The Silver Attack

Going Paid

For the past three years I’ve been writing about macro, geopolitics, and markets while working two jobs (more on that later). I’ve given everything away for free. That changes today.

The free posts will continue. The philosophy, the geopolitical essays, the longer-form pieces on US-China competition. That’s not going anywhere. We’ll never stop rambling.

What I’ve noticed as this blog’s audience grew is that more and more people came looking for advice on markets. Tactical takes. This is something I love to do, but it takes time, so that’s what’s going behind the paywall: trade ideas, portfolio frameworks, and market memos. How I think about positioning, risk, and when to get out — not just when to get in.

What paid subscribers get:

Subscriber-only posts and full archive

Trade ideas and market analysis

Community access

What founding members get:

Everything above

Quarterly markets call

More responsive Q&A

Early notification of fund launches

Pricing: $50/month or $500/year. Founding memberships at $750/year.

This post is free. It’s a sample of what the paid content looks like. When I have the trade, you’ll get it behind the wall. In the meantime, there’s so much noise here, and so much fog of war, I’m out of this market from a long / short perspective, and will leave my comex backwardation trade (which has some short delta) against what’s left of my up and out call spreads (which have some long delta remaining).

Going Hunting

Over the past 24 hours, news hit the tape about a speculator out of China, based in Gibraltar, who accumulated a massive short in SHFE silver futures. The market dropped 17% in an hour while New York slept.

Initially I discounted this. Oh, another rant about paper versus physical. People licking their wounds. I don’t want to sound like those people.

So I went hunting.

Start with the intraday chart. Pull up SAI1 (Shanghai silver) and SI1 (COMEX silver) on the same panel, normalized. Then zoom in on the move.

SHFE underperformed COMEX by 6% during the crash.

That tells you two things:

The selling came from China.

The seller wasn’t hedging physical or closing an arb.

Now, looking at the normalize price (which is a better way to look than trying to line up price series with materially different closing periods in a market that is moving 10-20% a day, you might think the moves are just western players closing the arb. Capturing the premium by going long COMEX, short SHFE. If anything, the arb still looked tasty last night, so why not?

Well, remember, if you’re selling to get the highest price, you don’t destroy the market. It’s not in your interest. If you’re trying to hedge physical or take the other side of a US long, you want a high price for your silver. So why sell in a way that crushes the premium you’re trying to capture?

You wouldn’t. Unless you’re not hedging. Unless you’re attacking.

