Don’t F With The Money

A Family Fraud

Look, I don’t want to be writing about SBF. I had no exposure to the house of cards, outside of a couple friends who had money on the exchange, and I don’t place any blame on folks who gamble and lose. This post isn’t about the evils of speculation, or crypto, or any of the usual moralizing.

This is about the rules of the game. Who wins, who loses, whether we allow cheating. Who accumulates political power, and how. And most of all, who goes to jail and why.

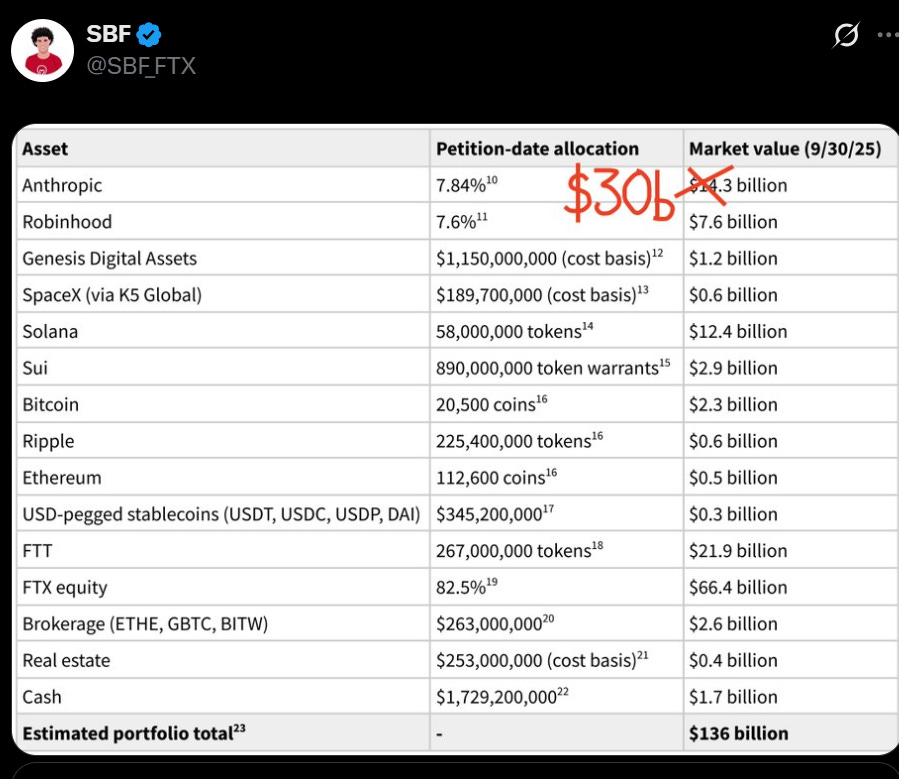

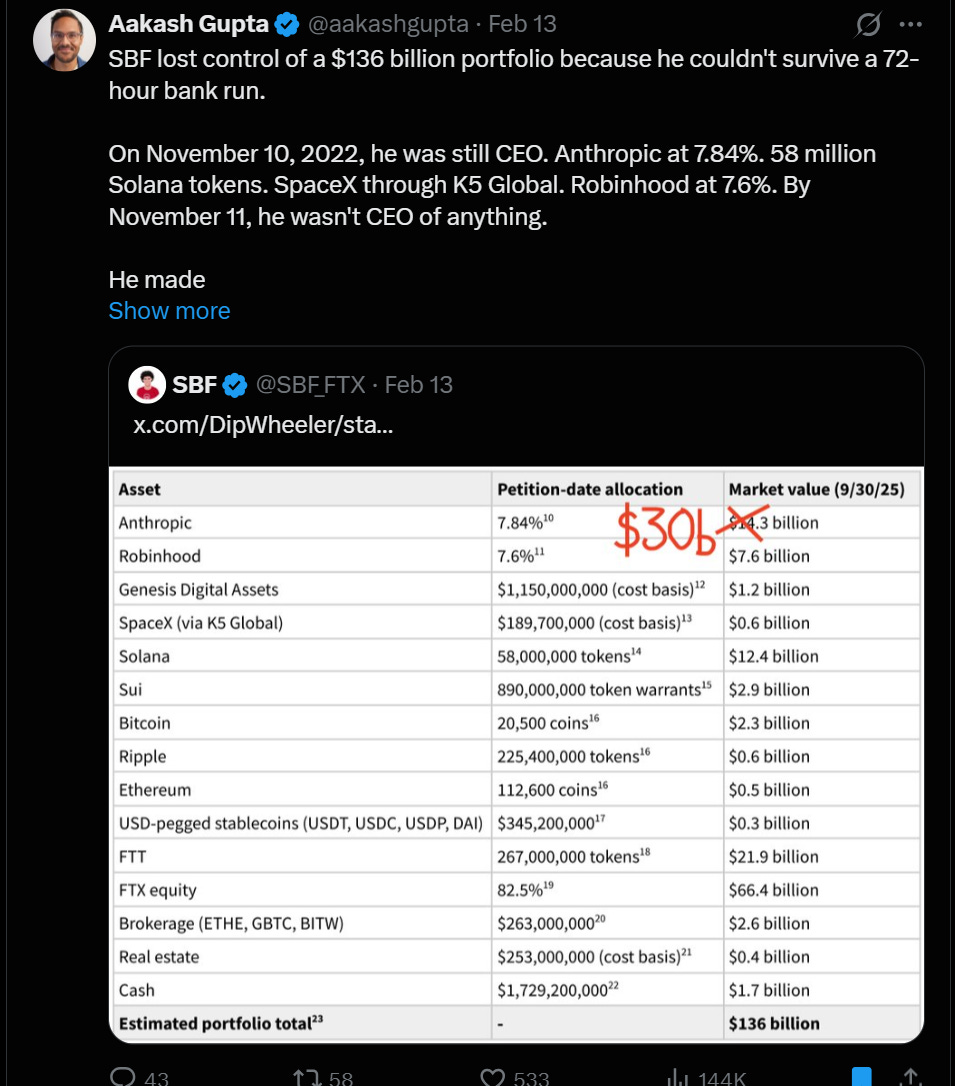

I don’t even want to be writing this on a Sunday, but as you may have noticed, SBF has been tweeting incessantly from prison, trying to glory-wash himself with Anthropic’s success, manufacturing a consensus that FTX was solvent, that he was just a good venture investor who got caught in a bank run, that he’s basically a political prisoner. All of which, like seemingly everything else he says, are lies.

So today we’re going to take this from the top.

Principles of Money Management 101

The most important principle I learned at Lehman Brothers was simple: Don’t F With The Money. I’m surprised they didn’t teach it at Jane Street.

Back then, and I’m sure to some extent today, it was common practice on the trading floor to “smooth” your P&L. What this meant practically was marking your book to squirrel away money on good days by under-marking your positions, so on bad days you could lessen the blow by marking aggressively in the other direction. If you have 10 assets each worth $1m but you mark them at the bid at $900k, you’ve got a $1m buffer to cushion your daily reporting when things go wrong.

Now imagine instead of 10 stocks with public bid/offer spreads, you had 1000 interrelated exotic derivatives, and the marks depended on concepts like “implied correlation” or “expected dividends” or “implied volatility.”

You can see where this is going.

