The War Phase

What does Evergrande have to do with Taiwan?

4yrs ago I made two big calls:

1. Chinese real estate was a bubble.

2. WW3 would start over Taiwan.

At the time people treated me like a schizo.

Now the first prediction is yesterday’s news and the second is a normie opinion all over my Twitter timeline.

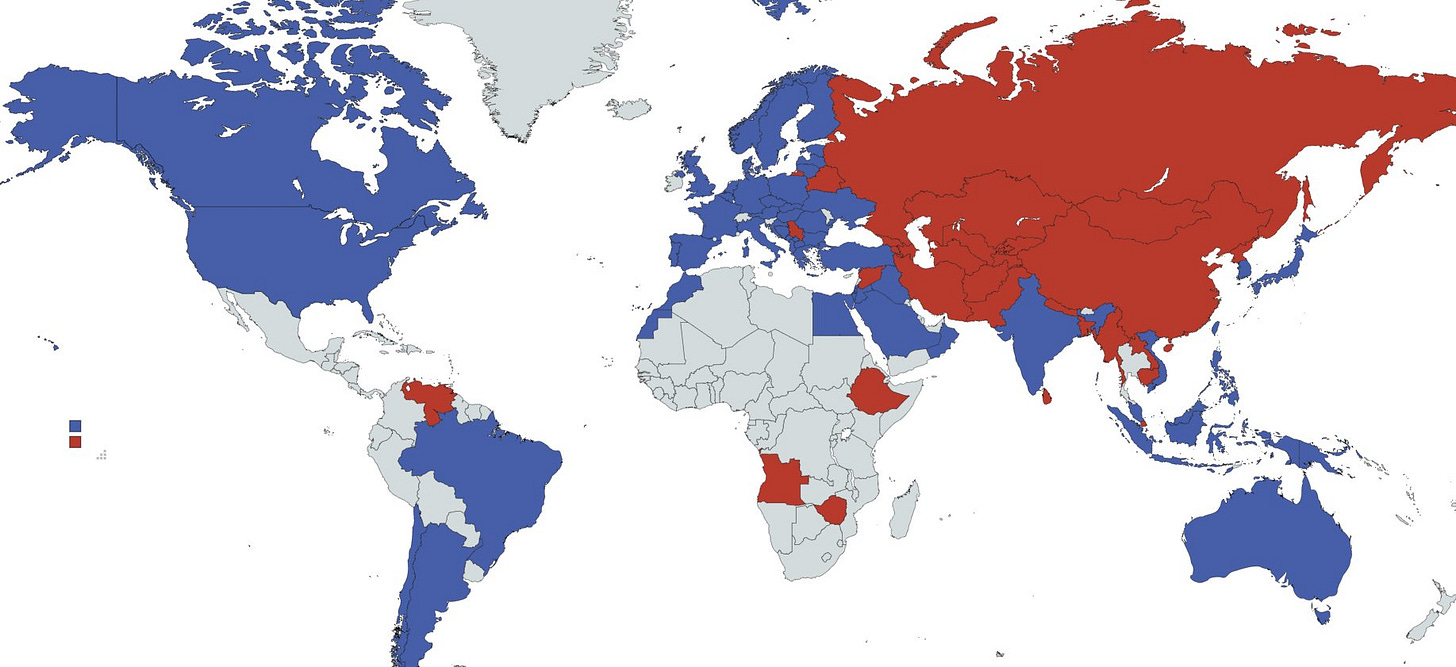

At the time it was hard to see the connection between the two. Just like it may be hard for some people to see how this...

Pretty quickly turns into this.

Or, as my old mentor and boss Ray puts it: "We're approaching the war stage."

