Still Long Silver

The case for silver in 2025 is relatively simple.

Yes, silver had a great 2024 (34% ytd as of writing December 10th, 2024), but we think the fundamental case is improving, rather than weakening.

To review the fundamental logic here, despite the huge run-up:

Silver remains historically 'cheap' compared to gold.

This is largely due to losing its legacy as 'money' back in the late 1800s.

Which is reflected by its under allocation in both global official and household reserves.

Solar power consumed ~20% of new silver last year, and models suggest this could exceed 100% in 10 years.

This fundamental demand will drive monetary demand, as escalating conflict and inflation increase interest in holding energy-producing metals as strategic and monetary reserves.

More timely indicators - inventories, speculative positions, and local price premiums - are moderately bullish.

To flesh that out:

Silver remains historically 'cheap' to gold.

There is only 10x more silver than gold in the earth, and ~8x above ground, but gold currently trades at 80x the value of silver.

Silver's role in monetary history is profound - it once comprised up to 50% of Chinese and Indian reserves, with significant holdings in the US and Germany through the mid-1800s. From Williams Jennings Bryant's Cross of Gold speech to Chinese reserves pre-opium wars, through the White Lotus and Taiping Rebellions, silver was central to the global monetary system.

As it went out of favor, it fell in value relative to gold and dollars.