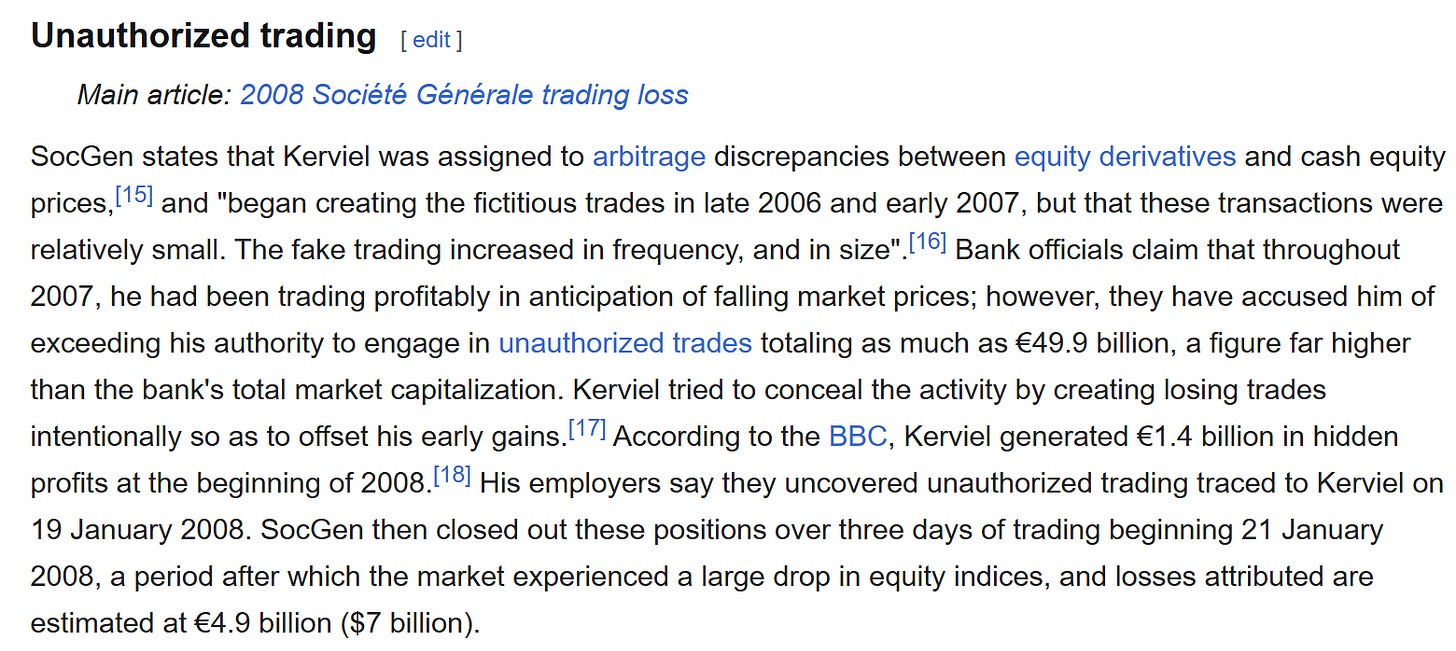

Folks in the market long enough to remember Kerviel have seen the consequences. A single trader who appeared successful as a "flow" trader, offsetting the firm's equity futures exposure, was actually just punting his portfolio. His bosses didn't pay attention when he was printing money. When his gambling went negative and the firm discovered it held massive long positions, the carnage to unwind sent the entire European stock market down 7% in a single day on no news.

The consequences of messing with the money are much greater than any individual’s losses. There’s an important, diffuse value in the truth that markets ascribe to the numbers and pipes they run on. When you mess with that truth, you undermine the financial position of every participant.

FTX customers learned this the hard way.

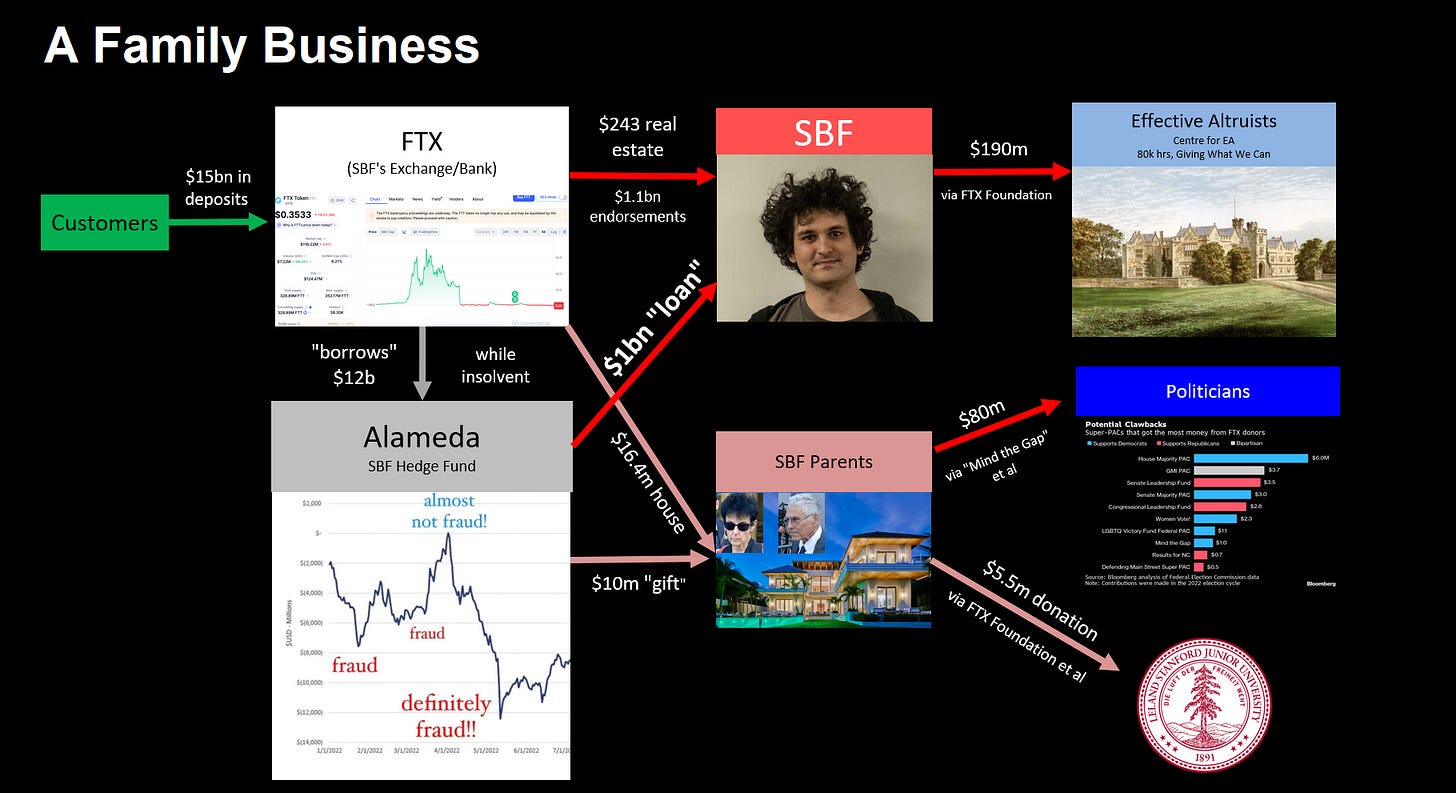

But my problem with FTX wasn’t just that they lied about stealing customer deposits. It’s two other things:

They used the same pipe they stole through to enrich themselves personally.

They used that enrichment to buy off politicians.

This is where the scale gets much bigger than Sam and his apologists would have you believe. We move from a messy bankruptcy, past securities fraud and wire fraud, into violation of tax laws and election laws. Into RICO territory and criminal conspiracy.

It’s an actual threat to our democracy. When people see rich Stanford professors walk free while Curtis Wilkerson serves 25 years to life for stealing a pair of socks (yes, that’s a real case, and we’ll come back to it), they stop believing the rules apply to everyone. And when people stop believing that, they stop following the rules themselves.

When two-tiered justice becomes undeniable, rule of law erodes. This is how liberal consensus dies. Not with a bang, but with a shrug.

So no, this isn’t just about whether some gamblers lost money on a shady exchange.

The Rehabilitation Campaign

SBF is tweeting from prison. Let that sink in.

A convicted fraudster serving 25 years is running an active PR campaign to rehabilitate his image.

The current narrative wash goes like this: FTX was "money good." If only they'd been allowed to hold customer deposits for four more years, everyone would have gotten paid back. The bankruptcy proved it: creditors got 118%! Sam was just a genius VC who got caught in a bank run orchestrated by his enemies (Binance). He's basically a political prisoner now!

This is poppycock. But it’s clever poppycock, because it requires you to untangle the very fraudulent accounting that got us in this mess to see through it.

