Stocks vs Bonds

Thinking about balance amidst extremes

Ok folks, today we're going to talk about Stocks vs Bonds.

I will try to keep this one brief, partially because "stocks vs bonds" is a very well-worn topic, and partially because our conclusion for the moment is so tepid: given the uncertainty in the world, you probably want and need both. Our bearishness towards bonds has decreased with the recent sell-off, and while we continue to think that gold is a superior diversifier to stocks, we are slowly reducing our short and looking to potentially go long US and global bonds as equity market valuations stretch higher.

Why Stocks vs Bonds?

You can think of the division between bond investors and stock investors as greater than two different prides of lions, but less than two species. It starts with the fundamental premise of investing: you give me a dollar today and I try to give you more than a dollar tomorrow, to take into account the pain and suffering of removing you from your money for that period of time.

That is, unless interest rates are negative, but let's not get out of hand Campbell.

The modern division between stocks and bonds evolved from something more unified. In the very old days, you'd have something akin to a partnership, where two to four respectable citizens got together to share in the upside and downside of the outcome of the firm. Many law firms, private investment houses, and other service industries still operate by this model below a certain scale (which in some cases, can be billions).

Recall that before Lehman was a stock on the NYSE it was a couple of... brothers. Selling cotton, and taking financing, transport, and warehousing risk before diversifying into... junk bonds and proprietary equity volatility trading.

Looking at securities in the past, you get this weird thing where many of the shares are notionally bonds but trade like stocks. The South Sea Bubble, the Mississippi Company, the Price of Poyais - these were each pieces of debt that somehow hoodwinked Newton of all people to get caught up in the game.

Over time, financial institutions got pretty good at dividing the claims on the assets into two pieces, the fixed amount that must be paid back (debt), and the variable part that incorporated the upside of the underlying asset (stocks).

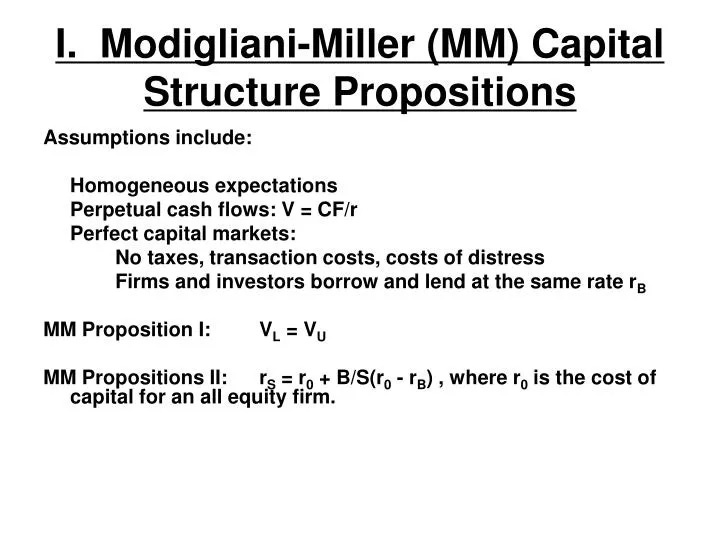

With that, came the fundamental distinction between bond investors and stock investors. That of exposure to volatility. See, bond investors universally hate volatility, they are looking to lend a fixed amount of money and get that money back, with interest. Big changes are good for these folks. Whereas equity holders, particularly for companies where the ‘optionality’ of the equity becomes material, may even seek volatility. In a sense, stock holders are looking for this upside vol, and are willing to trade the safety of a guaranteed return in order to get that exposure. Whether those two investor bases getting what they want reduces the overall cost of capital, I will leave up to readers to reflect, starting with the famous Modigliani-Miller theorem which states that the valuation of a company should be independent of it’s method of financing (with some pretty chunky assumptions like no taxes, transaction costs or cost of distress for being near bankruptcy).

