Contagion Comes for Credit Suisse

The market is now actively hunting weak banks, again.

We’re calling it.

Readers of this newsletter know we have been tracking this problem for some time.

More recent readers know we’ve discussed the underlying mechanics of financial crises in depth. Every crisis is the same, but the assets and players are different.

Leverage. Tightening. Stress.

Then it’s bailout or bankruptcy time.

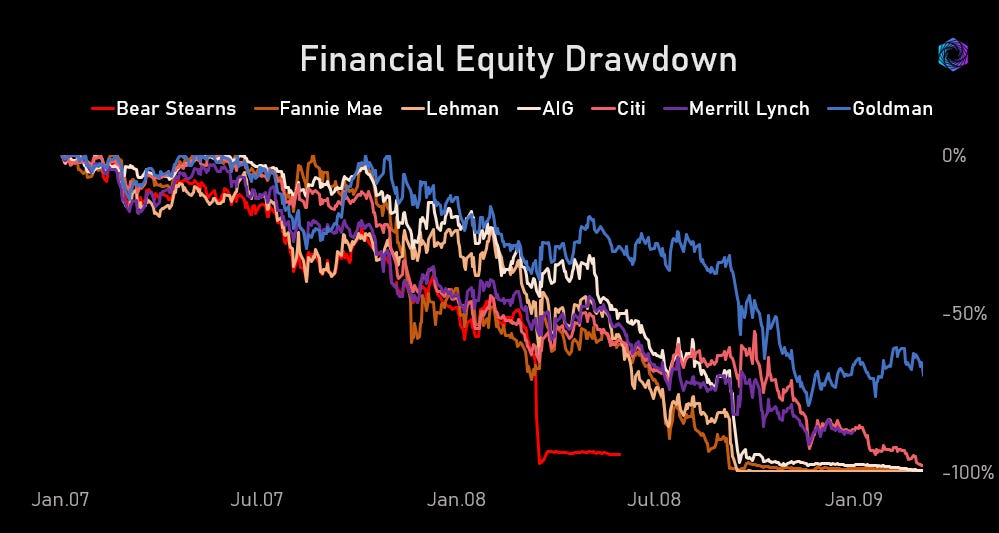

Folks old enough to remember the 2008 financial crisis will remember how this played out last time.

The market may have the attention span of a neurodivergent high school kid off their meds for the summer, but it’s pretty good at figuring out *one thing at a time*.

During the GFC, the questions were:

How much real estate exposure?

How much leverage?

What happens when the next domino fails.

Where the next domino was the name du jour. And everyone knew ‘who’s next.’

Bear Stearns, Fannie Mae, AIG, Lehman, Merrill, (Morgan Stanley, Goldman)…

See when it comes down to it.

Trading financials in a financial crisis is actually pretty easy.

Rank the banks.

Short the bad ones.

Buy the good ones (if you want to be market neutral).

Stay away from risk until the bailout is in the works.

Monitor asset drawdowns and bank funding conditions to gauge how much pain is coming down the pipe.

Well.

No bueno.

What’s different this time is that the balance sheet problems facing the banks are not due to credit losses (yet).

But rather a rather understandable reaction to the regulatory overhaul in the wake of the global financial crisis.

When you tell banks that government bonds are risk free, and then lower rates to 0 for the better part of 10 years, what do you expect them to do?

When inflation forces tightening that crushes the present value of those ‘risk-free’ assets, policymakers really aren’t left with many options.

Lower rates, risk blowing out long term yields as markets price in sustained stagflation.

Keep tightening, further invert the yield curve, crushing bank profitability at a time when they need to rebuild balance sheet equity.

Rock meet hard place.

Mr Market, meet my friend Credit Suisse.

Think you two will really hit it off.

Disclaimers