The Dollar Squeeze Heads to China

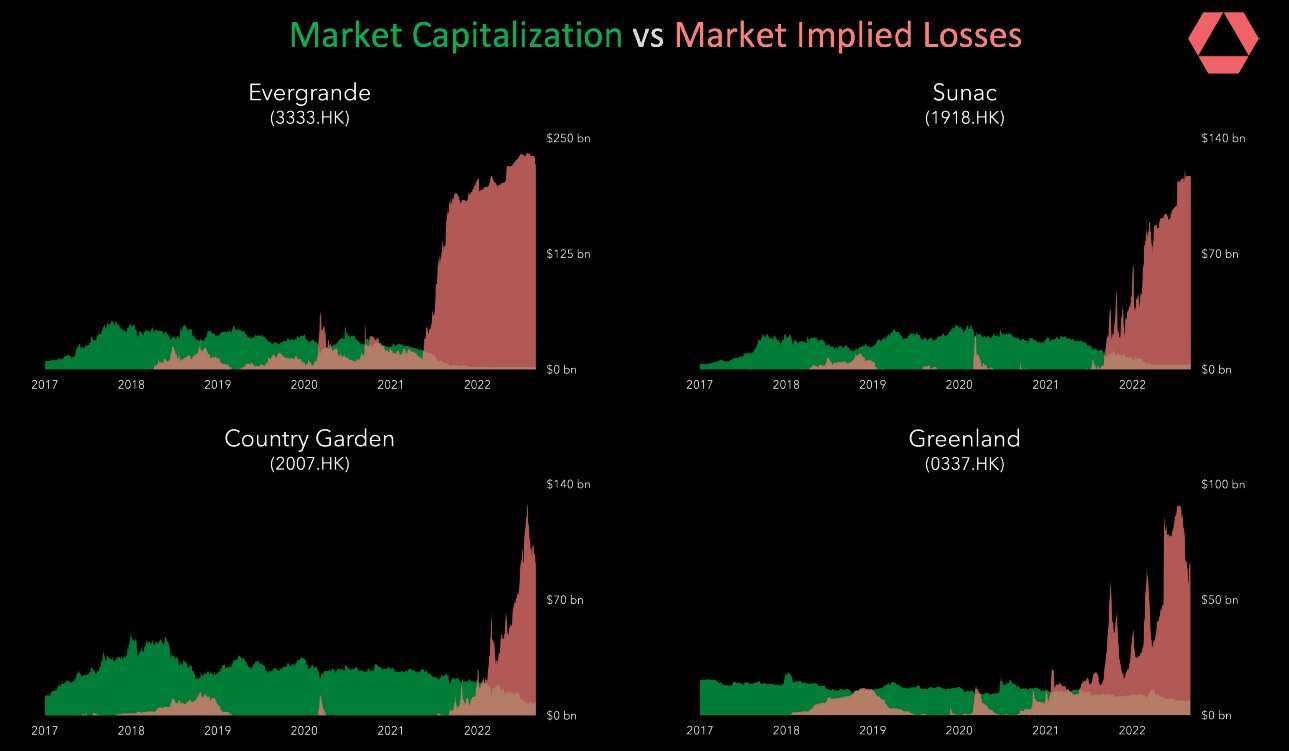

Last year, we told you Evergrande was dead.

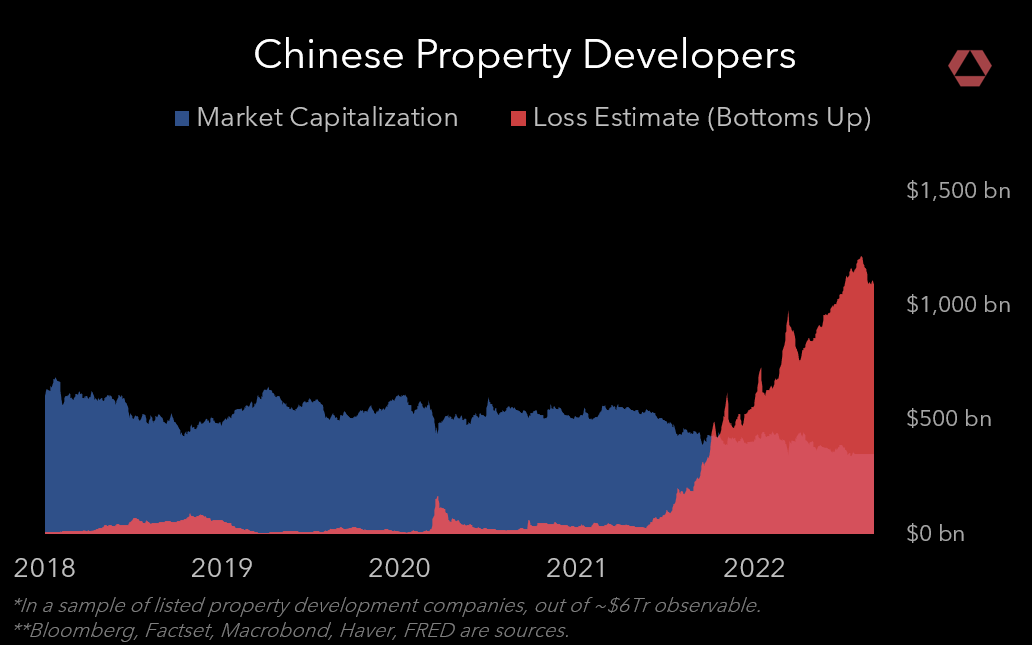

A year later, the entire Chinese property sector is on the ropes, with bonds now pricing in $1Tr+ of losses against <$500bn of mkt cap.

Here’s why this matters and why this is bullish for dollars and gold.

We can say the sector is dead by looking at the bond market.