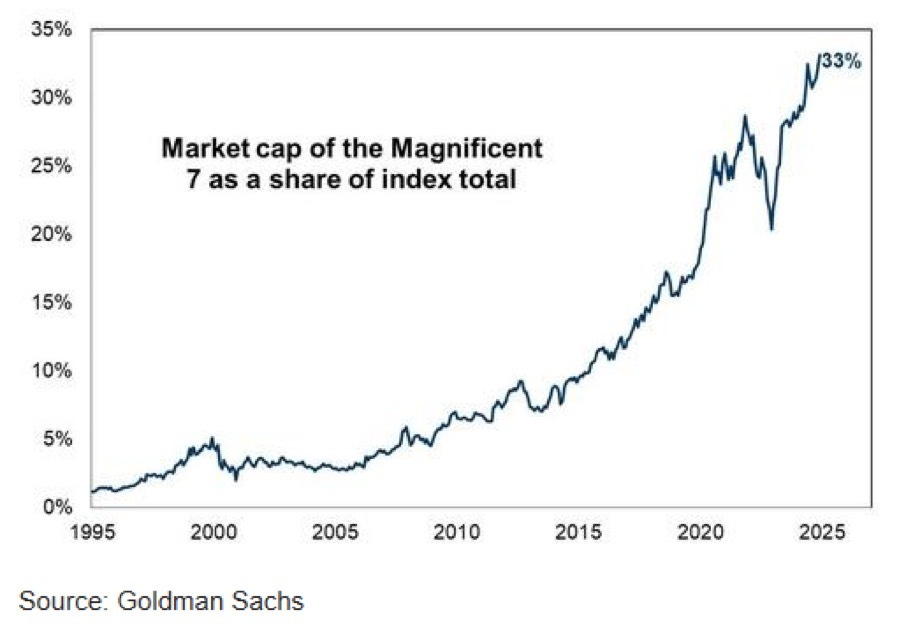

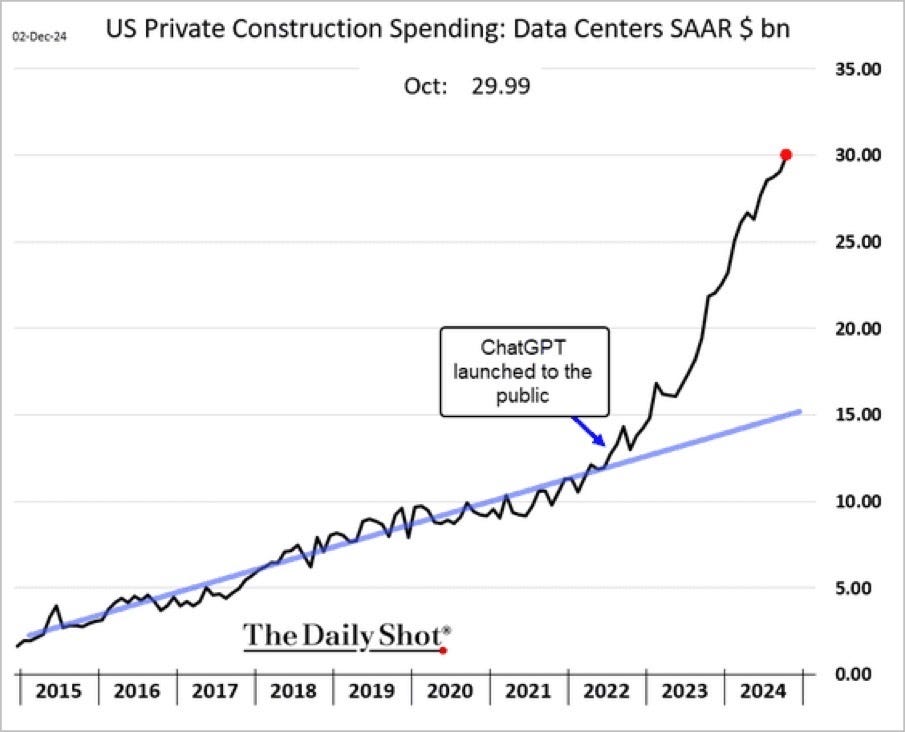

All this economic and market history brings us to today, where we face a peculiar situation. On the equity side, we're seeing something unprecedented - seven stocks now represent 33% of the US market cap, driven by an AI narrative that's reshaping the investment landscape.

