The Downside of the Yale Endowment Model - part 1

aka "What happens when you are 70% long illiquid beta and the fed tightens."

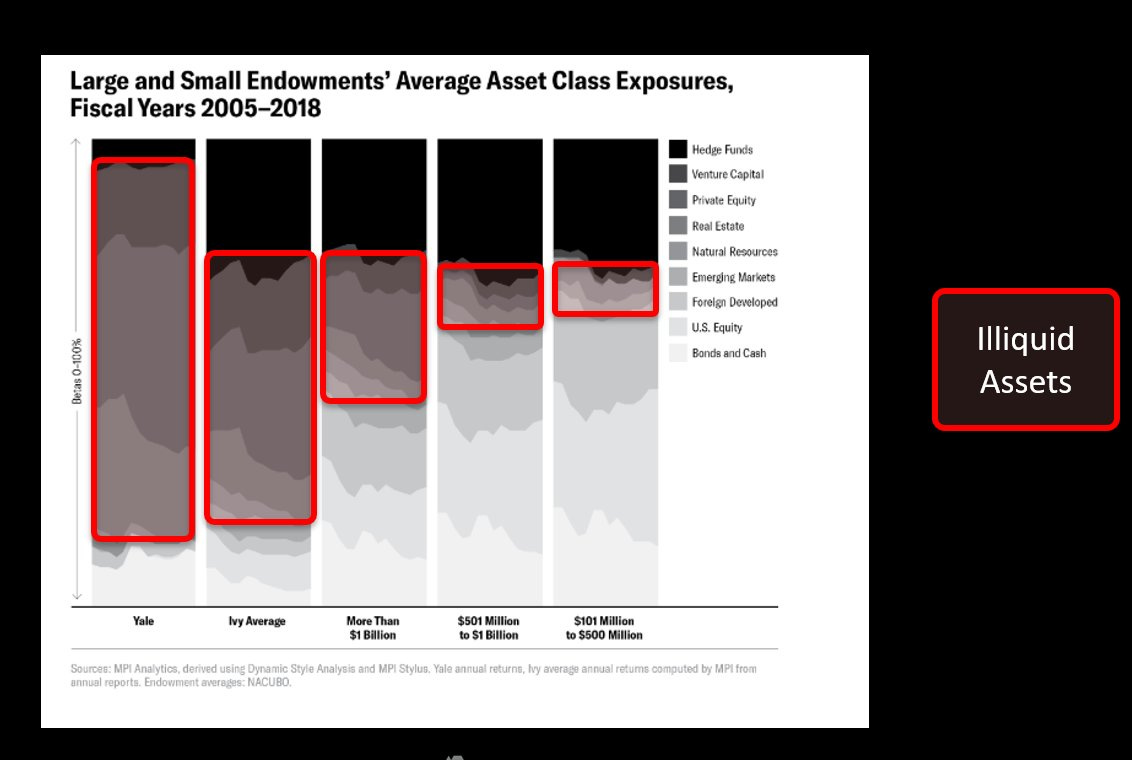

As far as we can see, the downside of the Dale Swensen's Yale endowment portfolio model is it's overweight illiquid, long duration assets like PE/VC.

What's the impact of 300bps of tightening on a portfolio with 30yr duration?

What happens to 'dry powder' when LPs can't make capital calls?

$540bn of dry powder according to WSJ. But a lot of that capital still needs to be called.

Asset / Liability management is important, but mark to market losses get realized today if liquidity for financial players comes under stress.

So what happens to those long duration portfolios when when dollar strength forces EM central banks to sell reserves (aka liquidate treasuries) and that drives up US interest rates further?

Right on cue..

Disclaimers