So, you wanna bet on AI?

Part 1

Lotta people looking to invest in AI these days.

New folks to the party.

Take it from someone that bet their career on it - 8 years ago (!) - it’s going to take some time.

First step for most people is try to apply it to your work life…

Maybe you are a big corporate, looking to improve your productivity workflows.

Maybe you are a fund, looking for the latest alpha in tech.

A bank, trying to manage it’s duration.

A fintech, trying to report users to your VC.

Maybe you are someone that REAAALLY liked the Rose demo, and now you are trying to homebrew your own (you know who you are).

Each of these examples - incredible expensive experiments - that may or may not bear fruit.

So let’s do it the good old fashioned way, and go long AI by punting stocks!

Turns out, it’s not a bad theme to bet on.

In the interests of expediency, we put together this basket of stocks for you. The performance profile below is in log scale, meaning that outperformance is a ‘wowza’.

Which, when you are looking further up close, looks like a bit of a bull market!

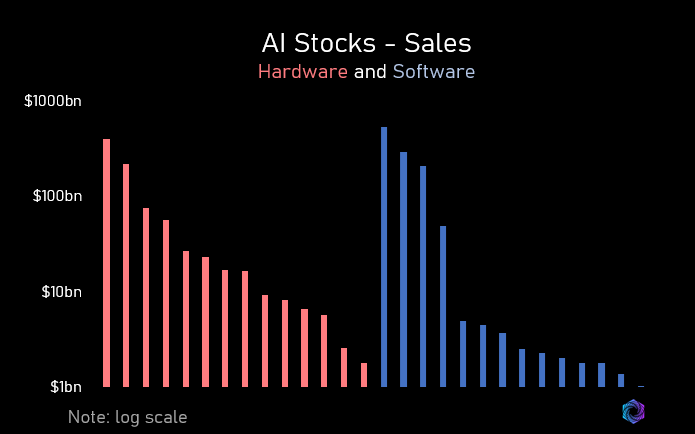

A nice mixture of hardware and software businesses in our basket.

As you would expect, hardware companies spend a lot on cost of good (COGS).

Outside of a notable exception, our hardware AI stocks trade a noticeable discount to software, where 4-20x sales (in public companies no less) is common.

Our hardware names are entirely positive margin enterprises.

On the software side, not so much.

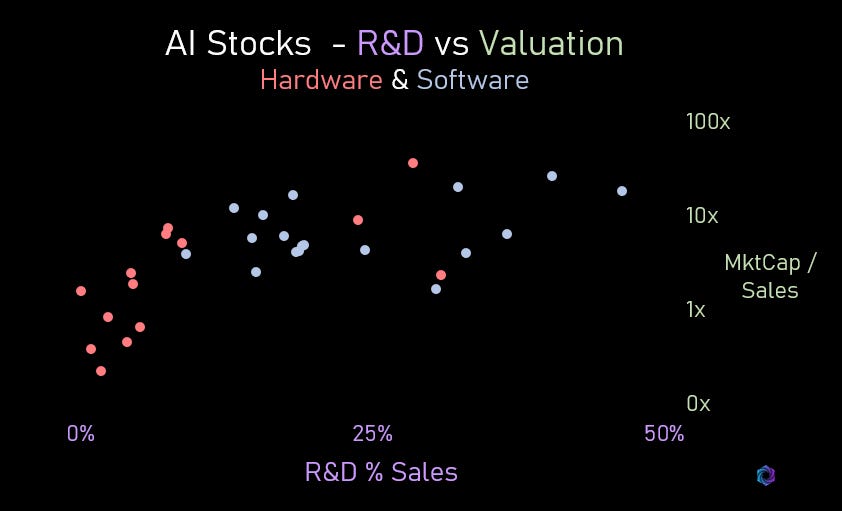

Even though there are decent margins in hardware, the market places relatively low valuation premium on the sales of these hardware shops.

Interesting that the market seems to reward R&D a LOT.

We’ll go deeper into this group of AI stocks next time, maybe even provide a little transparency on who’s in the book.

As a sneak preview though….

Taiwanese stocks looking pretty good right now.

Disclaimers