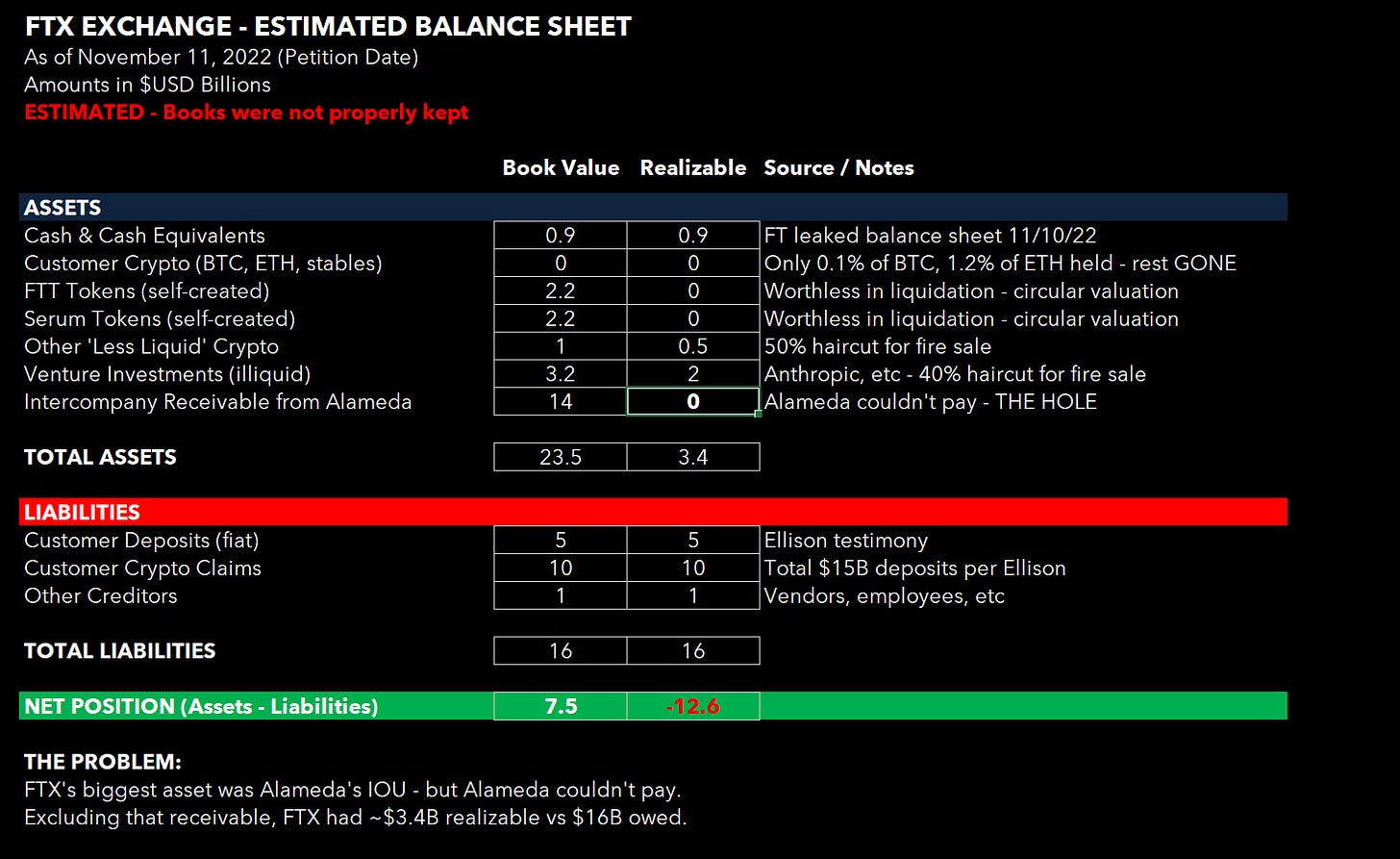

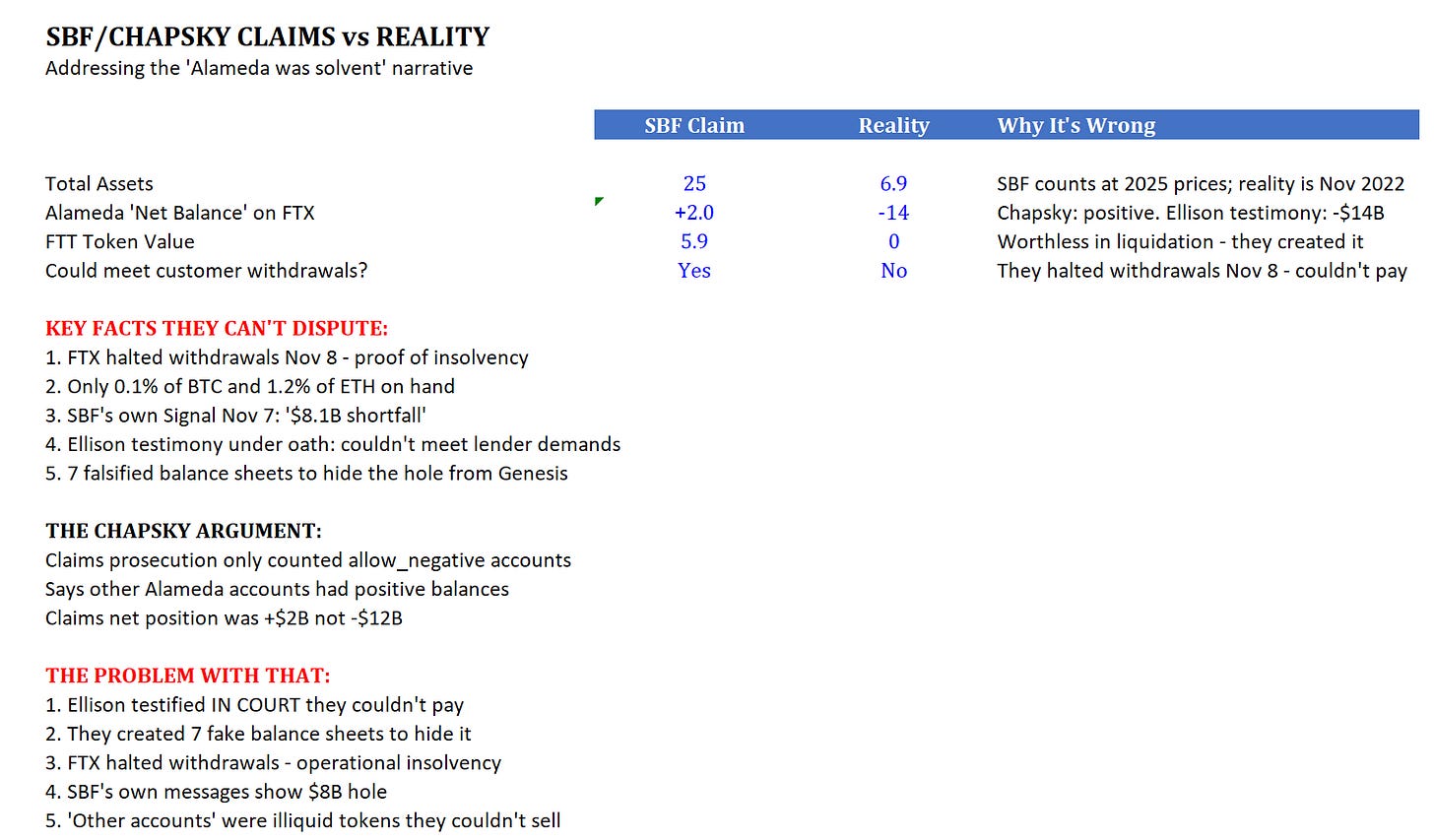

The guy who’s pushing this most aggressively is Dan Chapsky, who filed a sworn declaration arguing that Alameda actually had a positive balance on FTX, not a negative one. The prosecution, Chapsky claims, only counted certain “allow_negative” accounts and ignored other Alameda accounts that had positive balances. Net it out, and Alameda was fine.

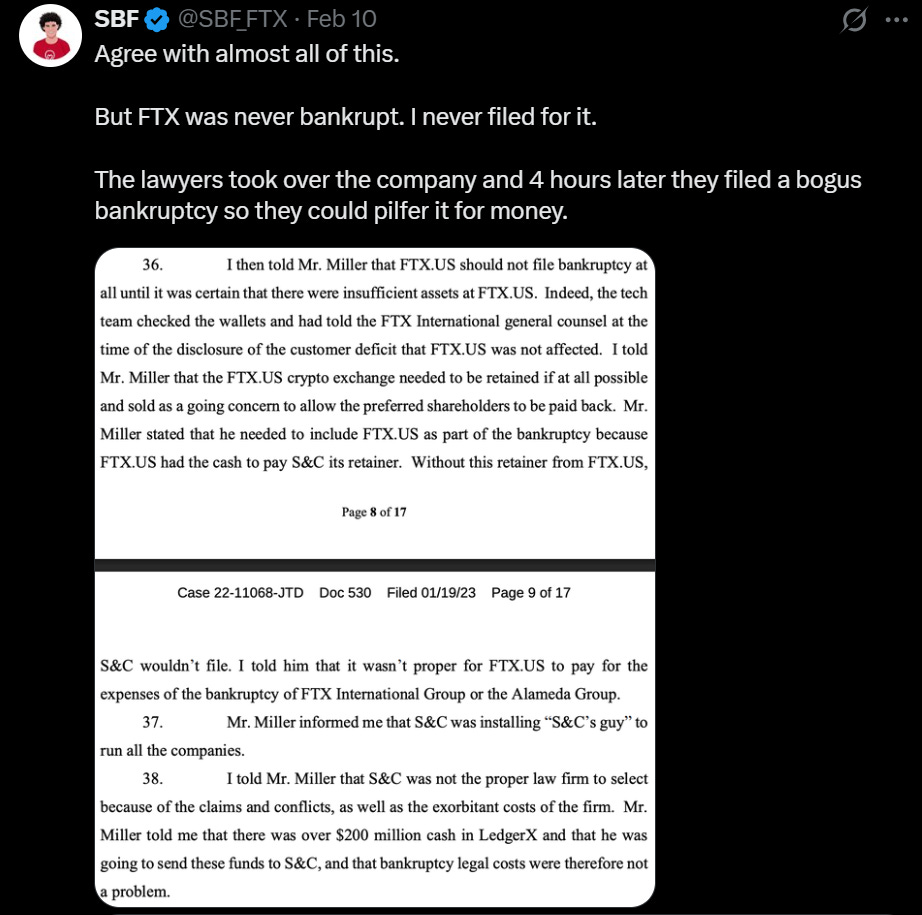

SBF has been signal-boosting this everywhere. Here’s him telling me to stop commenting on things I haven’t read when I posted Alameda’s crazy negative $10bn+ pnl too many times in the replies of his sock puppets.

Well Sam, I’ve read it. Took the liberty of burning a couple of hours on Valentine’s Day weekend to deal with your drivel. And now we’re going to explain exactly why it’s wrong.

FTX Was NOT “Money Good”

Let’s start with the obvious: FTX halted customer withdrawals on November 8, 2022.

That’s it. That’s the proof of insolvency. When customers ask for their money and you can’t give it to them, you are insolvent. Everything else is commentary.