The Math

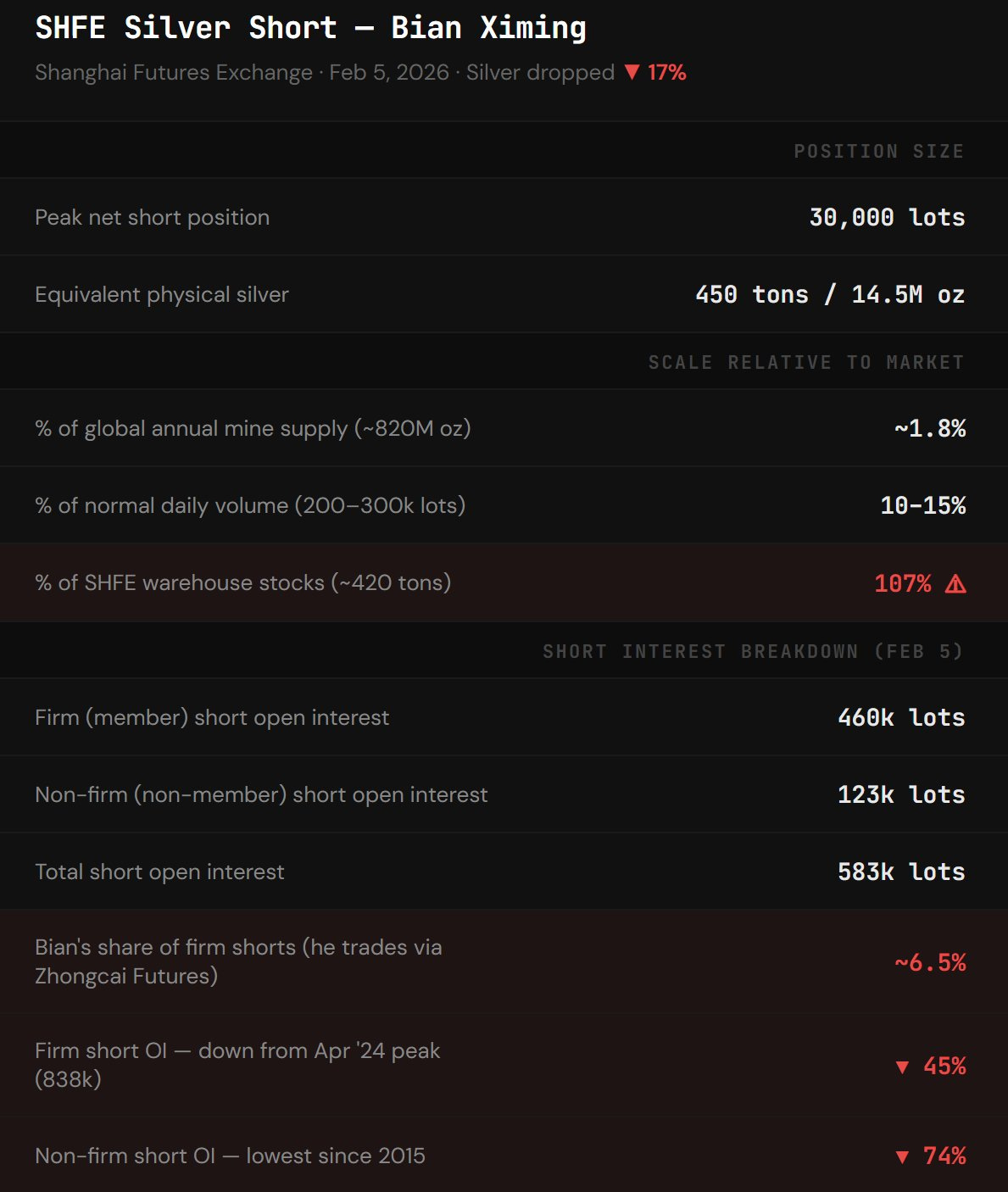

The trader is Bian Ximing.

