All The Silver In The World

The long - and somewhat confusing - origin story of 'the dollar'

It used to be that we made our money out of silver.

Worth about 1/10th to 1/15th gold.

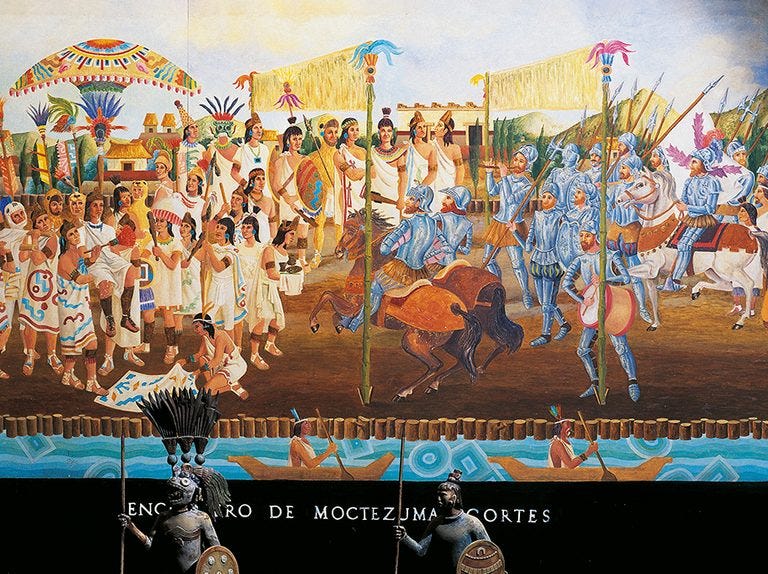

Then in fourteen hundred ninety-two, Columbus sailed the ocean blue, and while he didn’t find gold, the conquistadors he left in his wake found plenty of silver.

By 1497, the Spanish were using silver to print dollars.

In 1535, there was a mint in Mexico City.

Halfway across the world in China, the Ming dynasty decreed in 1465 that silver was the only way to pay your taxes.

No more unsuccessful experiments with strings of copper ‘cash’ that turned green, no more ‘flying money’ (aka paper).

First they called them liang, eventually calling them taels.

A localization of the European thaler.

Itself a shortened version of the the German Joachimsthalers (1525).

Thalers minted in the image of the equally easy to pronounce Guldengroschen (1486).

With all these Germany names, no wonder the simple ‘dollar’ caught on.

Didn’t hurt that the silver dollar didn’t depreciate much in a couple hundred years.

By some measures, only 4% by the mid 1700s!

Imagine that kind of track record.

The Romans would blush.

By 1792, the American colonies were independent and making their own laws about money, and like many an emerging nation after them, they decided to peg their currency to the dollar.

In 1806, America made it official, and the Spanish Dollar was made legal currency.

Right as the Latin America caught the revolutionary fever, and took all that silver out of Spanish hands.

Fifty years later, Spanish coins were out, and domestic currency was in.

Partially a result of a 1846 law fixing the American price of silver relative to gold higher than Europe, leading to a influx of silver and a move to not only ban foreign coins, but to ban silver as money all together.

In the intervening period, the British fought (and won) two wars with China over the right to pay for tea and pottery with opium instead of silver.

Putting strain on a imperial treasury already empty from two very expensive civil wars.

So it goes.

A story for another time.

By 1873, silver was officially demonetized in America.

Short term interest rates spiked to 12(!), kicking off a banking panic and a 5 year depression.

Strangling the nascent railroad boom in it’s crib.

Who knew tightening was bad for tech?!?

Policymakers responded to the panic by (eventually) easing, as they are wont to do.

This time by reintroducing silver as money in 1878. They called it bimetallism.

Now we call it Quantitative Easing.

Whatever you call it, monetary easing is good for stocks.

In spite of this easing, the writing was on the wall for silver.

First Europe, and the the world, slowly moved off silver, and onto gold.

Then, finally, from gold to paper. With some confusing fits and starts along the way.

By 1973, Nixon had gone to China, and the US was off gold.

The dollar no longer tied to the metal coins from which it derived it’s name.

By 1980, gold and silver were up ~15x in USD terms.

While the American way of life felt under threat.

Leaving us wondering about the parallels to today.

Along with a handful of questions:

If gold is 15x rarer than silver in the earth’s crust, why when you count all the bullion that’s ever been mined, is there only 8x as much silver?

2. If gold is only 8x rarer than silver above ground, why is that gold 80x as expensive?

Finally, forget gold for a second - I know, hard to do - would you rather have all the silver in the world, or all the crypto?

These questions have been bugging us for years, and something tells me, we aren’t that close to answering them yet.

If you have thoughts, our DMs are open.

Till next time.

Disclaimers