Meanwhile, in the bond market, we're getting mixed signals about whether we're heading into an inflationary boom or deflationary bust.

This brings us to today's market, where both bonds and stocks face unique challenges. Let's start with bonds. From an alpha perspective, we still have reason to be bearish bonds. Across five indicators we track, each is relatively bearish, though less so than earlier this year.

Note combining these indicators gets you a relatively bearish picture from an alpha perspective for bonds. Something like a 0.6 Sharpe Ratio since 1980, though that performance has waned the last year or so.

Bond investors have by and large gotten the message that deficits and high inflation tend to be bearish for bonds (especially relative to gold).

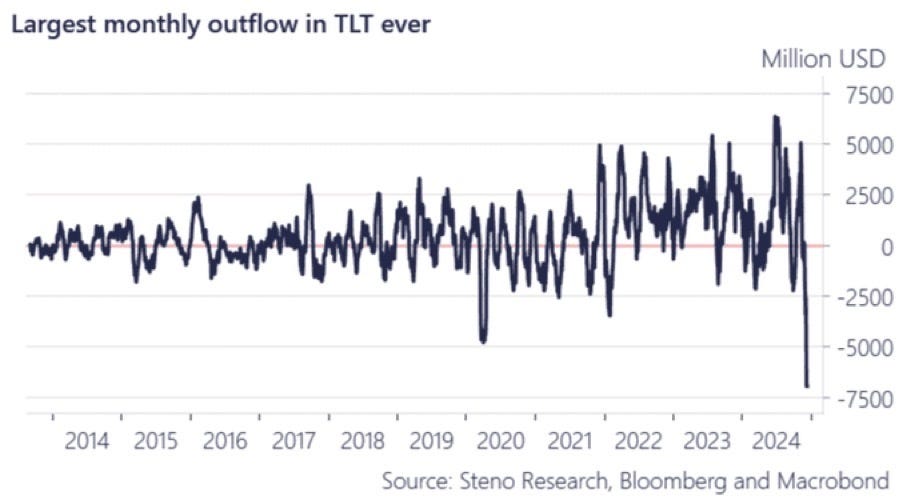

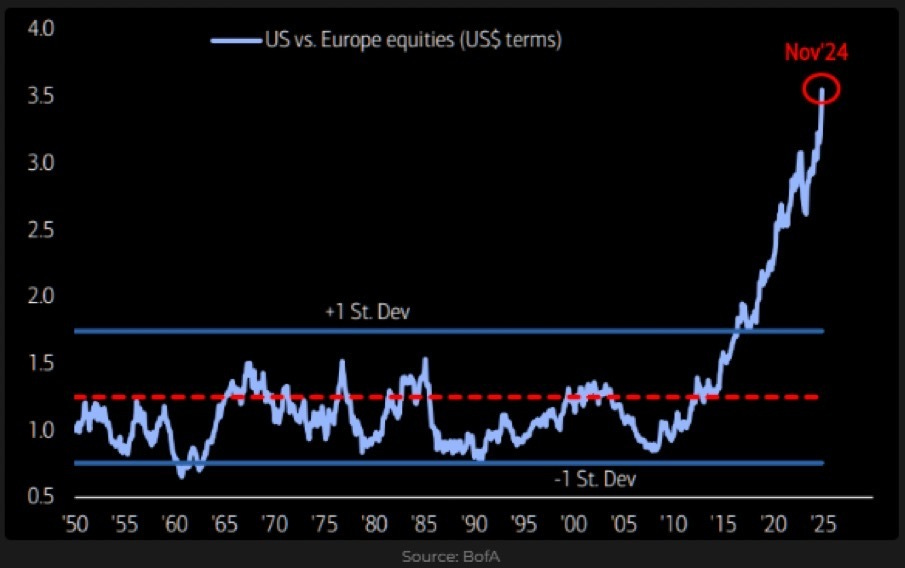

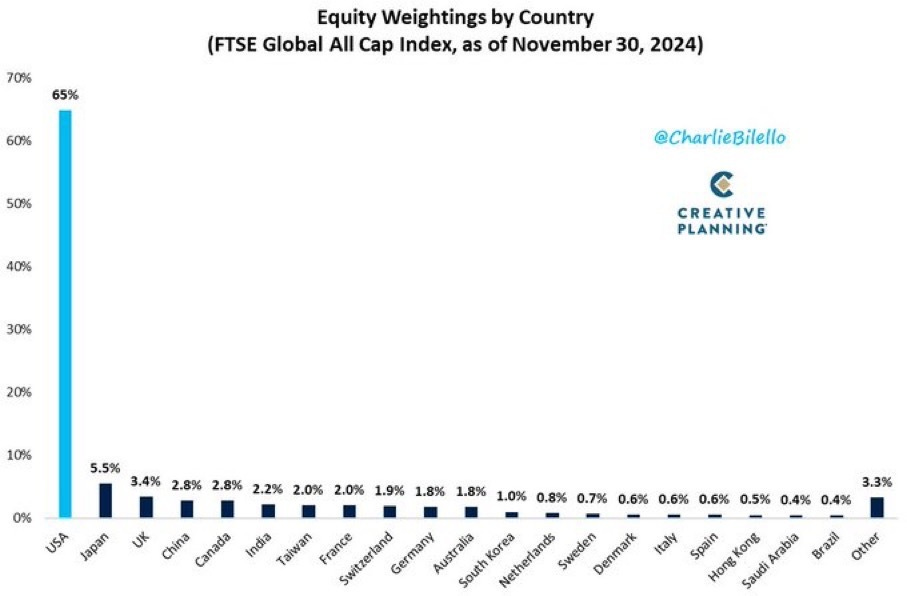

This has resulted in retail outflows from popular US Bond ETFs like TLT, just as we're seeing the opposite in equities - massive inflows into a concentrated handful of tech names, driving up US stocks and leaving global equity portfolios with a large bias towards US stocks.

But here's the thing - timing alone isn't enough right now. We're in this weird place where nobody really knows if we get:

The inflationary growth scenario from tariffs, stimulation, and deregulation (which could benefit those concentrated tech positions), or

Deflation from entitlement reform/deficit reduction, China not restarting its engine, and what looks to be weaker labor market conditions.

The most important thing holding these two worlds in view has been the decrease in inflation in general and energy prices in particular. Food inflation, looks to have bottomed.

