Staring at the (deflationary) abyss

Investor Update - March 30th, 2020

Yesterday we sold (most of) our gold.

Something about the movement in inflation linked bonds reminded us of 2008. When people start pricing in deflation, and all of a sudden investors had to break out the pencils to see which of their TIPs lost money when prices fell.

This was a bit of a widowmaker trade for me at Lehman personally.

I began to accumulated TIPs in Q4 2008, legging into a falling knife trade. Only to have a potentially epic run cut short on January 16th by a margin call from above ("we are reducing risk and I don't understand this trade, kill it").

Sometimes the fundamentals don't matter, sometimes you just have to sell.

Which would explain why LTPZ (another inflation linked bond ETF) is currently trading a big discount to NAV.

Someone doesn't care, someone just has to sell.

With TIPS/LTPZ getting whacked, and real yields rallying, everything started to get a bit 'dollar squeezy.'

Higher real yields + higher dollar = doom for gold.

So, in spit of the fundamentals, we got out.

Thing is if you are thinking about inflation vs deflationary impact of coronavirus, we don't think it's straightforwardly deflationary.

If you are selling airplane tickets, coronavirus is deflationary.

If you are selling NBA tickets, it's deflationary.

If you are selling face masks or medical equipment or toilet paper, it's inflationary.

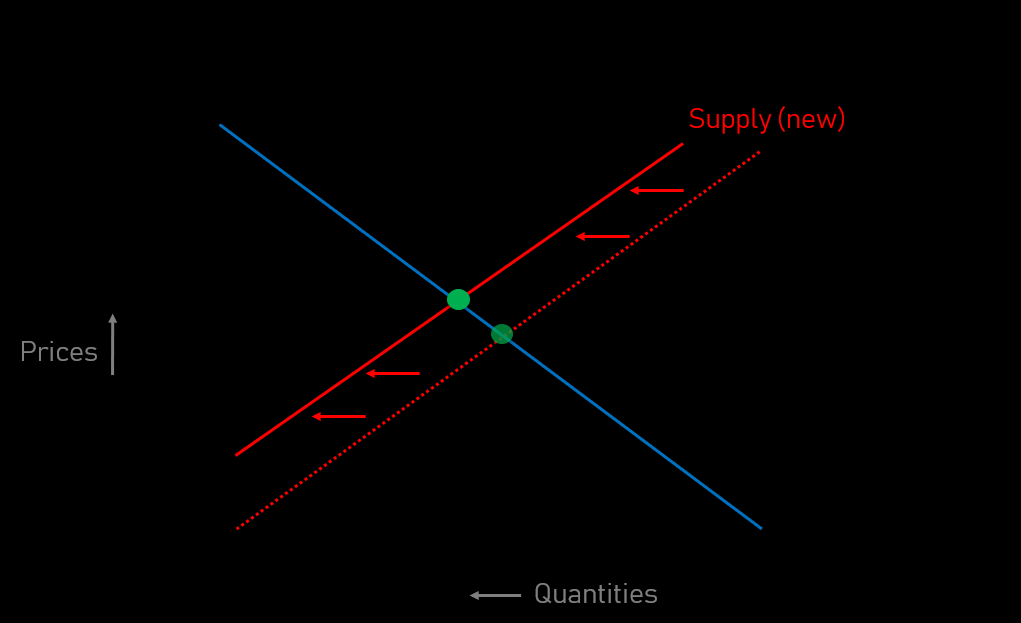

And really there's lots of other demand that probably won't be impacted that much by the virus, food, clothing and shelter etc. Meanwhile, every other headline is about supply disruptions. Which, if I remember my econ 101 tend to be inflationary...

$/Q = P

When you have the same amount of dollars, but a lot less stuff, it means you have a lot more dollars per unit of stuff.

It means higher prices.

On a brighter note, as we learn more about the virus, it appears to be relatively heat-phobic.

With the worst outbreaks occurring in the northern, temperate zones currently experiencing wintry 0~10C degree temperatures.

And so while we might be in for a rough couple of months, let's not forget...spring is coming.

Leaving us wondering what the world looks like in May, after governments have effectively printed enough money to keep the economic machine running for two months while the economy 'works from home'.

Seems like we could be sitting here with a lot of printed money, and not as much stuff.

Seems like on the other end of this panic, we might be in for some inflation.