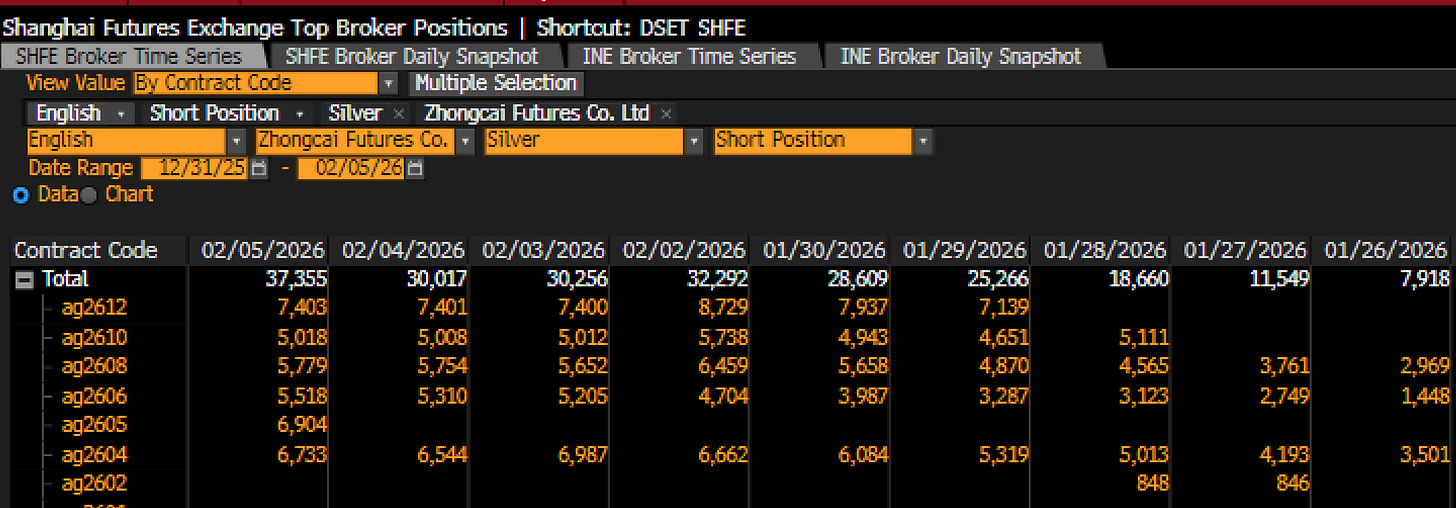

He trades through Zhongcai Futures.

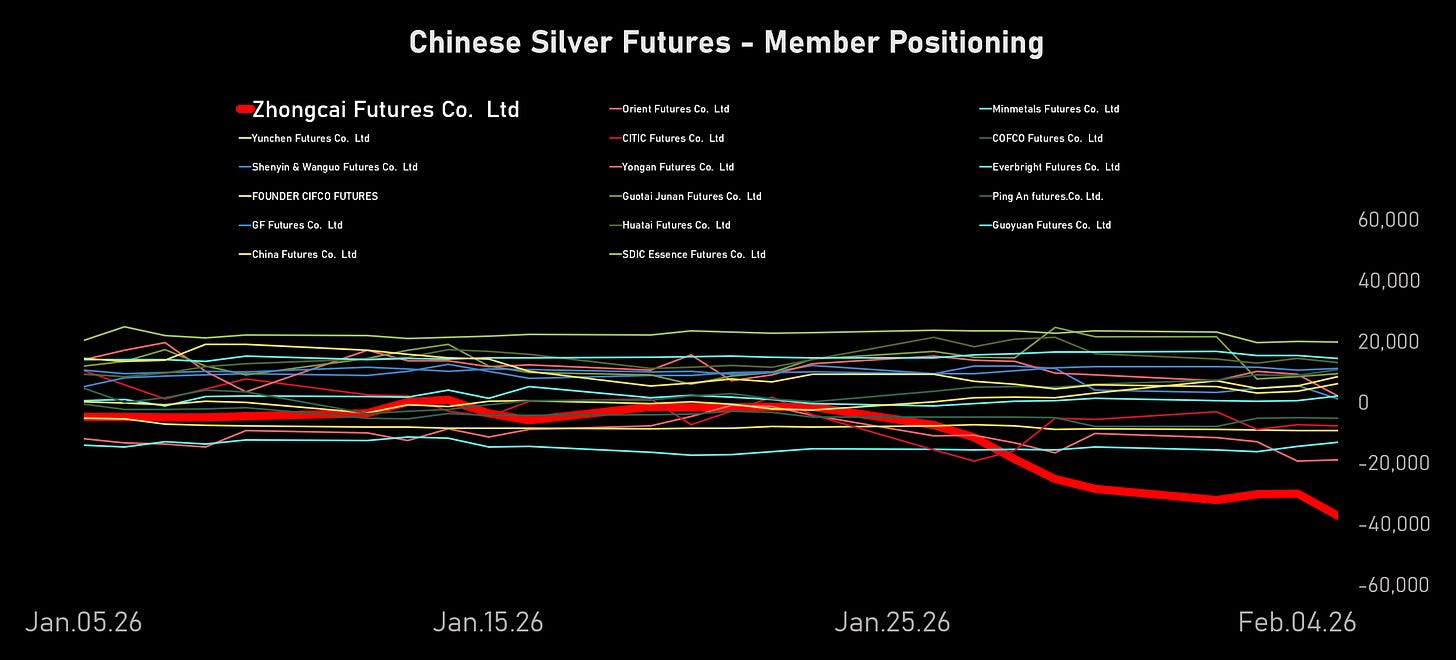

According to Bloomberg data, his net short position peaked around 30,000 lots going into last week. The biggest short in the Chinese market.

