Silver in India

There was a trade called “Gold in China.”

The conclusion to the game.

We show you where the printing is,

you tell us where there’s pain.

We show you the relief valve,

the asset that will gain.

A trade is just a theme.

A basket with a name.

Sometimes it’s called a ticker.

Sometimes it’s called a SAFE.

A handle to represent

where this idea lives, in my human head,

without paying any rent.

Always a wrapper, a mnemonic, a meme

aka an idea

that comes attached with a price!

Sometimes you point to a trend.

Best if you can use a track.

Sometimes to really prove it,

you need to go way, way back.

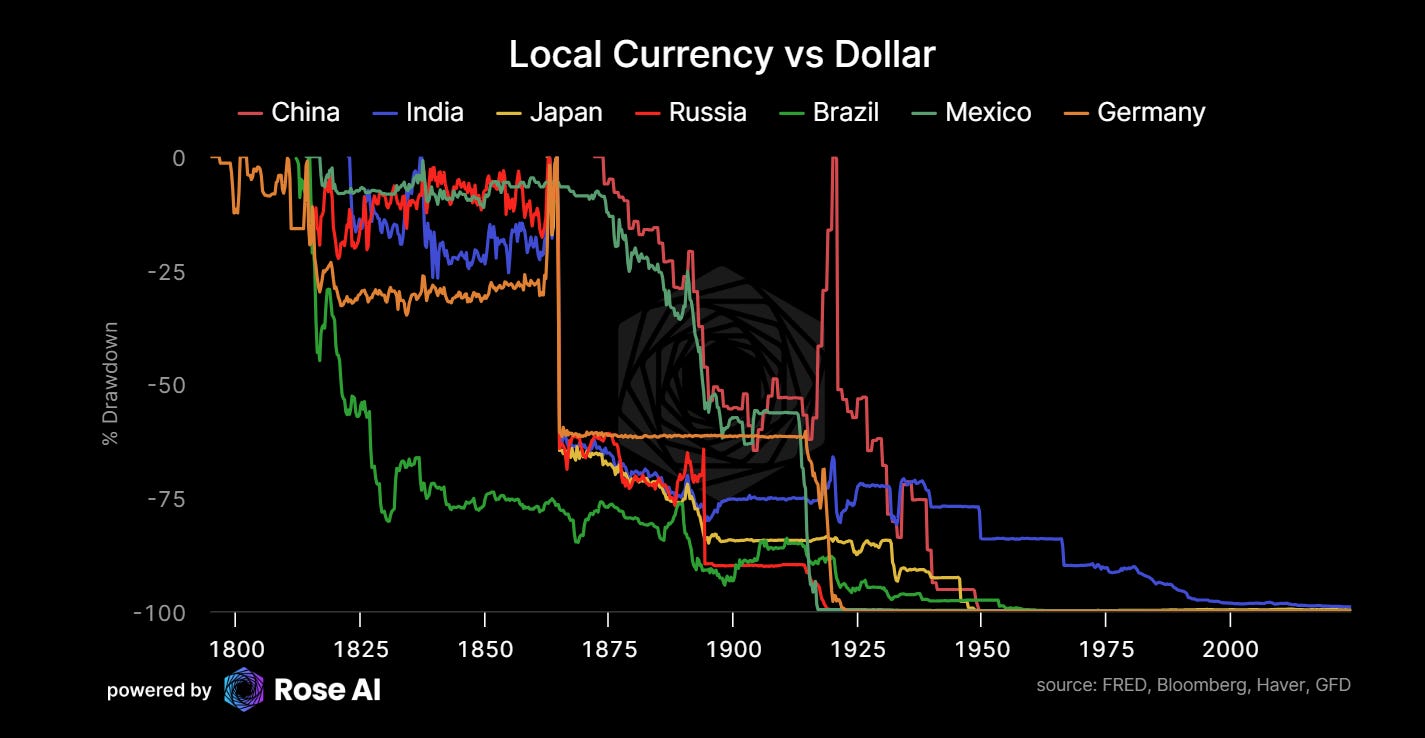

Thing is you learn a lot by where your data ends.

Or rather, when it starts.

Did that timeseries appear post World War era?

Or earlier still?

Do you need a log scale to sort it out?

These emerging market lessons generational,

in ‘strategic asset allocation.’

Don’t trust paper,

or things denominated within.

Buy real assets with your money.

The road to true wealth lay therein.

So now we’re going to shift the frame.

Play this story out.

Apply this to the present day.

Help us sort this whole mess, right on out.

