The Death of Globalism

Conflict is Inflationary: Part 3

Thirty years ago, the Berlin Wall fell and the world was made safe for democracy. Or so we thought.

America – drunk on the fall of the Soviet Union – spent the next three decades distracted, arrogant, and preening. We had "won" the ideological battle; all that remained was sweeping up the occasional tinpot dictator and letting the market solve everything else.

"No two countries with McDonald's have ever gone to war," they said, as if the mere existence of global junk food supply chains could dispel centuries of historical, cultural, and religious differences.

And we believed them.

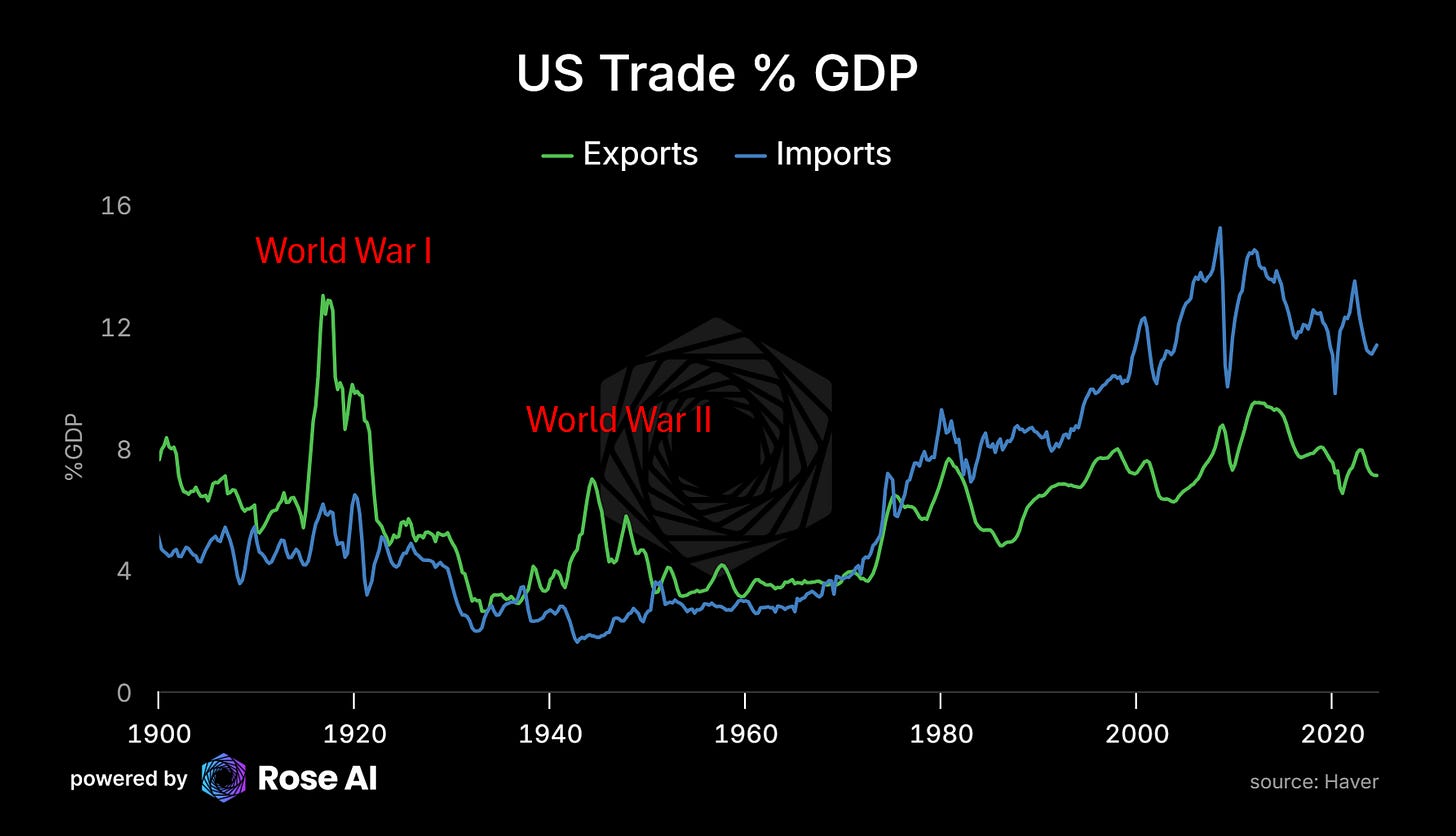

First, we opened our ports and markets to trade, and in the process hollowed out our ability to make the very things that comprised modern life.

Then we opened our institutions, handing them over to those who would use them against us, without first ensuring the foundations could survive the assault.

Finally, we opened our culture and minds, and in the process largely forgot much of what we had been fighting for.

All in the name of liberalism and its capitalist cousin: globalization.