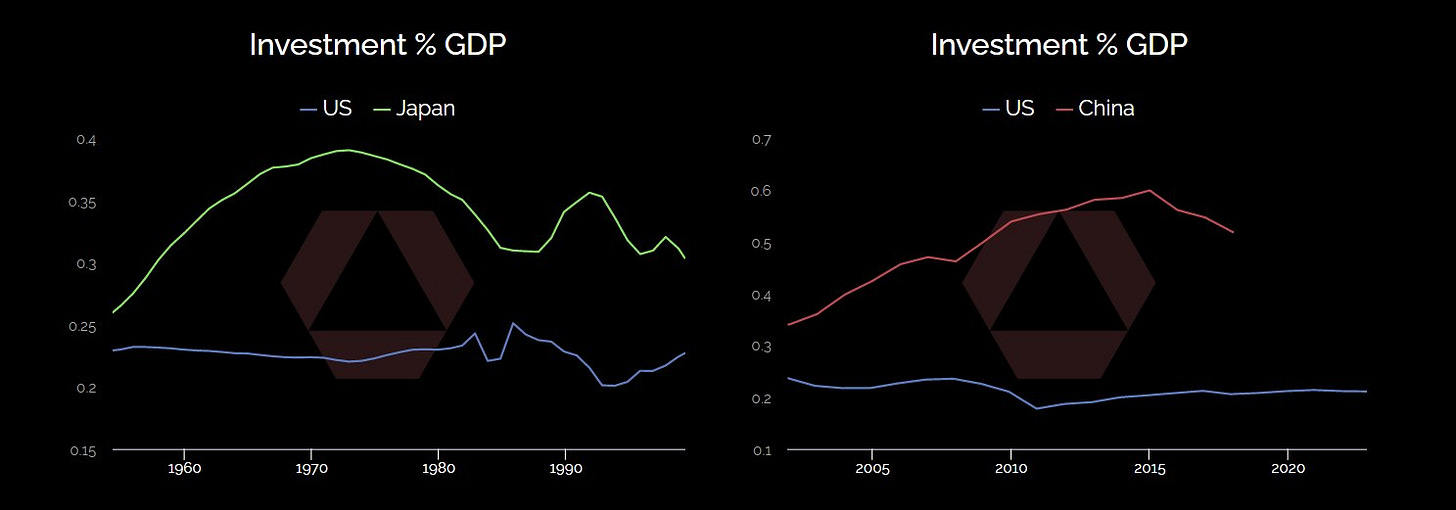

At the core of this view is the answer to a frequently posed question "How is China's rise similar or different to that of Japan in the 70s/80s?"

Both had development paths that printed a lot of money to invest in an export oriented economy.

Now, one may object to the above:

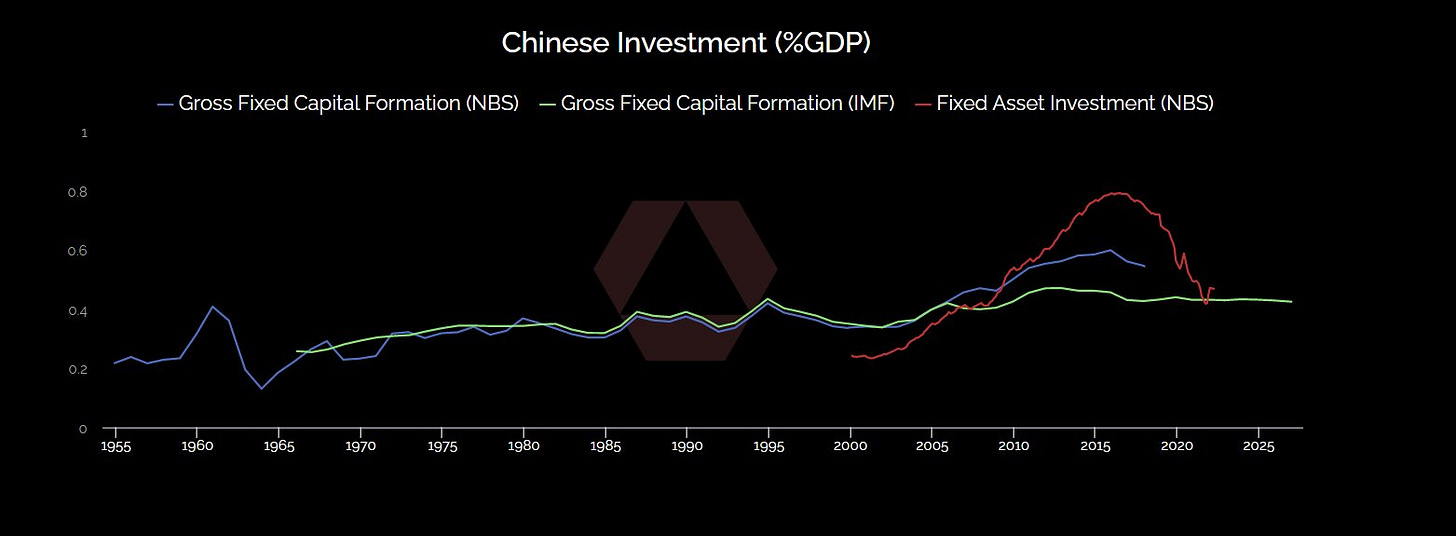

"But Campbell, that China chart stops in 2018!"

To which I say, yes, bc that's when the NBS stopped reporting that stat (as they tend to do).

Thing is, it's not the simplest thing to track. And if you actually *look* at the numbers...

You see things that actually don't make sense.

For example:

How can China be investing at a rate of 50% of GDP, a rate higher than ANY country in recorded history...

...while at the same time also be investing* at a rate of 80% of GDP in 2016!

Ask questions, get a lecture about the differences in "Fixed Asset Investment" vs "Gross Capital Formation."

These acronyms obscuring the truth , there's no way that Fixed Asset Investment in China was *ever* 80% of GDP.

Imagine GDP where 80c of every $ is buying washing machines...

In reality, they aren't buying washing machines. They are buying buildings.

How does an economy spend 80% of GDP on new buildings?

It doesn't. To get to 80% of GDP, somewhere, someone is booking an investment in a real asset (land) as fixed asset (aka a machine).

Aka investment is over-reported.

Aka GDP is over-reported.

So you ask, how are they paying for all the land that's being bought and booked as income/GDP?

Well, with borrowing, of course.