We started with “Gold in China”

The idea being relatively pure.

There’s a lot of money in China.

Looking for a home.

A place to park it, right offshore.

Say a bit of that money flows into gold…

Once the propcos start to blow…

Or trusts issuance starts to slow….

Then pop goes the market!

The lessons from the past,

telling that capital where to flow.

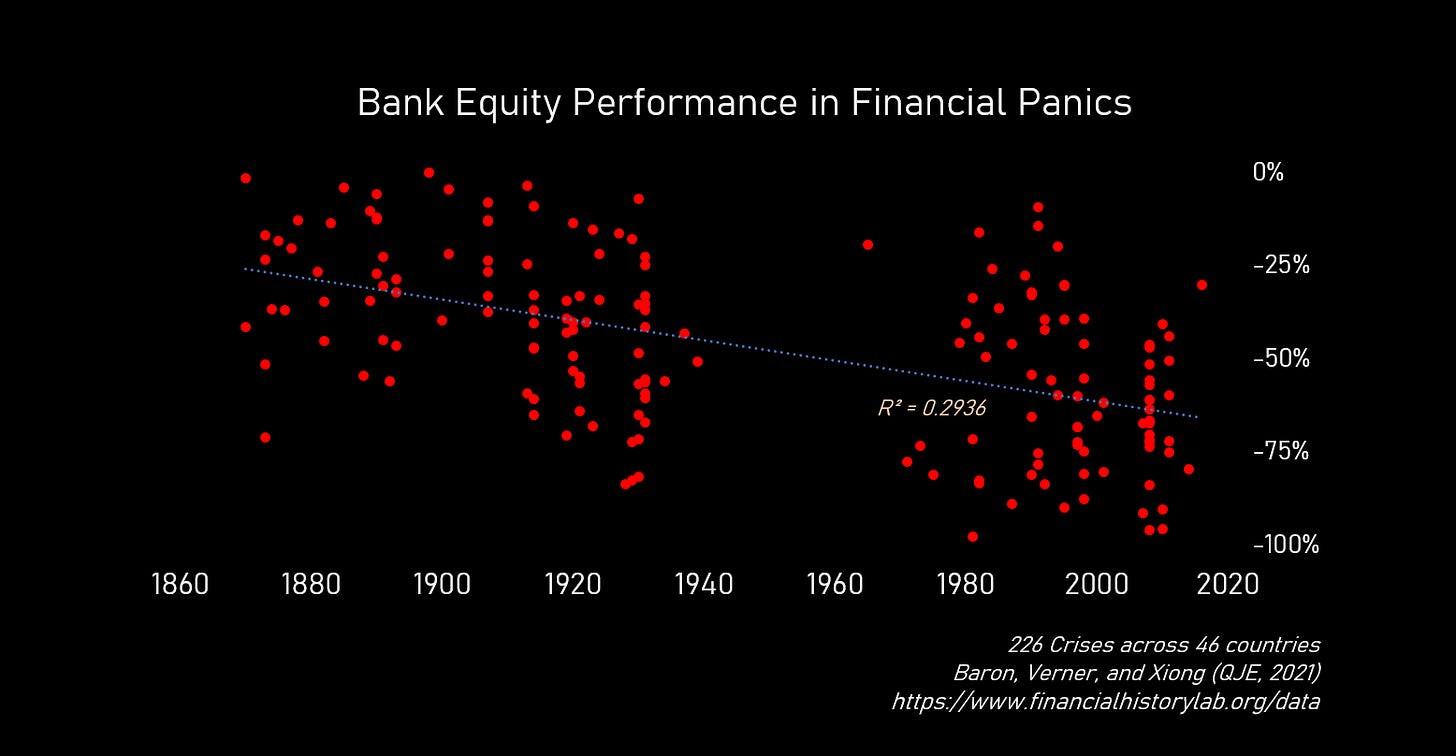

When the system starts to reverse,

the banking system find itself a trap.

These crisis drawdowns are increasing

as leverage upon leverage gets piled right on top.

