Oh hi Silicon Valley Bank 👋

Looks like the unicorn economy is experiencing a run for liquidity.

We shorted Silicon Valley Bank at Black Snow.

Twice. Once in 2016, and then again post COVID.

Terrible trade. Stopped out twice.

Always 5 years ahead…

Turns out they do a lot of intermediation for LP capital calls to funds.

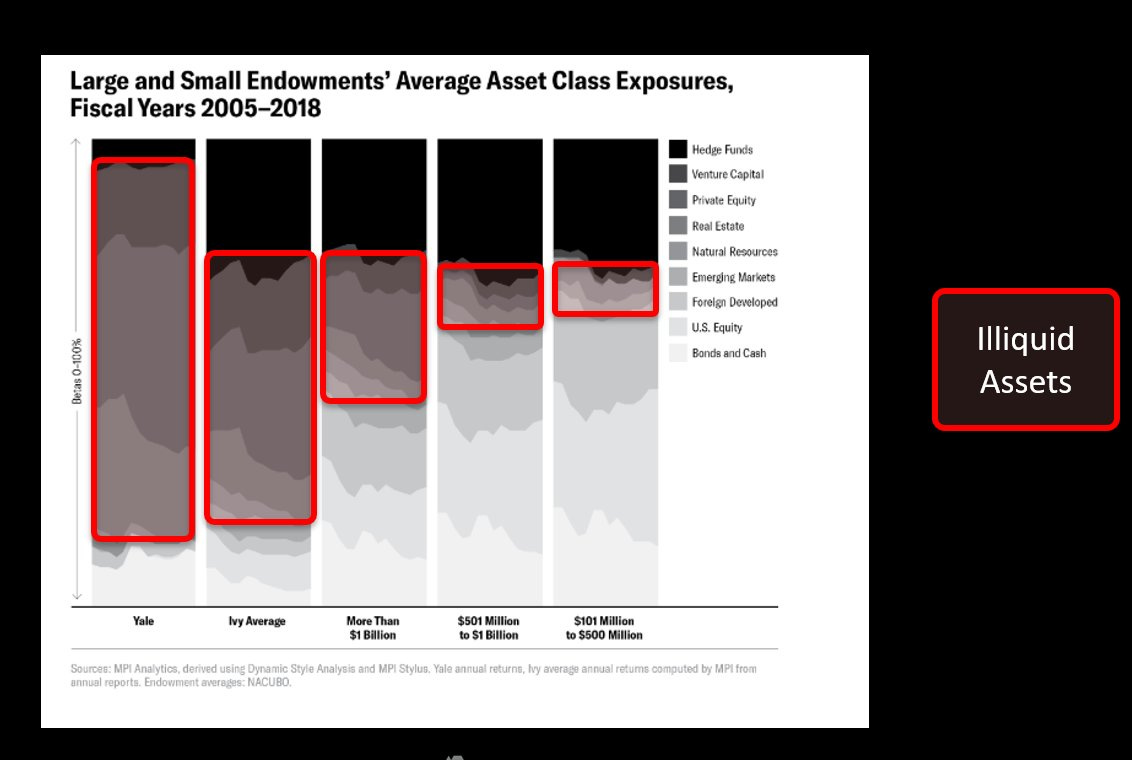

LPs that took their old 60/40 portfolio, and divested to buy illiquid, levered beta in fixed income and PE/VC.

Not going to too well.

If only someone could have known.

If only someone could have told us how super-accommodative monetary policy and faddish investment trends would lead institutional investors to overweight illiquid, levered beta. First PE, then VC, and finally, if you prefer balance, levered inflation linked and nominal bonds.

Remember, there are bonds in the stocks, and the Fed is tightening.

Be careful out there.

With the amount of secondaries that just happened into year end and how many of them relied on hidden leverage, there will be blood. So many funds have been deploying into investments without having finished calling capital, but relying on borrowing against those commitments (that have since been flipped since the initial LP).