Portfolio Update: January 2025

Today we’re going to take a break from rants on AI and get back to markets.

Give the people what they want:

Yup, we’re going to go 100% open source.

This time, on our investment process and portfolio.

In the past, we’ve been a little hesitant to post our actual ideas and implementation, you know, we wouldn’t want to be accused of providing unsolicited investment advice after all (and to be clear, we’re not and if you think we are you are simple).

Investment advice should always be specific to a particular person or institution’s existing portfolio, balance sheet, risk profile, thematic bias etc etc. If someone is telling you something with 100% confidence they are full of shit.

That being said, if we can see Pelosi’s portfolio, and funds have to post 13Fs, we should be able to post our book and talk about it. So in the interest of transparency, I’m going to start publishing my ‘book’ here, and talking through in the moment how I am thinking about these risks.

Also, and to be clear, this is not ‘alpha’ portfolio or my ‘beta’ portfolio. This is not the portfolio I would recommend to you. The last time I did that I told institutions they had too much venture and not enough gold in China.

Rather this is a portfolio I made for me. A portfolio that is designed to retain liquidity, protect / hedge some of the illiquid beta and alpha trapped in the equity of a company that might be worth billions someday and could be worth 0 in twelve months. A book to help you hedge. Meaning to some extent it’s supposed to be low or even negative correlated with stocks (though at the moment we are running low leverage and so are having to take some market correlation to generate a positive expected return).

Anyway, with that in mind: this is not for you…let’s do the quick intro.