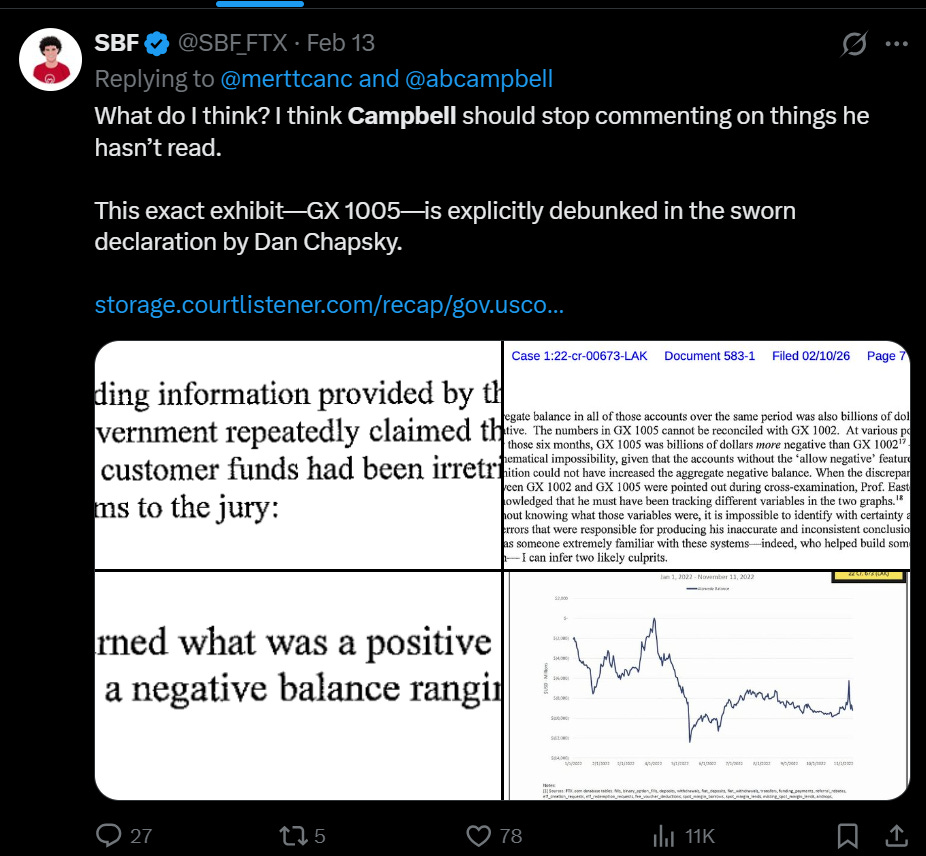

Your job was to take deposits from customers, in dollars and crypto, and hold it on balance sheet. Section 8.2.6 of your own terms of service. You didn’t, you used them to buy yourself real estate, you used Alameda to launder them to yourself and your friends, you used them to buy off celebrities and politicians. End of story. Whether FTX was technically solvent is a red herring.

But since SBF wants to play in the weeds, let’s play in the weeds.

The Balance Sheet Reality

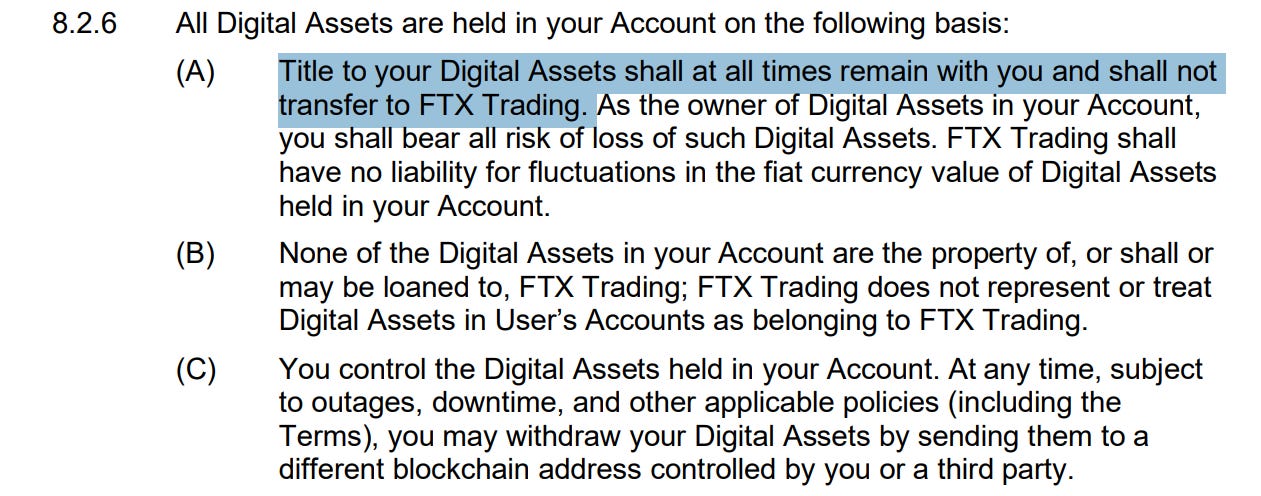

Here’s what FTX actually looked like on the petition date:

On paper, FTX had $23.5B in assets against $16B in liabilities. Looks solvent, right?

Except $14B of those “assets” was an IOU from Alameda. A receivable that only had value if Alameda could pay it. And Alameda couldn’t pay it, because Alameda was also bankrupt. A company that, remember, Sam owned and controlled.

Strip out that intercompany receivable and FTX had $3.4B in realizable assets against $16B owed to customers. That’s a $12.6B hole.

But What About Alameda?

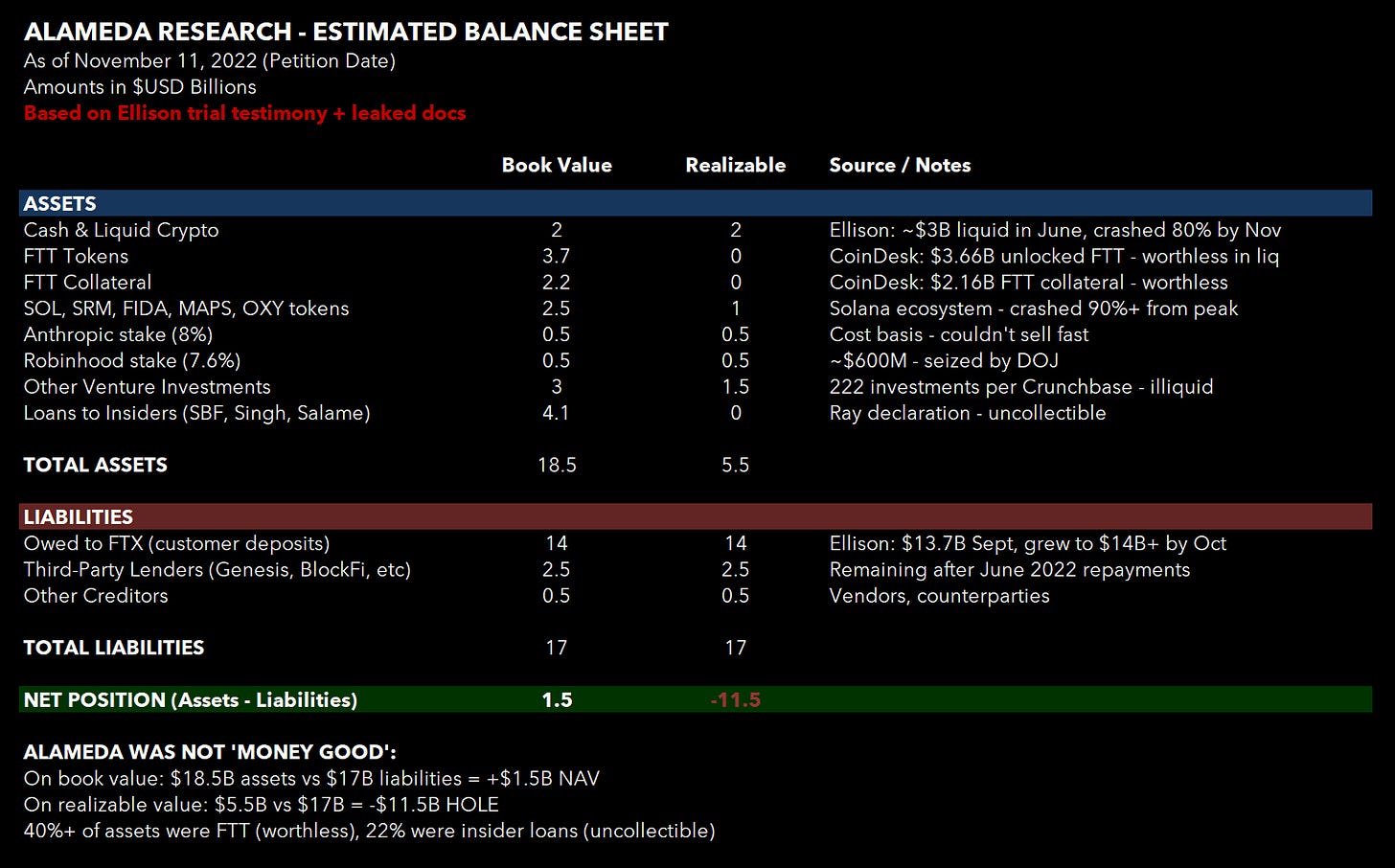

Here’s Alameda’s balance sheet:

Alameda had $18.5B in “book value” assets against $17B in liabilities. Looks almost okay, right? A $1.5B cushion.

