Twitter saying forced liquidations, I’m left wondering if maybe the market is right.

Credit spreads and equity volatility higher, though still not at crises levels.

Bond volatility almost at the highs. Makes sense, given the 4 cuts just left the curve.

If Lehman is any guide, expect choppy waters whilst the market hunts for the weakest member of the herd, while the rest of try to figure out the classic questions:

How much was hedged?

How big are the losses (actually)?

How fast can liquidity conditions change vs Fed policy.

Stay safe out there.

Disclaimers

US regional bank stocks now making huge gains off the lows in after-hours trading.