The 100% Inheritance Tax

100% Inheritance Tax, 0% Income Tax to Save the Republic

(Part 2 of the New New Deal Series)

Last time we talked about why America needs a “New New Deal.”

Today we're going to focus on one of its most controversial elements: a 100% inheritance tax paired with 0% income tax.

Before you close the tab in horror, let's talk about Rome.

The Cautionary Tale of the Roman Republic

The Roman Republic didn't fall because it was weak. It fell because it got too rich - specifically, because that wealth concentrated in fewer and fewer hands until the very idea of republican governance became a joke.

As military power became privately funded, soldiers became loyal to their paymasters rather than the Republic. The Senate, supposedly representing both democratic ideals and aristocratic wisdom, couldn't handle the contradiction.

Here's the interesting part: The Roman Empire actually stumbled onto a (part) solution. When emperors died, their wealth went to the state. The system was so oligarchic that it became impossible to disentangle the emperor’s balance sheet from that of the empire, thus upon death, the entirety of the emperor’s estate passed to…the state. The first 100% inheritance tax, in the strangest of places.

Fast forward to today. We're about to face a concentration of wealth and power that would make a Roman emperor blush. Why? Because of how automation and AI actually work.

When we automated farming, people went to factories. When we automated factories, people went to services. When we automate services... what exactly is left? This isn't about the "robots will take all jobs" argument - that's too simple. It's about what happens to the economic machine itself.

Where do profits come from?

Let's get technical for a minute. There's this economist named Kalecki who asked a fascinating question: Where do profits come from?

Micro level, it's simple: sell stuff for more than it costs. But macro level? If workers can only spend what they earn, and they earn less than the total price of goods (that's where profit comes from), how does anyone buy anything?

The answer (of course) is debt.

At a national income statement level, it's actually obvious - if more and more spending concentrates in fewer and fewer hands, and those hands tend to save rather than spend (which is how they got rich in the first place), then the only thing supporting continued spending and hence profits is... leverage.

We've built an entire economic system on the assumption that tomorrow's growth will pay for today's spending. When eventual incomes grow in line with those expectations, it all works out. When they don't... well, that's when things get interesting.

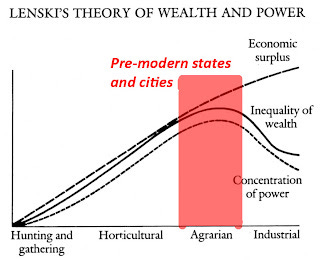

Automation > Inequality, Inequality > Chaos

Now add AI and automation to this machine. And not just regular automation - exponential automation. Every AI improvement makes future improvements faster and cheaper. Every market captured becomes easier to defend. Every advantage compounds.

So what happens when most income goes to a smaller and smaller band of oligarchs - those who own the machines that are getting better at owning themselves? Workers' wages don't just fall, they collapse. The Kalecki paradox goes into overdrive: those who own the robots get all the income, but who's left to do the spending?

The machine breaks in one of three ways:

1. Massive consumer debt (hello 2008)

2. Extreme deflation (hello 1930s)

3. Some kind of redistribution (which is where the New New Deal comes in)

Traditional redistribution - progressive taxes, welfare, even UBI - doesn't solve the dynasty problem. In fact, it might make it worse by crystallizing a permanent aristocracy and a permanent dependent class.

This is where the inheritance tax comes in. Not because inheritance is wrong - it isn't. In fact as a capitalist, you have to swallow the (somewhat) bitter pill that most folks with a lot of money did something good for the world to get it!

This is a bedrock assumption in the model. Someone paid you that money in exchange for some value you created. The inequality in outcome reflects differences in effort, skill, or... merit.

That argument gets weaker when it's the son or daughter's turn to manage the family business. It becomes laughable by the third or fourth generation. Meaning the fundamental assumption that forms the basis of capitalism, free and fair competition is attacked.

The Trillionaires Dilemma

In fact, inherited wealth creates a particularly nasty second-order problem: the sclerotic impact of taking someone with tremendous human capital and making their status more dependent on how they spend their grandfather's money than on what value they can personally create. Elon’s kids are pretty smart, but if they all start on third base, what will they create?