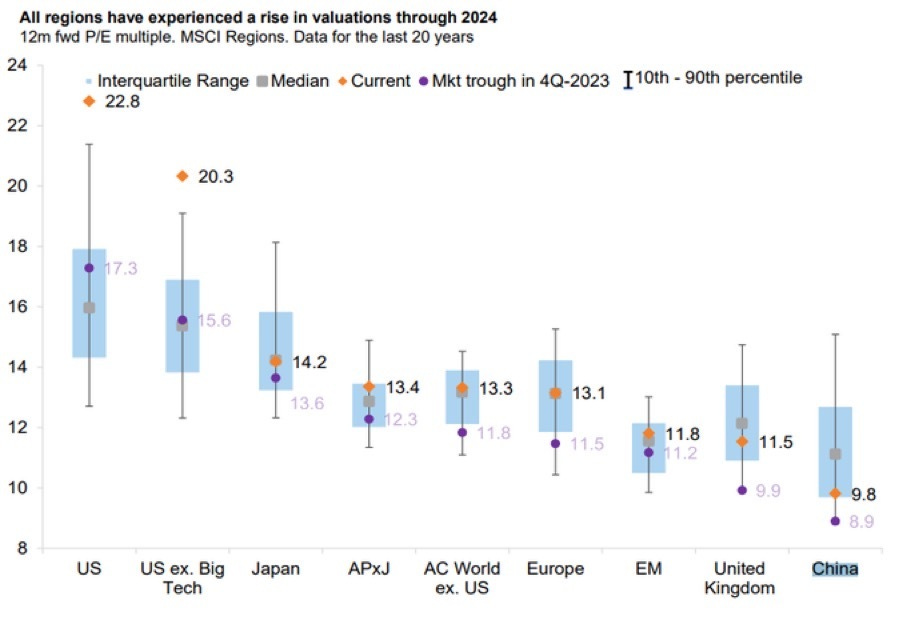

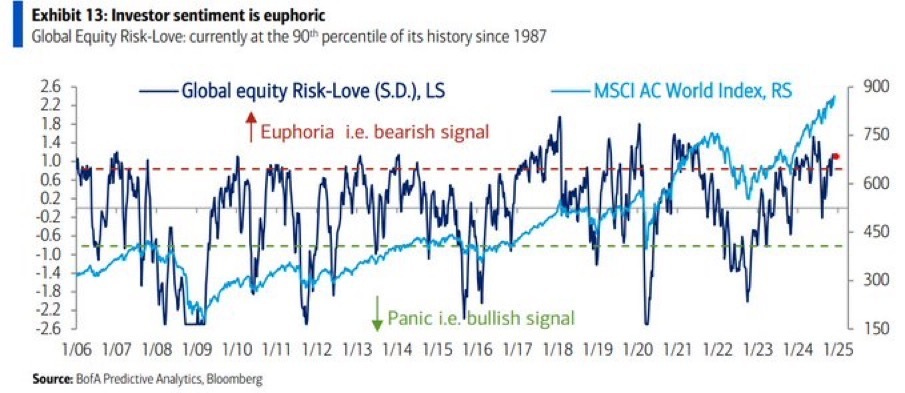

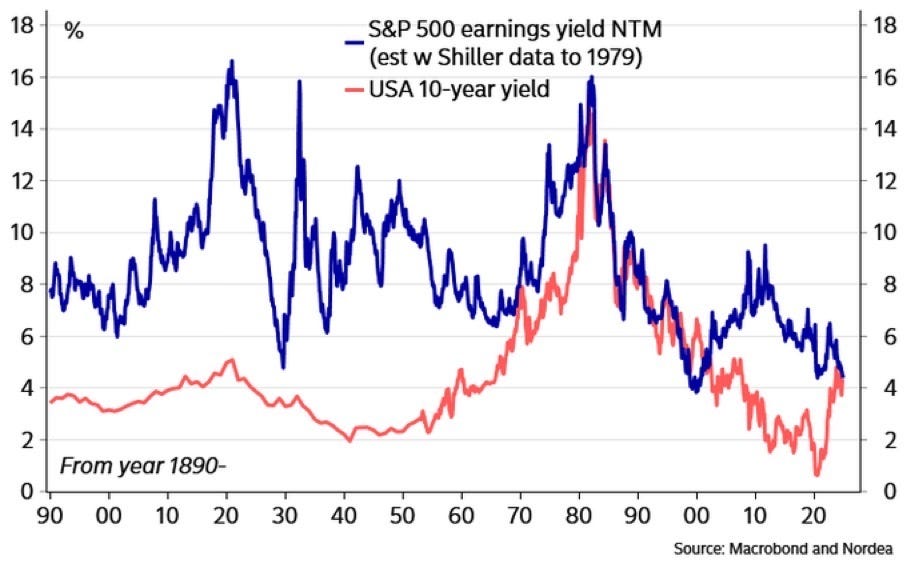

Plus, the huge run up in speculative behavior in bitcoin and AI stocks has to give you pause. When you see that kind of speculation combined with valuation metrics like these, you start thinking about the portfolio insurance value of bonds rather than timing.

Our system for tracking rebalancing flows (which just looks at the outperformance of equity vs bonds) suggests that natural hedging pressure is building. When stocks run this far this fast, especially in such a concentrated manner, somebody has to rebalance back into bonds.

The equity concentration risk is particularly acute when you consider that these seven dominant stocks are all essentially making the same bet on the AI revolution. While the fundamental bullish trend in AI spending is clear, we're also seeing concerning signals in the broader economy...

The broader economic picture adds complexity to both the bond and stock outlook. We're seeing some mildly worrying signs in the labor market, where seasonal and immigration dynamics have made it hard to parse what's happening at a macro level.