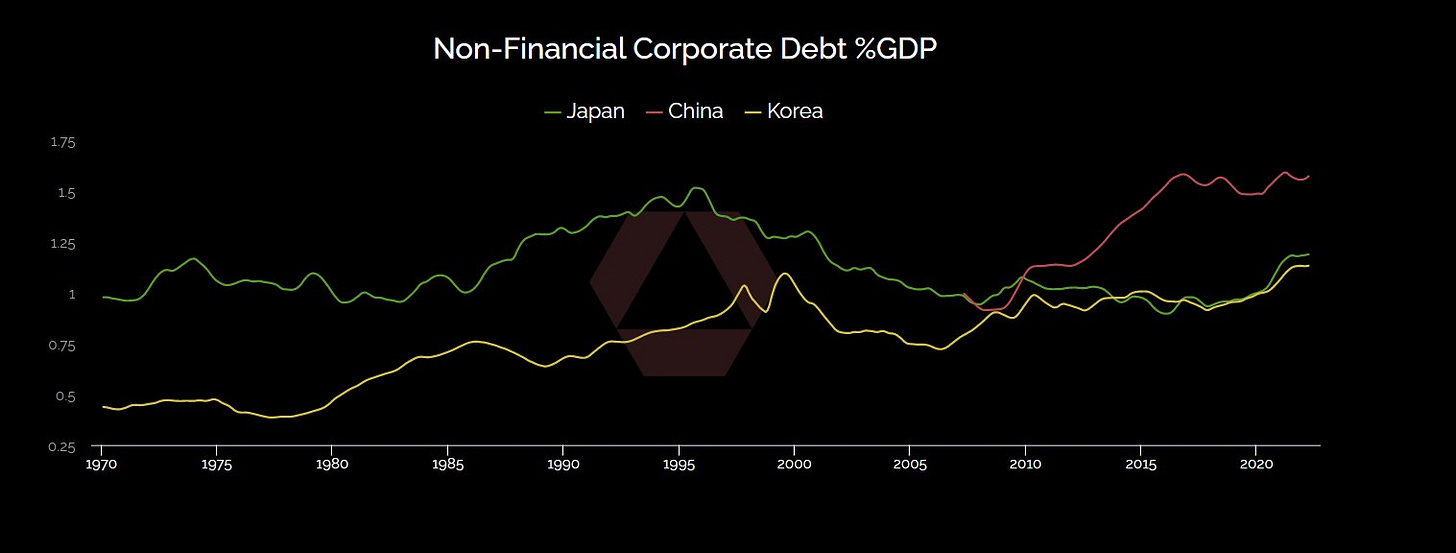

First, following in the fine footsteps of Japan and Korea, by loading up the corporate sector with debt.

Second, when the corporate sector runs out of capacity for debt, turn to the household sector, and get *them* to borrow to invest in real estate.

All according to plan.

What wasn't to plan was when these over-indebted companies, many of them the same property companies that have now gone bankrupt, started selling esoteric and bespoke financial products *directly to households.*

(Note the data has gone dark here, like many of the juiciest time series)

It's one thing to write down greedy bankers bonuses, and quite another to stick mom and pop with a 90% loss.

Right cue, here's Evergrande in '21, once the most prominent property company in China, proudly reporting on a 10% (!) repayment on their WMPs.

Which is by and large representative of a problem with the entire sector, almost half of which is currently trading at distressed levels.

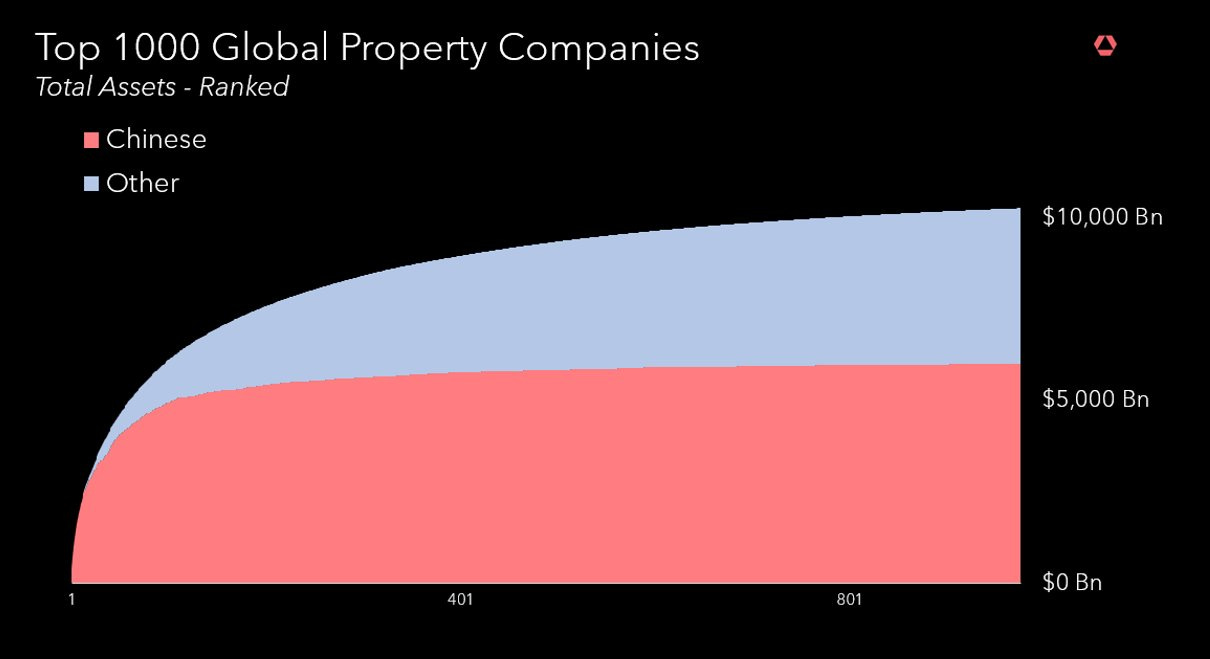

Keep in mind this 'sector' is half of the global property market, by assets.