That sounds abstract. Let’s make it concrete.

30,000 lots = 450 metric tons = 14.5 million troy ounces.

That’s 1.8% of global annual mine supply. In one position. On one exchange.

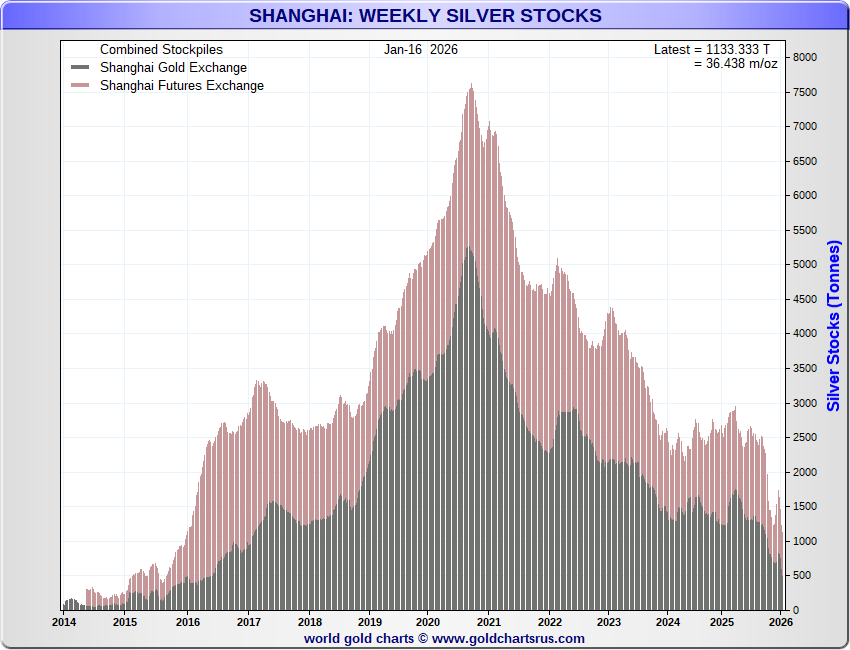

But here’s the number that matters: SHFE warehouse stocks sit around 420 tons.

He is short more silver than physically exists on the exchange.

And those warehouse stocks aren’t static. Combined Shanghai silver stockpiles have fallen 85% since 2021, from 7,500 tons to 1,133. The pool he needs to deliver from is draining.

The Trap

On February 5th, the SHFE restricted his account, along with five others. One month ban on opening new positions.

Sounds like a slap on the wrist. It’s not.

In futures, if you’re short and want to avoid delivery, you roll. Buy back your near-month contract, sell the next one out. But rolling requires opening a new short position in the deferred month.

Which he now cannot do.

His options: cover (buy back), or deliver physical silver at expiry. But his position is 107% of warehouse stocks. The silver to deliver doesn’t exist.