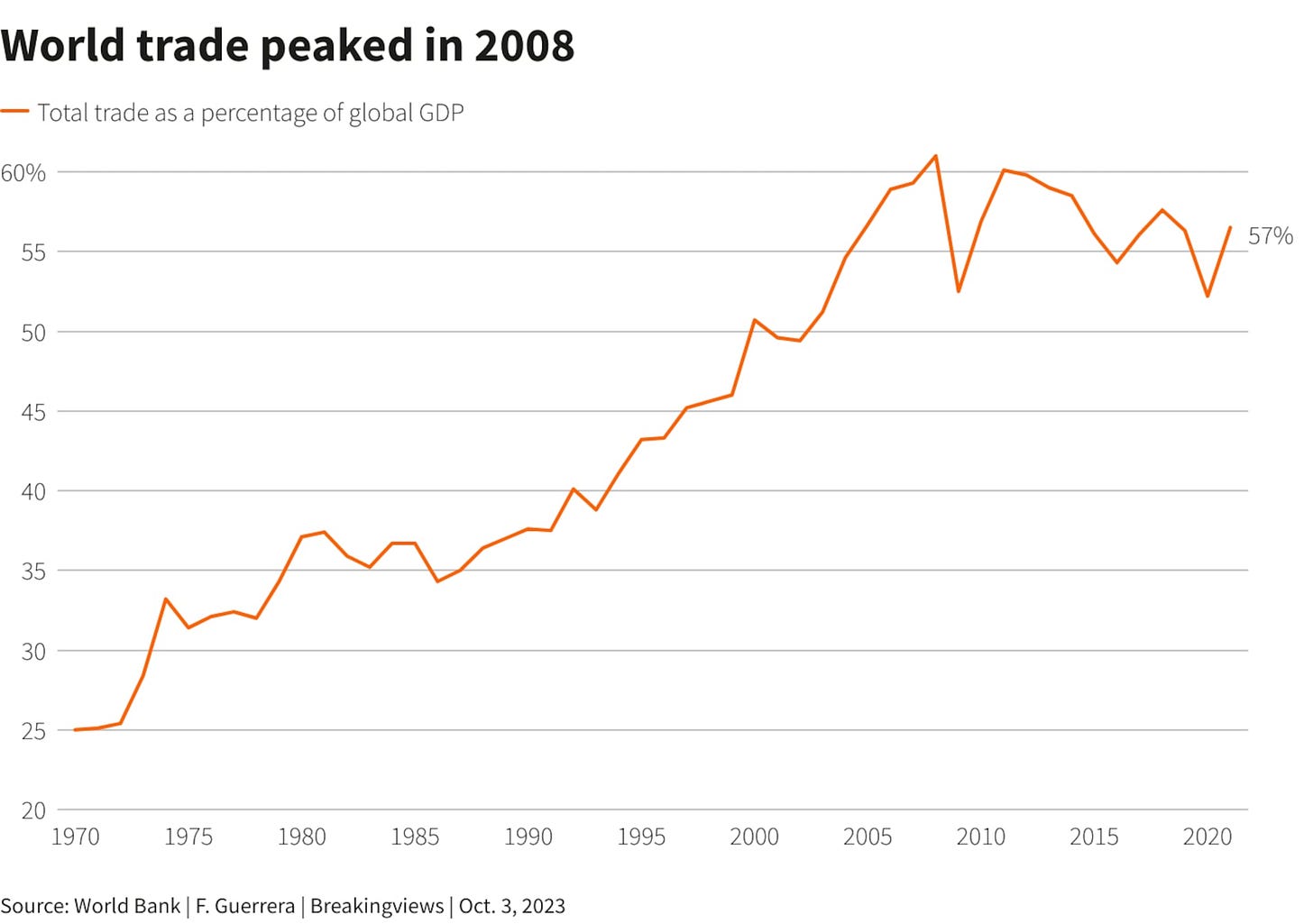

The Great Unraveling

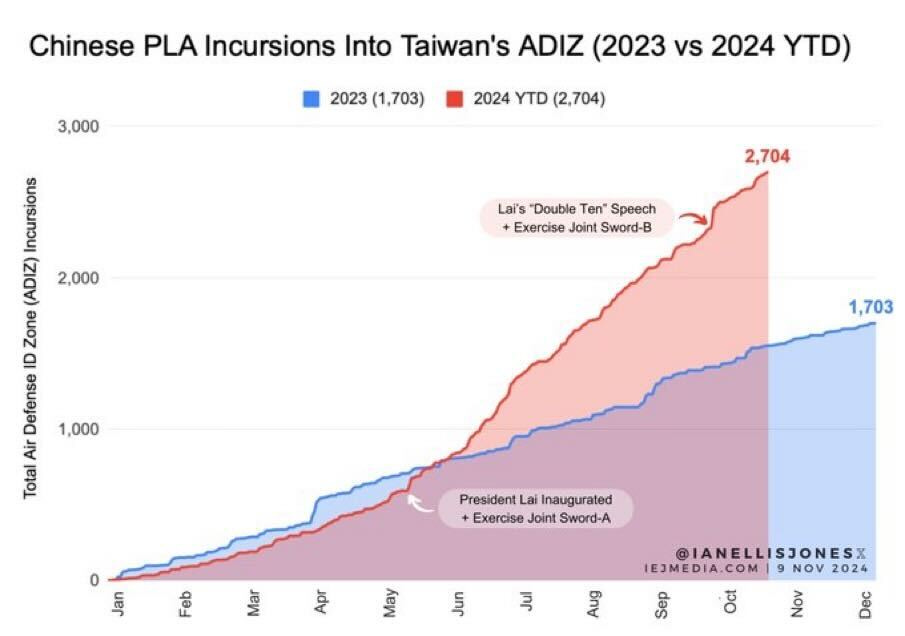

Today we find ourselves at another turning point: the death of globalism. The rise of nationalism, protectionism, and yes, militarism isn't just predictable – it's a rational response to a world designed to extract value from our liberal markets and institutions without sustaining them.

The return of "Great Power Politics" will inevitably lead to the balkanization of our markets and societies, and a somewhat needed 'fortification' of the homeland. To protect the global market, we may need to abandon it, for a time.

