The Tit-for-Tat Loop

The Game Theory of Escalation in the Middle East

Today we’re going to examine the emerging conflict in the Middle East from a game-theoretic perspective. We’re argue that all parties appear locked in a cycle of escalation, one where zero-sum games like tit-for-tat are rapidly shifting towards negative-sum games resembling all-out conflict. We'll use this game theory to make some intermediate conclusions about the near future and the implications for markets. As we have said repeatedly, two of our investment principles are "Conflict is Inflationary" and "Inflation is about Oil," both of which seem relevant to the current situation.

Introduction to Zero-Sum Games

I was introduced to zero-sum games as a child. Everyone is. Think of the various 'tournaments' we ask our young people to engage in as a part of growing up. These are games designed to sort you from your peers and allocate resources and opportunities according to the outcomes:

Who would get the A? (not me)

Who would start at quarterback? (not me)

Who would get the girl? (also, alas, not me!)

This process of education/socialization/signaling is perhaps the single most important game played on earth, and one I personally saw as highly biased against those without means.

During this time, I was also introduced to the idea of 'winner take all markets', as a driving force toward inequality resulting from increased scale. Think of how the radio transformed the music industry, turning thousands of local singers into a handful of global superstars.

If you only think of the world with these two principles - zero sum games and winner take all markets - it can get pretty dark. Especially if you're a poor kid from the projects.

Trying to understand these types of societal games led me first to economics, and then inexorably into the field of game theory, in a search for the math that drove this human behavior.

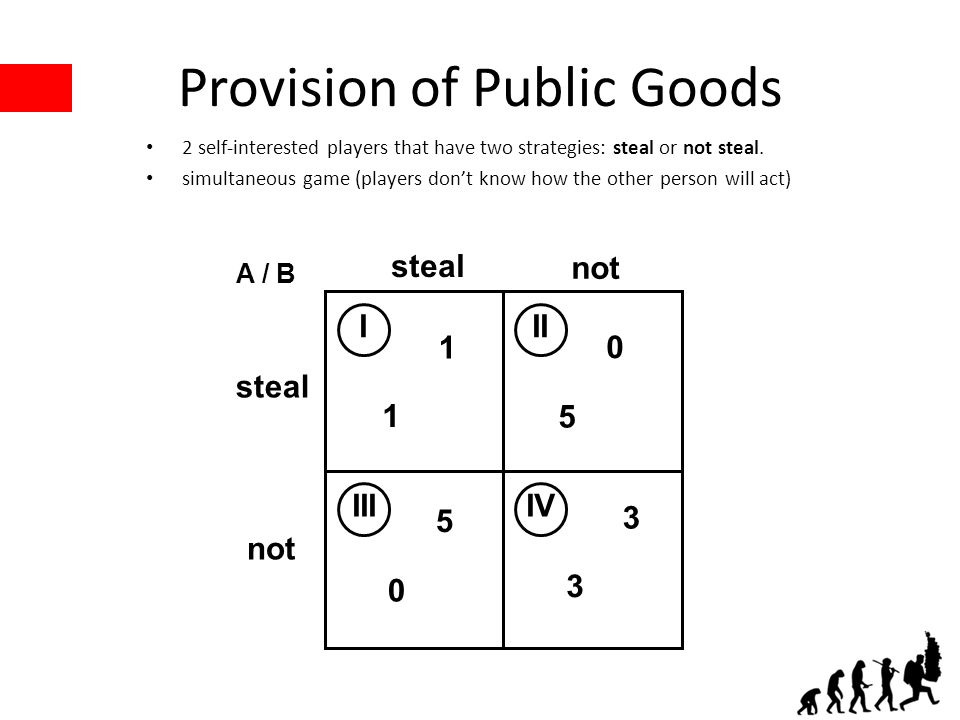

Indeed, the first lessons you learn in game theory is the math of zero-sum games. The classic Prisoner’s Dilemma outlines the logic of “dammed if you do, dammed if you don’t” which can drive two people to an outcome neither would prefer over what’s possible, but is the best they can guarantee they will get.