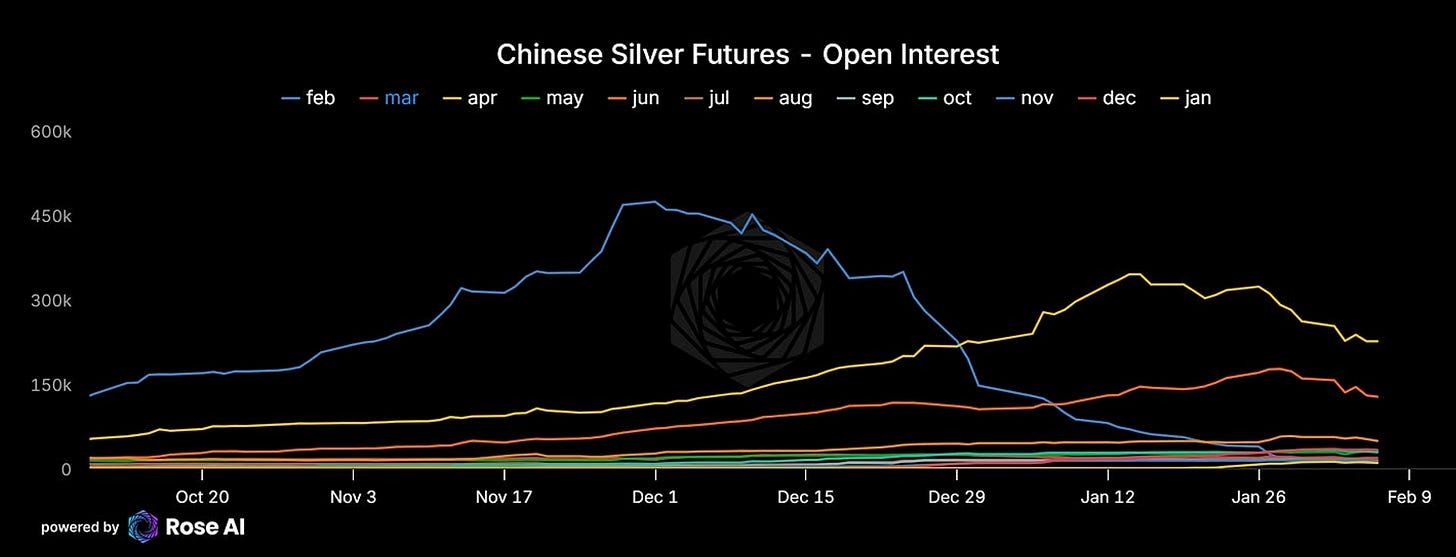

Look at where the open interest sits. April has 225,000 lots. June has 130,000. Those two months are 61% of the entire market.

If he’s in April — and that’s the most liquid contract, so he probably is — he’s got weeks, not months.

He can’t add. He can’t roll. He can only buy. Though he was smart enough to only go short April out, meaning he won’t be asked to deliver any silver over the time period where he is restricted.