While "conflict is inflationary" and while tariffs, protectionism, and mercantilism feed this narrative, there are cross-cutting impacts that make the inflationary calculus much less clear.

“America First”…Again

The evidence of this transformation surrounds us. In the past 24 hours, Trump announced plans to use the U.S. military to deport millions of undocumented immigrants, while Canadian PM Trudeau announced a freeze on new immigration. Who would have thought Canada would pause immigration before California paused AI?

Meanwhile, across the Atlantic, European communities struggle to reconcile their liberal, cosmopolitan consensus with the integration challenges posed by millions of new members of society, many holding cultural and political perspectives deeply dissonant with the liberal West. This tension appears most starkly in the UK, where people face imprisonment for social media posts – "We need to kill liberalism to save it" if there ever was an example.

But I digress. We don’t raise these issues to even take a particular side, but rather to observe the broader trends at play and the consistent pressures facing most western liberal democracies. Increasingly existential competition from abroad, cultural and political dissonance within, and a global consensus that seems further and further in the rear view mirror.

This has by and large been our take since writing on the topic back in 2020 and continues to be our core view. Conflict is inflationary. We’re going to get more conflict, so sell bonds to buy gold. And yet…

The Markets React

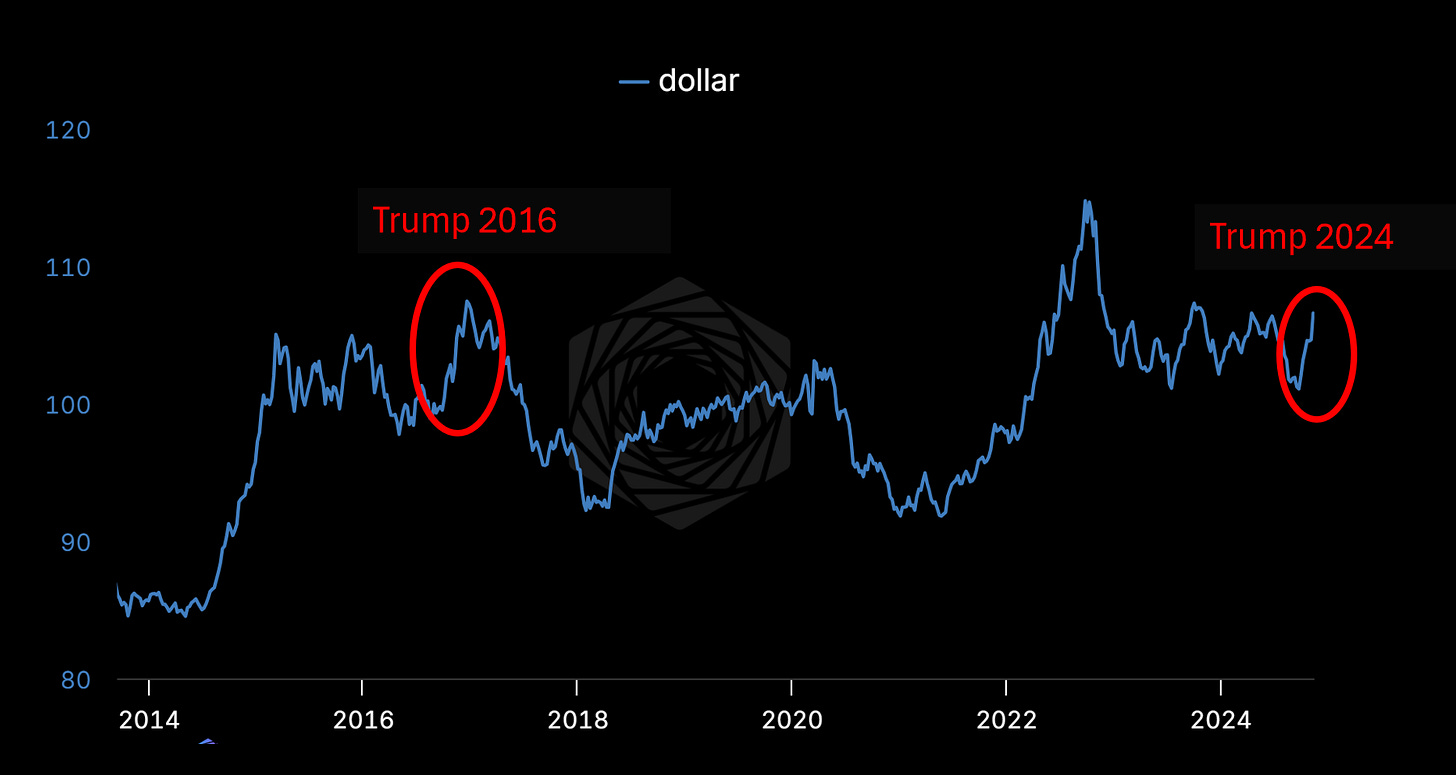

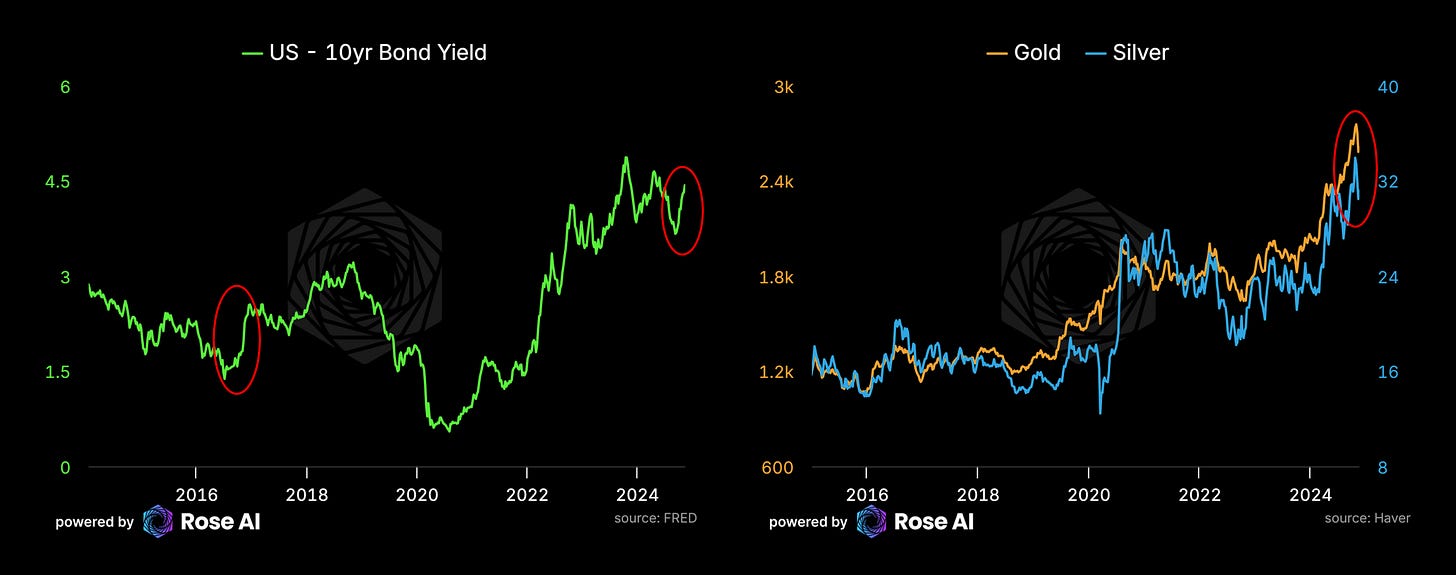

Two weeks after the U.S. election, the shape of things to come is slowly coming into focus. The strongest immediate move was the surge in the dollar, echoing what we saw in 2016 during Trump's first unexpected win. Also mirroring 2016, Trump's election has been followed by a material increase in bond yields – now 80 basis points higher than September's lows.

Amidst the strengthening dollar and rising yields, gold and silver have been smacked down. We live in a world of dollars, after all. When the dollar rallies and yields spike, the price of gold in dollars mechanistically falls. This is why we recommend holding gold AND dollars rather than gold IN dollars for your protection portfolio.

