Is it time to start worrying about US economic surveys?

According to the corporate sector, yes.

Surveys can be a good way to understand what's going on the economy.

Below, we made an index which collects a handful of the most important economic surveys / stats for US domestic activity. This is a relatively bearish indicator for the economy.

Notably, unemployment levels remain low, even though consumer expectations have fallen off remarkably.

Consumer confidence is down from the lows but hanging in there.

That makes sense, as inflation has begun to eat into real household wages, even before we see any credit or monetary tightening related lay offs.

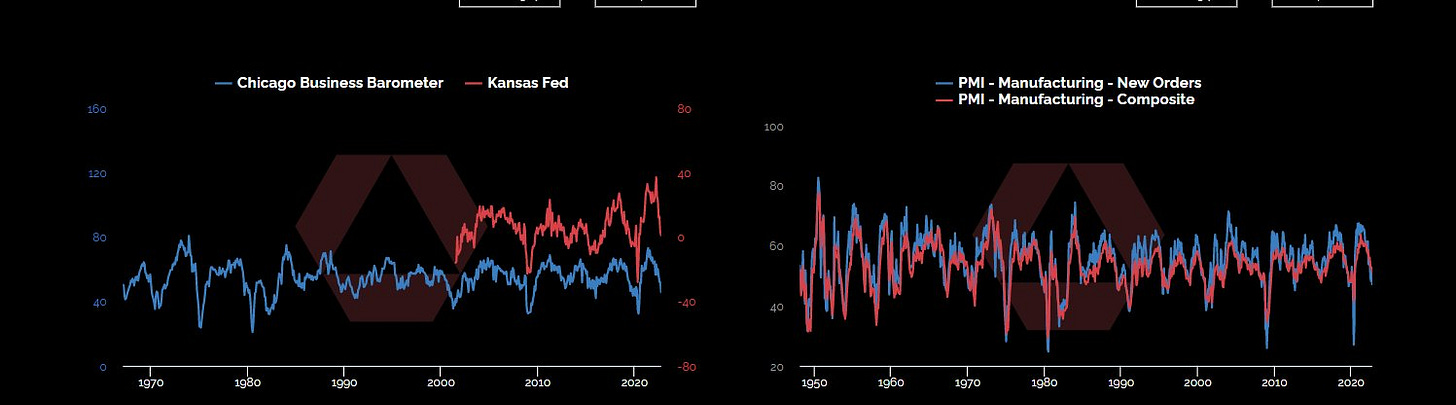

The majority of the deterioration in our survey indicator is a result of very weak corporate surveys. There are lots of ways of measuring these, but they are all in weak territory. Likely the corporate sector is looking ahead to borrowing conditions, and seeing weak demand.

Knowing what's going on with economic surveys is useful for understanding the economy, but not necessarily trading markets. Below are the backtested returns from using our economic survey index to buy or sell stocks and bonds.

And here’s the video where we walk through this dashboard. Still experimenting with the form, be gentle, yes the music is way too loud.

:)

Disclaimers