Except look at what those assets actually were:

$5.9B in FTT tokens. Tokens that FTX/Alameda created themselves. In a liquidation, worthless. Backed by a loan to Alameda which was, again, illegal and a violation of securities law.

$4.1B in loans to insiders (SBF, Singh, Salame). Uncollectible. Why do we know? Because most of it wasn’t collected.

$2.5B in illiquid Solana ecosystem tokens that had crashed 90% and couldn’t be sold in size.

On a realizable basis, Alameda had maybe $5.5B in assets against $17B in liabilities. That's an $11.5B hole. Which we can prove by looking at the recovery of Alameda's creditors. If they don't get paid back in full, it means FTX was necessarily running a negative balance with Alameda. Which meant that FTX wasn't going to get paid back in full, which means not only were customer funds commingled (fraud), but that FTX lent Alameda money when it knew it wasn't money good. Double fraud.

This is ALL you need to know.

That’s all I needed to prove that not only the funds got commingled (wire fraud), but that money was lent to an entity that

a) you controlled, that

b) you knew was underwater, that

c) you purposefully forced the exchange to accept unlimited liability from.

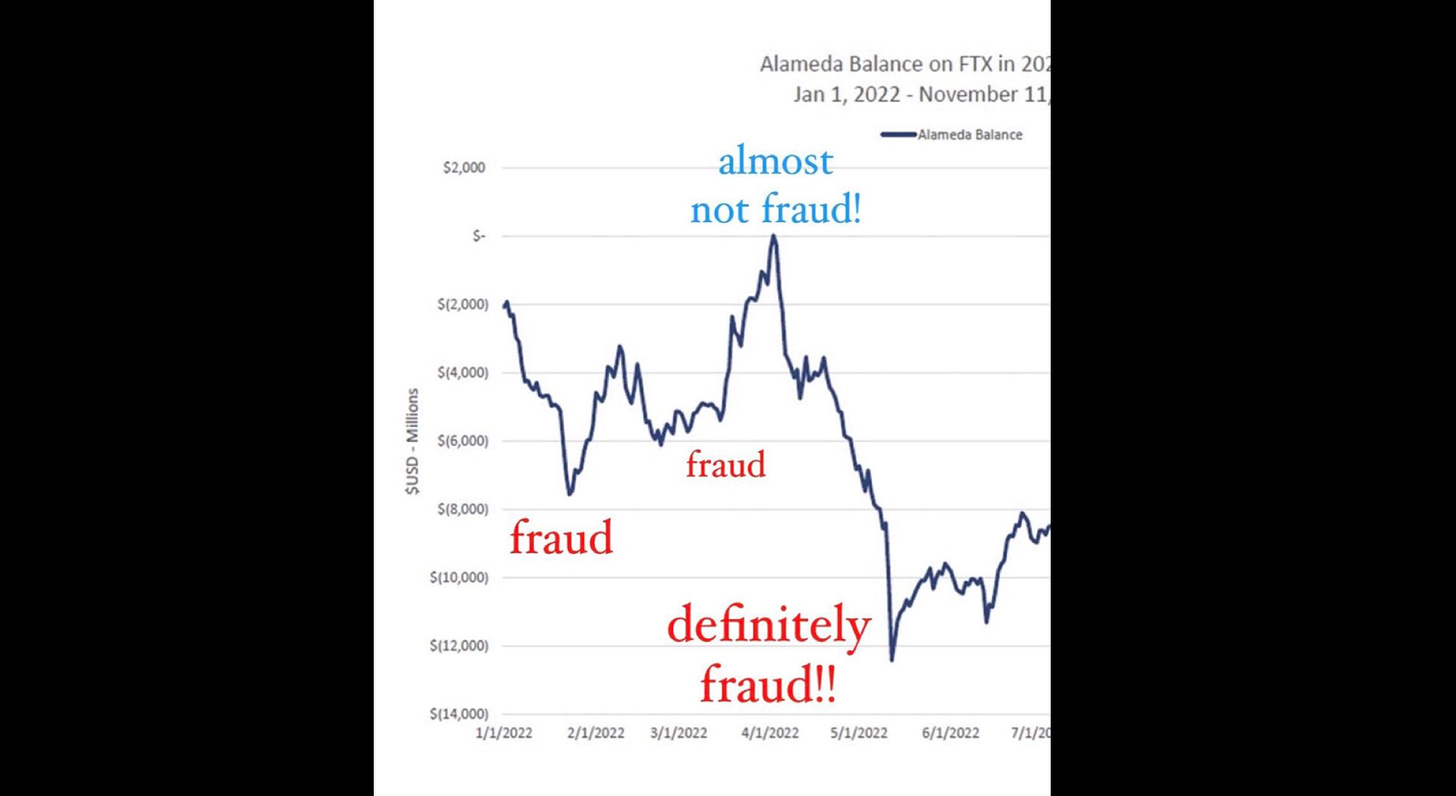

You can claim that Chapsky’s argument implies there were other accounts than the ones below (showing $12B of lending by FTX to Alameda) but if Alameda wasn’t money good, then even the aggregate line was negative. Meaning fraud. Meaning go to jail. Do not cross Go. Do not collect $250M.

Further, the shape of this line shows intent multiple times. Maybe you had a bad run in early 2022, which quickly recovered in April. But it's clear that nothing was learned from that experience, that you were hell bent on gambling with customer money, through an insolvent entity you were also extracting money from, until someone stopped you. Given the money doled out to celebs and politicians, it probably wasn't going to be the regulators, so the market had to do it for us.

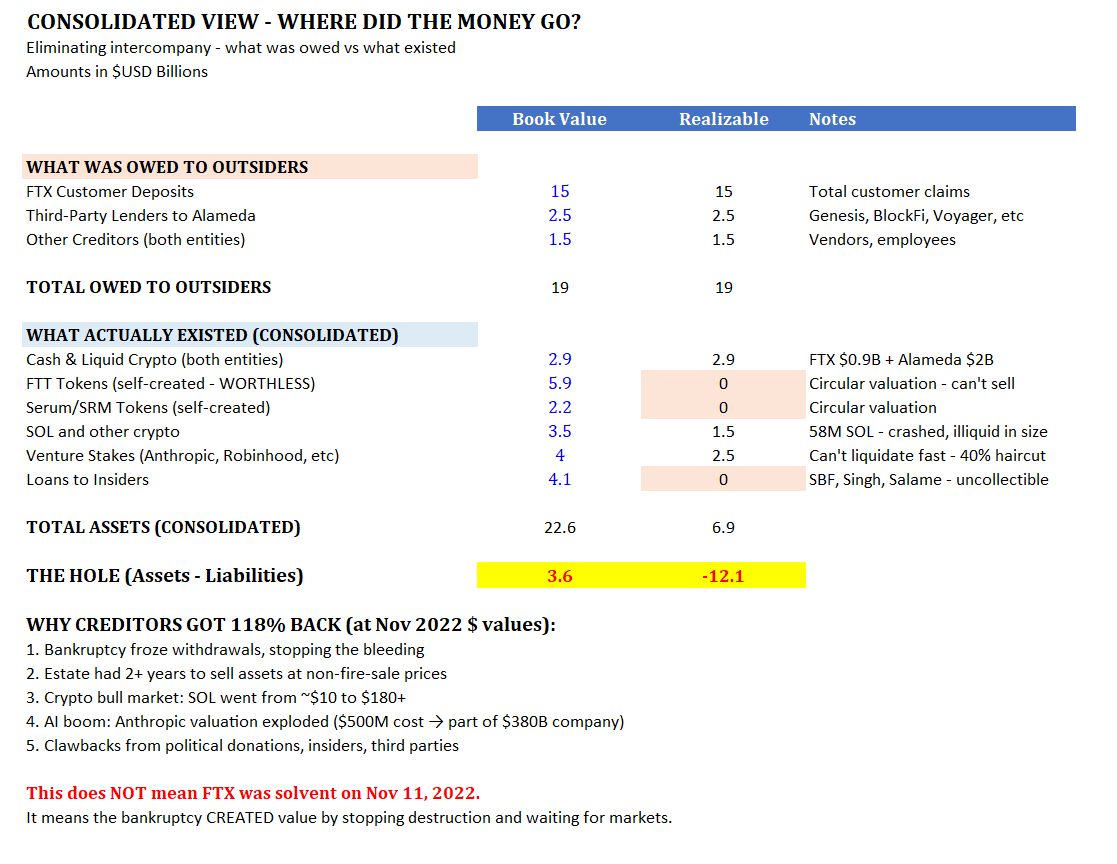

The Consolidated Picture

When you eliminate the intercompany stuff and look at what was actually owed to outsiders versus what actually existed:

Owed to outsiders: $19B

Realizable assets: $6.9B

THE HOLE: -$12.1B

That’s the number. Twelve billion dollars of customer money, gone.