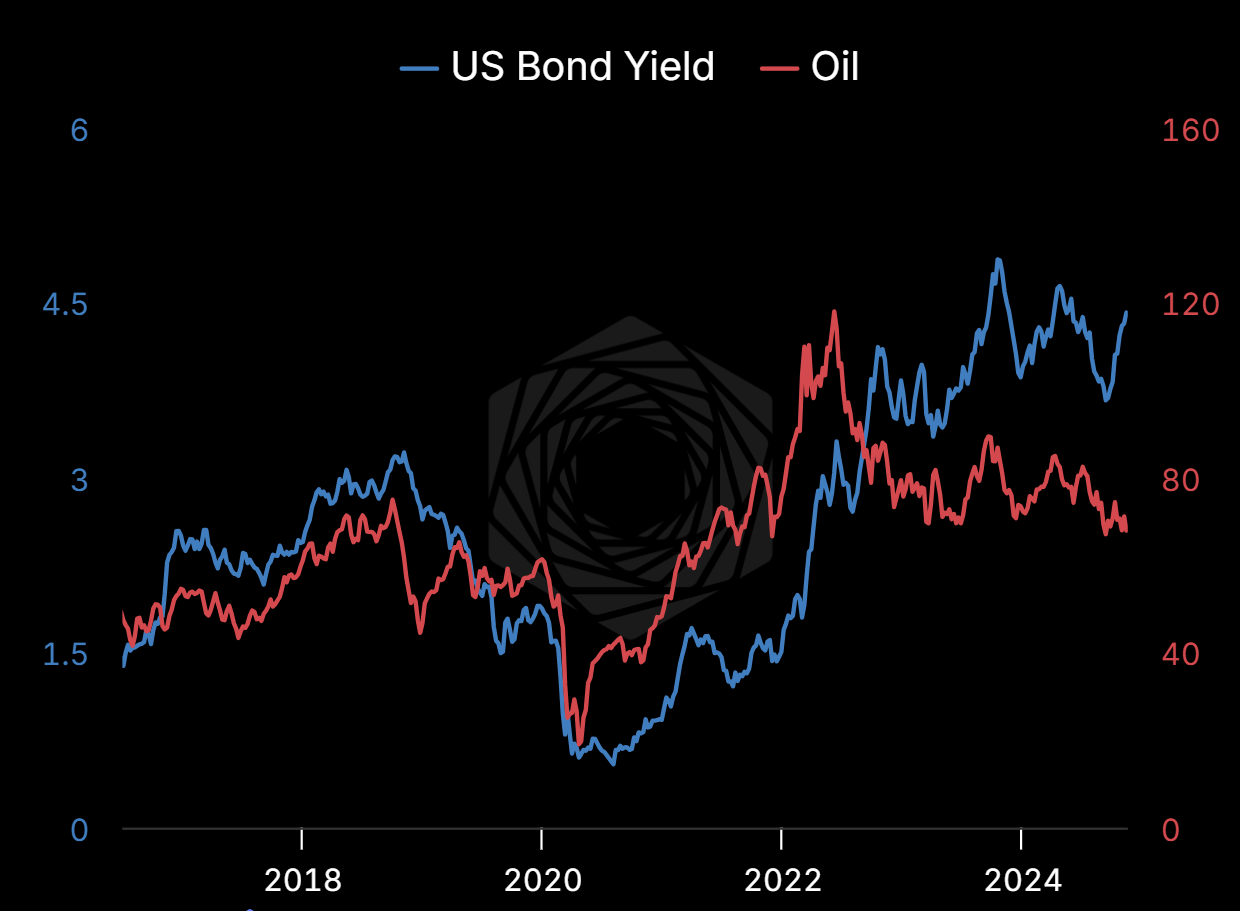

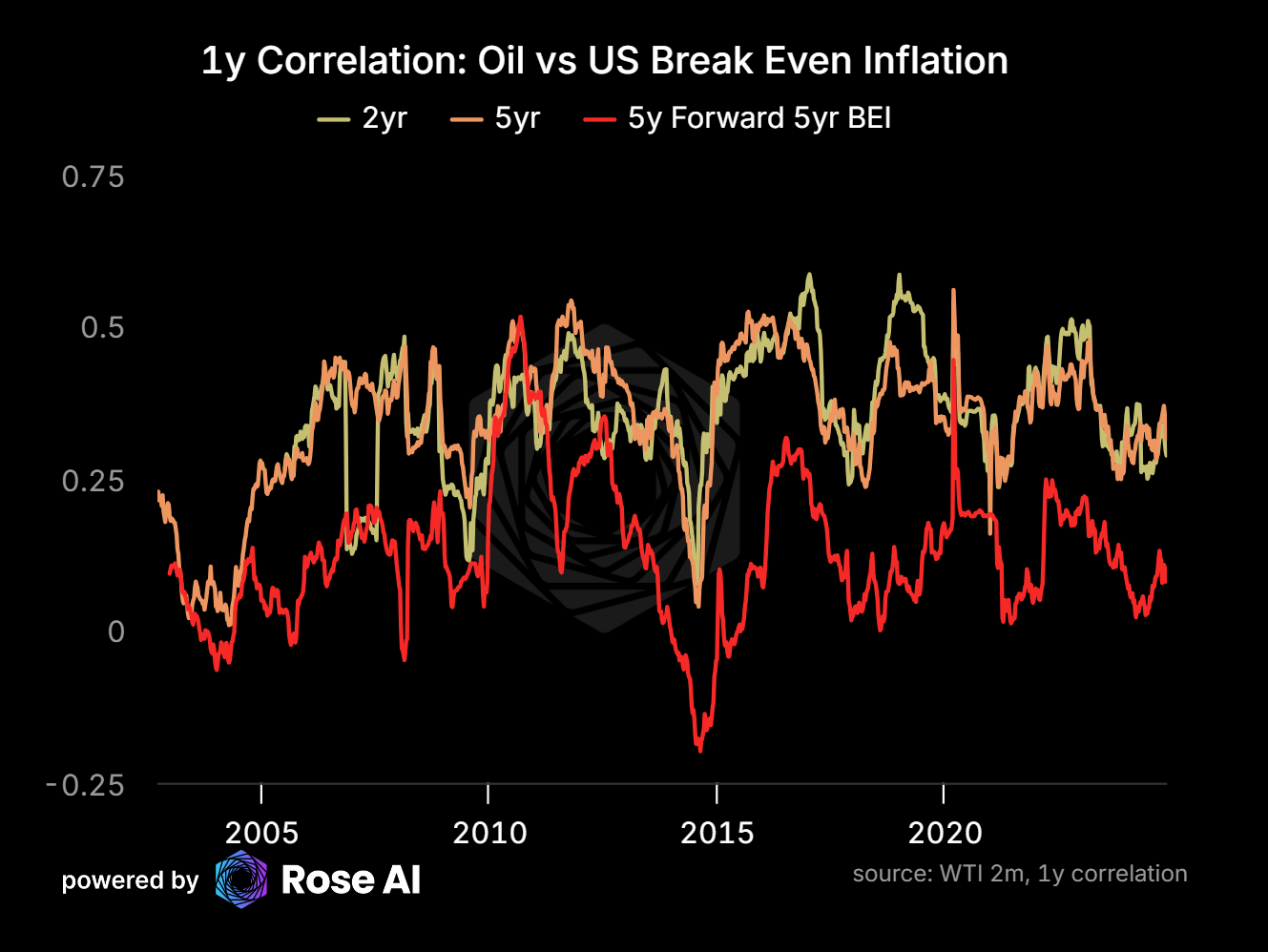

What's particularly interesting about this move in bonds is that it hasn't been met with a corresponding increase in energy prices, which typically move in sync. Usually, bonds and oil move in the same direction (remember: "inflation is about oil"), but today, that relationship has broken down.

