How can we measure growth in China without the GDP Report?

Luckily for you, Rose has an answer

Yesterday, China refused to release their Q3 GDP report.

For those used to following their banking system, this is no surprise.

China watchers know to build their own data, and below I will show you what the stats are saying, and why it's SO bearish.

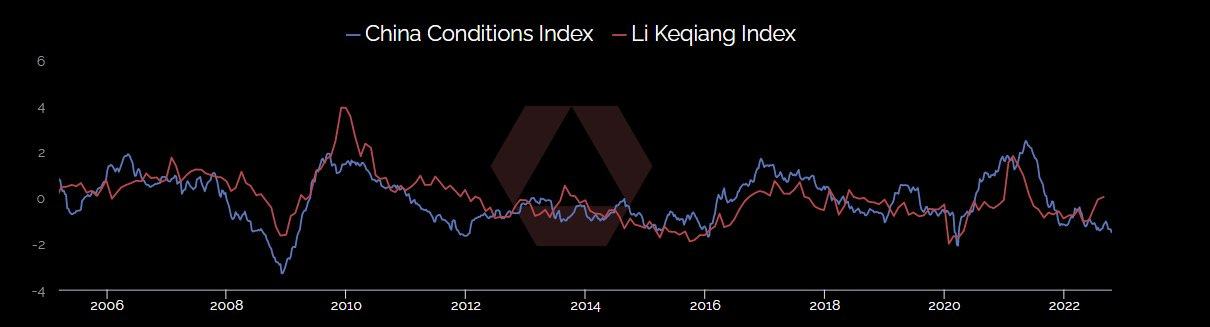

Our indicator tracks data across three themes.

Activity - Measures of real economic activity.

Policy - Measures of monetary policy.

Prices - Measures of asset and commodity price inflation.

As you can see, activity and prices are as bad as they have been since lockdown, in spite of strong easing support by the PBoC.

Looking first at the underlying stats for Activity, I will show the raw unadjusted series on the right, and the 'indicator vs trend' we extract as a signal from this data. Starting with consumer confidence...lockdown has been a disaster here.

Electricity Consumption looks healthier, though seasonally adjusted and de-trended relative to past strong growth, it's actually a relative weak reading.

Railway Freight traffics looks a bit more healthy, though on marginally so. This is likely why the Li Keqiang Index from the Economist is stronger than ours, as it relies on electricity and freight data.

Industrial Production is pretty choppy, and you can see how the Spring 22 lockdown really hit across all sectors of the economy. 4% a year growth here is low by historic standards.

As opposed to some of these 'hard measures' of activity, soft measures like surveys are much more negative. An aggregate of various business and banking surveys are as bad as they have ever been.

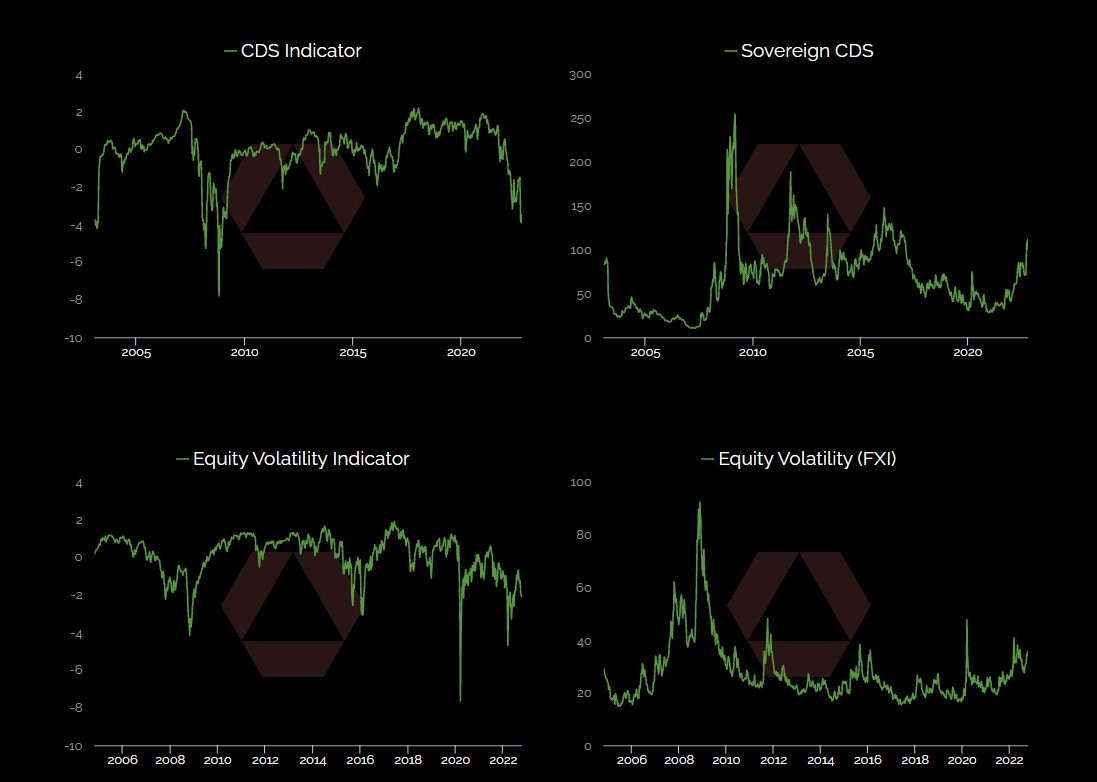

Weak conditions for economic activity are mirrored in financial markets, where prices for assets has crashed.

Property prices are confirmed falling now across China. Given the amount of debt funneled into real estate, this is extremely bearish.

Steel is well off the highs, after being inflated along with other materials in the build boom coming out of the covid easing. Energy prices for inputs to steel making like coking coal remain relatively elevated however.

Like steel, iron and copper are now well off the highs, though long term demand/supply worries continue to support copper prices. Iron and steel, most closely connected with construction and real estate are saying the bubble is dead...for now.

Here's confirmation that the financial system is in trouble. In addition to falling prices for commodities and real estate, financial assets like REITs and bank stocks are collapsing.

Turning to our economic policy indicator, we can see that policymakers are already stimulating into this economic weakness. Pretty much as much as they have ever done since the GFC. With Activity and Prices so weak, it begs the question of what it would look like without this.

The strength of our policy indicator derives from:

a) very low interest rates.

b) strong money and credit growth These stand out in stark contrast to policy in the west, where the Fed and others are at peak tightening.

This is pretty much as bearish as it gets, Activity and Prices cannot catch a bid even with strong Policy easing.

Which explains the lack of transparency. Anyone following Evergrande, Shengjing, Huarong etc will recognize: If you can't report good news, just don't report!

Note this piece was originally posted earlier this week as a thread on twitter. Follow us there for this kind of work as and when it comes out.

Disclaimers

Great stuff. Found your substack after your great podcast interview today on the Macro Trading Floor. I think whether China is reopening or not is THE factor to watch in real time to determine if the global economy will dodge the recession bullet. The White Paper protests have increased the likelihood of earlier opening.

I have been looking for leading indicators that would help us determine if they are reopening and this blog gives several good suggestions.

Hi Alexander, just a quick question, those data in the chart are they available on Bloomberg? Or they are derived data that is prop to you.

I see coking coal CKCA on BG the price is very different from what you have.