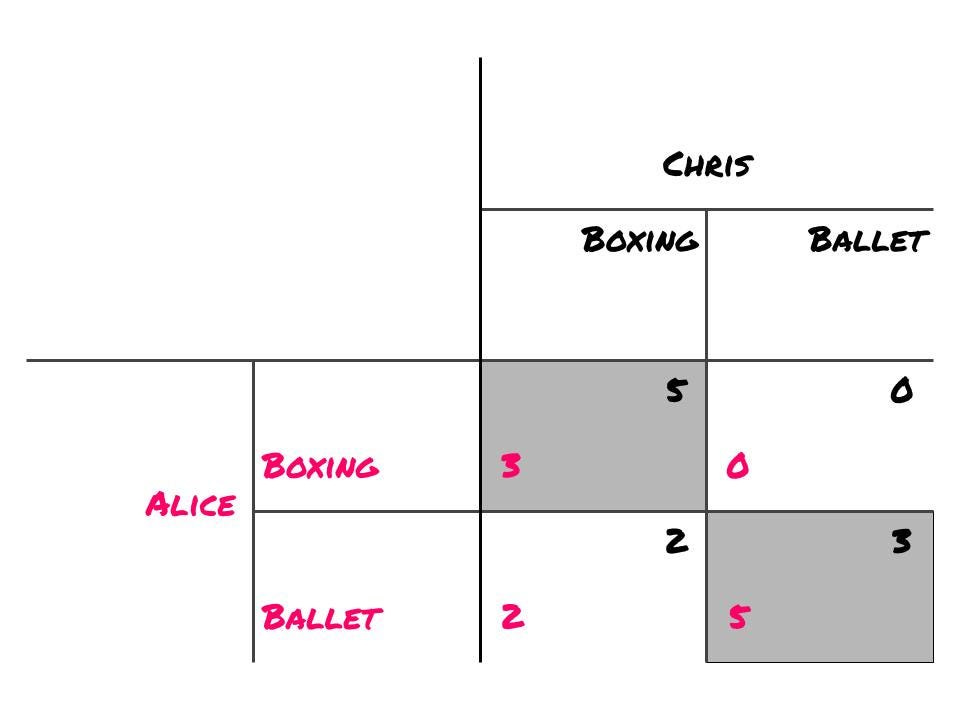

For help in understanding these ‘strategic form payoff diagrams’ see a similar game below which does a better job of labeling the game:

This is about as a far as most people get in this subject, which is actually kind of dangerous memetically. The idea that there’s often some form of 'equilibrium’ which suggests a ‘rational’ strategy that just happens to be selfish and harmful has done a lot more bad than good. But it does essentially capture the logic of ‘it’s us or them.’

Positive Sum Games

But there's a crucial second lesson: Positive-Sum Games. A classic example is the "Boxing vs Ballet" game, where two people prefer different activities but value being together more than getting their way alone:

In this game, Alice and Bob have made plans to spend the day together and have bought tickets to both the Ballet and Boxing. For some reason their communication has been shut down before making a joint decision, so both must make a one-time call about whether to meet at the boxing or the ballet. Consistent with the gender assumptions from 1960s American Economists, Alice would prefer the Ballet and Bob would prefer the Boxing. Both would prefer to be together, rather than going to even their preferred option alone. In short, the equilibria in this game are the two places where the alternative choice by any player would lead to a lower payoff for both players. By coordinating their choices, the two players can 'grow the pie' rather than arguing about how to split it up.

This introduces the idea of 'coordination games' - a special category of positive sum games where the problem isn't 'you vs me' but coordinating across different preferences and outcomes.

“Public Goods games” are related to this idea.

As an aside, this is where markets come in. Markets often allow for the coordination of the exchange of goods and services across preference sets. You don’t like beef, I don’t like wheat. So once a year I come to the ‘market’ to sell my wheat and buy beef. The existence of the market makes it easier for you to sell your beef to buy wheat, and in the process, we both get better prices (aka ‘deals’) then if we ran around with our respective goods trying to find a random human who’s preferences were different from ours.

Next time you are in Walmart or Costco, look down at your cart and imagine how many different stores or workshops you would have had to visit 100 years ago to replicate that basket. It's an insane amount of time saved.