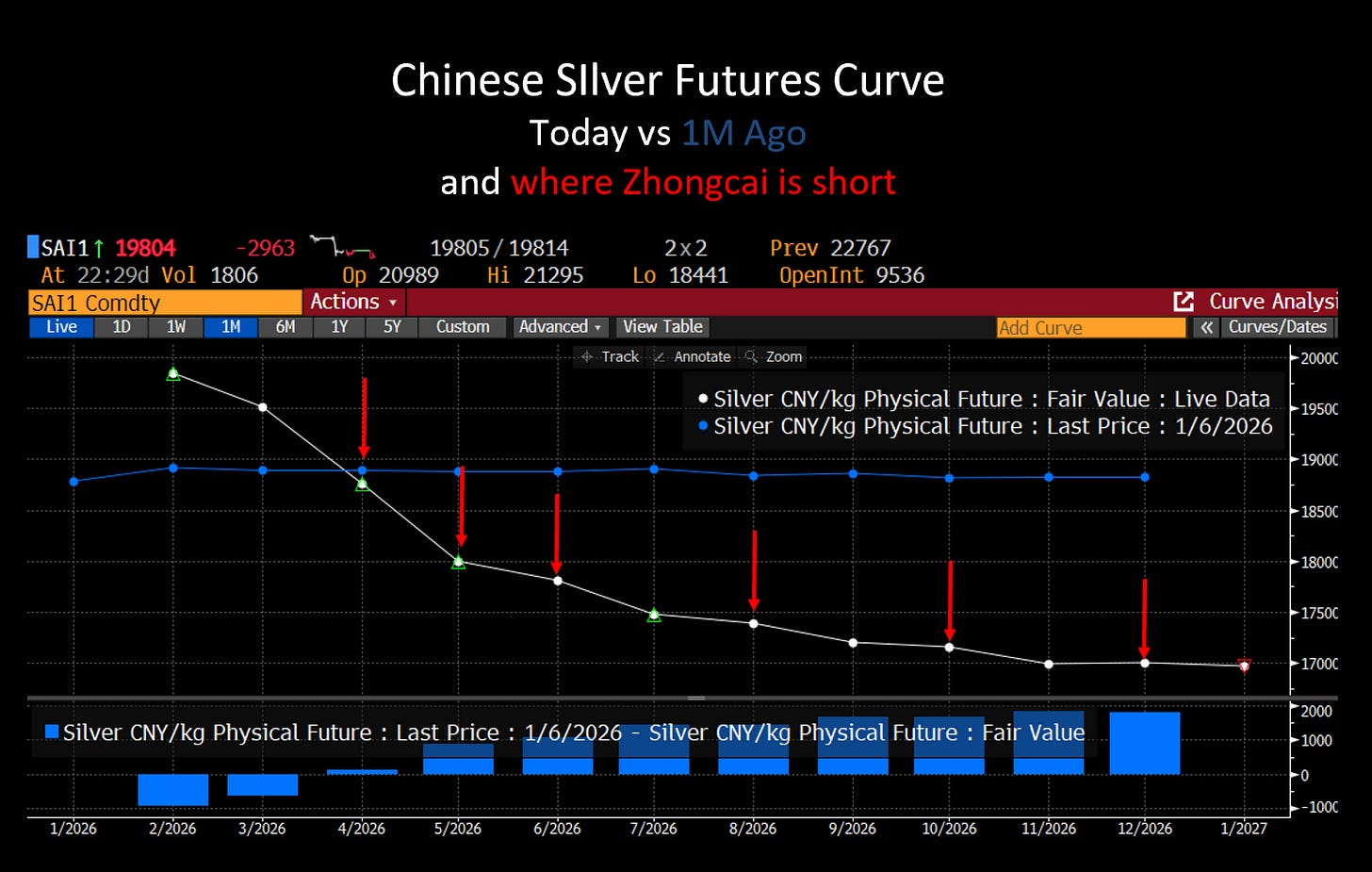

The Curve

Pull up the SHFE silver curve.

Front month: 21,124 CNY/kg. Back month (January 2027): 17,598.

That’s 17% backwardation. The market is paying a massive premium for silver now versus later. That only happens when physical supply is tight.

He’s short the middle of the curve — and in doing so sent it into backwardation. Shorts bleed on every roll. Except he can’t even roll. He may not be outright short, he may be arbing COMEX-SHFE, which would mean his shorts in China are offset by longs in COMEX, but even so, he’s short margin in both places.

The paper market says silver is crashing. The curve says there’s a shortage. One of them is wrong.

