Another (PropCo) Bites the Dust

What can the failure of Country Garden and Zhongrong Trust tell us?

As you may know, we’ve been trying to get to the bottom of this whole Chinese credit mess for some time.

We started by looking into the banks, and found a complex morass of shadow banking designed to obscure and befuddle.

In reaction to this, 5 years ago we ranked those Chinese banks, looking for:

fast growing banks, with

exposure to problematic provinces, and

lots of ‘investment receivables’ - aka a balance sheet line item used to warehouse non-loan credit instruments (hence outside of regulatory scrutiny), which would then be packaged / channeled into seemingly safe deposit-like “Wealth Management Products” and sold directly to households.

At the top of our list, was Shengjing Bank.

A couple months later, it was gone, bailed out by none other Evergrande, the largest and most levered in a sea of Chinese property companies

Which got us thinking about debt.

As my old boss used to say:

Find the Debt, Find the Trade

Then we told you Evergrande would fail, the largest and most levered in a sea of Chinese property companies vulnerable to a scramble for liquidity.

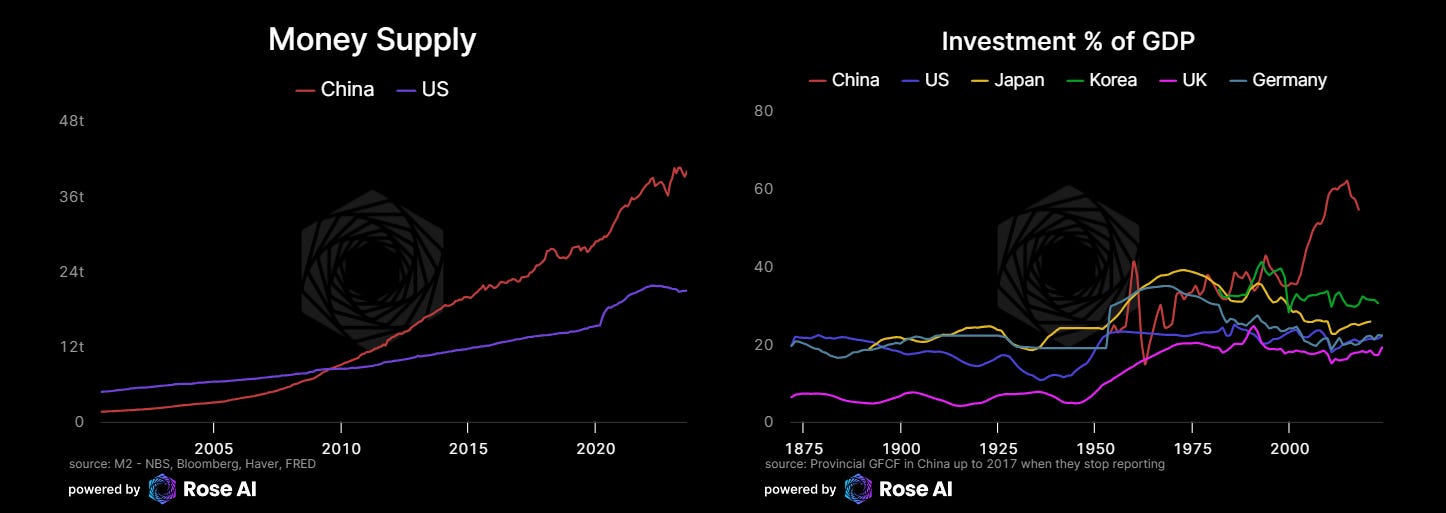

See, the macro story in China had fit the classic real estate bubble pattern for years.

Too much money, financing too much investment.

So much investment, it beggared belief!

We found official data suggesting “Fixed Asset Investment” of more than 70% of GDP. Basically guaranteeing some combination of double counting and / or counting land purchases in investment (and potentially official GDP stats).

So, we did what we normally do in these situations. We took out our pencils and paper and ranked the property companies, looking for the same patterns of leverage, reliance on short term financing and ballooning inventories that helped us identify risky banks.

That was three years ago. Most of the names in red are suspended, failed, or in limbo.

Which brings us to today.

The average Chinese dollar property bond now trades in line with bankrupt Evergrande.

The system is insolvent.

It's not just a dollar bond problem anymore.

Country Garden onshore RMB bonds now trading 20-30c on the dollar. One of the names from our list that was trading as a healthy credit only a couple of months ago.

This is not confined to Evergrande and Country Garden.

The entire $7tr property sector is currently trading distressed. RMB bonds are starting to price in material losses.

We are talking TRILLIONS of dollars of distressed real estate assets.

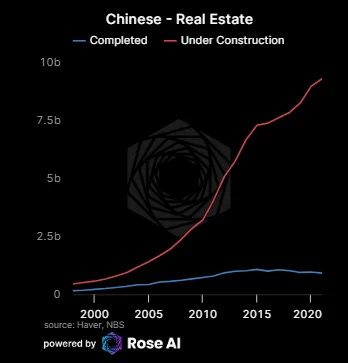

For the past twenty years, Chinese property developers have been able to fund their inventory builds via shadow banks.

These channels are now closed and regulators are looking at 30 Manhattans of unfinished 'inventories' which will never get built.

Shadow banks in the space operating as LGFVs (quasi gov entities that exist to warehouse property debt) and Trusts.

These entities then package the short term debt from developers into "Wealth Management Products" (WMPs) that are sold directly to households.

WMPs these developers and LGFVs are now defaulting on.

As developers start to default, liquidity problems have flowed back to the shadow banking players that initially financed them.

Putting to test, the implicit government guarantees these projects previously had.

Tests they are now failing.

Some claim China's limited external debt means the restructuring will be easy. That officials have more than enough assets to forcibly restructure the morass.

What this perspective misses is the role that WMPs played in exposing households directly to the worst shadow banking offenders and radically increase the complexity of policymakers jobs.

This week, Evergrande declared Chapter 15 bankruptcy in NY courts.

Two years since we wrote this:

Note, these things take TIME!

Meanwhile Country Garden is under stress...another $300bn problem.

Policymakers may have the money to do a restructuring, but they are running out of time.

Financial crises are defined as much by their speed as the depth of their losses. By exposing households to the worst offenders of the credit bubble, it is almost guaranteed that many of these failed financial products will need to be bailed out by the financial institutions (read banks) that initially sold them.

Likely in a rush, and likely in response to widescale protests.

Which in turn, will put pressure on bank balance sheets and force the central government to decide how much pain they really want to impose in the name of morals.

Meaning for China watchers, the medium term plan is simple:

Look to see the depth & breath of onshore losses imposed by developer defaults.

Monitor the liquidity strains faced by LGFVs, trusts, and other shadow banks.

Keep a very close eye on the bigger but risky banks like Minsheng, to evaluate the scope of contagion in the commercial banking system.

So far the view from this framework appears to be a system on the brink, but where pain is contained to missed payments and low level defaults.

Meaning thusfar, Chinese policymakers have successfully walled off the pain from the core banking system. A notable achievement for sure, but one that has sucked up a lot of time.

Meanwhile, losses build while reserves fall.

Tick Tock.

In the meantime, for those looking for some specific take away or investment recommendation, our advice is the same as when we broke the Shengjing story:

Short CNY, buy Gold.

Ideally overweighting the RMB leg, and deployed via options for more protection.

Or, as we put it, “Gold in China.”

Disclaimers

Bravo for nailing this 4 years ago! And now!