So this is our first gleam of hope against the darkness. The idea that a) not everything is a zero-sum game, and b) the evolution of markets as unlocking a lot more positive sum games than we even really perceive.

Robert Wright's "Non-Zero" takes this idea further, tracing a trajectory through history whereby the evolution of science, technology, and culture enabled us to play more and more positive sum games.

It’s a good read, and I don’t want to ruin the ending, but the conclusion of his book is pretty radical: look back on not only the recent history of the world, but back to pre-history, archeology and even evolution, and we can see an arc of history moving towards more and more positive sum games between more and more complex organisms/systems.

From this perspective, even the starkest materialists is faced with the shocking, confrontational question of “Why?”

Why does the system appear to work this way? Why does it look like humans are generally getting better off? Why does it seem the moral circle is inexorably expanding (with animals on the cusp)?

What "Non-Zero" provides as an adjustment to a world full of pure 'rationalism' is HOPE. The idea that, wait, the world may seem to operate under the cool mathematical logic of zero-sum games, but as you zoom out from those million tiny zero-sum interactions, there appears to be some broader positive-sum phenomenon at work, shaping our behavior over the eons. That against this cold logic of self-interest, the door opens to love. The very reality that we all have someone or something at our core that we truly love. That we would sacrifice our own welfare for.

Conflict as Negative-Sum Game

Now that we understand zero-sum and positive-sum games, we can introduce the notion of negative-sum games. Negative-sum games are the kind of game where the more you play, the more you lose.

Negative-sum games are devastating counter-forces to the positive-sun trajectory outlined above. They are games where the total pie shrinks the more you play. Think of bitter divorces, fights over inheritances, or intellectual property lawsuits between two monopolies

The closest analogy in game theory is the idea of an ‘all pay auction.’ This is an auction where you have many players, and the prize goes to the highest bidder, but individuals are forced to actually pay their bid, or pay to bid. Think of a patent trial where the winner earns a billion dollar settlement. Each side has sufficient incentive at each step to continue investing in winning, even past the point where they spend more money on the process than the pie is worth!

At each subsequent step in the auction, rational players may be forced to cough up higher and higher bids, under the belief that ‘just this last one’ will force the other players out.

This is what's breaking out in the Middle East - a cycle of tit-for-tat escalation trapped via the 'cold logic of escalation' into something extremely negative-sum.

Each justified reprisal slowly ratchets up the damage, gradually turning a zero-sum game over things like land into a negative-sum game where the two sides begin to actually damage each other's core capabilities. Each reprisal sets off two more, like the first steps of nuclear fission as the system goes hypercritical.

That’s what’s occurring in the Middle East at the moment.

As of writing this, reports suggest that the Israeli response to the Iranian response to the Israeli response to the Hezbollah response to the Israeli response to the action of Hamas, will come down to potential strikes against Iranian nuclear facilities in Natanz (and others) or the oil refining and transportation facilities of Iran.

In a strange mirror to the Israel’s scrambling of F-35 fighters in anticipation of Iranian ballistic missile strikes, Iranian crude tankers have moved off their piers. Moving away from the center of mass for incoming strikes.

A strike on Natanz would conceptually make it harder for Iran to create or deploy a nuclear deterrent to match Israel’s, the last card in a world many years forward where they lack traditional regional military dominance.