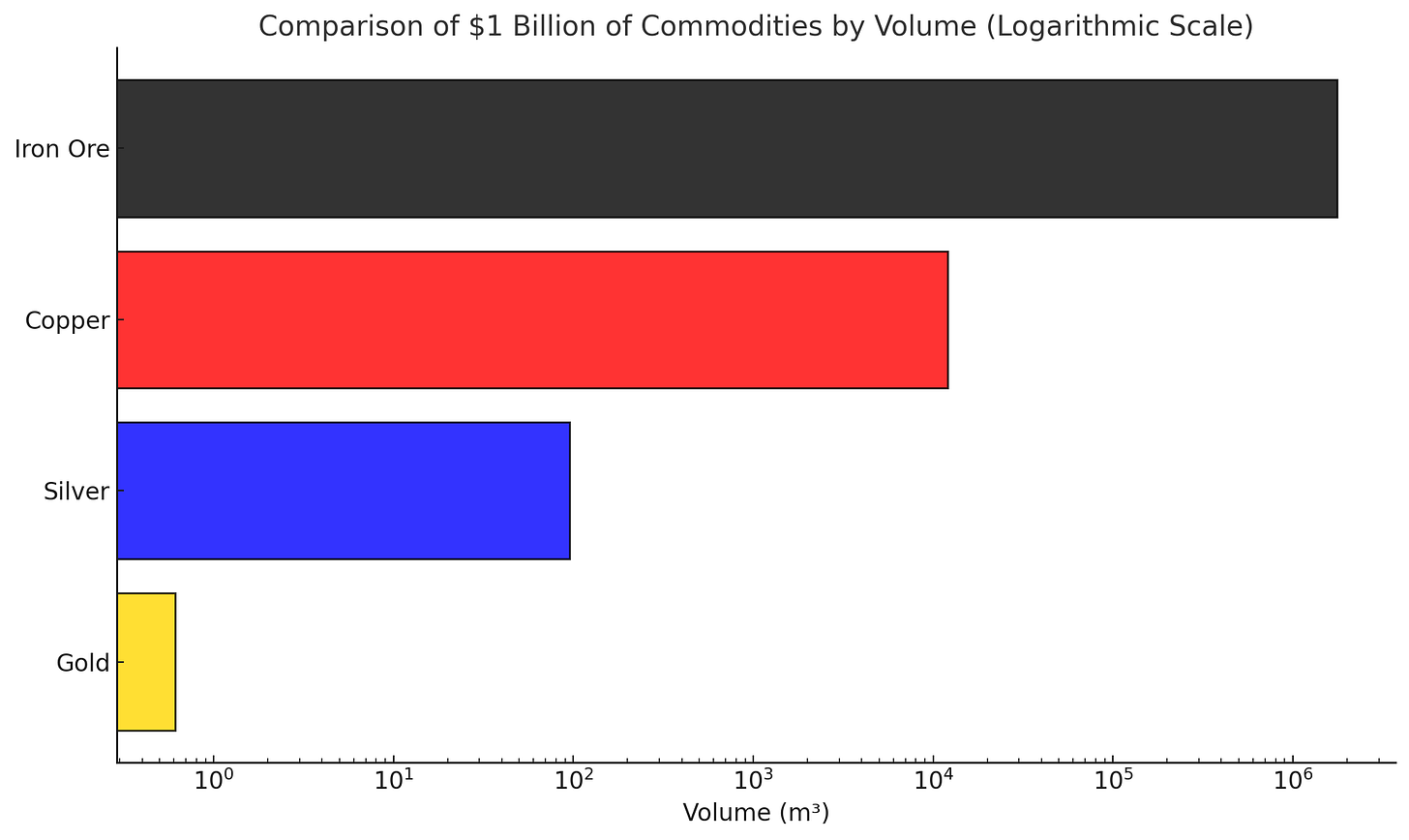

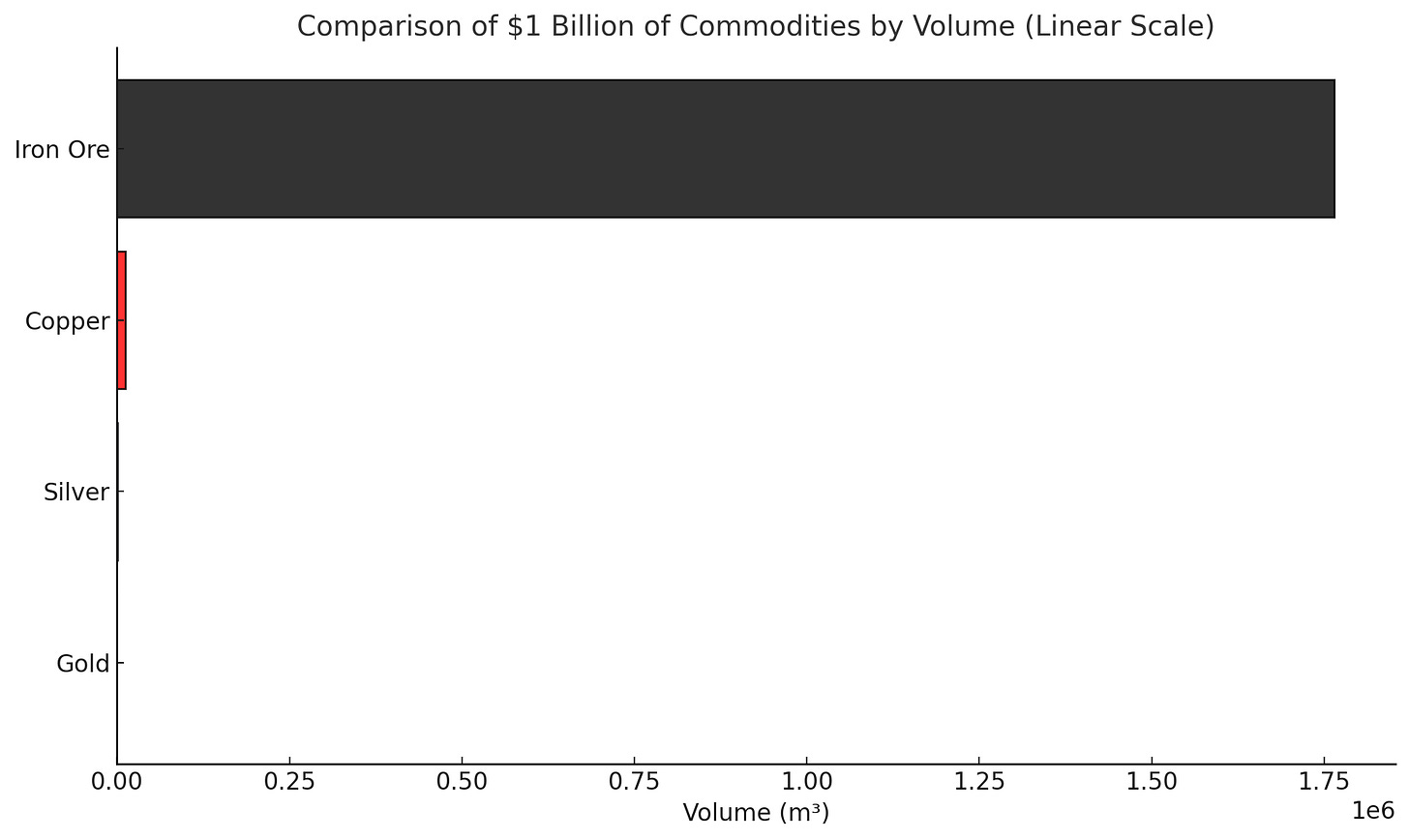

This disconnect is self-reinforcing - as silver became less monetary, central banks stopped holding it as reserves, which made gold's density premium even more valuable. In a weird way, the more valuable gold is relative to silver by volume, the more competitive it becomes as a liquid storehold of wealth. At some point, it's a volume game: a billion dollars of gold fits in a closet, silver fills a room, copper a warehouse.

Or, in non-log scale, a billion dollars of iron spans multiple football fields. The physical reality drives the financial reality.