Breaking Down the Bond Market

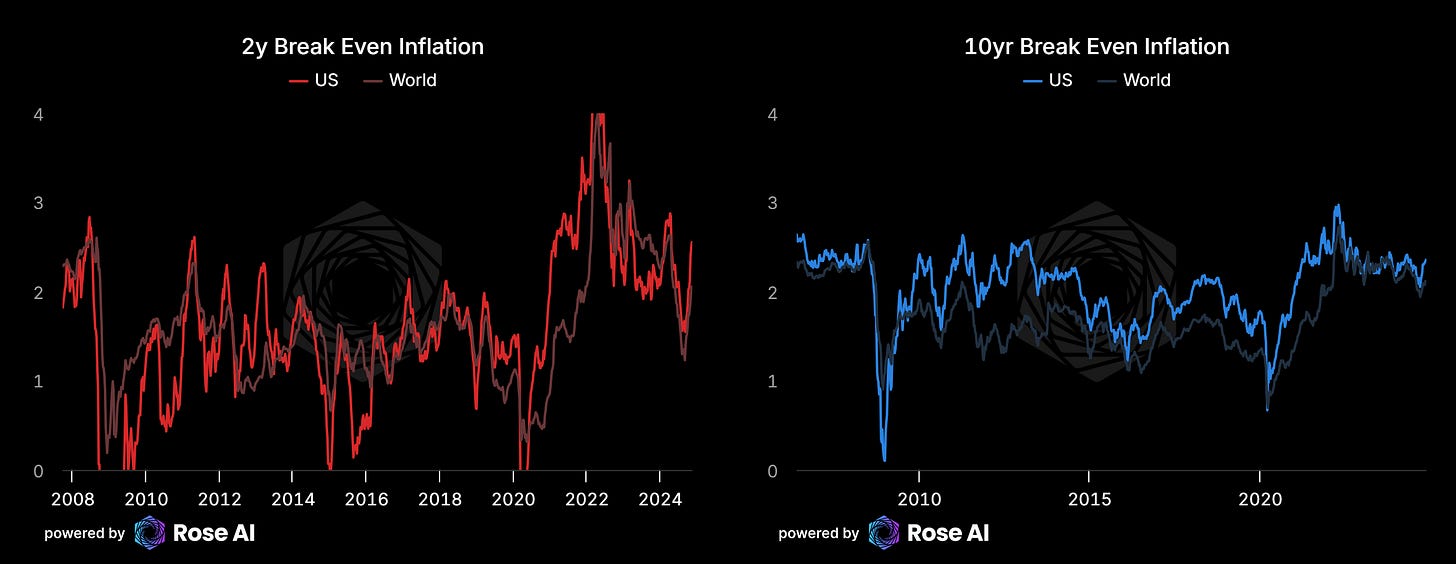

Specifically, in the wake of Trump's election, we've seen a quick rise in "breakeven inflation" – finance-speak for the market's inflation expectations stripped from bond yields. Short-term inflation expectations were falling dramatically right up to the election (and with them, bond yields), but this trend rapidly unwound as markets began pricing in not just Trump in the White House but a potential Republican sweep.

As a reminder, oil and bond yields (particularly the inflation component) tend to move strongly together, so this is divergence is actually something to note.

So how can bonds sell off at the same time as oil?

Think about who holds all those bonds and their relative attractiveness as a store of wealth in an era with a unified American government prone to tax cuts, tariffs, and a bombastic figure on the Throne of Westeros liable to stop paying you interest if he doesn’t like the cut of your jib.

It makes sense that foreigners might sell bonds – we saw it in 2016, why not again?

The Deficit Question

Then consider the deficit dynamics. If the U.S. federal deficit is already running at 6%+ of GDP, what happens when taxes get cut?

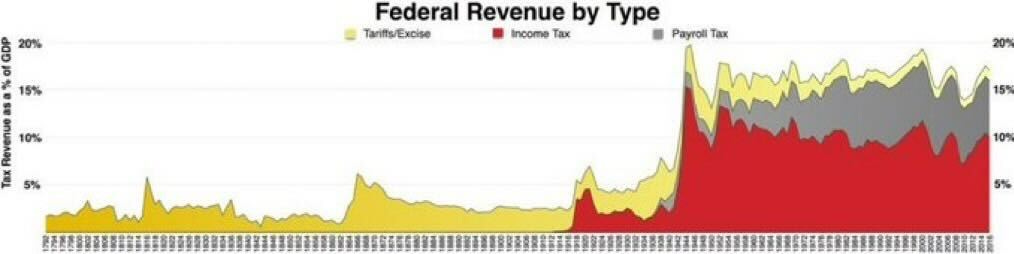

This is where tariffs enter the equation. Long ago, the vast majority of government revenue actually came from import taxes.

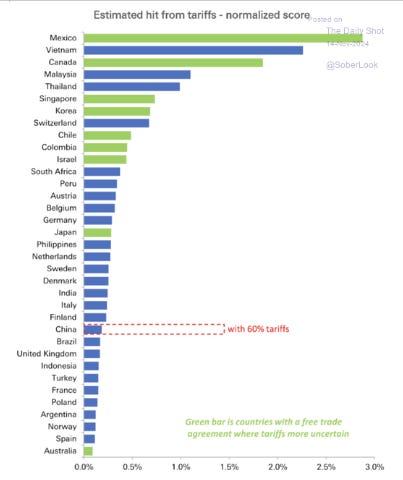

Tariffs are inherently inflationary for the importing country – foreign goods become more expensive, and in China's case, potentially dramatically so.

But remember: for countries exporting to the United States, tariffs are actually deflationary. They face reduced demand at lower prices – another headwind for a Chinese economy already struggling to find its way through a necessary deleveraging.

The Numbers Game

Looking at the specifics: With imports running at 11% of GDP and exports at 7%, tariffs could theoretically help close both the current account deficit (imports minus exports) and the budget deficit simultaneously. A 20% tariff on overall imports (~10% of GDP) and 60% on Chinese imports (~2% of GDP) would fill about half of the current deficit.