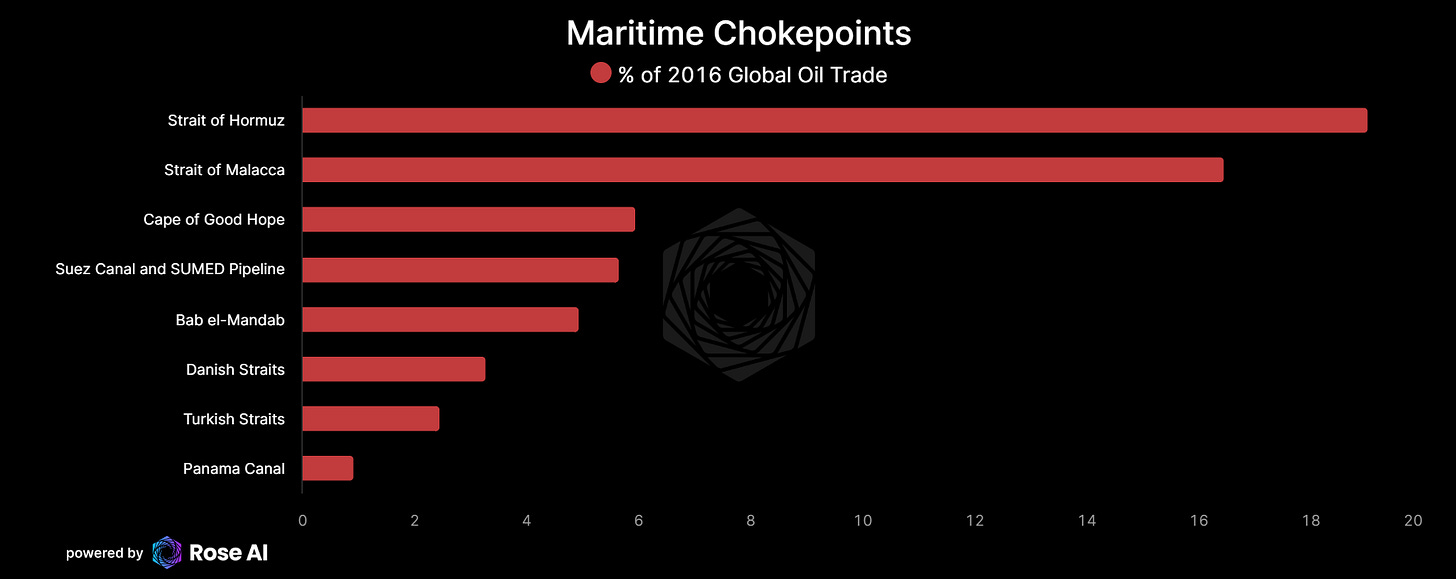

A strike on Iranian oil port facilities then likely to trigger issues in the Strait of Hormuz, which sees around 20% of the world’s crude, and represents the single greatest maritime chokepoint on earth.

An active war between Iran and Israel would be the final blow to the push from pre-October 7th, to better integrate Israel into the region's economy, and open up competing trade routes to the Belt and Road in the process. A dream gone, for now.

Implications for Markets

You probably read this article for my views on markets, not my views on the Middle East. That being said, you likely have direct or indirect exposure to what occurs between these players in the next couple of days and weeks. In particular, we see the following implications for markets, given the speed and violence with which the conflict appears to be turning into a negative-sum game in the region:

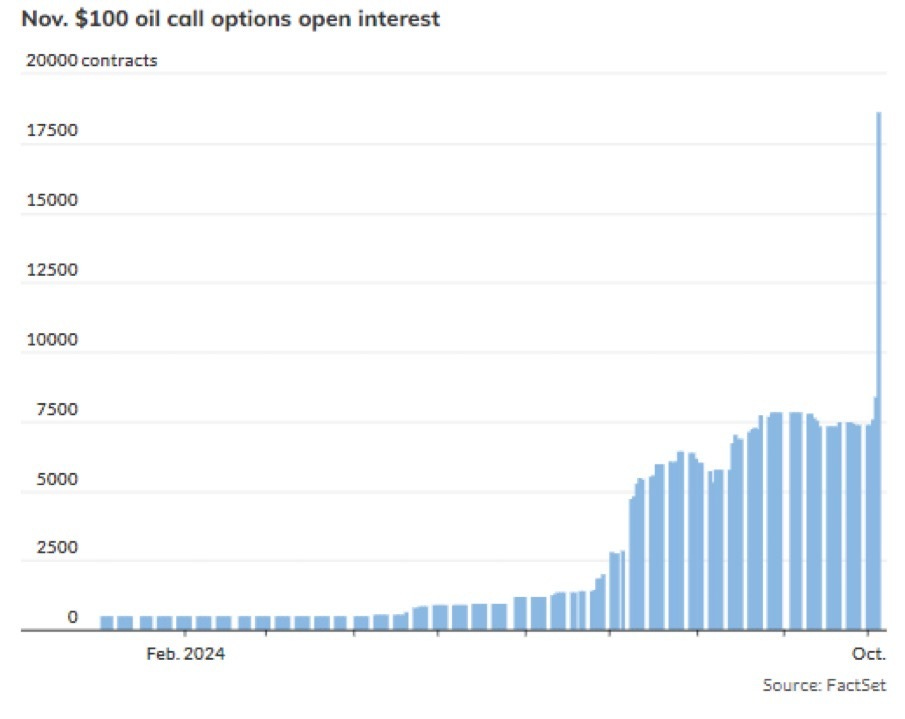

Don’t short oil. Not right now. Just don’t. Global central banks are now easing, China appears to be committed to stimulation (we’ll see) and any significant escalation affecting either the oil production or transportation systems will likely be extremely volatile. Conflict is inflationary, etc.

Given the scale of recent call option buying, we would also be wary of piling into a position long at the very ‘front end’ of the futures curve, where the call buying has likely been concentrated.

US oil futures remain deeply ‘backwardated’ (meaning the contracts close to expiration trade at a higher price than the further away contracts), with front month contracts rising more than 10% in the past week. For those looking to go long oil here, we would recommend avoiding the front month and going a bit further out. If we get another oil shock, these contracts will shift up possibly more than the front months, which are currently expensive due to this last-minute buying.

Probably hold your gold. With the shift to Chinese stimulation, we will likely see a rotation out of gold and back into risk assets like stocks. If this occurs at the same time that the Fed easing expectations go off the table, we should expect to see a rise in short-term US rates and a commensurate strength in the dollar. Geo-political tensions are generally good for both the dollar and gold, so "gold in dollars" is likely to underperform "gold in other currencies."

Watch for any green shoots in inflation. It looks like the port strike was mostly averted pre-election, thank goodness for the hubris of a man wearing a $20k watch, making $900k and demanding a ban on automation. This means that transportation links for goods into and out of the US remain stable for the time being, but disruptions to global crude supply would impact not just the price of energy, but everything else that runs on electricity. "Inflation is about oil" is one of our principles. This leads us to short bonds.