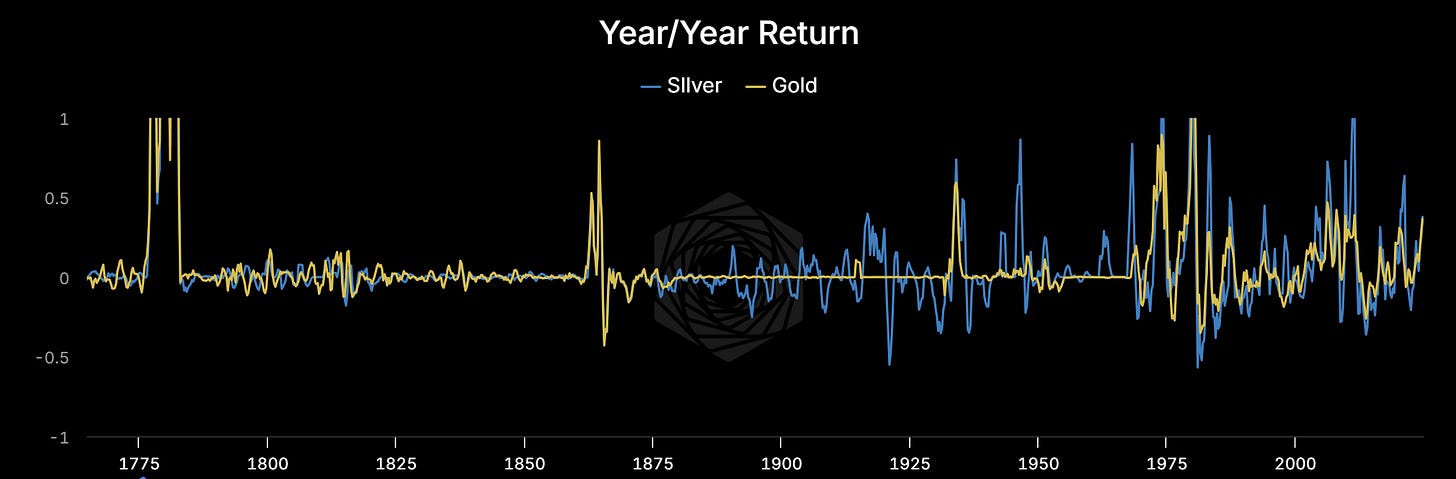

This history is reflected in silver's current under allocation in global official and household reserves, even though it acts like a higher-leveraged version of gold over time.

Prior episodes of extreme price squeezes have created generations of investors scarred by the metal as an asset class. Which, as we've learned recently with crypto volatility, might actually signal opportunity for excess returns rather than risk.

The Solar Angle

Solar power consumed ~20% of new silver last year and contributed 40% of net new energy supply in 2023. Data below is lagged but illustrates how significant 5 exajoules of energy per year is. Over 5 years that would be 25 Exajoules, roughly 50% of long-term energy growth needs.

Data below is lagged but shows you how big a deal 5 exajoules of energy a year is. Over 5yrs that would be 25 Exajoules, which would be around 50% of long term energy growth needs.

Someone should check my numbers, as it gets tricky with stocks and flows, but think about it this way: how long can solar demand (and hence silver demand for solar) grow at 30% while mine supply grows at 2% before these collide?

If you map out even 10% solar growth over 10 years, combined with new forms of solar using more silver per watt (up from 10 to 20, with some arguing up to 65!), that puts significant pressure on global supply.

Our best hope is that efficiency improvements make panel costs less sensitive to rising silver prices. Numbers below are illustrative, but you basically can't fill the demand gap without significant recycling of existing silver.

Probably a good time to start a silver recycling company. Silver is notoriously inelastic, coming mainly as a byproduct of other mining processes (though I need to go deeper on that). Keep in mind silver supply hasn't actually grown for more than a decade and is currently in drawdown, with prices near the highs.

The Industrial to Monetary Bridge

This industrial demand creates a new floor for prices. As panel production automates, more of the cost becomes raw material rather than labor. Casey Handmer has a good piece on why solar wins for next-gen data centers - when you're building at gigawatt scale, the commodities matter more than the tech.

Fundamental demand becomes monetary demand. Whereas before your cost of carry for silver was negative, now you have a positive yield - it can be turned into energy. At least this is how people will start to think of it.

Combined with escalating inflationary conflict, we expect increased interest in holding energy-producing metals as strategic and monetary reserves. Current indicators suggest Western investors haven't yet embraced the diversification these assets provide. This will change.

Market Positioning

More timely indicators, like speculative positioning and local price premiums, are moderately bullish. Currently, specs are long but remain longer gold - a relationship that has shown predictive power historically.

Local price premiums in China have declined from their peaks but still sit more than 5% above U.S. levels.

The Strategic Context

Step back and look at what China just did with gallium (98% market share) and germanium (60%). The raw material costs are tiny compared to final product value, but supply disruption can halt entire industries. The lesson is clear - control of strategic metals means control of industrial capacity and thus deserves consideration in any industrial policy toolkit.