Currently, around half of the sector is trading at distressed levels.

Our system-level estimate comes from aggregating losses from individual property companies.

In the link, you can see our estimates for all the companies in our sample.

Pages and pages. Of property companies currently dead on arrival.

The weakness in credit for property companies led to the pain in their stocks.

~$500bn of market cap has evaporated in the past three years.

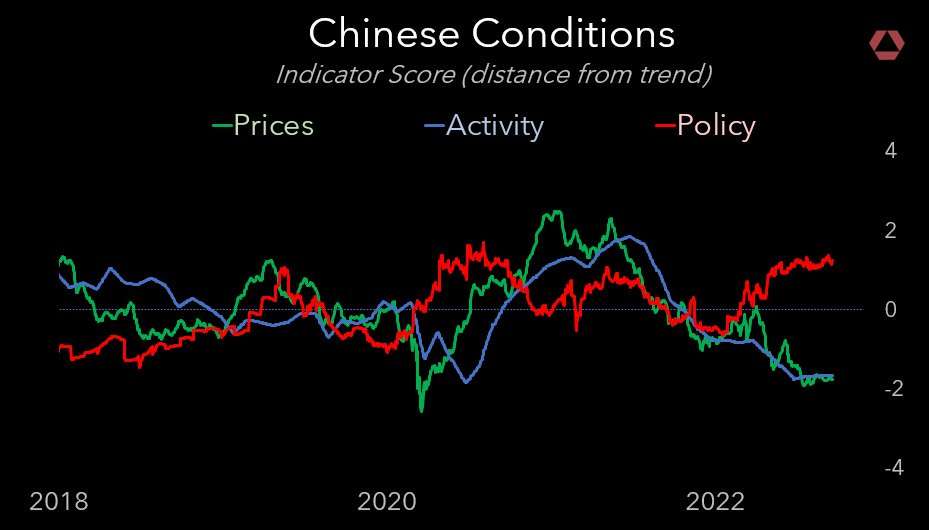

Importantly, the broader Chinese financial system remains relatively unscathed, outside of a smattering of smaller, regional banks.

This is due to two main reasons:

1. The pain is still primarily in the dollar bond market. Domestic credit markets are more sanguine.

2. The PBoC has begun an easing cycle.

Observable in our ‘Chinese policy conditions’ indicator, as bullish as it has been since the 2008.

Meanwhile, the Fed is hiking, putting upward pressure on the dollar relative to other currencies and gold.

This divergence in monetary conditions has recently led to weakness in the Chinese Yuan, though not as much as that seen by the Yen and the Euro.

“What happens next?”

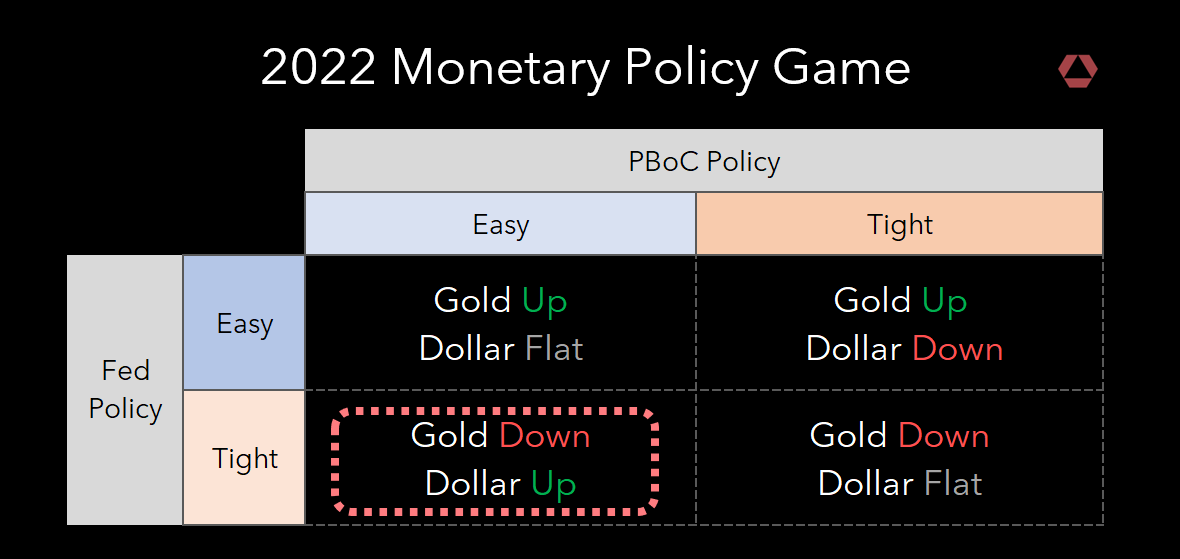

First, put yourself in the role of the Fed / PBoC.

With Chinese property imploding, the game below gets a lot simpler.

For the foreseeable future, the PBoC will print.

& as long as the Fed tightens...the weakness in the Yuan will continue.

There’s been a lot of talk in the past couple of years about the end of the dollar as the global reserve currency. The recent surge in the dollar has made these pronouncements look relative premature. At least for the time being, we live in a world of dollars.

As long as the Fed looks determined to crush inflation by tightening, we should expect continued dollar strength, and investors would be wise to ensure their portfolios are balanced to this pressure. Tightening will continue to put downward pressure on gold denominated in dollars, while gold denominated in foreign currencies looks much more positive.

If market action over the past weak is any guide, financial markets may be on the precipice of a widespread liquidity event. A shift in Fed policy would likely peak the dollar, while at the same time raising longer term inflation expectations, which will lead to a strong rebound in gold in dollar terms.

In the meantime, we recommend a portfolio of both of these assets, for those with the ability to construct it.

Disclaimers