Look, there's nothing inherently wrong with wanting to help your kids. Hell, despite writing this, it's something I personally intend to do. But I've seen what inherited wealth does to talent. I've watched some of the best minds of my generation optimize their lives around preserving wealth rather than creating it. Family office scions more focused on next year's Met Gala than next year's breakthrough technology.

The real efficiency gains from 100% inheritance / 0% income tax come from unleashing human capital at both ends of the spectrum. Think about all the talent currently trapped in:

- Managing family offices, clipping trust fund coupons rathe than starting companies

- Preserving inherited advantage instead of creating new value

- Maintaining dynastic wealth instead of building new institutions

Not to mention the quasi-permanent underclass that each western nation seems to effortlessly recreate.

To be clear, this isn't true of all heirs. About 10-20% of them take their parent’s ending point as a platform to build and create things at scales that make us all jealous. The Howard Hughes of our generation:

Losing this starting advantage will make their life harder, but in the process might unlock the capacity of the other 90% who are content with getting their children into the right schools and zip codes.

Not because wealth is bad - it isn't. But because capitalism only works when competition is real. Otherwise, why play the game? A phenomena I saw pretty directly growing up in the projects. A lot of kids opt out of the game because they (correctly) evaluate it from a very early age as biased against them.

Yes we will lose out on some of the benefits from good dynasties, but having met a couple of those folks on that list I think they will find a way to win regardless.

In exchange we gain not giving power to these people:

And here's the key part that makes this different from regular tax-and-spend: We don't want to give the money to the government. Instead, we want to force it to be given away before death.

Think about what happens when you combine 100% inheritance tax with 0% income tax. You create a system that rewards wealth creation while preventing wealth calcification.

You get maximum competition while alive, a complete reset between generations.

"But that's theft!"

Not really.

We already accept that property rights are not absolute - that's what every tax is. We're just shifting from taxing productivity and income (bad) to taxing death and dynasty (good) and conspicuous consumption (which we will get into next time, when we talk about 300% luxury taxes on status goods).

Want to get really rich?

Great!

Want to pass on a permanent aristocracy?

Sorry, not in this version of capitalism. We just can’t afford it.

Competitive Giving

And remember - we don't want to give this wealth to the government. God no. Let's not trust them with this boon. Instead, imagine a system where great wealth, upon death, must be given away. No more sitting on billions in a foundation while NGOs bow and scrape for their annual distributions.

Instead, we unleash competitive giving. Where individuals are evaluated on the impact of their giving while they're alive. Where status comes from solving problems, not accumulating lucre. Where the question isn't "how much did you inherit?" but "what did you build?"

Now imagine that talent actually competing, creating, building. The rich will still be fine. Their kids will still have better education, better networks, better everything. But they'll have to actually do something with those advantages.

You know, like capitalism is supposed to work.

Don't like 100%? Fine, let's start at $100 million. You can still make your kids richer than Croesus. Just not richer than Crassus. The goal isn't to punish success - it's to keep capitalism vital in the face of the greatest technological revolution in human history.

Think about the economic mechanics. Right now, we're heading toward a world where:

- AI and automation concentrate income in fewer hands

- Workers' wages stagnate or fall

- Consumer spending requires ever more debt

- Wealth becomes more inheritable and permanent

- Innovation gets stifled by dynasty

Instead, imagine a world where:

- Income is untaxed, maximizing incentives to produce

- Talent focuses on creation, not preservation of wealth

- New institutions emerge each generation

- Competition resets before calcification

- Innovation has to prove itself each generation

"But what about capital flight?"

First off, this is good policy for all nations. One that seems radical now but will feel obvious once we have armies of robots running around making Elon's kids into trillionaires. Besides, if you earn or hold assets in the US, this applies to you. And once the EU faces the same AI revolution (they will), what are you going to do - store all your wealth in the Cayman Islands?

Try protecting your property rights in the alternatives. Good luck getting your kid into Harvard.