Chapsky’s Red Herring

Chapsky claims the prosecution only looked at certain accounts. He says if you net all Alameda accounts on FTX together, the balance was actually positive $2B, not negative $14B.

Five problems with that:

Caroline Ellison testified under oath they couldn’t pay. She was the CEO. She was there. She said in court, repeatedly, that Alameda could not meet its obligations.

They created seven fake balance sheets to hide the hole from Genesis. If they were money good, why did they need to fabricate documents?

FTX halted withdrawals. If assets exceeded liabilities, why couldn’t they let customers withdraw?

SBF’s own messages show an $8B hole. On November 7, 2022, the day before the halt, SBF messaged his inner circle about an “$8.1B shortfall.” His words.

The “other accounts” held illiquid tokens they couldn’t sell. Having $5B in FTT that you created yourself isn’t an asset when you’re trying to meet withdrawals, it’s a line item in a computer designed to plug a trading hole. You can’t sell it. The market for it is you.

The Chapsky declaration is financial sleight of hand. The same trick they ran on Genesis: present a misleading picture by selectively choosing what to count.

“But Creditors Got 118%!”

Yes they did. At November 2022 USD values. Here’s why that doesn’t prove solvency:

Bankruptcy froze withdrawals, stopping the bleeding. The instant John Ray took over, customers couldn’t withdraw anymore. That preserved what was left.

The estate had 2+ years to sell assets at non-fire-sale prices. When you’re not under a bank run, you can be patient.

Crypto ripped. Solana went from ~$10 to $180+. Bitcoin tripled. The market did the work.

Anthropic exploded. FTX’s $500M investment became worth billions as AI boomed. That was dumb luck, not genius.

Clawbacks. The estate recovered money from political donations, insiders, third parties.

This does NOT mean FTX was solvent on November 11, 2022. It means the bankruptcy process created value by stopping the destruction and waiting for markets to recover. The professionals who took over did what SBF couldn’t: preserve assets and monetize them intelligently over time.

SBF is arguing he should get credit for the bull market that happened after he was removed from the company. This is like a drunk driver arguing he shouldn’t be charged because the pedestrian he hit eventually recovered.

It’s facile, it’s another layer of fraud, and you shouldn’t buy it.

The Fraud Chain

Let’s be specific about what crimes were actually committed here.

Commingling Customer Funds. FTX promised customers their deposits would be held separately. They weren't. Customer funds went straight to Alameda through the "fiat@ftx.com" account, which didn't even exist on FTX's books until John Ray's team discovered it.

Lending to Insiders While Insolvent. SBF took over $1.5B from Alameda: $1B in "personal loans" plus $546M to buy a 7.6% stake in Robinhood through a shell company in Antigua. Nishad Singh received $543M. Ryan Salame took hundreds of millions more. Call them loans if you want. They were theft. When you know your company is net negative on customer funds and you "lend" yourself money anyway, that's embezzlement.

Seven Falsified Balance Sheets. Caroline Ellison testified that she prepared seven different fake balance sheets for Sam to review, each presenting "alternative ways" of hiding the hole from lenders. Sam picked the ones he liked. These were sent to Genesis and other lenders to deceive them about Alameda's financial condition.

Political Donations With Stolen Money. Roughly $80M went to political campaigns. $40M disclosed, mostly to Democrats, and another $40M in dark money to Republicans that SBF admitted to but never reported. Another $23M flowed through Ryan Salame to conservative causes. All of it sourced from customer deposits routed through Alameda. Over 300 illegal donations made through straw donors. They purchased political protection with stolen money.

Tax Fraud. And then there’s his dad.

The Family Business

Joseph Bankman is (still!) a tax professor at Stanford Law School. One of the most respected in the country. He wrote the textbook on federal income taxation that law students across America use.

He also designed the scheme to funnel stolen customer money to himself tax-free. Barbara Fried is notionally retired but still an Ethics (!) professor emeritus. If I have any stake here, it’s that their continued association with the university impacts me personally as an alumnus. Here’s how the family operated across every entity SBF controlled.

The $10M “Gift”

Sometimes a gift is really money laundering.

In Bankman’s own words from emails surfaced in the FTX lawsuit:

He proposed the structure: “add 10M to the 250M loan Sam has from Alameda. Then, Sam gifts the money. No current tax on either transaction.”

He explained how to defer taxes indefinitely: “Eventually, Sam recognizes income when the loan is paid off or cancelled, at the dividend/capital gain rate, but that can happen in a year when he donates a lot, offsetting some or all of the tax.”

When Sam agreed to the scheme, Bankman replied: “perfect!”

Barbara Fried, his mother and fellow Stanford Law professor, negotiated the exact amount: “You wrote down $14 million for the cash. That would be right if you were giving dad $10 million in cash, but I thought you were giving him only $7.2 million in cash plus the $2.8 mill in the account in his name.”

These are not the emails of people receiving an innocent gift. These are the emails of people structuring a transaction to avoid detection.

Money Laundering Red Flags

The $10M moved like this: From Alameda's FTX US account to one of Sam's accounts. Then quickly to Bankman's account. Then $6.75M was withdrawn to three separate bank accounts. Some of the remainder was converted to 9,000+ Solana tokens.

Multiple accounts. Quick transfers. Crypto conversion. Textbook structuring.

After receiving the money, the parents sent an email to their son: “We are so touched by this gift. Mom is announcing retirement, which she would not have done otherwise.”

The $16.4M Bahamas Property

FTX Trading paid $18.9M for a property called "Blue Water" in the Bahamas. Not Alameda. Not the Foundation. The exchange entity holding commingled customer funds. Title went to Bankman and Fried. FTX Trading also paid $90K+ in furnishing, landscaping, and management expenses on the property.

Notice: the $10M gift came from Alameda. The house came from FTX Trading. The Stanford money came from FTX Foundation and Paper Bird. Joseph knew which entity to pull from for each transaction and how to structure each one for the best tax treatment. This is not the behavior of a passive recipient.

To this day, despite claiming to have "voluntarily returned" it, Bankman and Fried still hold title to the property.

Read that again. They still hold the title.

Researching Bankruptcy Protection

In November 2021, a full year before the collapse, Joseph Bankman was asking FTX's lawyers how assets could be "structured to be bankruptcy-remote." He specifically suggested placing FTX assets in Bahamas real estate and attached information about offshore asset protection.

A Stanford tax professor researching how to hide assets from bankruptcy courts. Using his son’s company’s lawyers. With money stolen from customers.

Covering Up the Whistleblower

According to the FTX lawsuit, as early as 2019 Bankman directly participated in efforts to cover up a whistleblower complaint that threatened to expose the FTX Group. 2019. Three years before the collapse. He knew.

Barbara Fried: “Partner in Crime”

Her words, not mine. She described herself as Sam’s “partner in crime of the noncriminal sort” for his political contribution strategy.

She co-founded and ran Mind the Gap, a Democratic PAC that received tens of millions via straw donors. Nishad Singh pled guilty to conspiracy for making donations through this exact vehicle. Ryan Salame played the same role on the Republican side. The money flowed from Alameda → to executive accounts → to PACs, reported under the executives’ names instead of as corporate contributions from a crypto hedge fund running on stolen customer deposits.

Separately, SBF poured $27M into Protect Our Future (pandemic prevention PAC), $6M into the House Majority PAC, and made direct contributions to dozens of candidates. His brother Gabriel ran Guarding Against Pandemics, which distributed another $1.7M+ to Democratic-aligned groups. The entire operation was bipartisan bribery at industrial scale.

The FTX lawsuit alleges Bankman “served as a de facto officer, director, and/or manager of FTX Trading, Alameda, Alameda Ltd., and FTX US” starting at least January 2021. He was involved in approving $543M in loans to Nishad Singh. He called Alameda and FTX “the family business” as early as 2018.

The Ratio

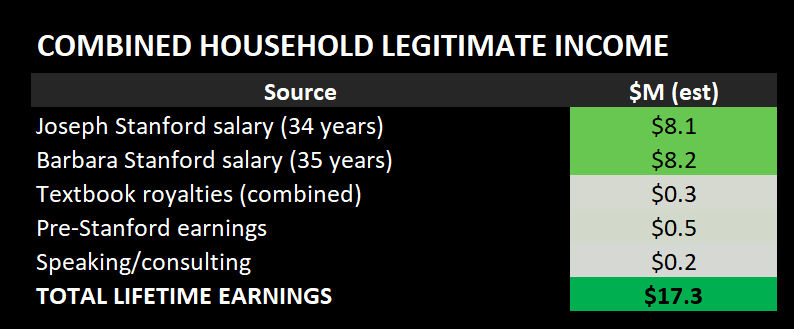

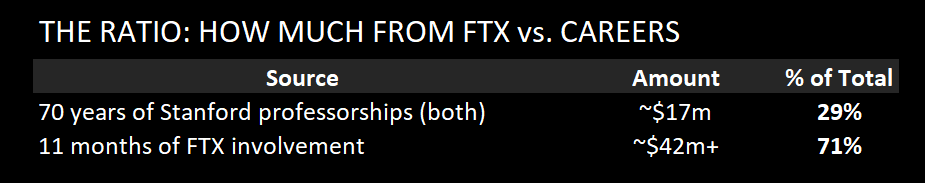

Joseph Bankman and Barbara Fried have had long, distinguished careers at Stanford Law School. Combined, they’ve been professors there for nearly 70 years.

