This Week in Markets

How much pain 'till the pivot?

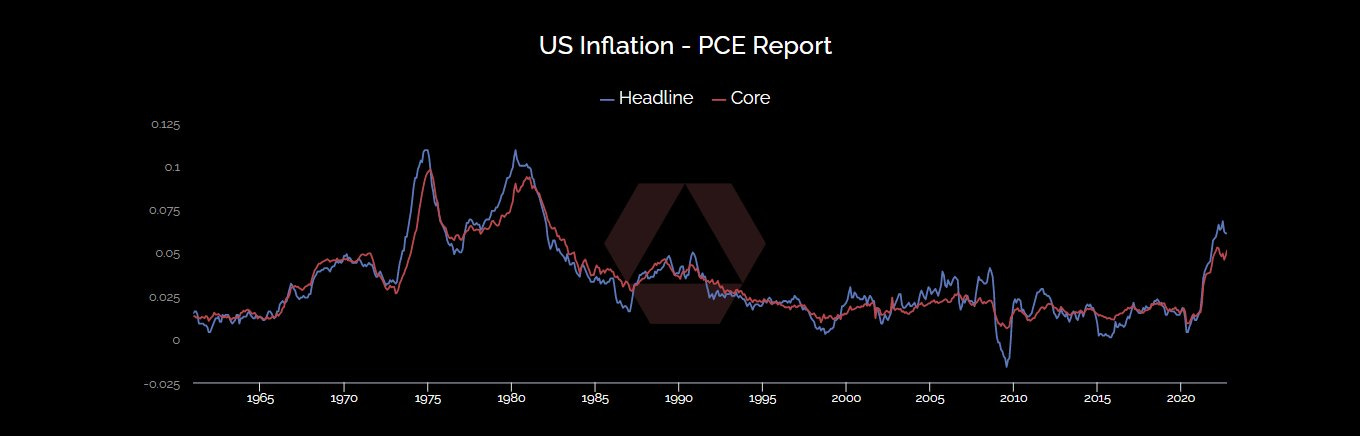

US Inflation, as measured by PCE, came in at expectations yesterday.

0.5% MoM in Core and 0.3% MoM for Headline - that's 6.3%, and 5.1% annualized for those counting at home.

No big surprises, but no relief either for those worried about prices making it difficult for the Fed to pivot.

Looking ahead, oil prices have come off the highs.

Without further escalation in Europe or supply chain problems (see below), this aught to bring down headline relative to core over the next 3m.

This will make it easier for policymakers at the Fed to pivot.

However, there continues to be supply chain issues in US domestic energy.

The situation in food, the other piece of headline inflation excluded from core, is less supportive of the pivot narrative.

Agricultural commodities have only recently peaked, and PCE prices are still inflating at ~12%/yr.

Oil tends to be a lot more volatile, and operates with a pretty big lead on food prices, which makes sense given energy is used in the production of food etc.

This flow through takes a long time, and is competing with local demand and supply to drive relative food prices.

Meaning, the inflationary wave looks to have peaked, all things being equal.

Looking forward, we can see the impact of Fed tightening on markets. The question remains, what that will do to demand and future inflation?

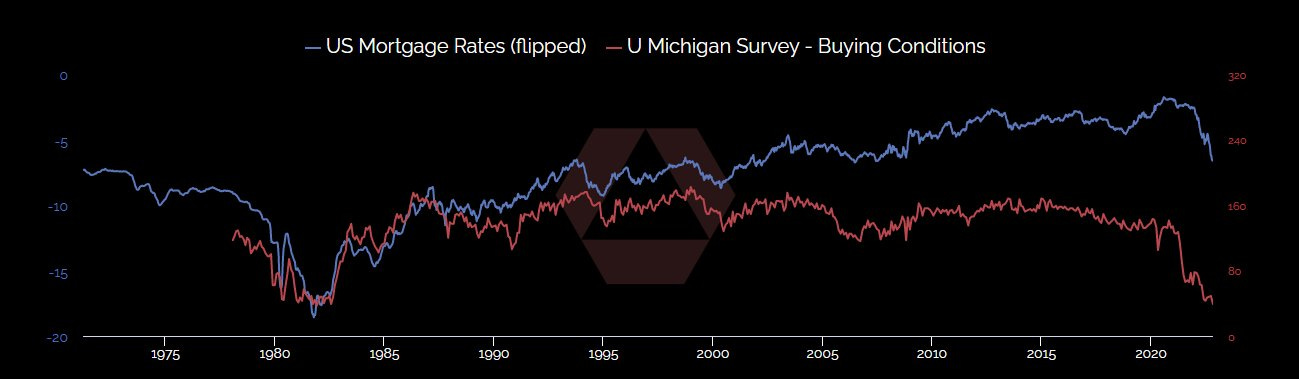

For example, the impact of Fed tightening on higher mortgage rates has severely reduced housing demand.