The Budget Reality Check

Which brings us to Elon and his pledge to drastically reduce not just the deficit, but overall spending. A close examination of the current budget quickly challenges this notion. Healthcare, pensions, education, and defense comprise roughly two-thirds of federal spending. This makes it nearly impossible to cut your way back to a balanced budget without... entitlement reform.

Surprisingly, such reform would actually be deeply deflationary – think of it as the inverse of what happened during COVID. What happens when those checks in the mail start getting smaller?

Add in the potentially deflationary impact of removing millions of people from urban cores, and it becomes clear that not everything on the horizon pushes inflation in the same direction.

The Immigration Equation

The immigration question serves as a fascinating microcosm of the debate currently raging in policy houses and investment firms. It's like a question on an undergraduate macroeconomics final: What happens to aggregate demand and aggregate supply if you remove 3 million undocumented immigrants?

Both curves likely contract, but does the inflationary impact of removing labor supply exceed the deflation from millions no longer living in our cities and demanding goods and services? How uniform is that net impact, and which industries or local real estate markets might face disproportionate effects?

These questions exceed our time to answer but are far from straightforward to analyze.

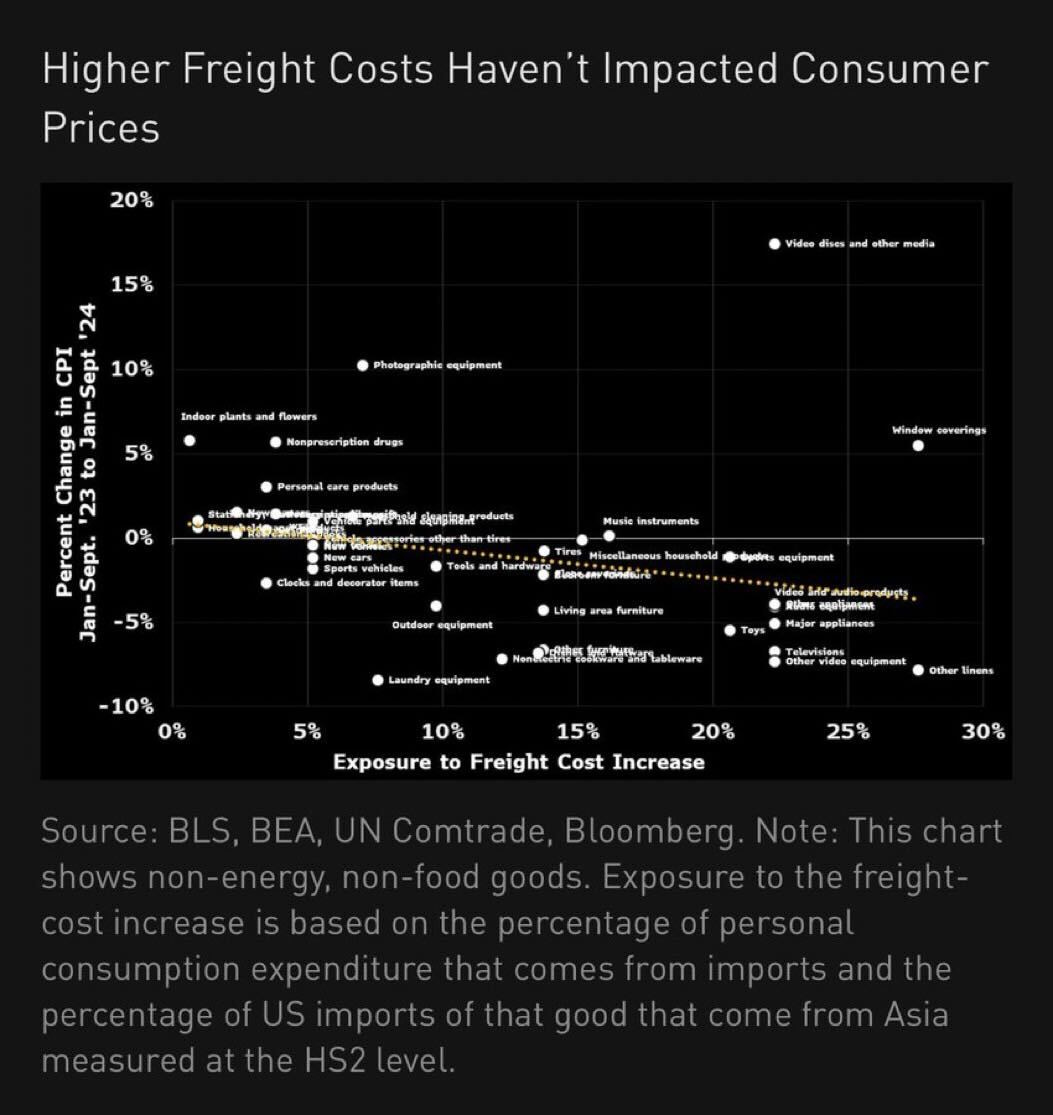

Supply Chain Complications

To further muddy the waters, we actually got the increase in shipping costs we predicted earlier this year from the Suez shutdown, but consumer prices haven't reacted with the same elasticity as during the first COVID wave. Whether this reflects the more limited impact (confined to shipping and a particular chokepoint) or better-prepared manufacturers than in 2021 remains unclear. For those of us trying to predict inflation, there are no easy answers.