"Ok Campbell, good for you, you called Evergrande, wanna cookie?

What does that have to do with Taiwan?" Well, you could meditate on why they keep inflating the bubble, or why they won't take the pain, or you could just listen to Xi:

For Xi, the lesson of the Soviet Union was simple.

Don't back down, down lose control.

With clear implications for the Japan parallels.

Don't liberalize.

Don't take the pain.

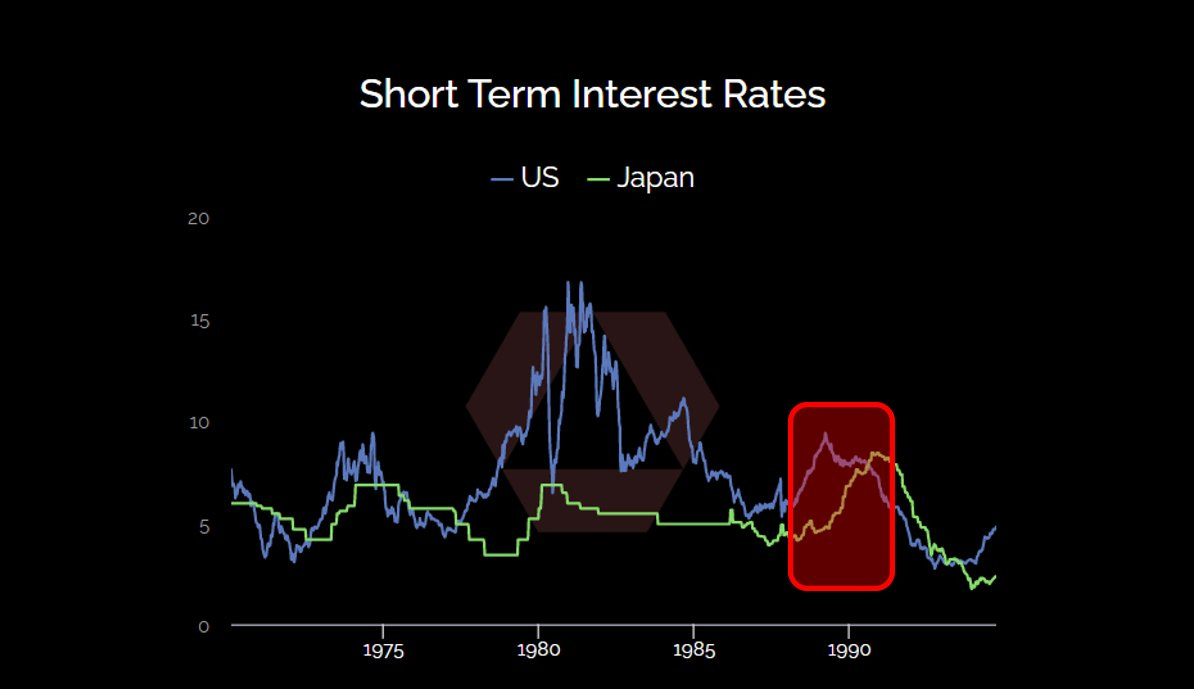

In '88, the US, like today, was engaged in a round of monetary tightening.

Higher short term rates. Japan, owing to the asset bubble in the tweet above, was slow to follow suit, only tightening in late 89.