Though various real-time measures of labor demand appear to have peaked, the story isn't straightforward. When this is compared with the ongoing contractionary impulse from high housing prices and high mortgage rates, the US economy appears to be healthy but moderately vulnerable. Good thing the Fed is still easing…

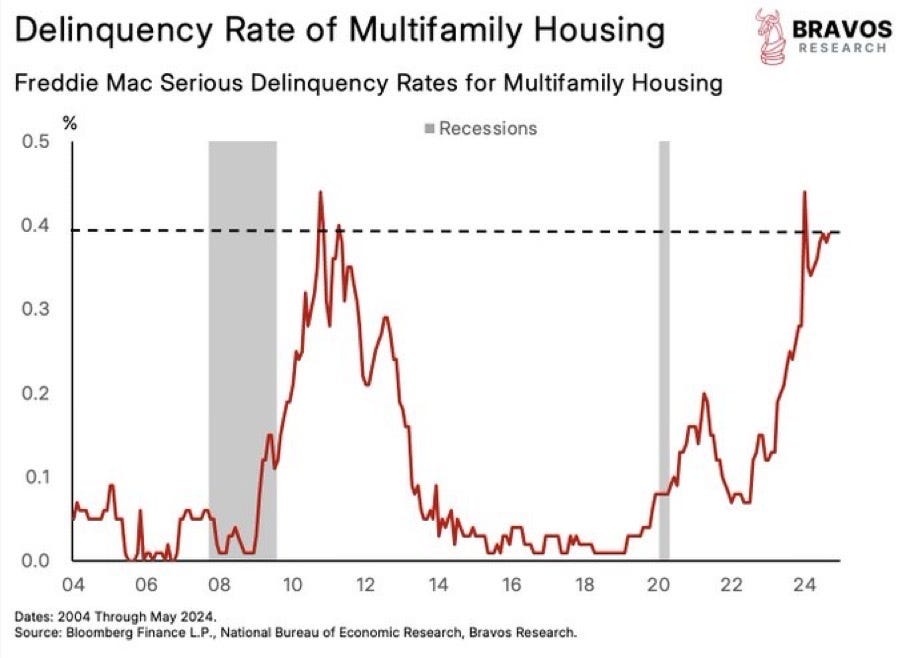

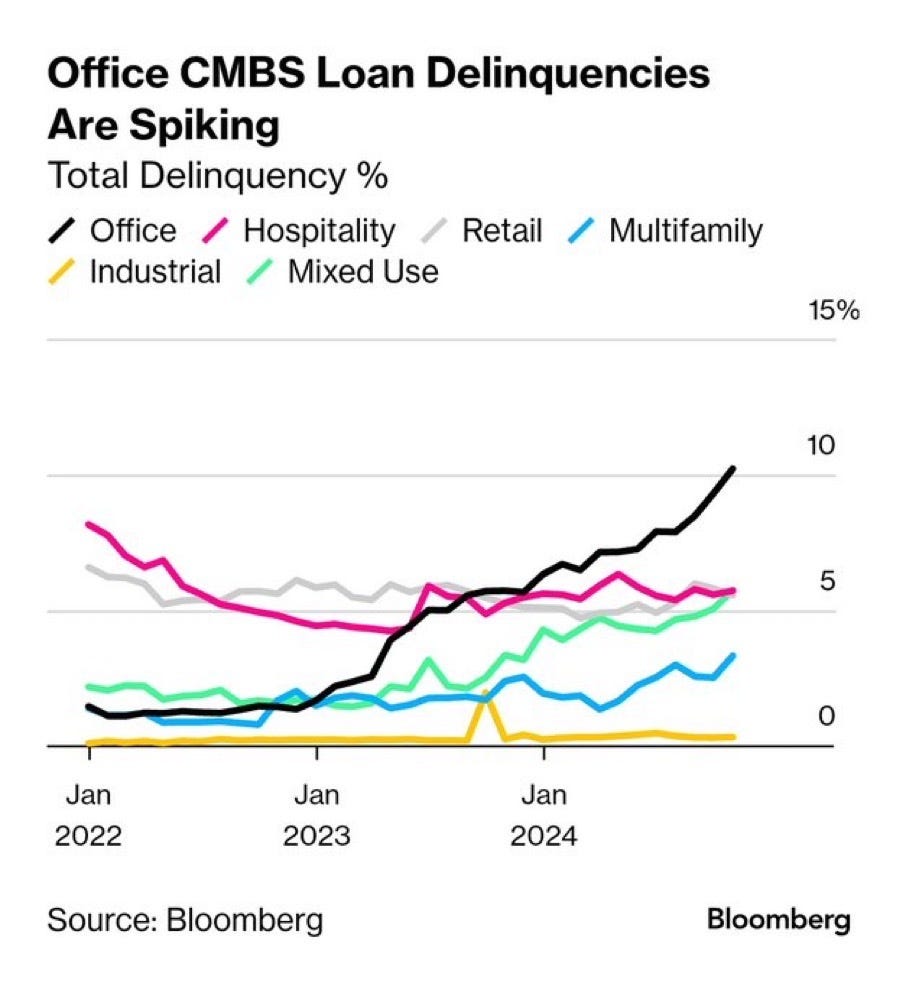

More concerning is the slow grind of losses we're starting to see with Commercial Office Loans, which have hit 10%. This kind of stress in commercial real estate could spread to both bond and equity markets.

So where does this leave us? Our tepid conclusion is that you probably want both right now. Not because we're particularly bullish on bonds - we're not. But because:

The run-up in stocks provides natural rebalancing flows

Nobody really knows which scenario we're heading into and in periods of ambiguity, it pays to diversify

Speculation keeps us wary of too much exposure to handful of major US stocks:

Seven stocks making up a third of US market cap