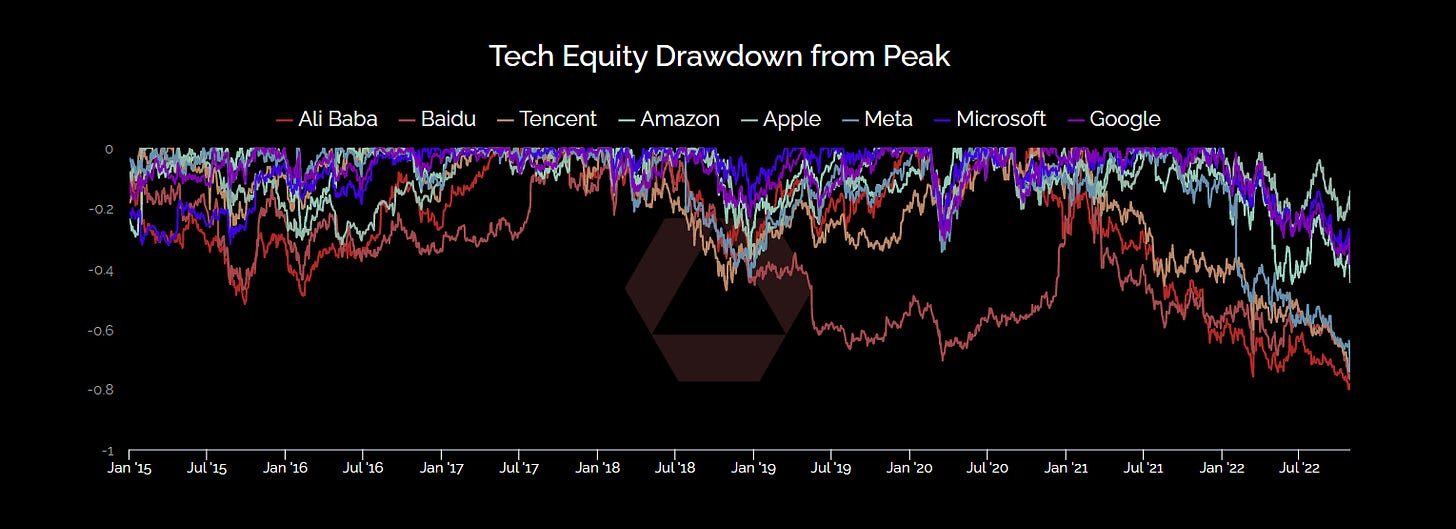

Meanwhile Blue chip tech in the US (aka everyone’s 401k) is just starting to feel the pain.

Meta being the most FAANG name whose equity price is in a drawdown on the same order of magnitude as Tencent, Ali Baba and Baidu.

Though it’s unclear how much the the latter are under stress due to their US ADR listing as about anything in their business.

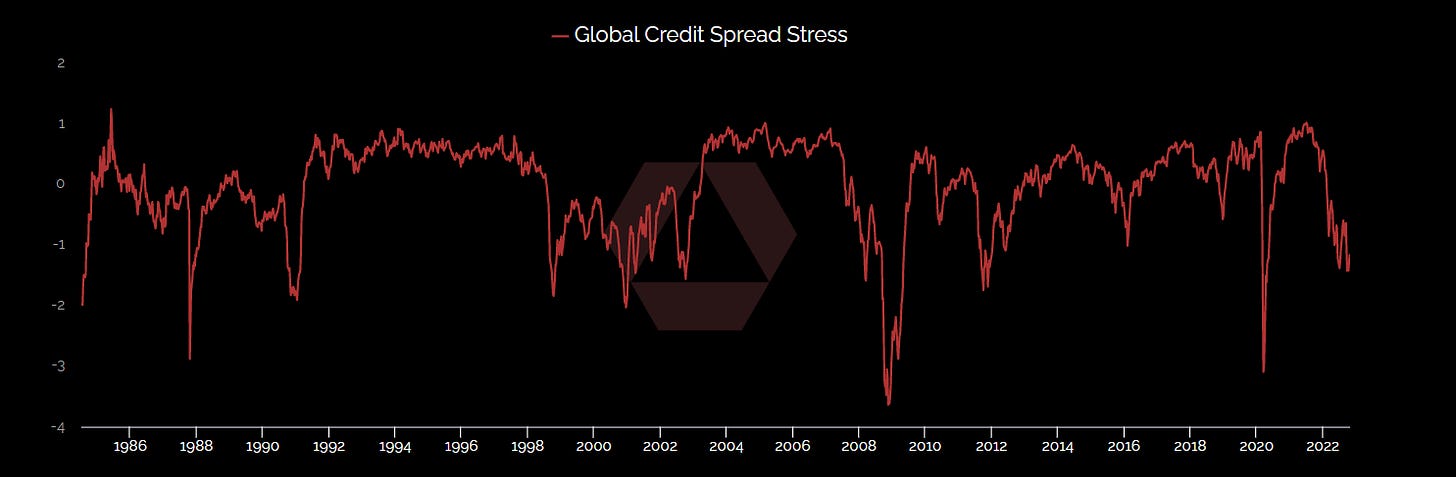

Recall that global credit stress is still elevated.