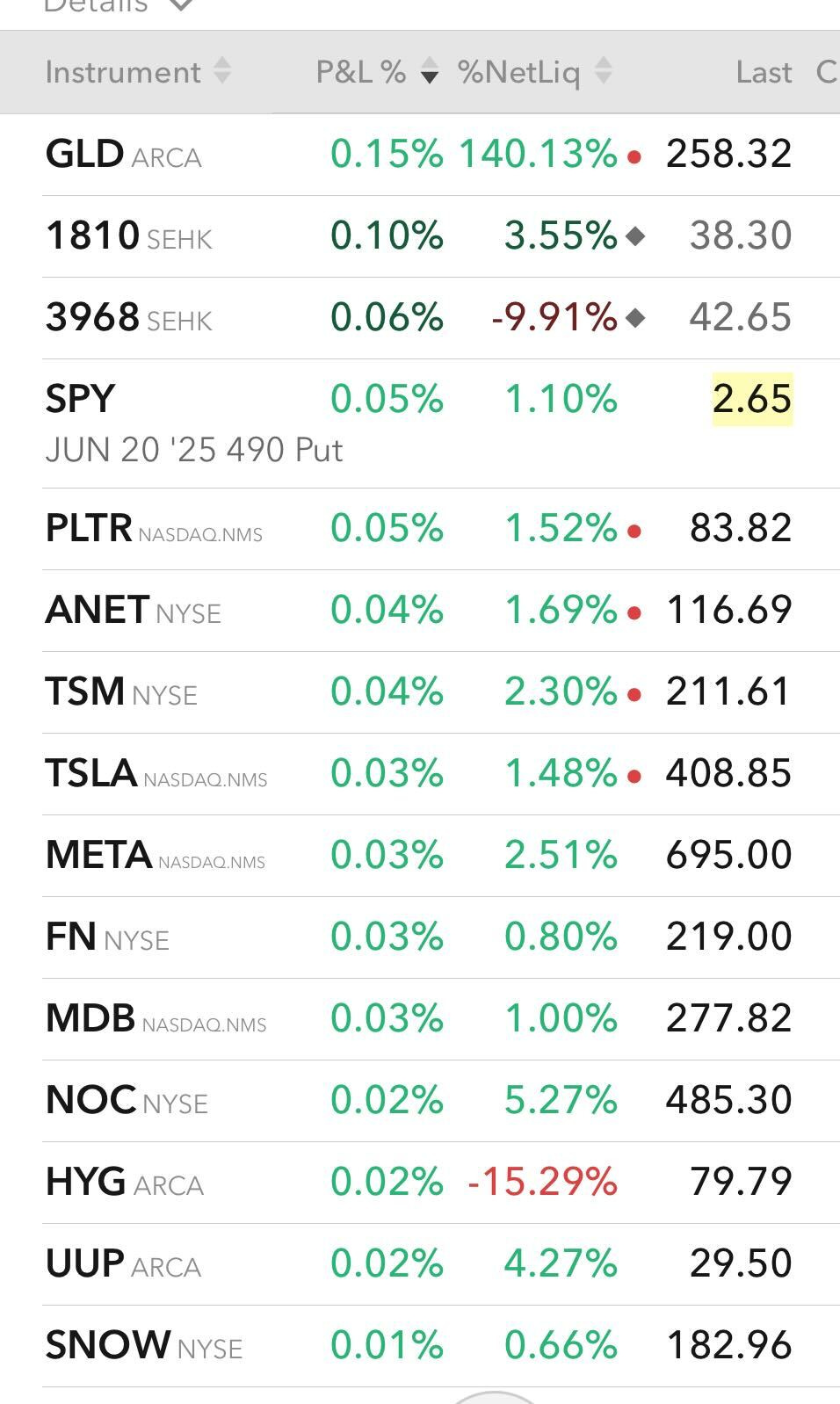

The last time I looked at this book was the 25th. The %NetLiq is what you might call my ‘delta’ or notional exposure as a % of the portfolio. The P&L% on the left is the positions impact on my overall portfolio.

The 25th was a bad day for gold. Which meant it was a bad day for me.

Previously, I had some golden butterflys that went way in the money. Which made money, but also left me with a lot of gold when they expired, and I left it on.

Meaning my ‘delta’ for gold was more than the total net value of my portfolio!

Put another way if gold goes down 66%, I’m zero’d out.

Which is why they tell you not to run too much leverage at home. Anyway, Monday obviously kind sucked. On the gold / silver as well as the NVDA. Down more than a percent kinda day, which is more than our target vol.

As you can see, that was also the local bottom. Sometimes it pays to hold, as we’re back at the highs.

That was also the day NVDA was down more than 15%. We are in the process of writing our screed on how much compute DeepSeek would lead to, given the chain of thought, given how memory intensive that ‘intelligent’ models really are.

So we bought some more Nvidia and sold some Microsoft.

In the coming weeks, we’ll go deeper on the individual positions, our portfolio construction and risk, as well as pursue more alpha in the infrastructure trade. The pipes, the chips, the data. That kind of thing.

Meanwhile, I’ll probably roll some of my gold into silver today.

Our options there also ended up in the money, but not to the same extent. Dollar is strong and so time to diversify a bit.

In the meantime, I’m out of time for today, it’s back to the terminal. The point of these updates is just to get them out in less than 30 minutes, so I can post more frequently amidst all the rants. Meaning: there will be typos!

Till next time.

Disclaimers

Charts and graphs included in these materials are intended for educational purposes only and should not function as the sole basis for any investment decision. As noted the views in this portfolio are not intended to maximize return and any use in a portfolio aught be considered in the broader context of your portfolio and investment needs and obligations. Please consult with a registered investment advisor if you would like financial advice, that’s their job.

This letter does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Rose, Campbell or any other third party regardless of whether such security, product or service is referenced in this brochure. Furthermore, nothing in this website is intended to provide tax, legal, or investment advice and nothing in this website should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

THERE CAN BE NO ASSURANCE THAT ROSE TECHNOLOGY INVESTMENT OBJECTIVES WILL BE ACHIEVED OR THE INVESTMENT STRATEGIES WILL BE SUCCESSFUL. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. AN INVESTMENT IN A FUND MANAGED BY ROSE INVOLVES A HIGH DEGREE OF RISK, INCLUDING THE RISK THAT THE ENTIRE AMOUNT INVESTED IS LOST. INTERESTED PROSPECTS MUST REFER TO A FUND’S CONFIDENTIAL OFFERING MEMORANDUM FOR A DISCUSSION OF ‘CERTAIN RISK FACTORS’ AND OTHER IMPORTANT INFORMATION

Seconded - rare and valued transparency, much appreciated.

insightful!