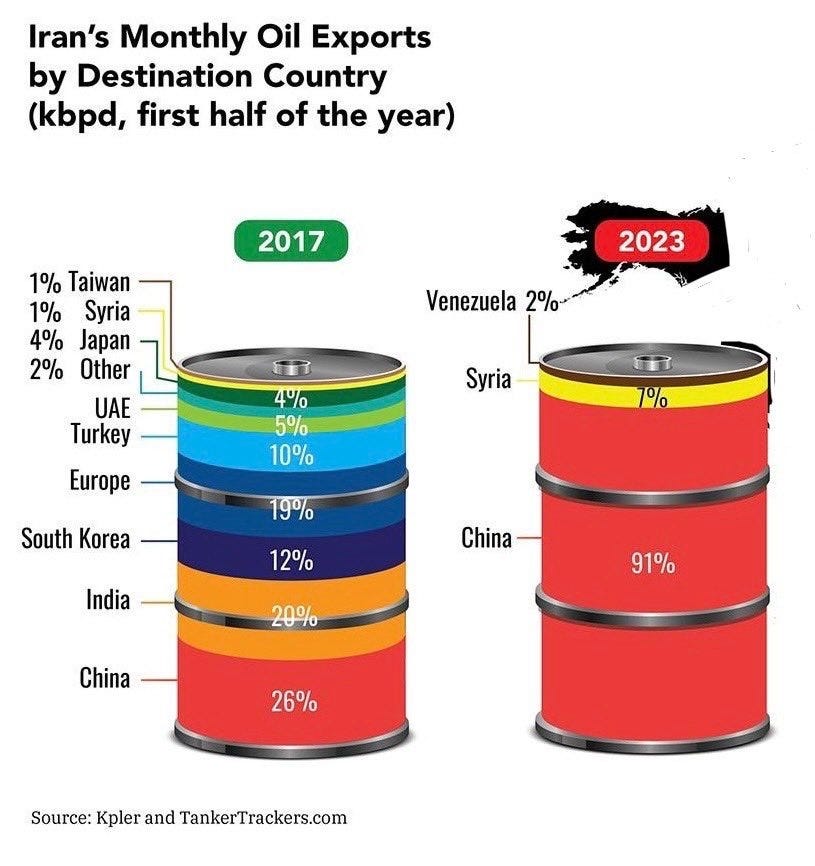

Don't take your eyes off the real ball, Asia. Despite reports of a Russian-Iranian military defense pact, the real final bell for WW3 will have to come from Asia. Outside of a radical escalation of conflict in the Baltics/Poland, the starting gun for WW3 is likely to be Taiwan, North Korea, or the South China Sea. Until such time as China decides that active conflict is a better way to meet their goals than passive grey zone conflict, they appear to benefit significantly from the escalation of conflict in the west. Iran is more dependent on their oil demand than ever before. With fewer and fewer buyers for Iranian crude, China is rapidly turning into a monopsony for their oil (dominant single buyer).

Meanwhile, Russia is rapidly becoming a vassal state, dependent on Chinese liquidity and manufacturing. This opens up a future where China may be able to negotiate (or simply seize without war) the northeastern land that was not only historically Asian, whisked away in an “Unequal Treaty” but also represents a significant extension of their ability to project economic and military power. A way to escape containment.

Meanwhile, the lack of replacement parts for 50-year-old US military aircraft tech has forced the Iranians to double down on drones and other autonomous airpower. They've gone to the point of scrapping their attempt at a fifth-gen stealth aircraft in order to put a robot in the cockpit and doubled down on unmanned drones and missiles as a way to counter western air power.

By striking Israel proper in their last back and forth, Iran also demonstrated that there are dividends to their investment in asymmetric warfare. Who needs stealth fighters if you can force Israel to burn $1bn to take out $200m in missiles and drones? This is kind of the definition of a negative-sum game, though one paid more so in dollars and military production than blood. Resources that their long-term ally, China. has in spades, along with essentially the same bleeding-edge capabilities possessed by the US military.