Their total legitimate lifetime earnings (Stanford salaries, textbook royalties, consulting, everything): approximately $17 million. After taxes over a career, call it $11-12 million net.

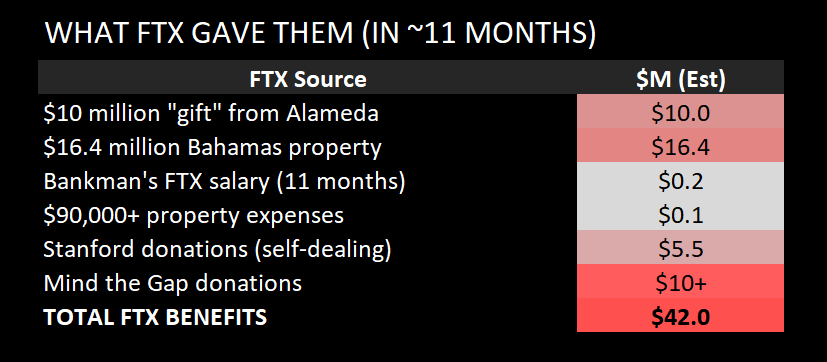

What FTX gave them in 11 months:

The documented transfers: $10M cash gift from Alameda. $16.4M Bahamas property from FTX Trading plus $90K in expenses. $200K salary from FTX US. $5.5M channeled to Stanford through FTX Foundation and Paper Bird. The lawsuit was partially redacted, so the real number could be higher. Add in private jet charters, $1,200/night hotel stays, and a Super Bowl commercial appearance, and you're looking at $32M+ minimum in documented transfers.

In under a year, they directly received nearly 2x what they earned in their entire careers. At their peak academic salary of maybe $350K/year each, FTX was paying them at a rate of roughly 35x higher.

And now they claim paying for Sam’s legal defense would “wipe them out financially.”

Where did the $32 million go? Did they pay taxes on all those gifts and loans? How much of the funds for his defense came from crypto money squirreled away by Sam before he was locked up? There were persistent rumors that money was leaving Alameda accounts days after SBF was released from jail. Did anyone ever track down where those funds went? I haven’t seen it.

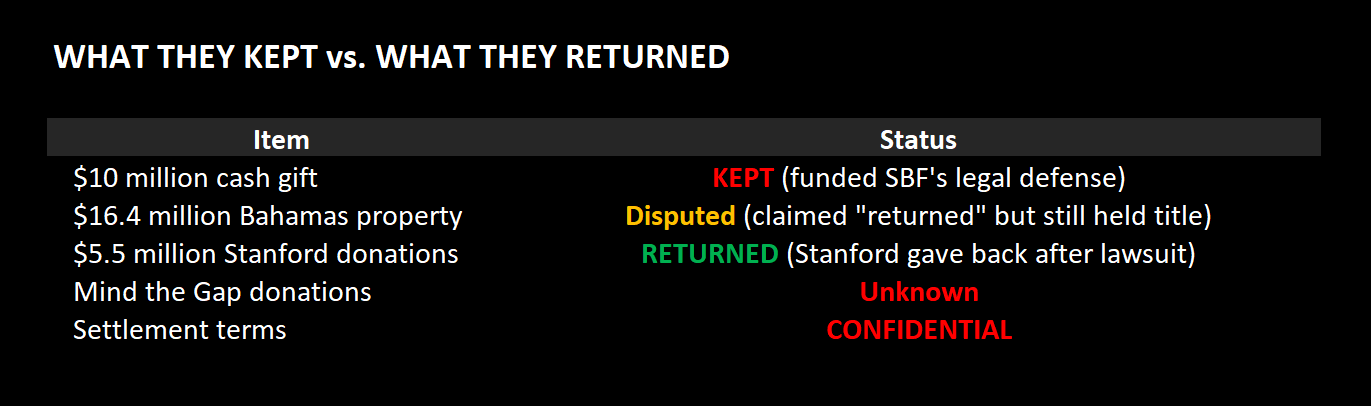

What They Kept vs. What They Returned

The FTX civil suit was dismissed "without prejudice" in early 2025, meaning they can sue again if new information emerges. The terms are secret. That's not what innocent people negotiate.

Enter RICO

Joseph Bankman remains the Ralph M. Parsons Professor of Law and Business at Stanford Law School. He teaches tax law. The same man who designed a scheme to funnel stolen customer money to himself while avoiding taxes is teaching the next generation of lawyers how to comply with tax law.

Barbara Fried holds emerita status. She teaches legal ethics. Co-conspirators in the same straw donation scheme she directed have already pled guilty to federal charges. She retains her Stanford affiliation.

The tax fraud tax professor and the unethical ethics professor. And it raises a question. Who’s doing all the tweeting? Who’s running the rehabilitation campaign? This is clearly a coordinated family operation.

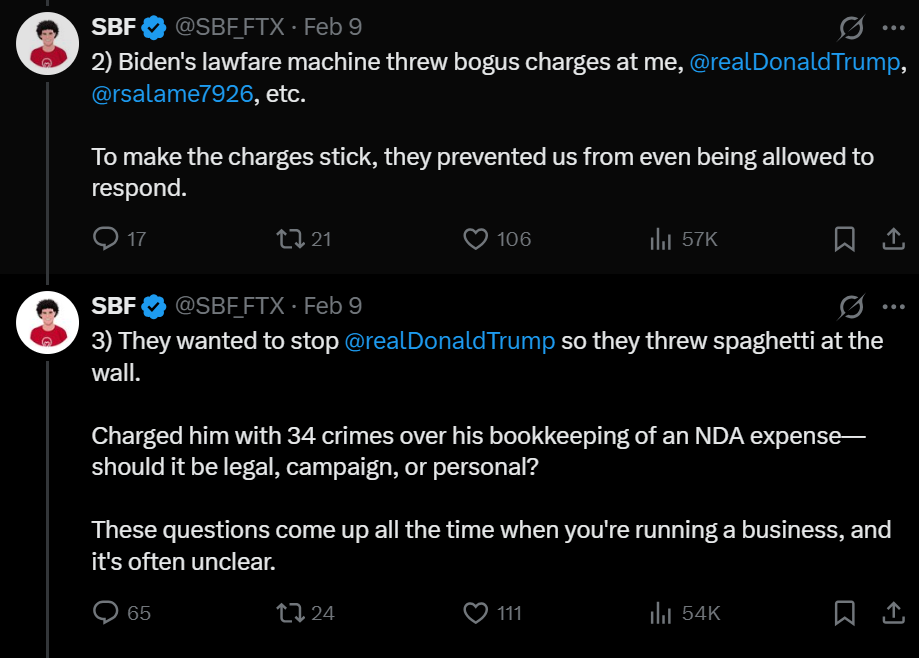

Both parents are now reportedly lobbying the Trump administration for Sam's pardon. The parents who helped architect a campaign finance fraud scheme that funneled stolen customer money to Democrats are now working Republican contacts to get their son out of prison. SBF is leaning into it, tweeting about how Biden's DOJ treated him unfairly, tagging Trump, doing Tucker Carlson interviews from prison using attorney-client video links.

The bill of particulars:

Joseph Bankman served as a de facto officer of FTX and Alameda going back to 2018. He designed financial schemes to extract and hide money from the enterprise. He researched bankruptcy-remote asset structures a year before the collapse. He helped cover up a whistleblower complaint in 2019 that would have exposed the fraud three years early. He directed $5.5M in donations to his own employer through the FTX Foundation and Paper Bird. Stanford had to return the money in disgrace. He structured the $10M extraction through Alameda to avoid all taxes, splitting it across three bank accounts and converting some to 9,000+ SOL tokens.

Barbara Fried ran Mind the Gap, the PAC at the center of the straw donor scheme. Nishad Singh and Ryan Salame both pled guilty to facilitating the same conduct she directed. She pressured executives into the conspiracy. She received a $16.4M property paid for by FTX Trading with commingled customer funds and still holds title.

Both parents used Signal with auto-delete enabled. Both settled with the estate under confidential terms. Both are now running the rehabilitation and pardon campaign from outside the prison walls while SBF runs it from inside.

Wire fraud, tax fraud, campaign finance violations, money laundering, whistleblower suppression, and ongoing obstruction. This us more than a civil liability situation. This is an ongoing criminal enterprise operated as a family unit.

Stanford's Faculty Handbook, Section 4.3, defines sanctionable misconduct as "dishonest or unethical behavior" and allows sanctions up to dismissal. A faculty member who directed $5.5M in stolen customer money to his employer (money Stanford had to give back) while simultaneously serving as a de facto officer of a $12B fraud meets that standard easily.

Stanford should strip both of their positions. The DOJ should investigate them for money laundering. The structuring of that $10M gift has more red flags than a May Day parade. If the evidence supports it, and I believe it does, RICO charges should be considered.