Even so, there are early signs Credit Suisse’s asset sales may be enough to quell credit markets and forestall any restructurings that would impact bond holders.

That being said, any broker with a 250bp credit spread is essentially uneconomical, so this bears watching.

Lastly, the impact of Fed tightening on the bond market is well documented.

So well, in fact, that days after we posted that, Bank of America promptly stole our chart.

There’s two important points here:

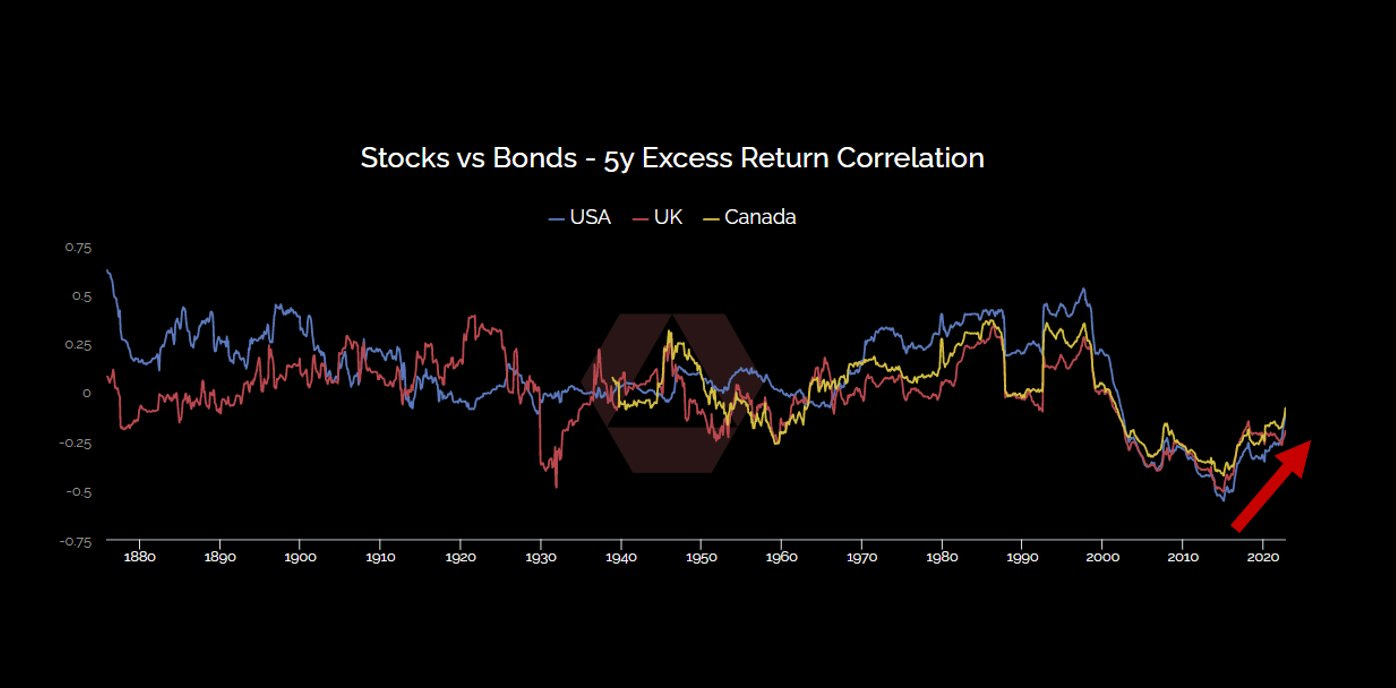

There are a lot of people waking up to the idea that there are bonds in the stocks and that rising inflation leads to pain in both markets. This is evidenced in the rising correlations in the west between bonds and stocks.

It used to be that when stocks fell, bonds rallied. This isn’t happening.

Markets still aren’t really pricing in short term interest rates at 5%. Yet.

So, where does that leave us?

Inflation remains stubbornly high, making it difficult for the Fed to truly back off in a significant way. Short term disinflation from the fall in energy prices is being countered by tight labor market conditions and continued supply chain issues.

Meanwhile, asset markets are just starting to feel real pain. Bonds are no longer protecting stocks, and the market is punishing tech companies for drops it would have overlooked in 2021.

Home prices have peaked and will continue to fall. Thankfully, the American financial system appears less levered and vulnerable in 2008, but European and Asian balance sheets appear weaker and more vulnerable.

Pain in the portfolio, pain in residential real estate, pain abroad.

In summary, pain everywhere but in the places that would really drive down prices.

Meaning, even if we see language from the Fed signally easier policy, Powell only has so much room. Walking a fine line between policy tight enough to crush inflation, while easy enough not to instigate another global financial crisis.

I do not envy the Fed.

Till next time.

Disclaimers