Silver = Solar = Energy = WATER

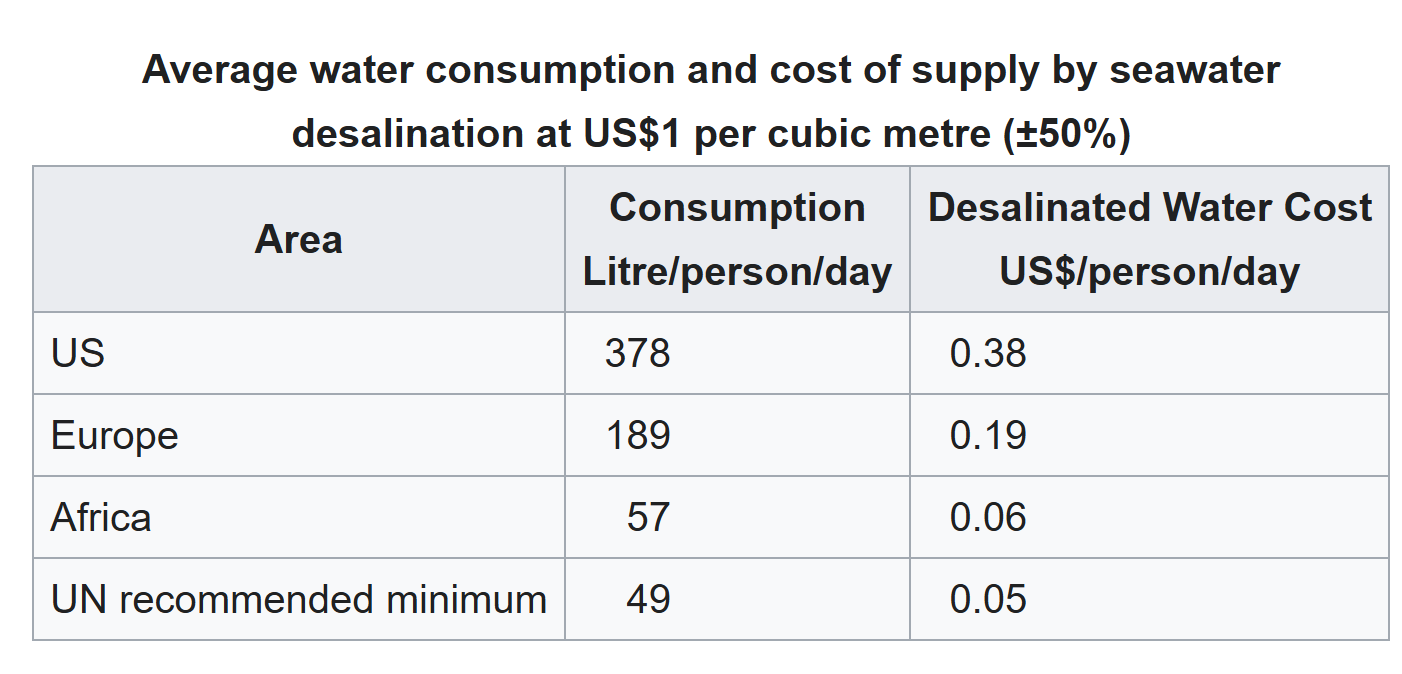

One of the more overlooked aspects of the solar question is how it intersects with the long-term water picture. Many regional conflicts are fundamentally about water. Reducing energy costs through solar will unlock clean water access just when the world needs it most.

Cost-effective energy anywhere on earth means fewer fights over rivers and streams. Industrialization both creates demand for and destroys supplies of potable/usable water. Energy represents 1/3 to 1/2 of water facility operating costs, and as solar costs fall, at some point the marginal cost of water will effectively become the marginal cost of silver. Which, to some extent, makes perfect sense.

Risks and Positioning

The counter-arguments are clear:

Prices are up

The dollar could continue to rally (which is true)

Substitutions would kick in

My response: substitutions take time, and while the dollar could indeed rally, much of the demand comes from non-dollar investors - we need to view this from their perspective.

Stepping back, the risks are clear: strong recent performance, potential substitution (though this takes time), and rare earth supply chain disruptions that could slow solar adoption. But unlike previous rallies, this one has fundamental drivers that strengthen rather than weaken with price.

Position

We're holding our substantial long allocation to silver, along with butterflies we bought when SLV was 25 and which are now a form of downside protection. Between these and a risk reversal (short call, long put) we did to sell some upside skew, we are comfortably long 10% of the book in delta, rolling to 50% by February when our options short roll off. Lots of positive carry just staying here happily marginally long and looking to add in the near future.

Till Next Time

Disclaimers

Great read. I agree, silver is a good buy. Curious if you've done any research Platinum?