U.S. valuations stretched relative to the world

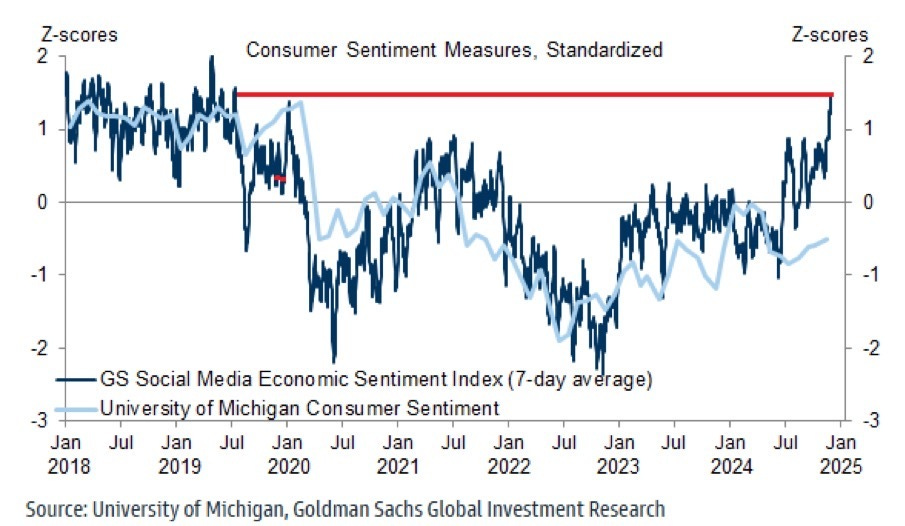

Investor sentiment at euphoric levels

Corporate executives selling stock while retail buys

Real economy signals flashing yellow

Sometimes the boring answer is the right one. Balance your portfolio, be prepared for either scenario, and don't try to be too clever about timing. When you see this level of concentration in stocks combined with this much uncertainty in bonds, the prudent move is to maintain exposure to both.

This is especially true when you consider that US stock dividends now yield in the ballpark of bonds - a historical rarity that suggests neither asset class has a clear advantage.

The history we started with - of stocks and bonds as unified claims on corporate assets that eventually split into separate instruments - reminds us that both serve essential functions in a portfolio. Just as the South Sea Bubble and Mississippi Company showed the dangers of excessive speculation, today's market suggests the wisdom of balance.

Till next time

.

Disclaimers