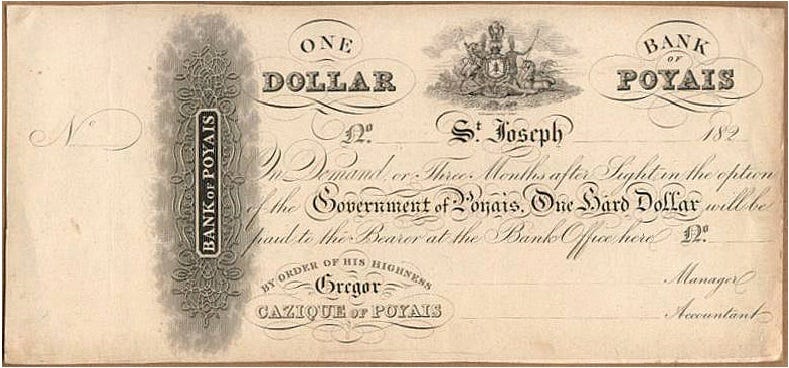

“Hold onto something real”

vs mechanisms to create liquidity,

or promises to deliver.

Pieces of paper.

Printed by the other guy.

“Gilt edged”, to make you shiver.

So take that core idea:

“Buy something real”

and pay for it with currency borrowed.

The kind unlikely to be paid back dearly.

Apply the idea to their neighbors.

They don’t need the story told more clearly.

Transmute that golden demand into it’s sister, silver.

Diversify the trade.

Swap out your borrowed Chinese yuan for Indian Rupees.

We’ll start to build a portfolio.

Designed to really last.

If you liked JPEGs of dogs the first time.

You’ll love them, this time with hats.

$3bn worth of rally here.

Just pls don’t tell the cats!

Did you hear about the time the doomers got $660m in SHIBA?

Didn’t stand a chance.

By the time they tried to liquidate,

a lot went up in smoke.

Still you gotta respect,

a tax arb with such a big moat!

If you like those digital tokens.

We think you’ll like the physical versions a lot.

We used to call them bearer securities.

When the lights go out, they’re all you got.

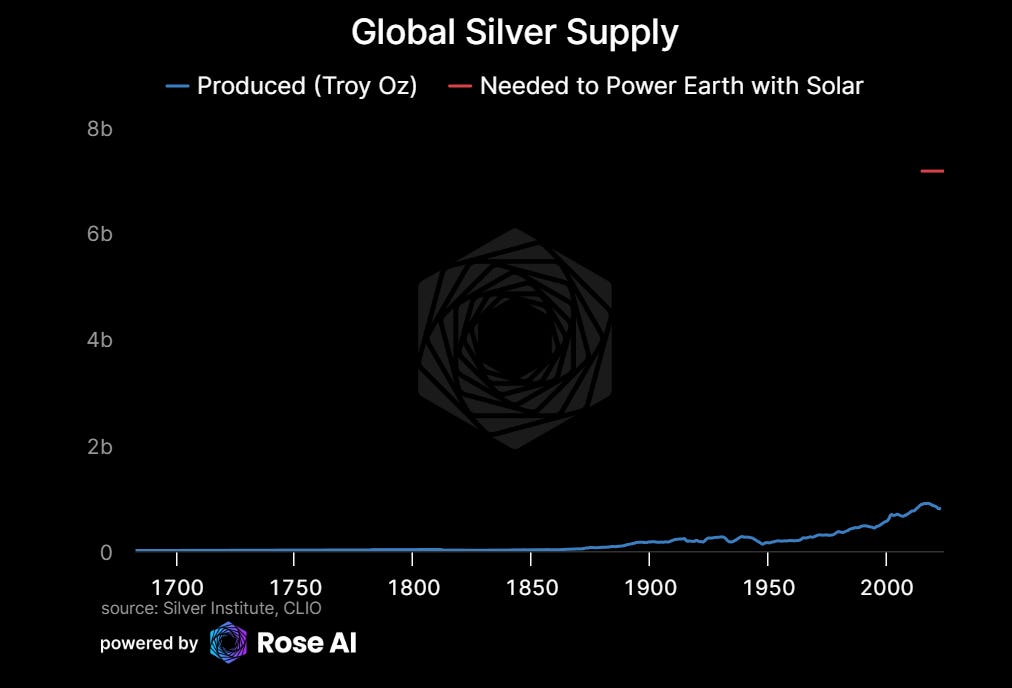

These days these shiny bearer rocks also go into electronics.

In particular the kind that generate energy.

Those photovoltaic cells eating up all my gains.

Demanding demand that takes up all my new supply.

Imagine we replaced everything with solar:

All 600 ExaJoules, or 170k TWh a year.

Looks like we’d need ~7x more silver.

Just to make the gears turn clear.

Pulling energy out of silver is expensive.

It’s still rather a chore.

Looks like we’d still run out.

Even with 4x more!

That energy demand bill coming due,

before the new data centers come online.

Those machines are rather hungry,

more Energon would suit them just fine.

Dashboard Links

Disclaimers

Links seem to be broken at least for me.