The day the oil machine went down - poem

April 26th, 2020

#TheMachineIsDown

…one of our tech principles.

~

A koan of sorts,

on the nature of managing money

in the age of the machine.

~

Never before

more dependent on technology.

Never before

easier for the lights to go out.

Anywhere and everywhere.

Acceleratingly unstable,

and convex processes.

Making us –

ironically –

never more dependent on individuals.

Individual humans,

capable of stepping in.

When the machines go down,

as they are want to do.

~

WTI was fine.

The market for oil was fine.

The May contract closed.

“Our systems weren’t built for negative numbers,” they said.

Again.

So what really happened?

Or at least, a version we could pretend

~

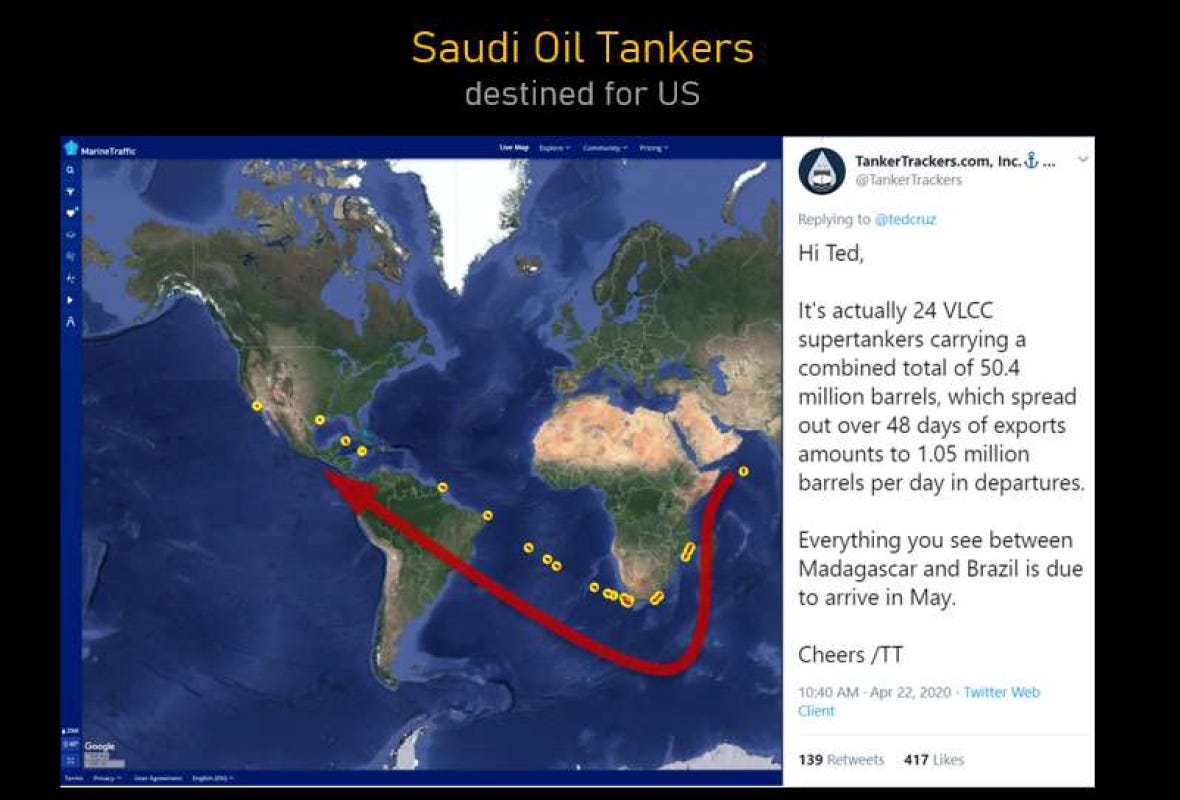

See, some humans, down in Saudi,

sent some humans in America

a couple months’ worth of oil.

A bomb of supply,

Gift wrapped,

In 24 VLCCs stocked full of crude.

OPEC, paying up for tankers.

Due for good ol’ USA, in May.

Competing ,with contango no less,

for boats,

priced at ~$200k per day.

Markets

Doing what markets do

Found a home for all that oil.

Coming at the expense

of a rather small lot.

Those caught long physical,

pants down.

The front of the curve

while the bottom dropped out.

With no home

for all that real oil,

The expiry,

Now a game of chicken.

Between financial players,

with capacity for spreadsheets,

and physical, with capacity for storage.

Wonder who will win out.

In the end,

financial longs,

forced to puke all their contracts.

To the guys privileged with physical.

Like Icahn,

Coming in at the lows.

Picking up a couple barrels

Way down, on the cheap

Contracts priced at negative

just to calm everyone down.

Alpha coming back again,

time to cull the (beta) herd.

Spring 2009, the last time

Super-contango, cleared USO out

USO, so passive,

USO, so systematic.

Selling this month’s WTI future, buying next one,

transparent to the tick.

The market,

she woke up to this.

Came in the day before

USO showed, to roll

and get herself out.

Selling today to buy tomorrow.

out just a little, there in front

enough for 10%,

per roll, per month

not bad for yeoman’s work

Macro players, from the distant land of futures

taking their alpha bite.

From beta strategies oh so systematic

“Let’s hope we track the index right”

Wrote down their retail paper

a good 75%,

no bounce

never to return.

That loss of capital, permanent

Another lesson learned.

“Pay no attention to that man behind the curtain”

The human, inside the machine.

all of a sudden, out in public.

Actively managing, for all to see

Yanking levers, here and there,

heretofore unseen