The Influence Campaign

It’s worth pausing on how the rehabilitation narrative is spreading. These aren’t organic posts from concerned citizens. This is a coordinated campaign using sock puppet accounts and crypto influencers to manufacture consensus:

The pattern is the same every time: Chapsky files a declaration, SBF quote-tweets it, and within hours a network of accounts amplifies the “FTX was solvent” line. The message discipline is impressive for a guy who’s supposed to be in a federal prison cell. Somebody is running this operation, and it isn’t happening spontaneously.

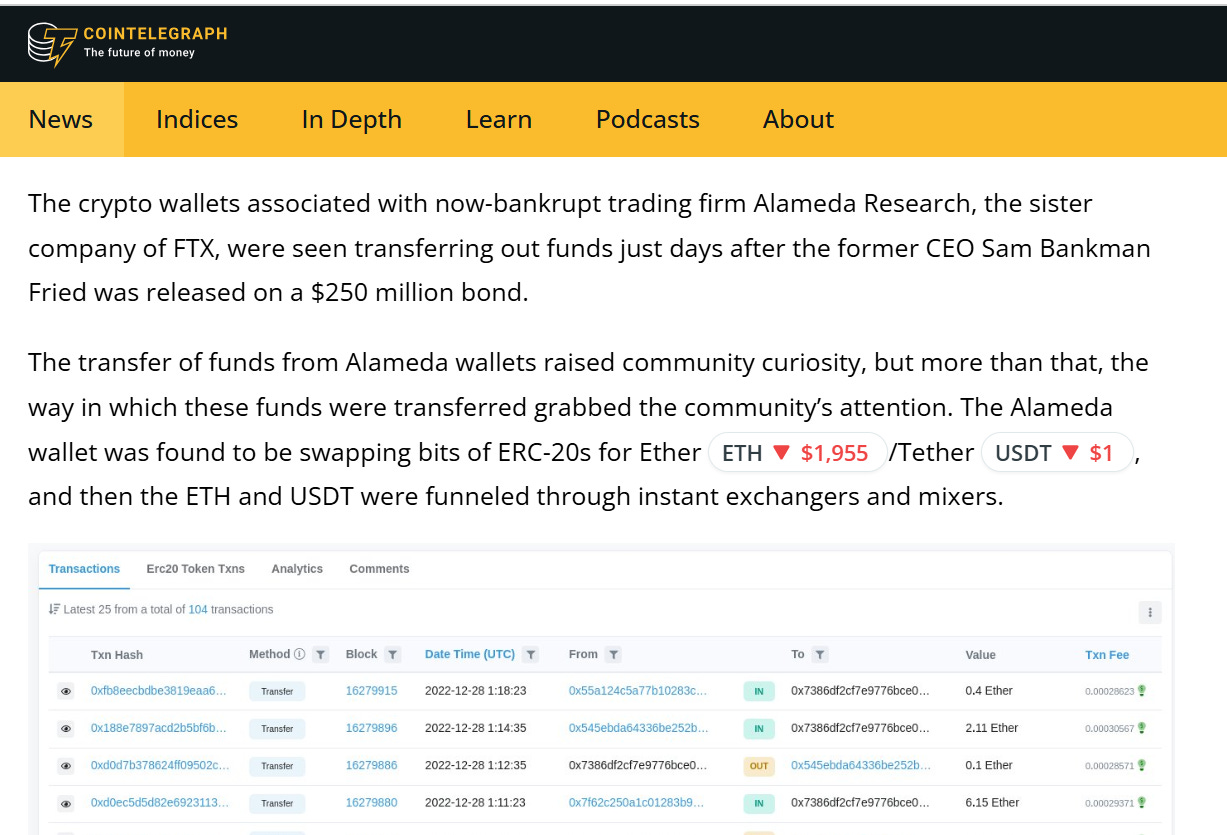

Meanwhile, on-chain data tells its own story. Days after SBF was released on bail in December 2022, Alameda-associated wallets started moving funds through mixers and instant exchangers.

Nobody has publicly accounted for where those funds ended up.

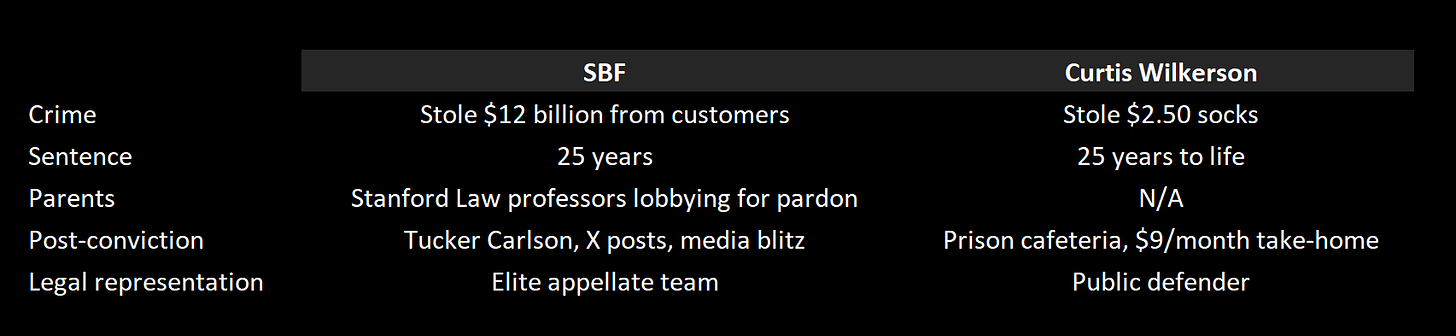

America’s Two-Tiered Justice System

In 1995, Curtis Wilkerson stole a pair of white tube socks worth $2.50 from a mall in Whittier, California. His two prior strikes were from 1981, when he was a teenager serving as a lookout in robberies. He was sentenced to 25 years to life.

While serving his time, Wilkerson worked in the prison cafeteria earning $20 a month, of which the state took $11 to pay off a $2,500 restitution fine for the socks.

Same sentence as SBF. For $2.50 worth of socks versus buying politicians with $12 billion in stolen customer deposits.

Wilkerson didn’t have two Stanford Law professors working full-time on getting him out. He didn’t have a coordinated social media campaign. He didn’t get to do Tucker Carlson interviews. He didn’t have a family member designing tax-free schemes to hide his prison commissary earnings offshore. He certainly wasn’t able to tweet from prison.

He's not unique. Leandro Andrade got 50 years to life for shoplifting $153 worth of children's videotapes from Kmart. Timothy Jackson got life without parole for stealing a $159 jacket, a crime that now carries a six-month sentence. More than 3,200 people nationwide are serving life without parole for nonviolent offenses. Sixty-five percent are African-American.

The system gave a pair of socks the same weight as $12 billion in stolen customer deposits.

The progressive response to two-tiered justice has been to stop prosecuting the small stuff. We can see how that’s going: CVS locks up the toothpaste, Walgreens shutters 150 stores, the Tenderloin is an open-air drug market, and entire neighborhoods have lost access to basic retail. Decriminalization hasn’t fixed the underlying problem. It’s made daily life worse for the people it was supposed to help.

The right answer was never to stop prosecuting the small stuff. It was to start prosecuting the big stuff. With the same ferocity we bring to a pair of tube socks.

The Principle

I started this piece with a principle I learned at Lehman: Don’t F With The Money.

Here’s the corollary: When you mess with the money, you don’t get to claim credit when the market recovers after you’re removed.

Sam Bankman-Fried stole $12 billion from customers. He used stolen money to buy political influence. His parents helped him hide it and are now running the campaign to get him out. The fact that crypto rallied after he went to prison doesn't make him a genius. It makes him lucky that John Ray and the professionals who took over were able to salvage something from the wreckage.

And there's a deeper problem with the "$136 billion portfolio" victory lap. FTX didn't own Anthropic. Alameda did. FTX customers had a claim on Alameda's debt, not its equity. So even in SBF's own fantasy scenario where he held on and everything mooned, FTX depositors wouldn't see a dime of the Anthropic upside. The entity that owed them money was bankrupt. The entity that held the golden ticket was a different company. The whole narrative is built on an accounting trick, which is fitting, because so was the original fraud.

The narrative that FTX was "money good" is a lie designed to get a fraudster a pardon. The Chapsky declaration is financial sleight of hand. The rehabilitation campaign is being run by the same family that helped perpetrate the original crime.

And every day they walk free while Sam tweets from prison, more Americans conclude the rules don’t apply to the wealthy and connected.

That’s corrosive. Not just to markets. To everything.

We can’t let them get away with it. Our system can’t take it.

~~~~~~~~~

If you found this useful, subscribe to Campbell’s Ramble. If you have additional evidence or documentation on the Bankman-Fried family’s involvement, I’m at @abcampbell.

Once the pipes of the system are bent for a well-connected family, it goes beyond a financial scandal. It's basically an attack on the rule of law itself.

Interesting to know about the parents’ role and the coordinated rehabilitation campaign. This isn't just about one reckless founder.

Appreciate you doing a sidebar from the usual topics here. Drunk driver analogy is perfect.