The Short Capitulation

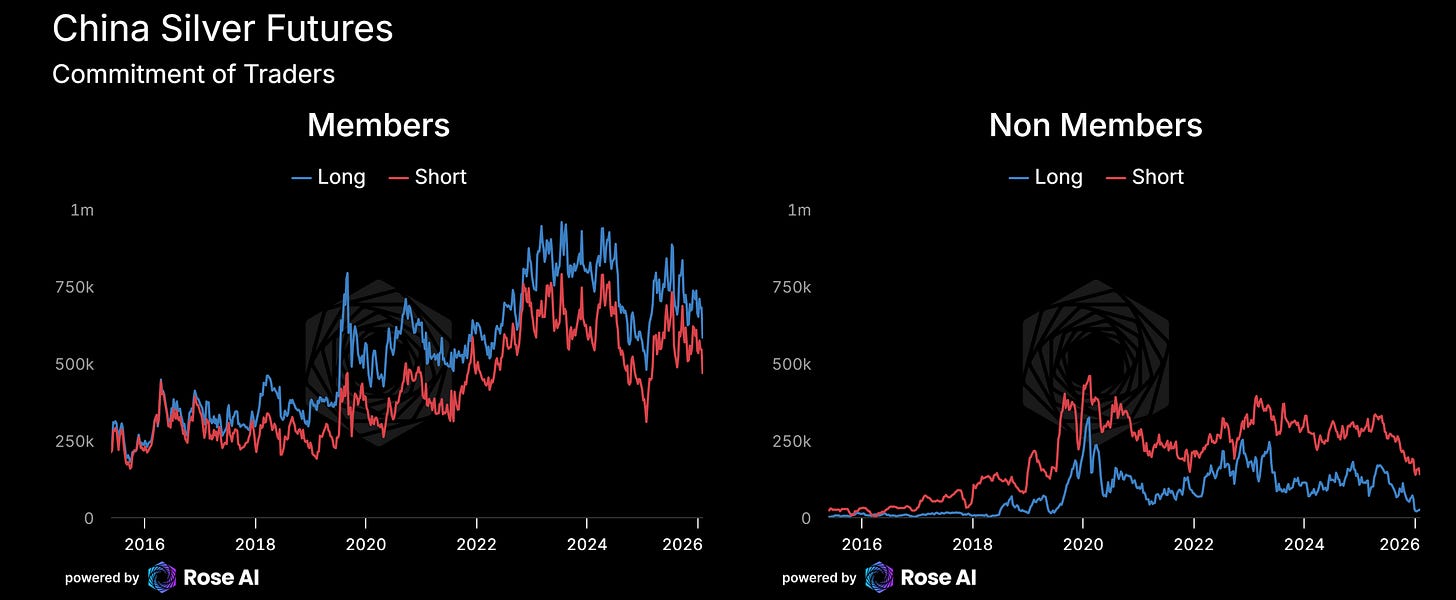

Here’s what caught my attention when I pulled the positioning data.

Firm (member) shorts: down 45% from the April 2024 peak. Non-firm (retail) shorts: lowest level since 2015. Down 74%.

The entire short side of SHFE silver is gone. Everyone covered. Everyone except Bian.

His 30,000 lots now represent 6.5% of all firm shorts. That percentage grows every day as the denominator shrinks.

Every short that still exists is a future buyer. And the biggest one just got locked in a cage. My bet is he lays low for the next couple of days, and then starts buying back now that the chart looks terrible.

What I Don’t Know

I’ll be honest. I can’t fully explain February 5th.

Volume hit 1.3 million contracts. But when I pull the broker data, I can only find 30–40k lots of long liquidation across the major Chinese firms. The major longs weren’t puking like I thought they were.

The major shorts were actually covering — buying, not adding.

Which leaves two options:

Non-members going short (which I guess could be western banks closing the arb)

Folks successfully attacking the market and then getting out before the close of business (entirely possible.

Most of the shorts look to have built their position going INTO the sell off, like Guotai.

When the things you don't know start growing faster than the things you do, in an increasingly volatile market, it's time to let discretion be the better part of valor.

Why I’m Flat

The near-term and medium-term are pointing opposite directions.

Near-term: risk-off is still running. Correlations going to one. Silver sold off again after the US close tonight (but before Shanghai opened) mostly because stocks sold off (unless the bears are just getting creative).

Crypto is getting destroyed.

SHFE longs — 600,000 to 700,000 contracts of them — haven’t fully capitulated. I can’t identify who’s selling or when they stop.