Conclusion

We're not proposing this because we hate capitalism or wealth. Quite the opposite. We're proposing it because the coming wave of AI and automation will create concentrations of power that make the Gilded Age look like a socialist paradise. And unlike previous technological revolutions, this one comes with compounding advantages that could calcify into permanent dynasties.

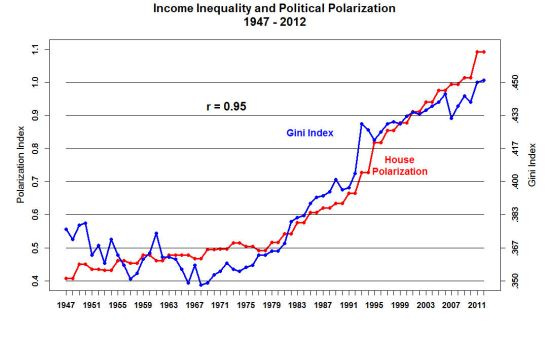

Think this is hyperbole? Look around.

We're already seeing:

- Network effects creating winner-take-all markets

- AI capabilities concentrating in fewer hands

- Wealth gaps becoming capability gaps

- Societal slowing as preservation of advantage takes priority

We have two choices:

1. Let AI and automation create permanent over & underclasses, watch capitalism collapse under its own concentrated weight, and wait for the inevitable populist backlash.

2. Update the system to keep competition and democracy vital by ensuring each generation has to earn its place

The 100% inheritance tax isn't a radical idea - it's a conservative one. It conserves what actually makes capitalism work: competition, innovation, merit. It just means doing it each generation instead of letting victory in one century determine winners for all the centuries that follow.

Next time in the New New Deal series, we'll zoom out to the full framework: from new infrastructure and industrial policy to education and immigration reform.

Some of it will sound crazy. Some of it will make people angry. But all of it aims at the same goal - keeping American dynamism alive in the age of AI.

Because if we don't figure this out, the alternatives are much worse than a few trust fund kids having to work for a living. History shows us exactly how this movie ends - with democracy collapsing as economic inequality hardens into social hierarchy, and the death match between oligarchy and populism tears the Republic apart.

Just ask Rome.

Till then.

Disclaimers

Charts and graphs included in these materials are intended for educational purposes only and should not function as the sole basis for any investment decision.

[Standard disclaimers about not taking inheritance policy advice from someone who usually writes about volatility surfaces and gold apply. Also, if you're managing family office money and this made you angry, call me - we have gold & silver strategies for your wealth in the meantime!]

First of all- your stuff just keeps getting better and better. Can’t say that about many here. Really appreciate your ideas.

Having studied history and in particular transfers of wealth, I’ll say you are absolutely on to something here- perhaps not at the 100/0 mark but nevertheless…

The starting issuing have, though, applies to productive wealth at death. I mean, wasn’t it family farms that drove the early impulse for the basis step-up in the first place? Or any operating business, for that matter, which could be a lion’s share one’s wealth at death. I’m in the wealth management business so I see a lot of this- from both sides. On one hand a group of grandkids that will inherit a massive stepped-up position in ABC stock up 10,000% in the owners lifetime- most of whom I can see are on a path to nowhere and will absolutely destroy that wealth. Or the 75 year old still running his equipment rental business that he’ll run until he’s in the grave, taking a reasonably ever-increasing distribution to enjoy life a bit more but ostensibly with most of his ‘inheritance’ wrapped up in something you can’t give away and that supports a lot of employees and customers.

In that latter case I suppose you’re saying that such a business might not exist in our AI society of the not-to-distant future. But I think that sort of issue will be real for long enough that a move toward an inheritance based system will need a lot of thought and creativity.

That said- the basis step up on non productive assets like stocks and real estate should be toast immediately!

Thanks for writing!

This is great! With all the data and ML tools we have now it shouldn't be that hard to get a model that the public would agree to. If we can stop the clowning around and talk about the impact to the future we could do it.

But does anyone care about the collective future enough? We might need more pain.