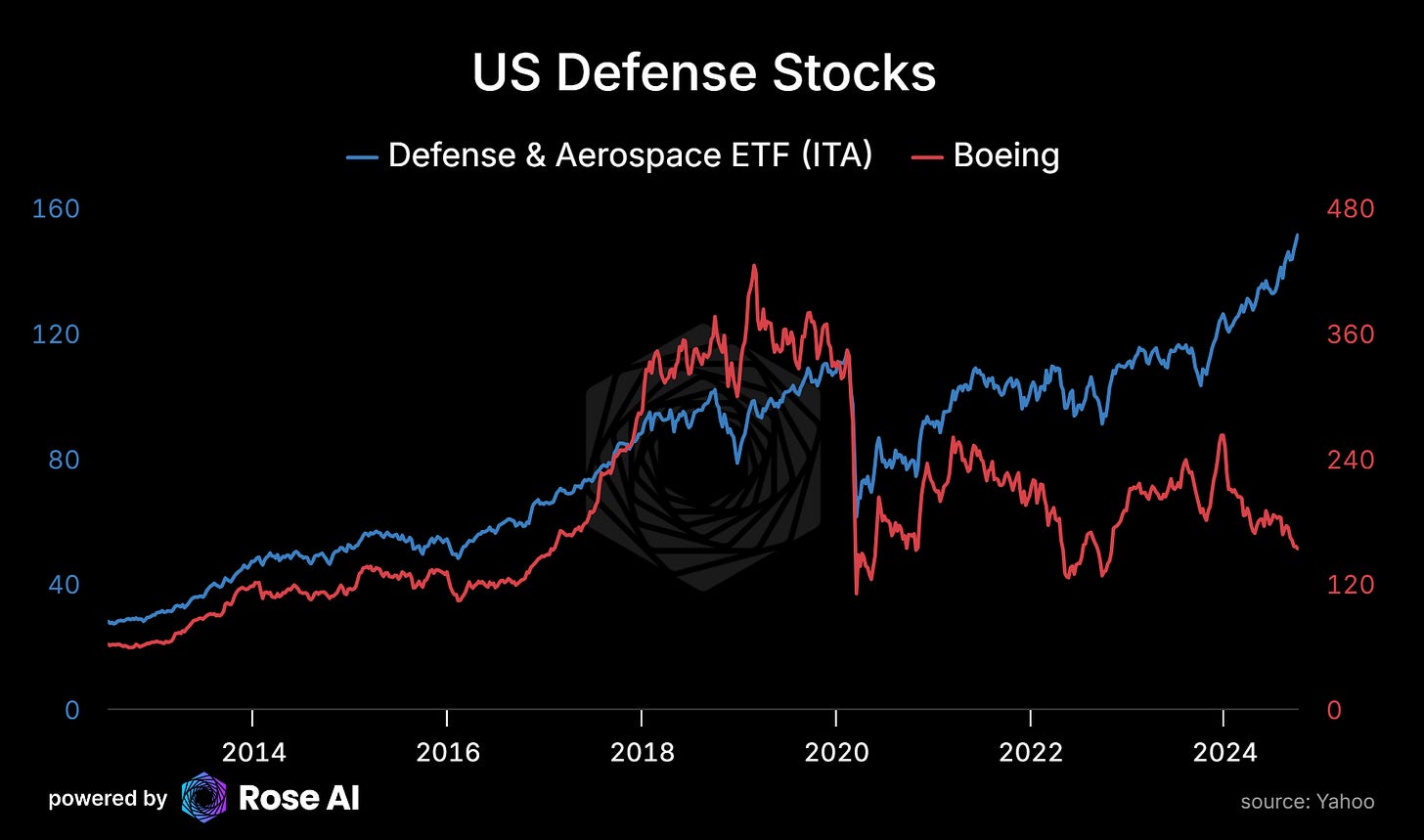

Our final, somewhat tragic investment implication is that this cycle appears to be accelerating and not slowing down. Without the UAE-Israel trade corridor project to create positive-sum linkages between Israel and her neighbors, all anyone can see are zero-sum conditions necessitating negative-sum conflict. As long as the US and China continue on their path towards great power conflict, there is nothing in place to slow this process of escalation down. This leads us to see a need for a 'hedge' for a world marching into military chaos: buying stock in the companies that make these new age weapons. Consistent with our goals of positive convexity negative exposure to chaos, we continue to hold a position in the US defense & aerospace ETF “ITA”, with a short position in Boeing. Boeing is an American institution and may not be going anywhere, but we may need to break it up or implement a clean sweep of management before it shines again.

In the meantime, there's SpaceX and Anduril stock, if you can get your hands on pre-IPO shares, or failing that, Palantir. These companies are perfectly positioned to benefit from not only an escalation in global conflict but also from the age of digitization of war.

Conclusion

Today we introduced the concept of positive, zero, and negative-sum games in the context of the conflict in the Middle East. We presented the simple idea that the current conflict between Israel and Iran appears to be transitioning from a zero-sum, tit-for-tat dynamic to one where each side's core capabilities are directly attacked. This threatens to unleash a set of negative-sum games capable of turning the region into chaos, and with it, global energy supply chains. Until there appears to be some regulator, buffer, or outside influence oriented towards de-escalation, we remain long gold, silver & defense stocks, paired with short positions in US Bonds and Boeing.

Till next time.

Disclaimers

Hey Alexander. Thanks for this awesome article, i enjoyed the game theory bit especially. Re your conclusion - Ben Hunt wrote a good piece saying that the US is on the sidelines for this, so i would weight the probability of 'a regulator/buffer oriented towards de-escalation' at a low level.

I wanted to ask about your(/Robert Wright's) thinking that science, technology, culture has taken us more towards positive sum. I think one could argue that it is almost entirely the result of fossil fuels. A barrel of oil contains 5 man years of work, so today's 100mmbpd of oil consumption (that's just oil!) unlocks 500m man years of work 'for free'. Humanity can afford to be much less selfish as a result - it's the oil that does the work. Could you argue that things remain reasonably zero sum, it's just that the negatives (oil reserve depletion) are hidden? Arguably it is 'the future' who are having their positives taken away from them? Interested in your thoughts :)

Amazing article!

Will share. Personally long platinum, palladium, silver, a bunch of defense stocks (not BA, but not short) and I am short bonds so we are similarly positioned in that regard. Own physical gold, but not trading it long paper.