Europe's Cautionary Tale

While the U.S. turns inward, Europe appears to be slowly disintegrating from within. The continent finds itself undone by a toxic combination: overconfident and restrictive socialist governance paired with uncontrolled and unassimilated immigration. European national identities, scarred by hundreds of years of ethno-linguistic conflict, can no longer protect and propagate their domestic culture. They're particularly vulnerable to the creeping ghettoization made inevitable by segregationist policies ("oh that's the Moroccan/Syrian/Nigerian/Afghan part of Amsterdam/Bruges/Paris") and social programs unable to cope with hardcore revisionist cultural movements.

While their social contract comes under pressure, their economy finds itself again caught between values (no nukes) and reality (no Russian gas).

Consider energy prices, the bedrock of manufacturing: European industrial electricity prices have surged 50-130% since 2019, while U.S. prices dropped 16%. This isn't merely a Russia-Ukraine thing – it's what happens when you build an industrial base dependent on Russian gas while letting your nuclear sector atrophy. The kind of strategic mistake that takes decades to fix.

Not that they have decades.

German real GDP tells the story. The engine of Europe remains stuck at 2017 levels. This is what the end of an economic model looks like: built on cheap Russian energy, German engineering, and exports... now watch all three legs of that stool wobble simultaneously.

The Shape of Things to Come

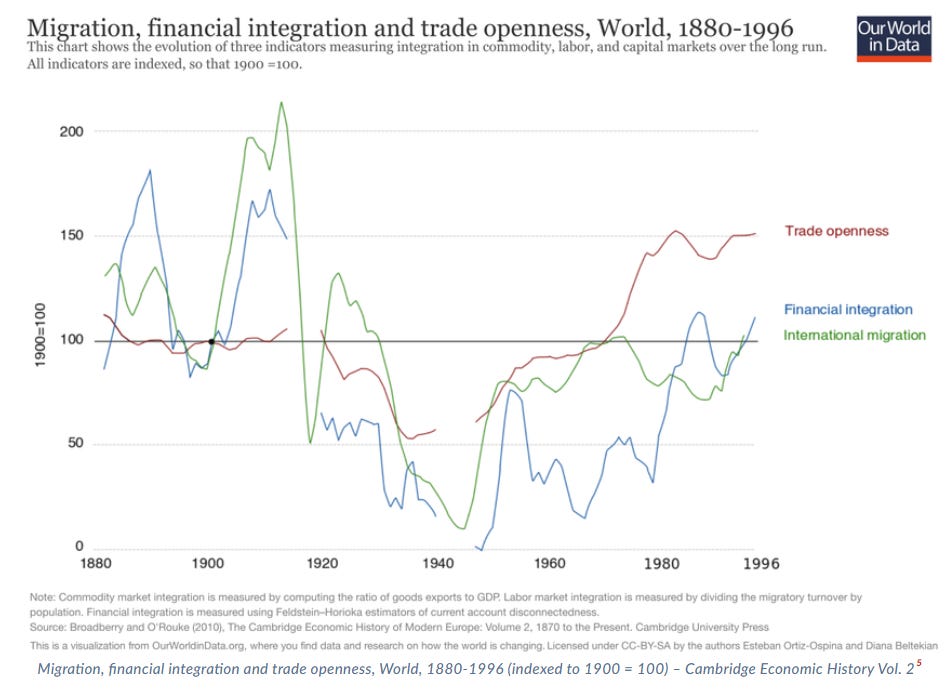

We find ourselves at an inflection point in history. The post-Cold War era of ever-increasing globalization is ending, not with a bang but with a series of reciprocal policy decisions, each seemingly rational in isolation, yet collectively dismantling the global order piece by piece.

The transformation manifests across multiple dimensions:

Trade: From efficiency to security

Technology: From sharing to hoarding

Capital: From global flows to friend-shore pools

Immigration: From open doors to fortress mentality

Energy: From interdependence to autonomy

For investors, this new world demands a fundamental rethinking of portfolio construction. The old correlation patterns – like the relationship between bonds and oil – are breaking down. New patterns are emerging, shaped by geopolitics as much as economics.

Our core thesis remains: conflict is inflationary. But the path to that inflation may be more complex than initially thought. The deflationary forces of demographic change, technological disruption, and debt deleveraging clash with the inflationary pressures of deglobalization, resource nationalism, and military buildup.

The winners in this new era will likely be:

Nations with resource independence

Companies with secure supply chains

Industries vital to national security

Assets that thrive on volatility

The losers:

Pure globalization plays

Nations caught between blocs

Industries dependent on free trade and free movement

Fixed income without inflation protection

The American Position

America enters this new era with unique advantages: energy independence, food security, technological leadership, and the world's reserve currency. But it also faces unprecedented challenges: political polarization, demographic shifts, and the need to rebuild industrial capacity.

The coming years will likely see:

Higher structural inflation

More volatile markets

Increased government intervention

Rising security premiums

For those positioned correctly, this transformation creates opportunities. For those clinging to the old order, risks abound.

Remember: we've been here before. The world didn't end when the first era of globalization collapsed in 1914, nor when Bretton Woods fell in 1971. It transformed. Understanding and anticipating that transformation is the key to surviving – and thriving – in what comes next.

Till next time.

Appendix - Chart Center

Disclaimers

![OC] America's $7 Trillion Budget (All Levels of Government) : r ... OC] America's $7 Trillion Budget (All Levels of Government) : r ...](https://substackcdn.com/image/fetch/$s_!2vIY!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F988c17de-9d8e-422b-800f-c54640719b1c_594x415.png)