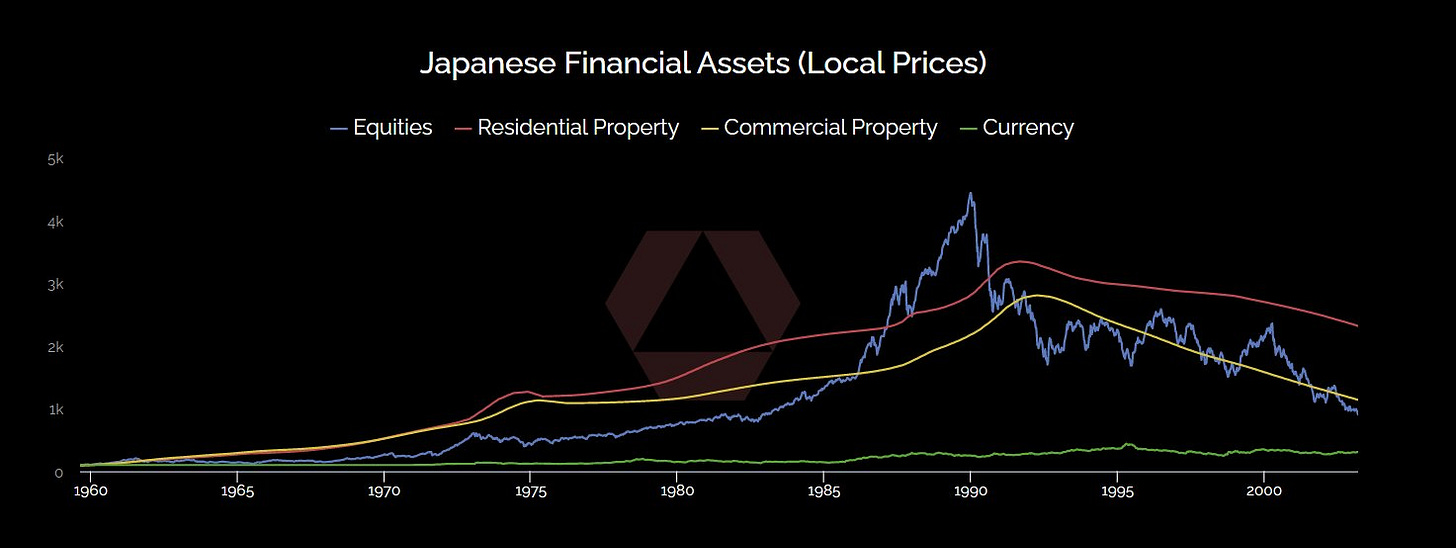

This tightening was enough to finally pop an out of control bubble in equity and real estate markets.

Equities peaked a couple months after the tightening started, housing 6-24m later.

The social contract between the PRC and the Chinese people is very different than post-war Japan.

"Prosperity without freedom" vs a decades of liberal government and relatively open capital markets.

Maybe China just can't take a 50% write down.

When Japan popped their bubble and 'took the pain' they lost the dream of having the world's most expensive housing in the world.

If China really pops their real estate bubble, they risk the following:

One China Principle

One Belt, One Road

One Country, Two Systems

Made in China 2025

The differences don't end there. The ruling political system in Japan was basically put in place by the western victors of WWII.

The ruling political system in China was created in direct opposition to foreign imperialism by western powers during that war!

These policy goals are not disconnected.

For Chinese nationalists, the sea inside the "Nine Dashed Line" is as much a part of China as Hong Kong, Taiwan, or Beijing.

For Chinese nationalists, the path of Japan looks more like one of vassalage than independence.

7yrs ago policymakers started the 'crackdown' on shadow banking.'

7yrs ago, there was about $20tr of 'money' in the Chinese financial system.

Today, that number is close to $40tr.

Maybe it's better to get credit for a crackdown rather than do one?

Bringing us to today, where the question becomes, are Chinese policymakers really willing to take the pain and let the worst banks fail?

Below you can see that weak bank stocks are now down 50%, and more healthy banks are down 25% and falling.

Were they to let the worst banks fail - and admit the emperor has no clothes - policymakers not only have to orchestrate bailouts, but they also have to control a population of 1bn+ that maybe, just maybe, isn't as rich as they were promised.

Rather than jailing ppl for protesting failed WMPs, why not lock them down and replace the promise of prosperity with a promise of unification?

Lenin's imperial late-stage capitalism, playing out live in a communist nation.

History is funny sometimes.

Disclaimers

Thanks for this - it's actually quite scary that Chinese social media towards Taiwan has become increasingly violent and the government chooses to let those ideas spread, whereas any criticism of zero-covid is immediately banned. Fits this narrative all too well.

Seems you "called Evergrande", you must have made an absolute fortune trading it?