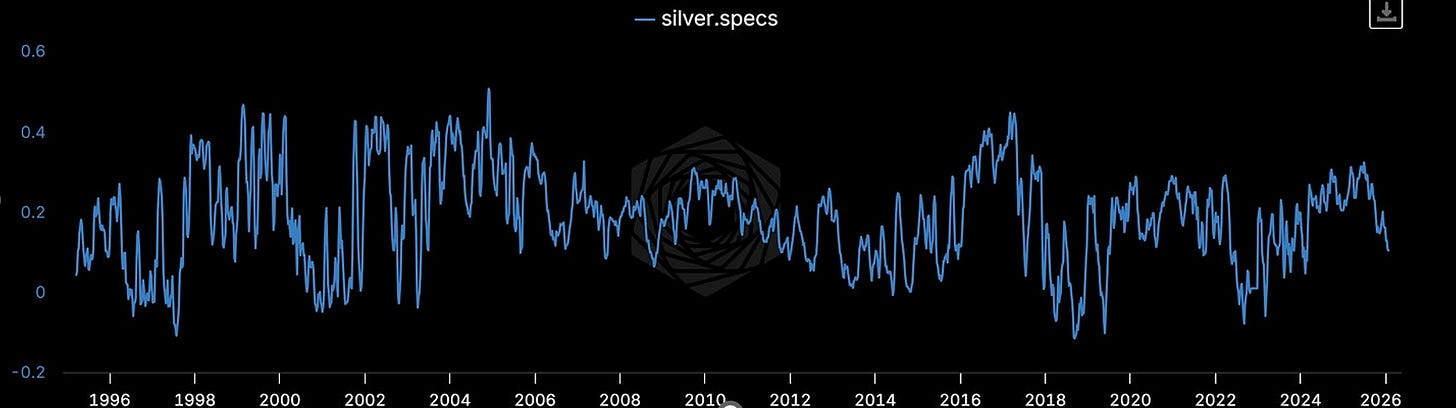

Medium-term: the biggest short is trapped and can only buy. Short base at decade lows. 17% backwardation. Position exceeds warehouse stocks. April expiry is a hard deadline and western spec data (though lagged) doesn’t imply extended positioning.

Going short here means picking up pennies in front of a steamroller. The steamroller is parked, but it’s still a steamroller. Bian has to buy 30,000 lots eventually.

Going long here means catching a knife during a liquidation I can’t see the bottom of. We said the weak hands would get flushed, we just didn’t go short fast enough. Now the chart looks like death.

So I sit. The setup isn’t going anywhere. He can’t escape. When risk-off clears, the asymmetry is obvious. If there was a time to go short, it was before yesterday’s attack. If there’s a time to go long, it’s when stocks find a floor and when they start buying back their short.

No crying in the casino.

What to Watch

Zhongcai Futures positioning in the daily SHFE data — that’s him

SHFE warehouse stocks — currently ~420 tons, watch for draws

April contract open interest as expiry approaches

SHFE-COMEX premium — currently ~14%, normal is 0–5%

Risk-off indicators — VIX, crypto, cross-asset correlations

When the flush ends, I’ll be writing about it. That one will be behind the wall.

This is what paid content looks like. Subscribe at $50/month or $500/year. Founding memberships at $750/year.

By the way, I noticed the silver premium in Shui Bei — China’s main wholesale jewelry and precious metals market in Shenzhen — has come down today. People there also mentioned that even when silver prices were higher, there was never really a shortage of physical supply. Does this kind of spot market signal add weight to the demand-side pressures we’ve been discussing?

I really enjoy the way you write — clear, engaging, and with a strong narrative flow, as always. Looking at the chart, it seems both longs and shorts have come down — shorts are lower than before but not quite at the absolute lows. Isn't that more a case of positioning shrinking rather than disappearing? I’d be curious to hear your view on that.

On the fundamentals side, one thing I’m watching is that starting April 1st the export tax rebate for solar panels will be cancelled. That drove a rush of exports earlier, but going forward it could reduce silver demand. In Q2 there’s also the trend of copper substitution for silver in certain applications, which might weigh on demand further. How do you see these factors interacting with the positioning story you’ve highlighted?

Do you think Bian’s confidence in holding such a large short position could be related to having access to industrial demand information? And how do you view firms like StoneX, which probably have better visibility into physical demand from factories — are their incentives similar to those of banks?